Ever heard of FreshBooks vs QuickBooks Online? Both cloud-based accounting systems have made a name for themselves because of their rich feature set and scalable pricing plans. Yet, they differ dramatically and are designed for unique business purposes.

So, which accounting system suits you better: QuickBooks vs FreshBooks? Let's find out.

Quick Summary

- Freshbooks lacks advanced inventory management and customizable reports, while the same features are present in QuickBooks Online. Unlike FreshBooks, QuickBooks Online misses time tracking and budget management in lower plans.

- Xero, Zoho Books, Odoo Accounting, Wave, and FreeAgent are the most popular alternatives to FreshBooks and QuickBooks Online.

- You can use a third-party app like Accounting and Invoicing Data Migration service to migrate your data to QuickBooks Online vs FreshBooks.

What Is QuickBooks?

QuickBooks Online is a cloud-based account system with considerable reporting capabilities and pricing modules designed for SMBs and middle-sized businesses. It brings the best of its QuickBooks Desktop into a simple online invoicing app that continues to enhance with every new version.

When setting up QuickBooks Online, you can specify your preferences to do as little or as much as you like. Later, if your company grows and you need a payroll system, you can always add that feature if you don't check one of the boxes, such as "Pay your employees."

Accounts receivables by class in QuickBooks Online. Source: QuickBooks

What Is FreshBooks?

Like its competitor, FreshBooks is online accounting software with an easy-to-use interface. It is straightforward, even for computer beginners, and offers a variety of features usually found in more robust products.

Mainly, FreshBooks is famous for its time tracking and invoicing. Founded in 2003, this company offers accounting tools that appeal to small teams and large companies. Moreover, FreshBooks offers an Accounting Partner Program that provides a more collaborative approach for its users.

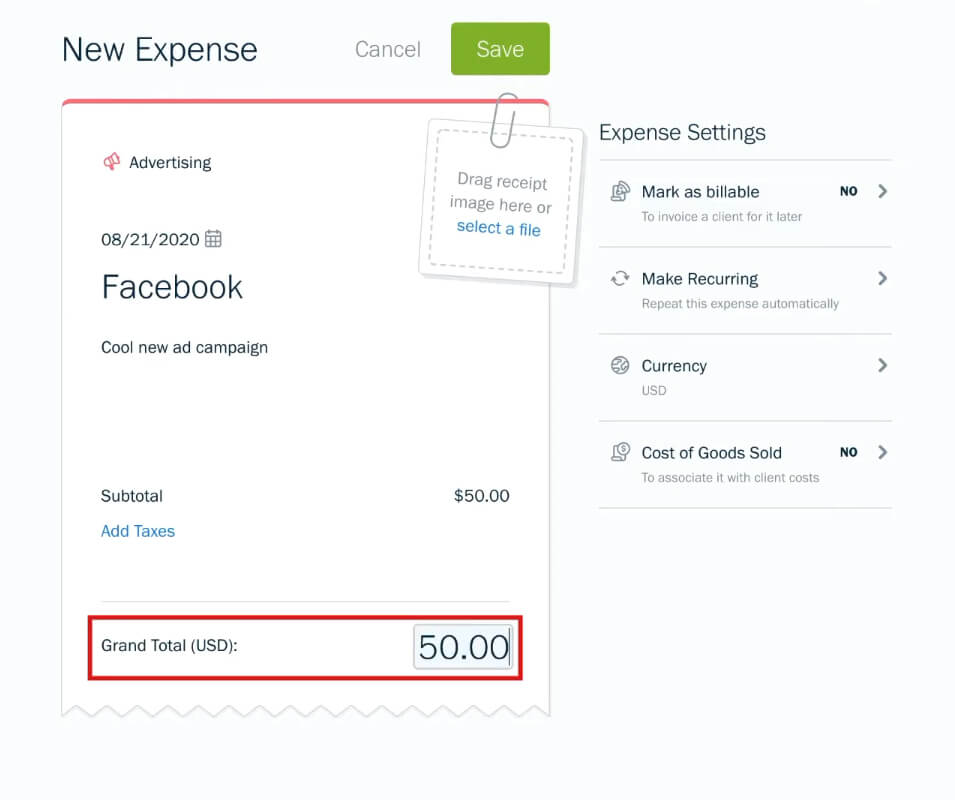

Add expenses in FreshBooks. Source: FreshBooks

Now that you have an idea of what QuickBooks vs FreshBooks are all about, let’s dive in and compare the cloud accounting tools directly.

A Sneakpeak at QuickBooks Features

QuickBooks Online functions differ from plan to plan, with many premium functionalities reserved for the higher-priced plans. But, all versions of the cloud accounting tool offer features to manage receipts, accept payments, run reports, and track sales tax with income and expenses. Like FreshBooks, QuickBooks Online uses everyday language in its solution.

Dashboard

Get every functionality you need on your dashboard, including sales, expenses, reports, banking, accounting, taxes, and more. View your business and what tasks you should do next with charts and graphs. You can also minimize the navigation bar to see more of your QuickBooks dashboard.

Dashboard in QuickBooks Online. Source: QuickBooks

You can create new transactions like invoices, bills, estimates, and timesheets in the upper right corner. Or manage your settings, recurring transactions, and bank accounts. You can access taxes, reports, expenses, workers, projects, banking, sales, and accounting on the left side.

Invoicing

Generate a more detailed invoice, including the payment method, payment terms, and customer location. You can also use the invoice builder to fine-tune invoice templates (add a logo or change colors) to gain complete control over the invoice design. Or you can set up recurring payments and reminders directly from QuickBooks Online.

Progress invoicing in QuickBooks Online. Source: QuickBooks

Then again, you can add a click-to-pay button on every invoice so your clients can pay directly from an invoice. For example, QuickBooks Online accepts payments via a debit or credit card, ACH payment, and Apple Pay. But unline FreshBooks, the cloud accounting software, records billable hours on the invoice with third-party apps like Google Calendar and TSheets.

Customer service

QuickBooks Online offers support by online chat and phone, Monday-Friday, from 6 a.m. to 6 p.m. PT. and Saturdays from 6 a.m. to 3 p.m. PT. for the Simple Start and Plus plan users. By contrast, the Advanced plan users receive 24/7 customer support. However, you can search for topics anytime in the knowledge base. Or communicate with other QuickBooks users in community forums.

User access

QuickBooks Online is a cloud accounting system for Firefox, Internet Explorer 10, Safari 6, or Chrome. And you can also download mobile apps for Android, iPad, iPhone, and tablets. Or browse QuickBooks Online on iOS, Blackberry, and Android mobile devices.

When you create a QuickBooks user, you can manage their roles like a standard user, company admin, and primary admin. Or limit their access to specific tasks. User roles are either non-billable or billable. Non-billable users don’t count towards the user limit, while billable users do.

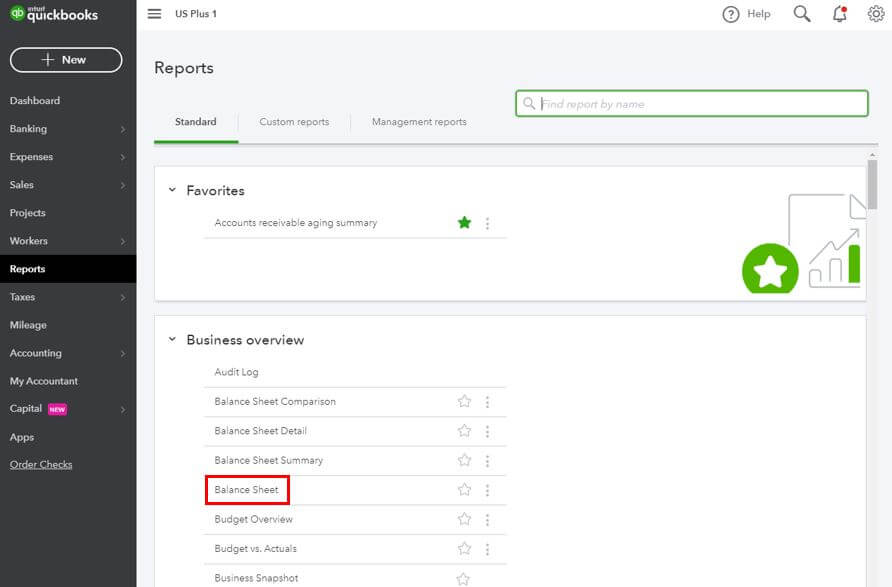

Reporting

Create a report from a variety of options. Report groups include sub-reports that drill down to the details you or your accountant need to analyze the data correctly:

- products and inventory

- accounts receivable

- accounts payable

- sales tax reporting

- employee reports

In other words, QuickBooks provides accounting insights into business operations. As a result, you can generate a detailed cash flow report and simplify tax preparation.

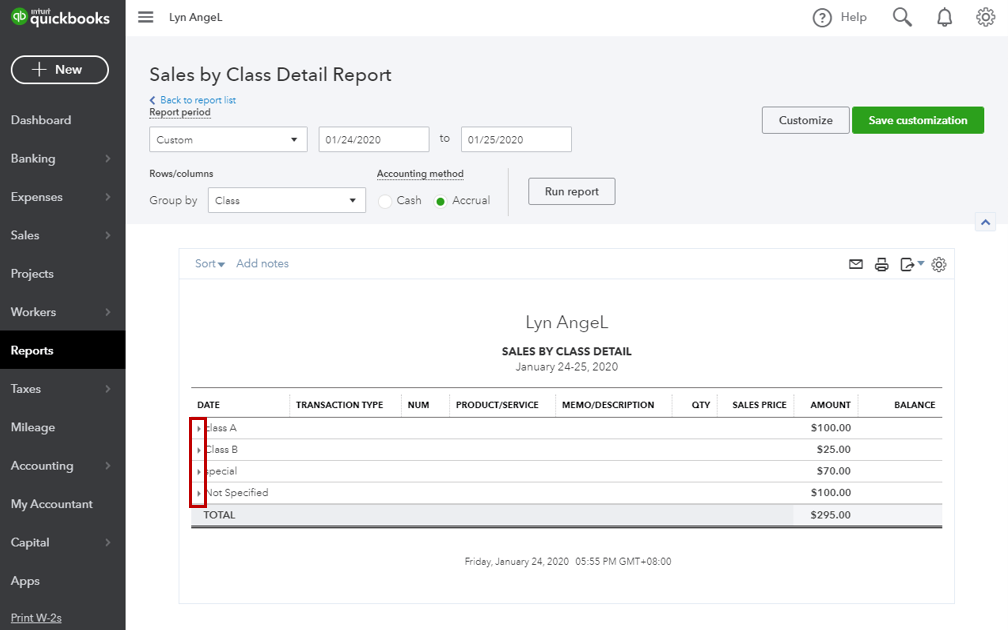

Sales by class details in QuickBooks Online. Source: QuickBooks

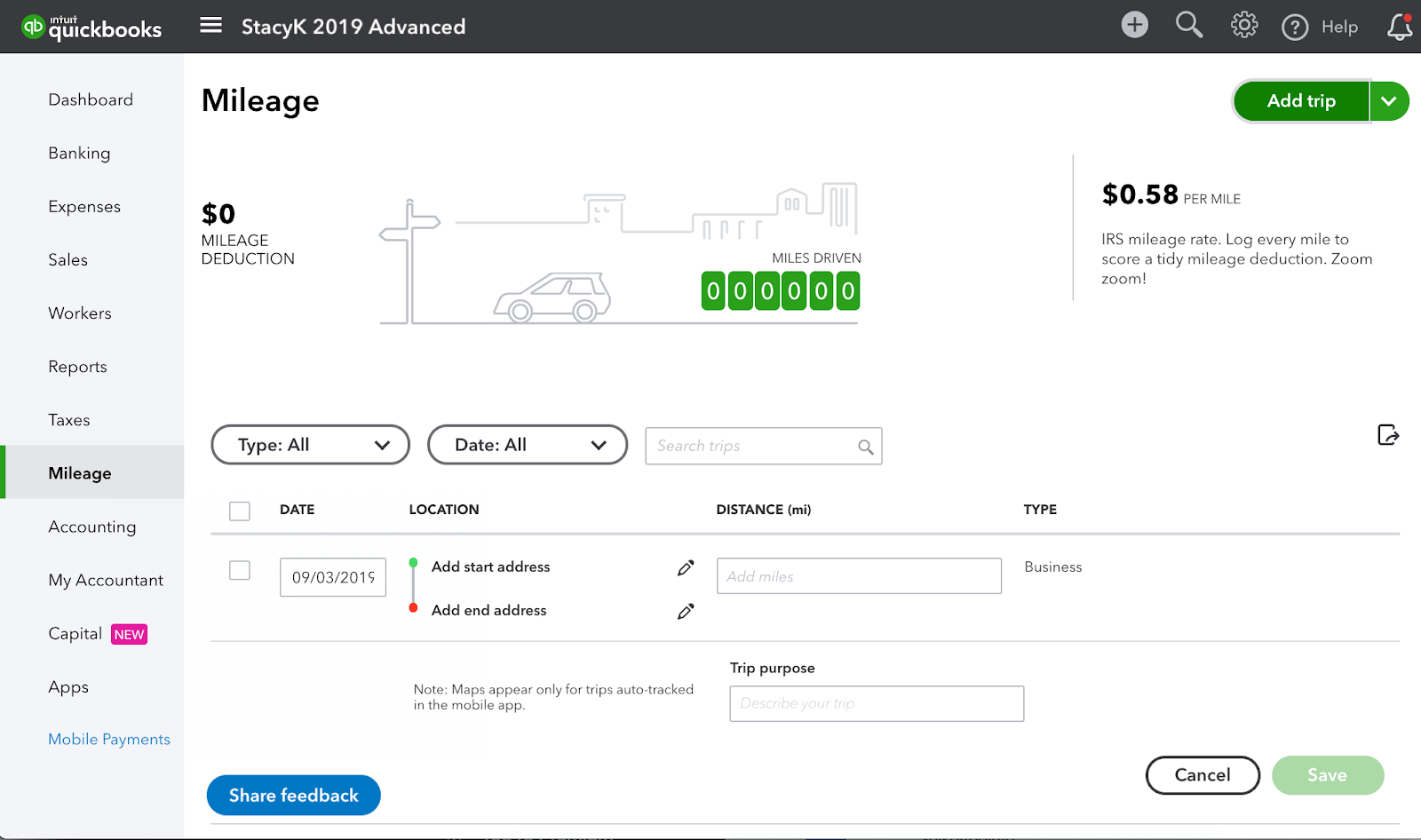

Time and mileage tracking

QuickBooks Online doesn’t have any in-built features for time tracking. Similarly, you can integrate TSheet or QuickBooks Time for an extra cost. For example, TSheets lets you generate paper timesheets and employee timesheets. By contrast, QuickBooks Time can track work time compared to full or part-time employees.

Mileage tracking in QuickBooks Online. Source: QuickBooks

Either way, you can automatedly track mileage, including your business miles and vehicle expenses. The mobile app also lets you access the track business miles. Just categorize the trip, and you are good to go.

Accounts payable

Record bills for your business. This way, you can track the money your company owes each vendor. So, every time your accountant enters a bill, the accounting software adds accounts payable to the chart of accounts.

Accounts payable in QuickBooks Online. Source: QuickBooks

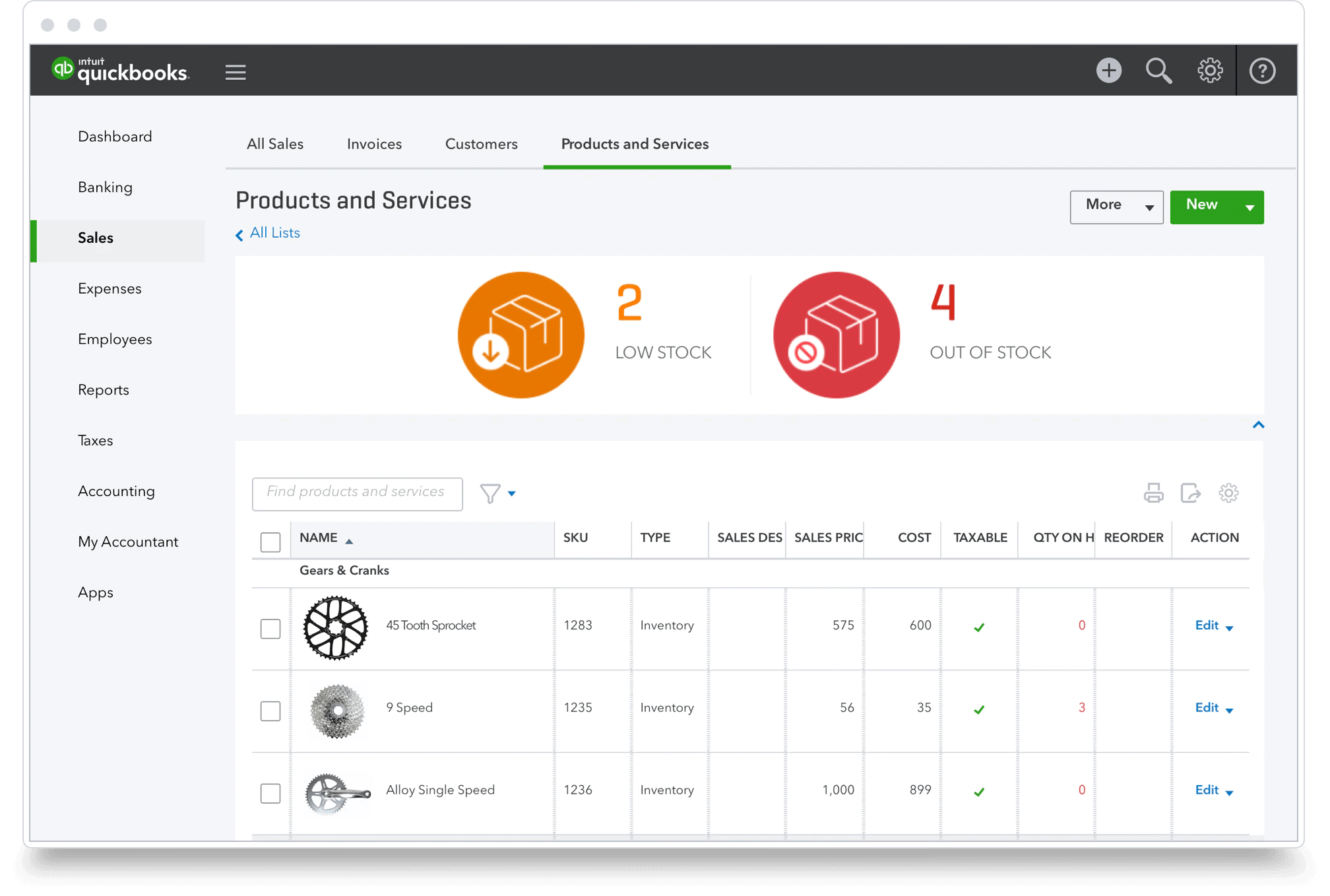

Inventory management

Comparing FreshBooks vs QuickBooks Online, the latter goes beyond basic inventory tracking. You can reorder inventory directly from QuickBooks Online. Or set up low-stock warnings. Plus, you can run inventory reports to discover which product carries the highest cost or which one is your best seller. Besides, you can track inventory on hand and enter payments for suppliers.

Inventory management in QuickBooks Online. Source: QuickBooks

Security

QuickBooks Online has all security means in mind, including password-protected login, 128-bit SSL encryption, and firewall-protected servers. And bank-level security stores your data safely in the cloud. Besides, the accounting software is a DigiCert® secured product—moreover, its automated tools and professional staff control service performance 24/7.

Integrations

QuickBooks Online is way ahead of FreshBooks in terms of integrations. In fact, the accounting software boasts over 650 third-party integrations with business banking, eCommerce, payment software, CRMs, and other software categories. This way, you can monitor your financial data and sales processes and ensure maximum visibility.

What Features Does FreshBooks Offer?

Like QuickBooks Online, FreshBooks adopts the standard bookkeeping method and double-entry accounting rules. So, your accounting data adheres to a solid framework, including improved insight into your business and structured record keeping.

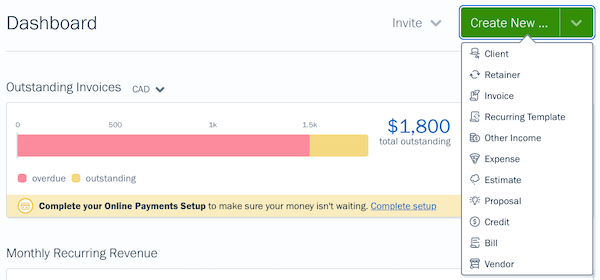

Dashboard

Get a quick snapshot of your company’s health and cash flow. Plus, create and invite a team member to your account. Based on your Reports, each graph provides a top-level view of your data:

- Outstanding Invoices

- Monthly Recurring Revenue

- Total Profit

- Revenue Streams

- Spending

- Unbilled Time

For instance, you can open up the outstanding invoices graph to see your accounts aging totals, all overdue and outstanding invoices. Or view a monthly recurring revenue summary via the monthly revenue graph.

Dashboard in FreshBooks. Source: FreshBooks

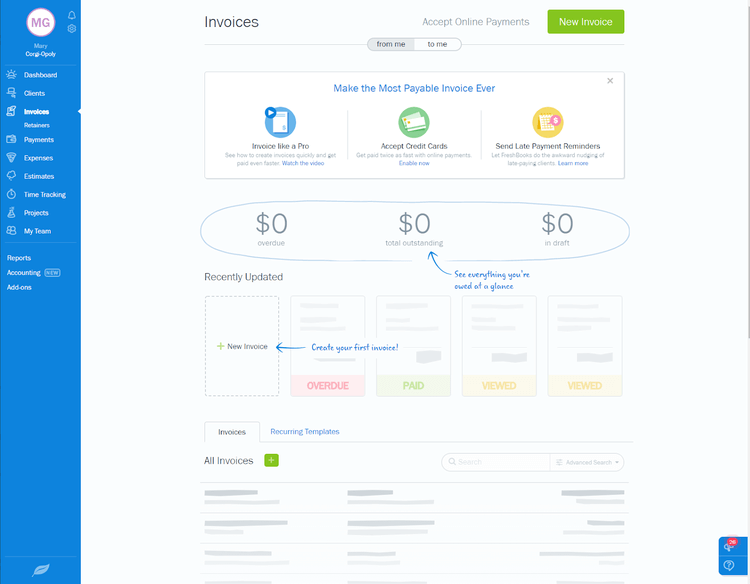

Invoicing

Easily accept or make payments with FreshBooks invoicing. You can customize your invoice designs by changing fonts and colors and setting up logos. Like in QuickBooks, you can also embed a click-to-pay button for customers. Or automate invoicing processes with the following:

- recurring invoices

- follow-up emails for overdue payments

- automatic invoicing of billable hours

Create an invoice in FreshBooks. Source: FreshBooks

Besides, FreshBooks pulls accounting data directly from timekeeping and generates invoices for billable hours. Your customers can pay an invoice via ACH, Apple Pay, and credit card. Or you can integrate Stripe and PayPal.

Customer service

Unlike QuickBooks Online, you don’t need to log into FreshBooks to get customer support. It delivers phone and email support Monday-Friday, 8 a.m to 8 p.m ET. Or you can contact a support team via a live chat on their website.

User access

FreshBooks is 100% cloud-based, meaning you don’t need to install software on your computer. Or you can upload a mobile app for iOS and Android.

You can collaborate with other business members - invite them into your account. Each team member can be Admin, Contractor, Employee, or Accountant. It just depends on what kind of role you want to grant them. If needed, customize the roles with Project Manager or Client Access settings.

Reporting

FreshBooks reporting focuses on profit margin, and its central dashboard displays the periodic output versus input. Since FreshBooks is primarily an invoicing and time-tracking tool, its reports focus on payment collection and a couple of tax-related reports. You can use filters to build more granular reports too.

The best part? FreshBooks provides various reports to keep track of

- General ledger

- Trial balance

- Balance sheet

- Journal entries

- Cost of goods sold

- Accounts payable

- Chart of accounts

- Accountant access

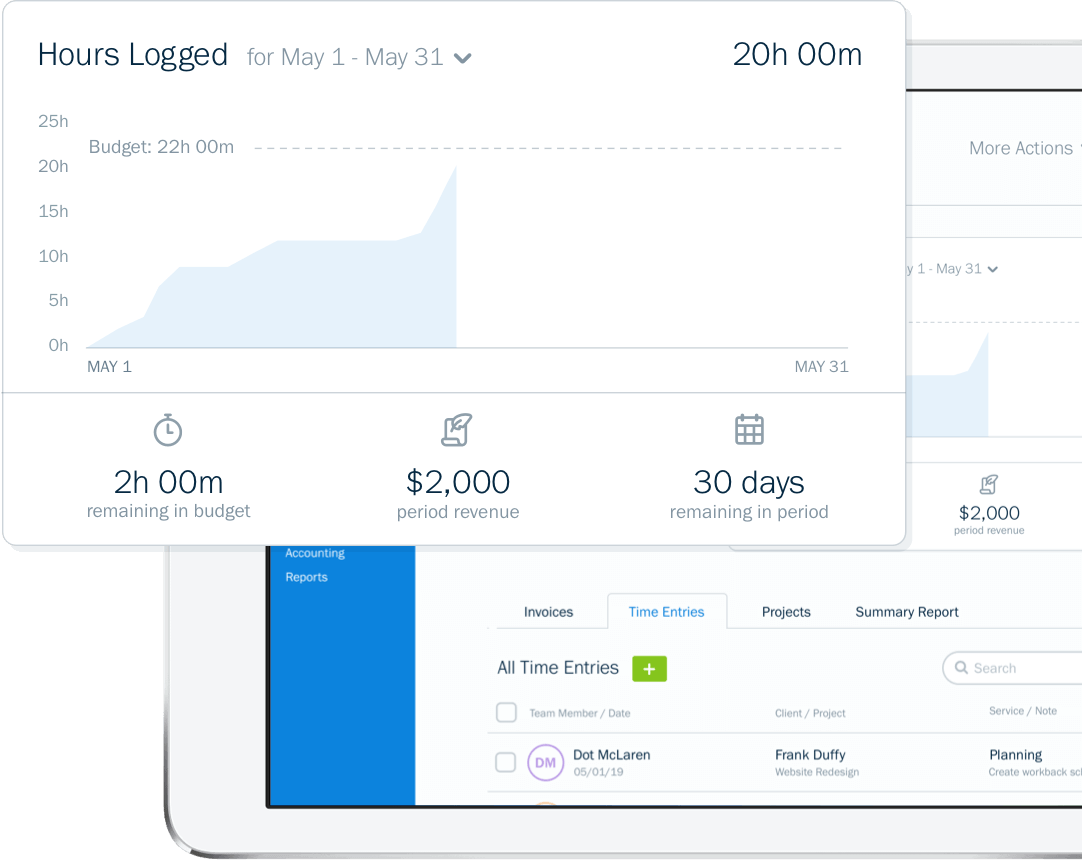

Time and mileage tracking

Unlike QuickBooks Online, FreshBooks delivers in-built time tracking. Just hit the “start timer” button to start recording the time. Then generate an invoice, and FreshBooks will automatically add the hourly data. Moreover, you can track billable hours with other project expenses, so your employees stay on the right track. You can also import this data in FreshBooks once compiled.

![]()

Mileage tracking in FreshBooks. Source: FreshBooks

Mileage tracking is also available in FreshBooks. So, every time you drive a car, the tool saves the travel history and logs each trip. Or download a mileage report from FreshBooks or send it to your email.

Accounts payable

Record and track all your bills for multiple vendors in one place. This way, your accountant can manage your cash flow; track how much money you owe every time.

To use accounts payable, you need to upload a photo/screenshot of a paper check to have a digital record and attach it to a vendor. Or you can generate a new bill. Once a customer has paid a bill, you can record the payment to track it in your account.

Account payable in FreshBooks. Source: FreshBooks

Inventory management

FreshBooks offers basic inventory tracking. Set up alerts to know when an item is out of stock. Or add and invoice goods with any FreshBooks plan. If you need more advanced inventory management, consider a third-party app, especially if you want to expand your product line.

Inventory management in FreshBooks. Source: FreshBooks

Security

When comparing QuickBooks vs FreshBooks, the latter is protected with 256-bit SSL encryption. Verify that you aren't talking to a phishing site by clicking the lock icon in your browser.

Besides, the vendor's servers are scanned regularly for vulnerabilities by Sikich LLP. Also, the accounting software leverages PCI DSS Level 1 Compliant partners and conducts an audit by a third-party app yearly.

Integrations

Comparing QuickBooks vs FreshBooks, the latter supports fewer integrations that target SMBs and middle-sized companies. For example, FreshBooks' apps let you connect your accounting platform to HR and tax-filing tools to round out the payroll-tax-invoicing circle. The list of available integrations includes Shopify, Stripe, WooCommerce, and HubSpot. Or you can connect Zapier to automate processes in other systems.

FreshBooks vs QuickBooks: Pricing Overview

To finish things out, let's look at how much you'll pay for FreshBooks vs QuickBooks Online.

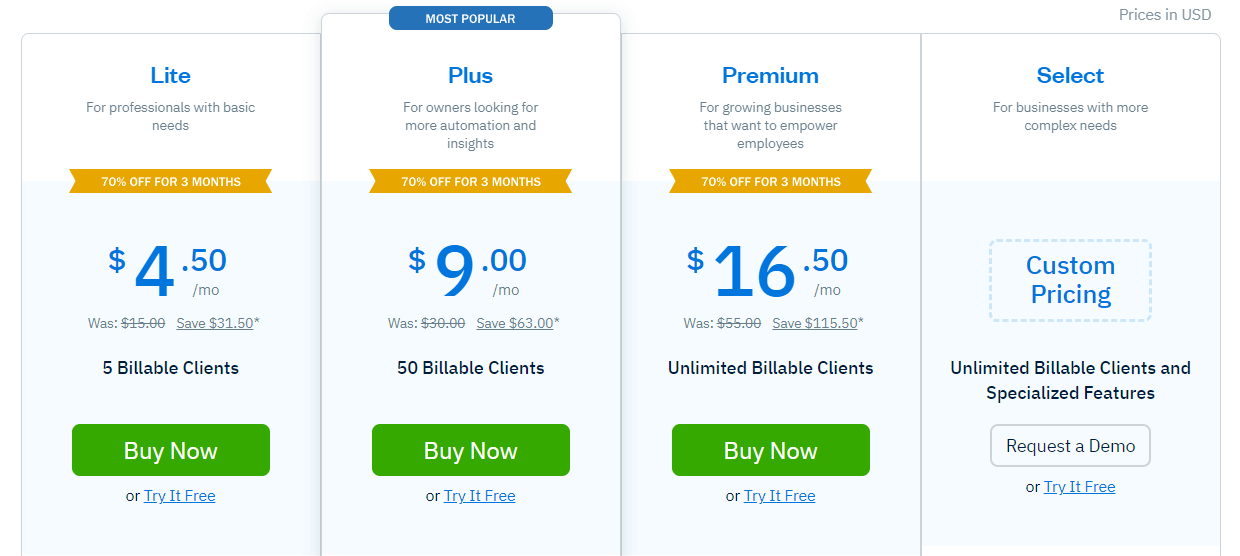

What Is FreshBooks Pricing?

FreshBooks delivers affordable pricing plans for small businesses and freelancers. Pricing modules depend on the number of billable clients, additional reporting, and tracking capabilities.

- Lite costs $15 per month with five billable clients. It offers unlimited expenses and estimates, sales tax tracking, and mobile apps for iOS and Android.

- Plus charges $30 per month with 50 billable clients, including unlimited estimates and proposals, business health reports, credit cards, bank transfers, and double-entry accounting reports.

- Premium is available for $55 per month with unlimited billable clients. This plan also delivers customizable email signatures, dynamic fields, checkout links, late payment reminders, and bill late fees.

- Select provides unlimited billable clients and specialized features. You can also get a dedicated account manager, help to migrate from other software, and set up an account with a custom onboarding service.

FreshBooks pricing. Source: FreshBooks

You can get a 10% discount if you pay for a full year in advance instead of using monthly billing. Plus, you can set up optional add-ons like Gusto Payroll, advanced payment, and team members. You can also try out a 30-day free trial.

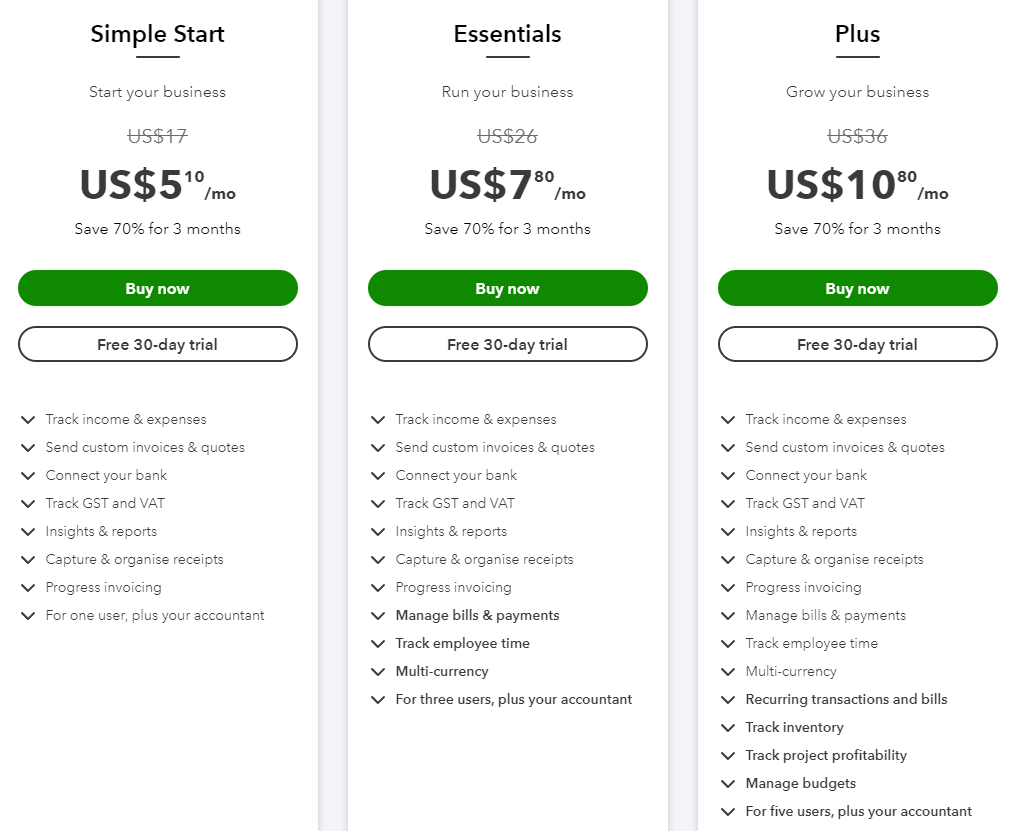

How Much Does QuickBooks Online Cost?

QuickBooks offers slightly more straightforward pricing. The basic plan, Simple Start, is only for a single user plus the accountant. At the same time, more advanced features like multi-currency, inventory tracking, project profitability, and time tracking would need higher-tier plans.

- Simple Start costs $17 per month per user and one accountant. It offers income, expense, GST and VAT tracking, custom invoice and quotes sending, and progress invoicing.

- Plus charges $26 per month per three users, plus an accountant. It delivers bill and payment management, employee tracking, and multi-currency.

- Advanced is available for $36 per month with five users and one accountant. It provides inventory and project profitability tracking, budget management, bills, and recurring transactions.

QuickBooks Online pricing. Source: QuickBooks

When you first sign up, you can pick a 30-day free trial or pay for the whole year for a 10% discount.

Comparing QuickBooks vs FreshBooks Pricing

Believe it or not, price matters for your business, especially if you run a small company. So now that you know the pricing structure of FreshBooks vs QuickBooks Online, let’s compare them.

Freshbooks | QuickBooks Online |

| Lite: $15/month per 5 billable clients and one user | Simple Start: $17/month per 1 user, plus an accountant and unlimited billable clients |

| Plus: $30/month per 50 billable clients and one user | Plus: $26/month per 3 users, plus an accountant and unlimited billable clients |

| Premium: $55/month per unlimited billable clients and one user | Advanced: $36/month per 5 users, plus an accountant and unlimited billable clients |

| Select: Custom Pricing with 2 users | N/A |

Figure 1. QuickBooks vs FreshBooks pricing structure

Both QuickBooks Online vs FreshBooks offer a 30-day free trial and a 10% discount if you pay for a whole year ahead. However, QuickBooks Online have users included in its plans while FreshBooks provides an add-on, Team Members, for $10 per person per month.

QuickBooks Online offers time tracking and budget management, starting from higher-tiered plans. By contrast, FreshBooks delivers time tracking, budget management, estimates, and sales tax in all packages. Besides, FreshBooks includes recurring bills in a middle-priced package, while QuickBook Online has it in the Advanced option. Finally, project profitability is available in both accounting systems, just in the higher-tiered plans.

Which Platform Is Better: QuickBooks vs FreshBooks?

While both FreshBooks vs QuickBooks Online deliver similar accounting features, each has its strengths and weaknesses.

What Are the Pros and Cons of FreshBooks?

Pros | Cons |

|

|

Figure 2. Strong and weak sides of FreshBooks

What Are the Advantages and Disadvantages of QuickBooks?

Advantages | Disadvantages |

|

|

Figure 3. Benefits and drawbacks of QuickBooks Online

Who Uses FreshBooks vs QuickBooks?

Accidentally or not, QuickBooks Online and FreshBooks have a long list of satisfied business owners who gladly recommend them online. But who exactly uses FreshBooks vs QuickBooks Online?

FreshBooks was primarily designed for freelancers. But today, the cloud accounting tool provides four plans, ranging from the Simple Start plan, ideal for self-employed and startups, to the Select plan, ideal for larger companies. FreshBooks caters the needs of such businesses as:

- marketing agencies

- field contractors

- legal venture representatives

- online service providers

Upwork and LinkedIn are among the most famous FreshBooks users. But that’s not all; FreshBooks is the ultimate choice for industries like Information Technology and Services, Computer Software, and Marketing.

Hours logged in FreshBooks. Source: FreshBooks

Similarly, QuickBooks was originally designed for small companies. However, this accounting software now supports all types of businesses. In fact, QuickBooks Online is ideal for those who fall into the following industries:

- accounting

- manufacturing

- contractors

- nonprofit organizations

- professional services

How to Migrate Data to QuickBooks or FreshBooks?

And, while you are still deciding which platform suits you more: FreshBooks vs QuickBooks Online, let’s see how you can migrate your data.

FreshBooks offers help migrating from other software if you’ve chosen the Select plan. In other cases, you need to use a third-party app. By contrast, QuickBooks supports an importer tool to transfer all your data in XML. Or choose a third-party migration service.

Whether you want to migrate your accounting data to FreshBooks or QuickBooks Online, consider Accounting & Invoicing Data Migration service. This way, you can transfer your accounting data automatedly without any XML files.

Which Accounting Tool to Choose: FreshBooks vs QuickBooks?

Overall, QuickBooks Online and FreshBooks are excellent accounting systems that beat most of their competitors. However, if you haven’t decided yet, consider your business needs.

If you run a small business or a large company that sells products or/and services, QuickBooks Online might be a better fit. But, if you are self-employed or work in a small company, FreshBooks better aligns with your business needs. Then again, you can test out a 30-day free trial to decide. And when you have your desirable accounting tool, contact Accounting & Invoicing Data Migration service.

Have already chosen your accounting platform?

Leave the accounting records migration to us!