Whether you are a small business or a massive corporation, accounting software is something that you rather not skimp on. These solutions will allow you to accelerate a myriad of operations and help you keep financial records nice and tidy. But how does one pick such a tool? And should small businesses even consider employing them at all? All this and much more in today’s article. Let’s get started!

Accounting Software In a Nutshell

Let’s start with the basics by defining what is accounting software and what its primary function is within a company. According to Wikipedia, accounting software is an application that was designed to process accounting transactions. It uses various modules, including but not limited to, accounts payable, receivable, ledger, payroll, and many others.

Generally, it functions as an accounting information system (AIS) and you can use it to store financial and accounting data. Decision-makers can also make good use of it. The market has a ton of different accounting solutions on offer. Some of these tools provide specialized modules for specific industries to ensure maximum efficiency. Mordor Intelligence estimated the accounting software market in 2019 to be 19,1 billion dollars worth.

Why Do Small Businesses Need It?

While it is often implied that accounting software is mostly used in large corporations, small businesses can still benefit from it massively. We’ve taken the time to gather some of the most important benefits you’ll get using a dedicated accounting solution.

Core benefits:

- Accounting Software, if cloud-based, will allow you to manage your finances remotely at any time. This will allow you to set up a remote department which is less costly than renting an entire office and constructing a team.

- Due to most tools being cloud-based, your financial data is extremely secure. Also, you don’t have to do any hardware maintenance and upgrades due to automation.

- Most accounting solutions allow you to see how well your business is performing from a financial standpoint. From performance reports to custom infographics, you can have a more holistic view of your business.

- Eliminates mundane tasks such as paperwork through smart, configurable automations. It also improves the accuracy of records as machines are immune to human distractions.

- Many accounting solutions come with a proper AI-enhanced bank settlement system that will sync-up and suggest matched entries for transactions.

- Most account tools allow you to control the overall cash flow in a modular fashion. It can help you save money by cutting corners or removing them completely.

- Accounting software is also used to help you identify financially incentivized employees. Knowing how to motivate people without breaking the bank can be a viable management strategy that accounting software enables.

- Accounting tools can manage your income and expense automatically. It will not only free up time but will allow you to make more effective decisions since data will be more structured.

- Fully auto-generated invoices will allow you to avoid common human errors, as well as free even more time since you no longer have to scroll through a ton of different documents.

Do keep in mind that these are only but a small fraction as to what these systems offer. They are good at crunching numbers and can be used to strategically reduce expenses. Moreover, these systems can scale other parts of your business through proper allocation. However, to leverage all the benefits stated above, you must know how to pick a tool properly which leads us to the next section.

How to Choose a Solution

Some say that you should always aim for the more expensive tools, others like to point out that the more features you have the better. We think that you should always align your needs with the capabilities of the tool. That way you won’t have to do guesswork and will get a tool that will solve most of your requests. Overall, it is a complex task but we managed to cram all the things you should do into just five specifics. Let’s take a look at each in detail.

Set your needs

As we already mentioned, you need to settle on specific needs the tool has to solve. If you are unaware of what those needs are, we suggest that you go straight to your accountant and ask things directly. It can be anything, starting from receipt-tracking to inventory tracking so pay good attention. Also, we suggest that you focus on just a few things at a time. Otherwise, you’ll find yourself in need of a swiss-army knife that will “solve” everything. Gather data, qualify it, and only then set your searches.

Devise a budget

The second and perhaps the most important part is to settle on a specific budget. You need to know exactly how much you want and need to spend and only then start bookmarking vendors. By doing so, you will avoid going over budget. Moreover, you will make sure that you won’t get off-track by cheaper/expensive tools. Finally, make sure your budget has at least some wiggle room but don’t go over 25% of the entire cost of the solution.

Prioritize features you need

Sometimes accounting solutions have way more features than you need. For example, if you see that the system has a huge focus on providing remote services to global customers but you only operate in the United States, consider dropping the entry. Your goal is to set features that you absolutely must have and only then explore secondary ones.

Ask the right questions

Ask both yourself and the vendor things that matter to you. It can be anything ranging from things such as “how well the API is documented” to “what are my back-up options”. By knowing what to ask the vendor you will save yourself from common issues that will arise later. Remember the stupidest question is the one that wasn’t asked so don’t hesitate.

See if it’s scalable

If you are planning to buy a new accounting software every time a new need arises, we’d like to ask the probability of you being a small business in the first place. You need to make sure that your solution of choice has room for scalability. See if the higher tier features can accommodate your potential needs. Also, see how fast your business might grow, and what are the market trends. By knowing these, you will save yourself a lot of hassle in the future, not to mention money.

By asking yourself and answering the following question, you are bound to land on a tool that would meet not only your needs but the need for specific departments within your company.

Five Tools Worthy of Your Attention

If you are in a hurry and don’t have time to deal with research and budget isn’t an issue, then consider looking at the list of systems below. These are handpicked by our experts and are also widely considered by the community to be the best accounting systems out there.

Also as a small disclaimer, we can’t talk about all the nitty-gritty details of each as it would take forever to complete, so instead, we’ll focus on the pricing, the core benefits these tools bring to the table, and finally, what support they offer.

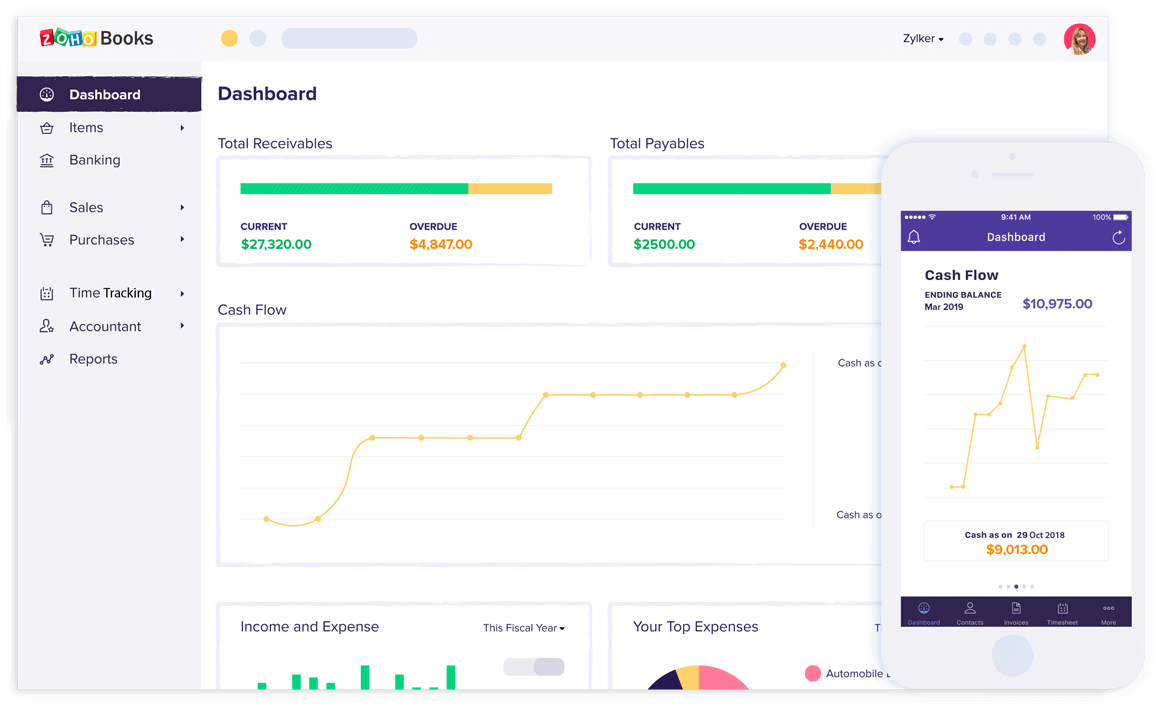

Zoho Books at $9/month

Known by delivering one of the best user experiences, Zoho Books is not new to the industry. It is part of the Zoho family of products and is often regarded as one of the most polished tools out there. Whether you need to manage cash flow or automate invoices, Zoho is perfect for such operations. The integrated suite of financial tools offer enough flexibility and the price point is also pretty fair for the amount of stuff you get. If you are unsure if it is for you, ask for a demo or trial and see it in action. However, be warned that the scalability route is quite expensive and not for everyone. Carefully study that aspect as well.

Xero at $9/month

If you are looking for a good mobile account platform, then there is virtually no better option than Xero. Starting at just $9 a month, you get access to one of the most robust custom invoices, inventory tracking, and automatic bill creation solutions out there. Right from the palm of your hand, you can get access to a myriad of performance reports, bank accounts, and even payroll services (although you’ll have to use their third-party partner, Gusto). The only downside of this system is that the support is kinda lacking in comparison to tools we’ll discuss later.

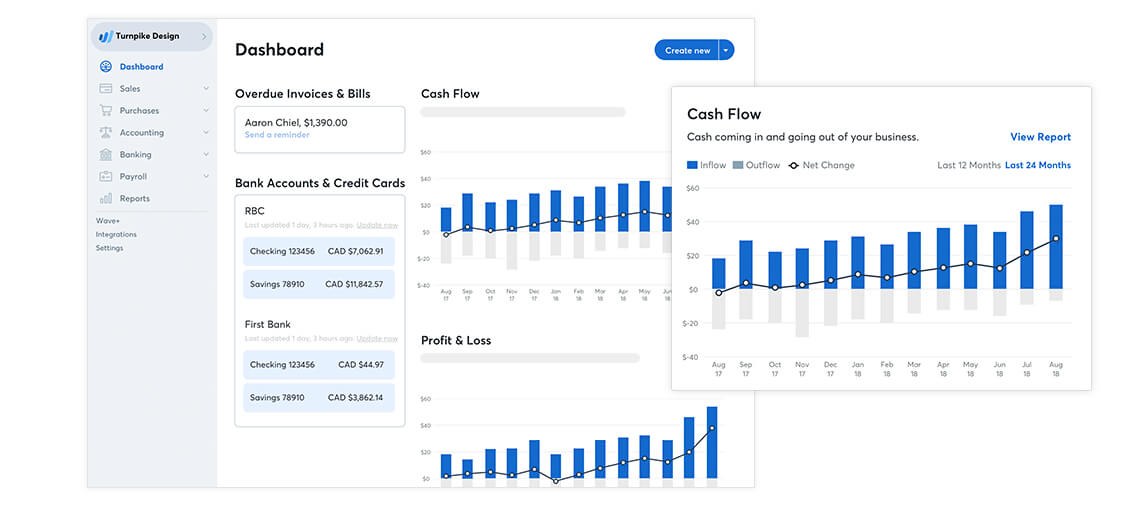

Wave at $0/month

Sometimes there are good tools that are free and Wave is exactly that, a free tool that will get the basics done. For an impressive price of none, you will get access to a proper invoice management tool, a transaction handler, and proper bookkeeping. Wave allows synchronization with these features. Although the tool is free, you will still have to pay a price. You won’t get a built-in inventory management tool, a project tracking tool, or even a time tracker. If all of this is necessary for the success of your business, you should keep reading further but if you just want a simple invoice solution, Wave is great.

Intuit QuickBooks Online at $8/month

Viewed by many as the best accounting software, Intuit QuickBooks Online is a powerful tool designed with big corporations in mind. So what does it has to do in a small business-focused article? It is quite simple, it’s the price point. For just $8 a month, you can gain access to the around-the-clock support system, a receipt capture solution, and a ton of integrations that include popular platforms such as PayPal, Square, and Shopify. Furthermore, by paying the minimum, you also get access to things such as the ability to track all cash flows, automate invoices, and even send estimates. The only downside of this system is that some functions are available at higher tiers that are quite costly.

FreshBooks at $15/month

If you are looking for a tool that can off-load a lot of mundane accounting work, the FreshBooks is here for you. While this is the most expensive tool on this list, it is also one of the most all-inclusive ones. For $15 a month, your company will get access to proper time tracking, recurring invoices, and a couple of dozens of integrations. And speaking about integrations, the system doesn’t just connect to other accounting tools but can hook to popular communications platforms among other things. This will allow you to streamline verification processes. The tool also comes bundled with a mobile app that would let you track how your business operates.

These tools are but a small fraction of what the market has to offer but they are good starting points. They have all the basic functionality and even offer some unique things. Yet, the best thing about them all is that they won’t cost you a leg and an arm to buy.

Bottom Line

So there you have it, our guide to affordable accounting software for a small business. If you are planning on using any of the above solutions, we can help you import your data. Be it a simple excel file or another accounting tool or even a database, we can help you carry your data over in a fast and accurate fashion. And if you don’t believe words, we don’t blame you. Hence why we offer you to order a demo migration service today to see it in action. After all, better see it once than hear it twice. Thanks for joining us.