Many businesses across the globe are turning to Zoho Books as their go-to accounting system. But it’s not the right fit for everyone.

The good news is that the accounting market offers countless Zoho Books alternatives. Still, which one should you opt for?

A quick summary:

- Zoho Books shines as an accounting system due to its feature richness, customer support, and free plan. However, it may be too limited for some larger companies because of fewer integrations, no built-in payroll, and limited users with invoices.

- The possible Zoho Books alternatives include paid options like QuickBooks Online, Xero, FreshBooks, Kashoo, Odoo Accounting, and FreeAgent. If you need a free accounting system, consider myBooks, Wave, Dolibarr, Crunch Accounting, and Zoho Invoice.

- You can manually export or import records like a chart of accounts, customers, vendors, items, transactions, manual journals, and purchase & sales transactions in CSV, XML, or TSV format. Or use a third-party app like Export for Zoho Books to do it automatedly.

What Is Zoho Books?

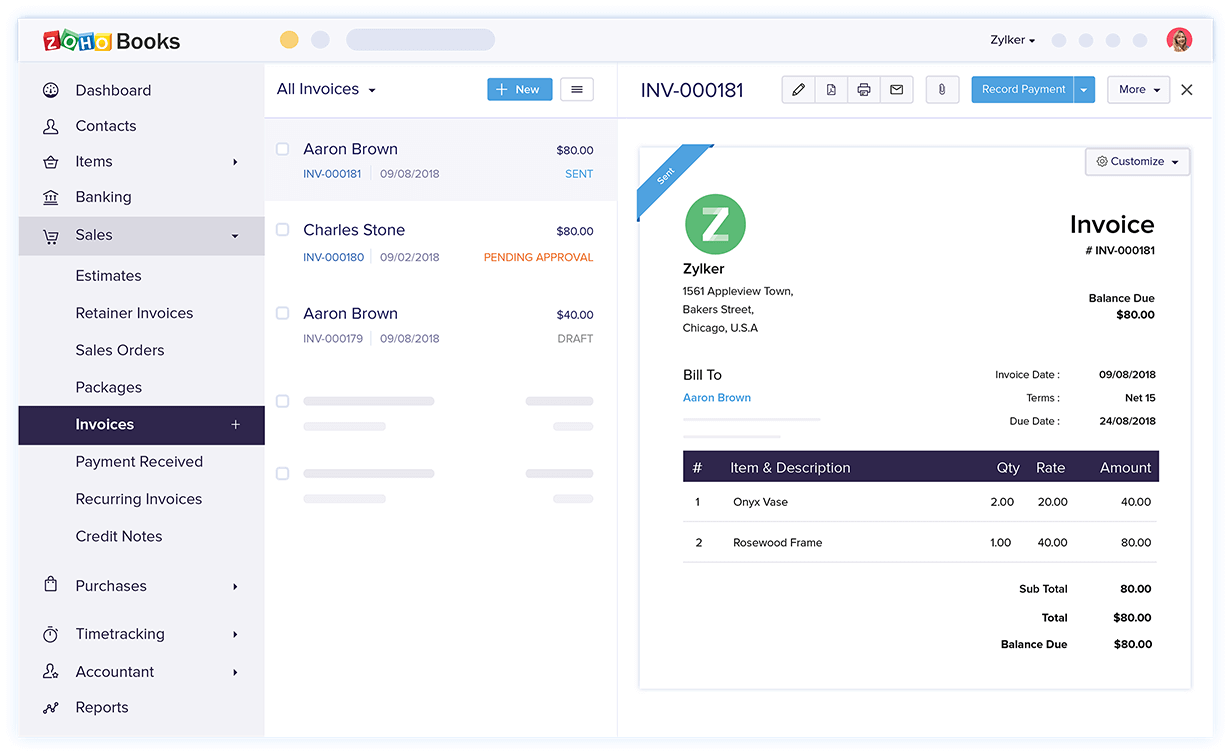

Zoho Books is a cloud-based accounting system designed by Zoho Corp. The app focuses on making financial management easier for small business owners. It has great invoicing features and free native integrations for payroll, invoicing, and expenses. Moreover, Zoho Books automatically imports bank feeds and helps you stay on top of receivables and payables.

Nevertheless, the most common users of Zoho Books are small businesses with up to 50 employees. Besides, the solution’s key customers work in the IT and services, marketing, and advertising industries.

Invoice management in Zoho Books. Source: Zoho Books

What to Look for in Zoho Books Alternatives?

You can’t randomly pick up a Zoho Books alternative, can you? And while the market is full of different accounting software, here’s what your next invoicing system should include:

- An unlimited number of users & invoices: You can only upgrade up to 15 users with Zoho Books. However, high-volume, employee-heavy businesses might require to onboard more users.

- Automation options: To make the most of Zoho Books automation, you need coding abilities.

- Inventory management: Zoho Books offers limited functionality, so you can’t go beyond identifying which and how much stock to order at what time.

- Payroll: The accounting software doesn’t have any built-in options for payroll. You can only integrate Zoho Payroll or another supported third-party app.

What Features Make Zoho Books Stand out?

Regarding features, Zoho Books provides several capabilities that help you complete your accounting tasks quickly and easily. This involves:

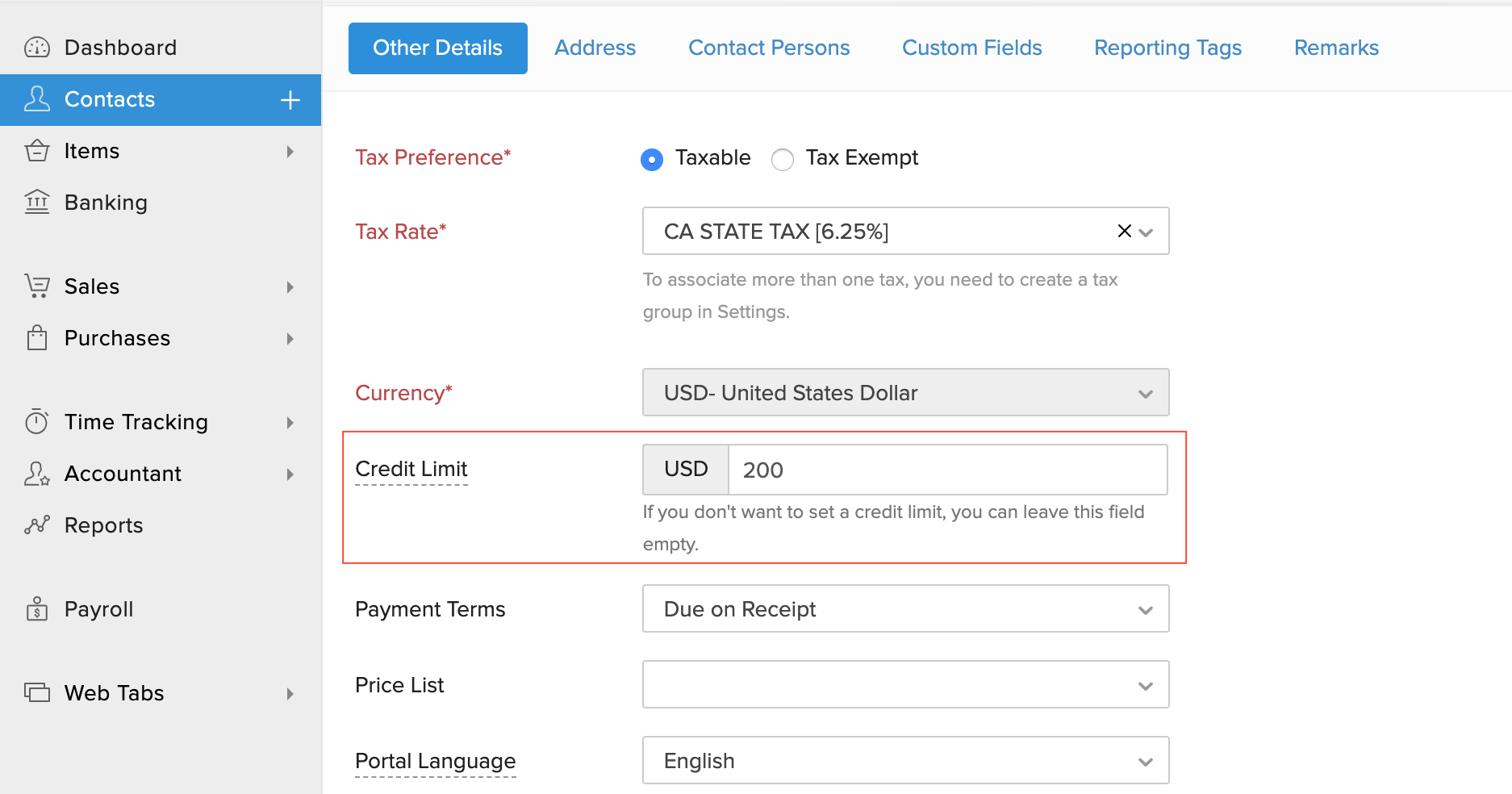

- Invoices and estimates: Create customized invoices, trade in multiple currencies, and set payment methods.

- Reports: Schedule reports on a weekly or monthly basis.

- Client portal: Let your customers see the expenditure along with their recent transactions. Besides, they can provide feedback with a satisfaction rating.

- Payment reminders: Automate payment email reminders and schedule multiple follow-ups.

- Account payable: Set up bills and recurring bills. Above all, add attachments and internal notes to bills.

- Chart of accounts: Get a default chart of accounts or customize it to fit your business’s needs.

- Audit trail: View all the details on the specific transaction, including its primary time, the created date, and if it has been sent, paid, or updated.

- Mobile app: Whenever you go, Zoho Books is within a few clicks with Android and iOS apps. It also has a version for Windows phones.

Update credit limits in Zoho Books. Source: Zoho Books

How Much Does Zoho Books Cost?

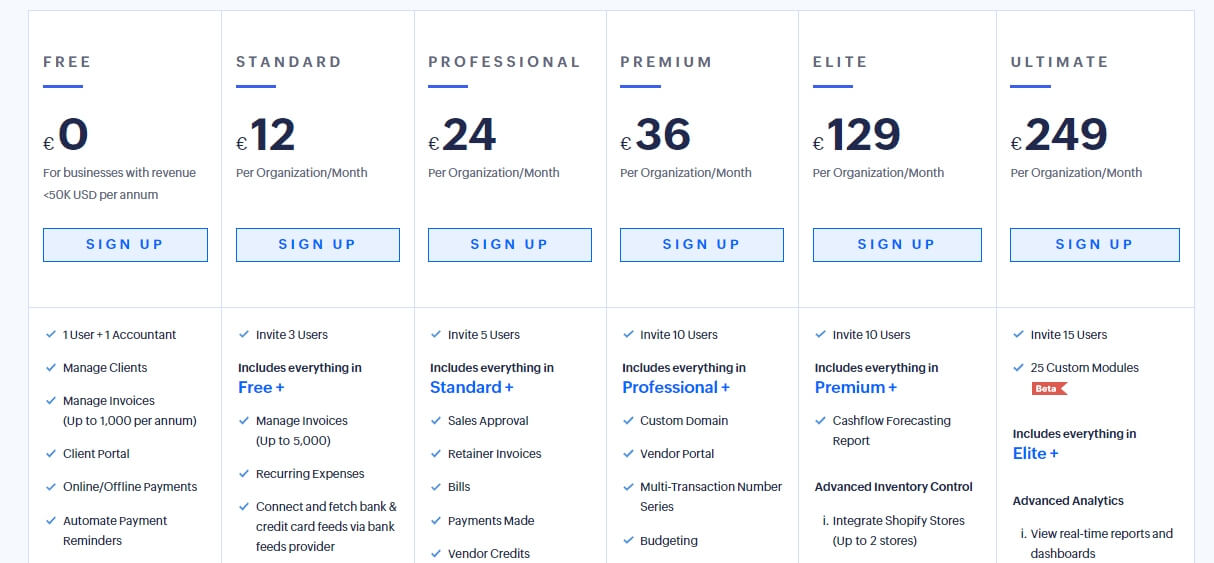

By contrast to Zoho Books’ competitors, the accounting software provides six pricing plans, including a basic free option for freelancers. But that’s not all; you can also choose add-ons as additional users, branches, and advanced autoscans for an extra fee. Let’s look at the pricing in detail:

- Free includes 1 user & 1 accountant, up to 1,000 invoices, three supported payment getaways, credit notes, manual journals, multi-lingual invoicing, taxes, and other basic accounting features.

- Standard welcomes 3 users and offers up to 5,000 invoices. The feature-set grows with a bulk update, recurring expenses, transaction locking, timesheet, and billing.

- Professional has even more to offer with 5 users, sales orders, purchase orders, bills, sales & clients approval.

- Premium supports up to 10 users and offers a vendor portal, budgeting, workflow, and tax rules.

- Elite also includes 10 users. In addition to that, you can advanced inventory control and cashflow forecast reports.

- Ultimate is accessible for 15 users and offers advanced analytics with 25 custom modules.

Pricing of Zoho Books. Source: Zoho Books

Zoho Books Pros & Cons: Review

But you’re probably wondering: if Zoho Books is a featured-pack, scalable accounting system, why look for an alternative? Let’s take a look at the benefits and drawbacks to make it more transparent.

Advantages | Disadvantages |

|

|

6 Best Paid Zoho Books Alternatives

Whether you need unlimited users or built-in payroll, the accounting market is full of Zoho Books competitors. Here are six Zoho Books alternatives and who might choose them.

FreshBooks

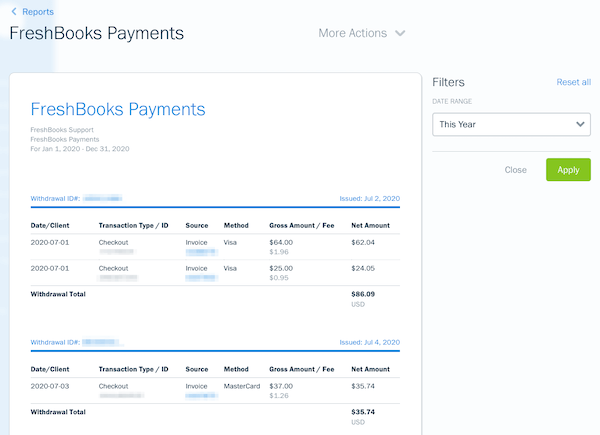

If you are in need of unlimited estimates, proposals, and invoices, FreshBooks is your best choice. The invoicing system outshines other Zoho Books alternatives with a suite of third-party integrations to help you customize the solution for your business.

FreshBooks Standout Features

Unlike other Zoho Books competitors, FreshBooks focuses on a feature-set for self-employed people. That involves functions as:

- Time tracking: Track your time and bill clients or generate an invoice from those hours.

- Invoicing: Get unlimited and customized invoices as well as unlimited estimates.

- Mobile app: Send invoices, capture receipts, and enter bills anytime and anywhere.

- Payroll: Seamless connects Gusto to FreshBooks to offer unlimited payroll, direct deposit, etc.

- Mileage tracking: View potential tax deductions, find logged trips, edit and adjust trip details, etc.

- Proposals: Easily convert proposals into invoices. Give your customers all the information supported by images and attachments.

Create payment reports in FreshBooks. Source: FreshBooks

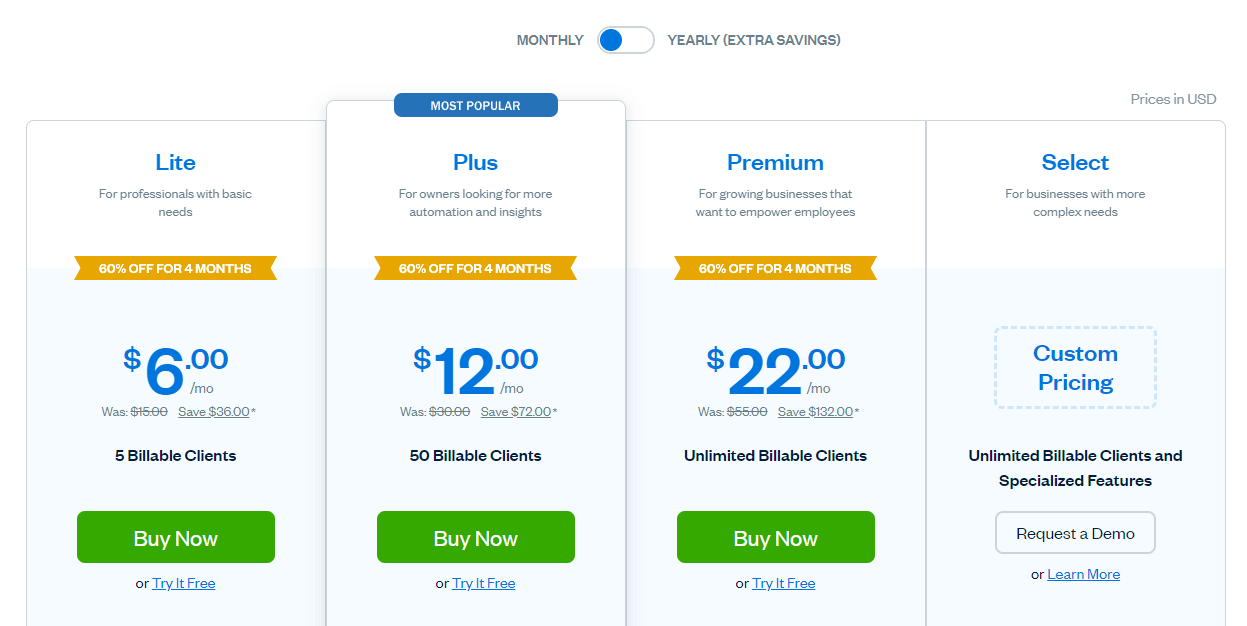

How Much to Pay for FreshBooks?

In contrast to Zoho Books, FreshBooks offers simpler pricing: three packages and a custom option. Or you can test an invoicing system with a free 30-day trial. So what options do you have?

- Lite includes 5 billable clients with unlimited invoices, expenses, and estimates.

- Plus lets you charge 50 clients, run business health reports, and track mileage in a mobile app.

- Premium has no limits on billable customers and allows you to get paid with checkout links.

- Select includes all features from the previous plans. In addition to that, you get access to lower credit card transaction rates and capped ACH fees.

Pricing of FreshBooks. Source: FreshBooks

Why to Choose FreshBooks over Zoho Books?

If you are looking for a Zoho Books alternative for self-employed people, pick FreshBooks. In contrast to Zoho Books, the accounting software lets you track time and mileage, includes integration with Gusto, and offers customer support via a toll-free number. FreshBooks is a worthy Zoho Books competitor for those who don’t need inventory capabilities.

FreeAgent

Do you need unlimited users? Then, chances are that FreeAgent is your perfect Zoho Books alternative. This accounting system is designed especially for small business owners that require timesheet management and business insights.

What Are Key Features of FreeAgent?

By contrast to other Zoho Books alternatives, this accounting software has a basic feature-set packed into one pricing plan. Then again, FreeAgent has its perks like:

- Business insights with Radar: Keep an eye on your business with Admin To-Do lists and insights. Get alerts in case of cash shortfall.

- Sales Tax: Set up your rates and consequently create sales tax reports.

- Dashboard: View cash flow at glance, track profit & loss live, and keep up to date with timelines.

- Estimates: Use estimate templates to send to your clients. Beyond that, get notified when they accept or reject your quotes.

- Expenses: View recurring expenses to plan ahead. Upload expense receipts directly from your mobile.

- Banking: Import all your bank transactions and link the bank accounts.

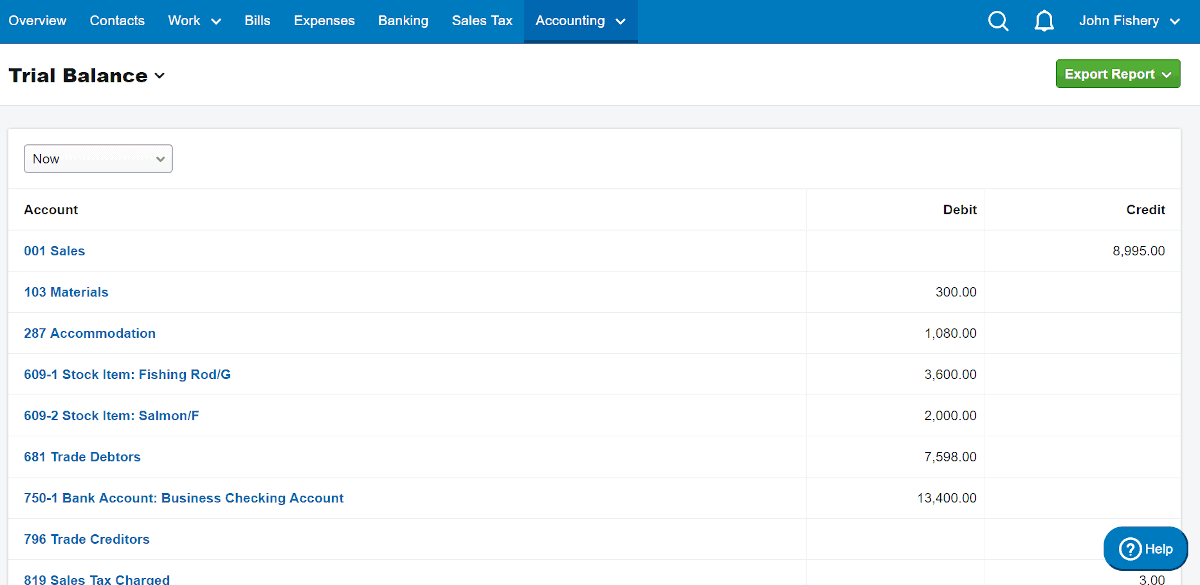

Trial balance in FreeAgent. Source: FreeAgent

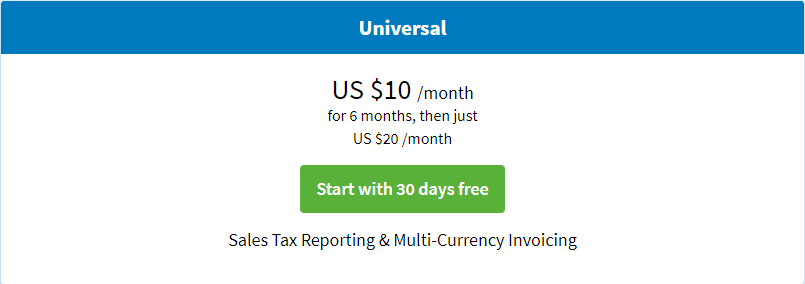

How Much Does FreeAgent Cost?

FreeAgent only has one paid pricing package, and it comes with pretty much everything you’ll require from a billing system. However, you can try it out for 30 days free.

FreeAgent Pricing. Source: FreeAgent

Why Is FreeAgent a Good Zoho Books Alternative?

FreeAgent suits users who need no limits on users, invoices, and expenses. Besides, it offers automated bank feeds, a mobile app, and a well-designed dashboard.

QuickBooks Online

QuickBooks Online is one of the most popular Zoho Books alternatives. Thanks to its overall features and vast integration options, this invoicing system might be an instant choice. Compared to Zoho Books, QuickBooks Online provides its payroll integration.

What QuickBooks Online Features to Consider?

You’ve likely heard of QuickBooks Online capabilities, including inventory tools, project profitability tracking, and business analytics. Mainly, the billing system includes such great features as

- Project management: track expenses by project and project statuses. Or, even better, compare actual vs. estimated costs.

- Invoicing: Create custom invoices, quotes, estimates, and sales receipts.

- Expenses: Keep track of costs and revenue. Beyond that, record expenses for tax time.

- Security: Get bank-level security to protect your accounting data.

- Multi-currency: Manage customers across the world with 145 currencies.

- Recurring transactions: Automate the invoices and track the status of all bills.

Project profitability in QuickBooks Online. Source: QuickBooks Online

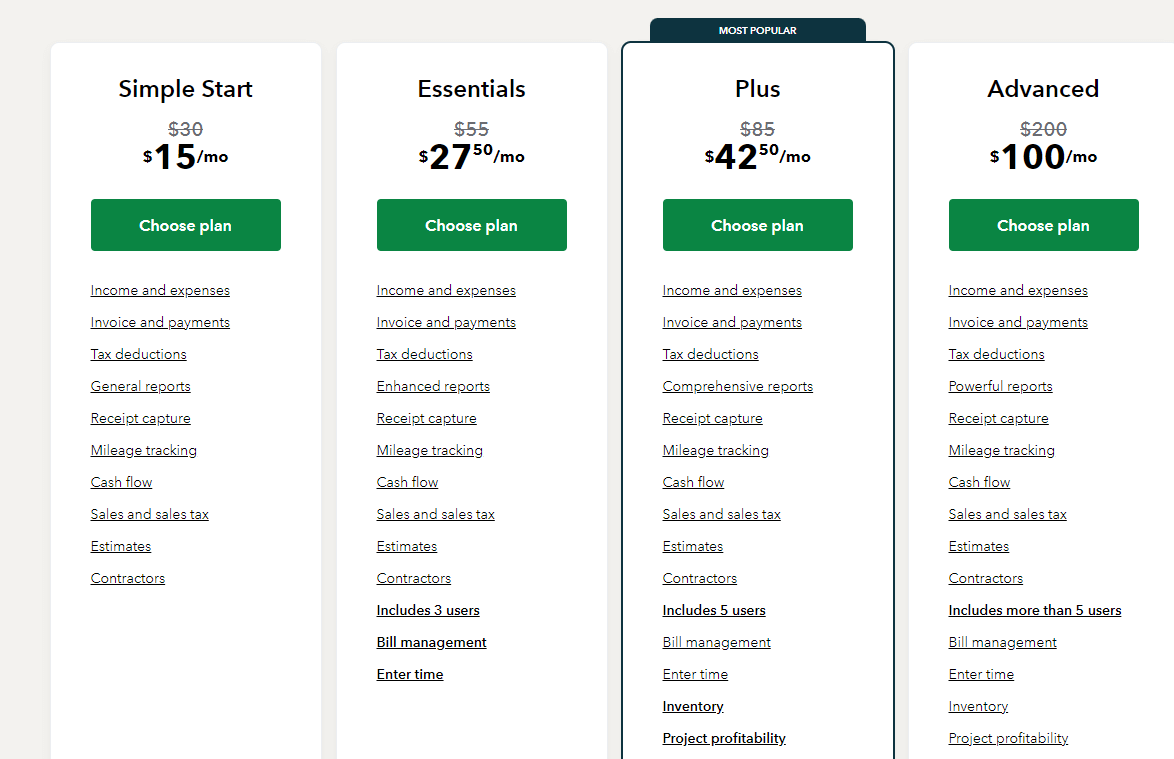

How Much to Pay for QuickBooks Online?

QuickBooks Online comes with three pricing options, each with a different number of users and features. This accounting system is more expensive than other Zoho Books alternatives. Here’s what you can choose:

- Simple Start includes 1 user with a tax deduction, general reports, cash flow, contractors, etc.

- Essentials is accessible for 3 users who can implement bill management, enter time, and enhanced reports.

- Plus is suitable for 5 users. Besides, it includes inventory and project profitability.

- Advanced features workflow automation, data restoration, employee expenses, and customized access.

Pricing of QuickBooks Online. Source: QuickBooks Online

Why Choose QuickBooks Online?

If your business requires more advanced features, high security, and many integration options, QuickBooks Online might be your alternative to Zoho Books. Even its simplest plan provides diverse functions and add-ons to skyrocket your business further.

Xero

This accounting system is best suited for businesses that demand fixed asset management. What’s more, Xero offers users much-needed integrations with third-party apps and unlimited users. In contrast to Zoho Books, it also comes with 24/7 email support.

Xero Key Features

Xero has the same core functionality as Zoho Books, including basic inventory management, project management, mobile apps, and bank reconciliations. However, it stands out with such functions as:

- Fixed asset management: Store fixed asset records and manage depreciation.

- Bank connections: Easily set up bank feeds and receive transactions directly to Xero daily.

- Reporting: Generate accurate accounting reports and collaborate with your team in real time.

- Purchase orders: Track orders and deliveries at any time. Besides, you can set up and send purchase orders online.

- Sales tax: Prepare sales tax returns with reports. Or, even better, calculate sales taxes on transactions.

- Quotes: Set up custom quotes via the cloud accounting software or the mobile app.

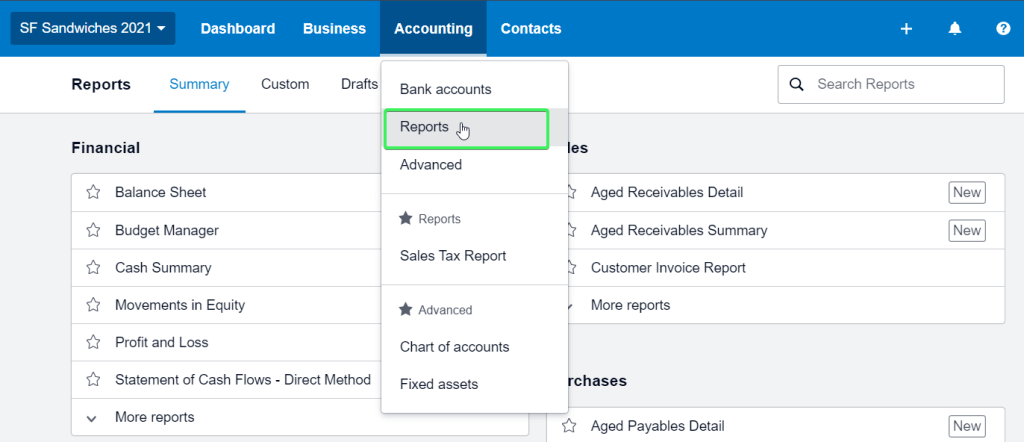

Access reports in Xero. Source: Xero

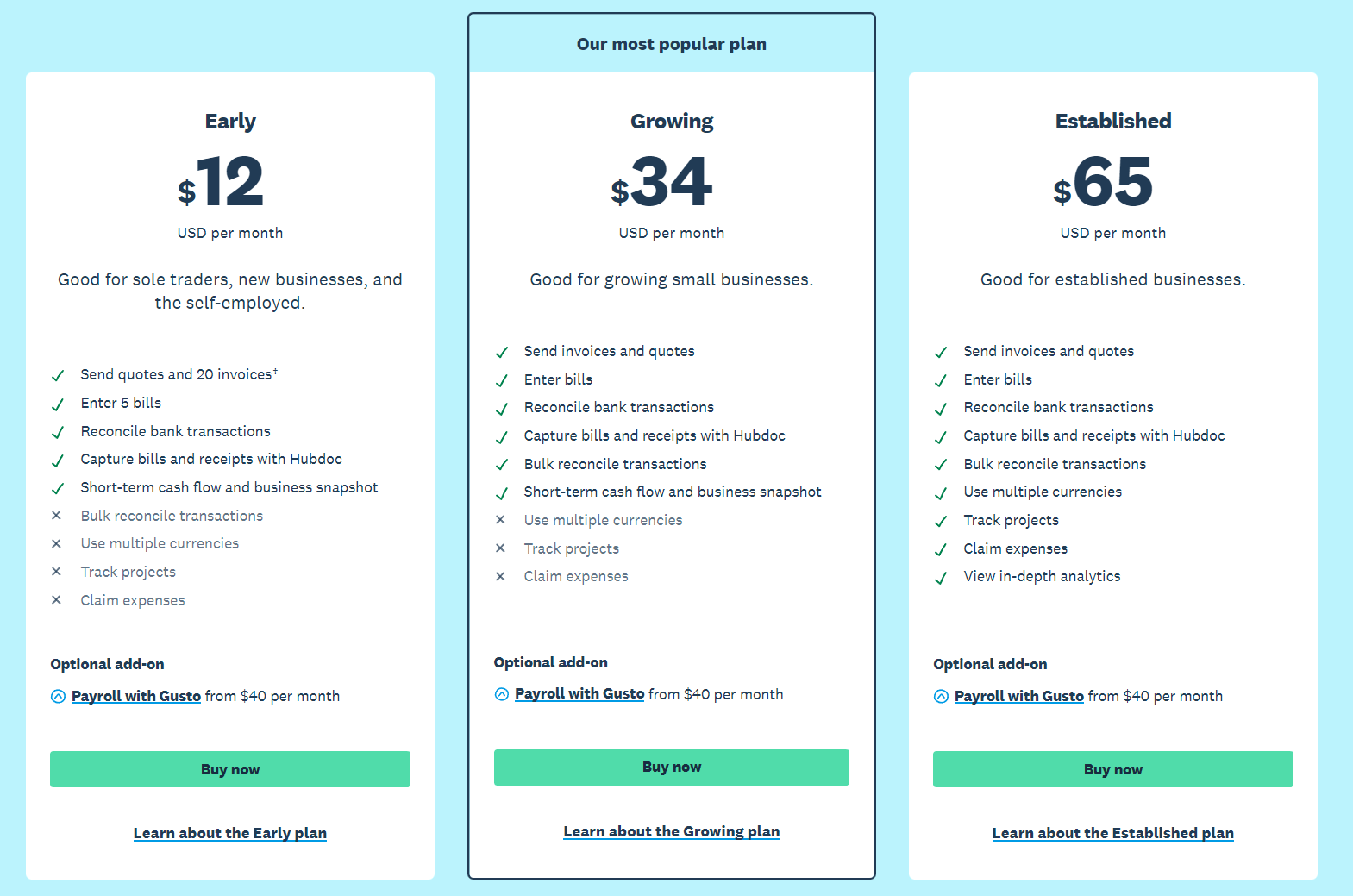

What is Xero Pricing?

Like some Zoho Books alternatives, Xero has pretty simple pricing. Your options boil down to:

- Early allows you to enter 5 bills, and send 20 invoices and quotes. Moreover, you can capture receipts and bills with Hubdoc.

- Growing includes sending unlimited invoices, bank transactions, and short-term cash flow.

- Established lets you track projects, view in-depth analytics, and claim expenses.

Pricing of Xero. Source: Xero

Why Select Xero over Zoho Books?

Xero is your best option if you need fixed asset management, a bigger number of integrations, and unlimited users. To top it off, this accounting system can substitute Zoho Books when you require customizable permissions and inventory management.

Kashoo

If you need unlimited users at no additional cost or a simple feature set, pick up Kashoo. It’s an invoicing system that boats accounting features for an affordable price. Also, unlike other Zoho Books alternatives, Kashoo has a good iPad app.

What Kashoo Features to Consider?

While Kashoo has fewer features than Zoho Books, it still has its pros:

- Contact management: Save client information and add such information as the default currency, sales tax rates, and income accounts.

- Reporting: Create such reports as unpaid bills, trial balances, income statements, balance sheets, and general ledger.

- Tax support: Set default sales tax rates for both clients and items. Above all, set unlimited sales tax options and add descriptions.

- Invoices & estimates: Get 8 invoice templates available for customization.

- Bank account connections: Sync all financial accounts and export required data to balance the accounts.

- Project cost tracking: Add projects and associate income and expenses with them.

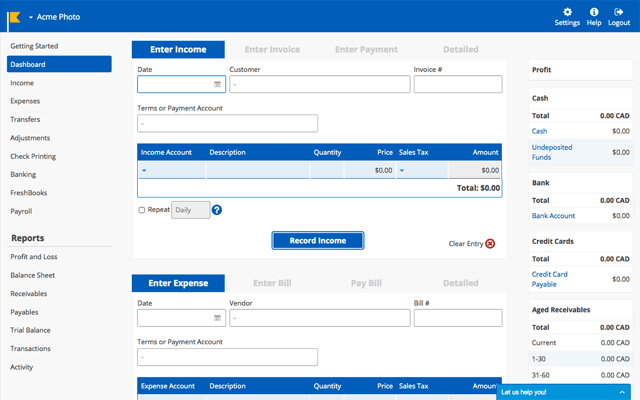

Dashboard in Kashoo. Source: Kashoo

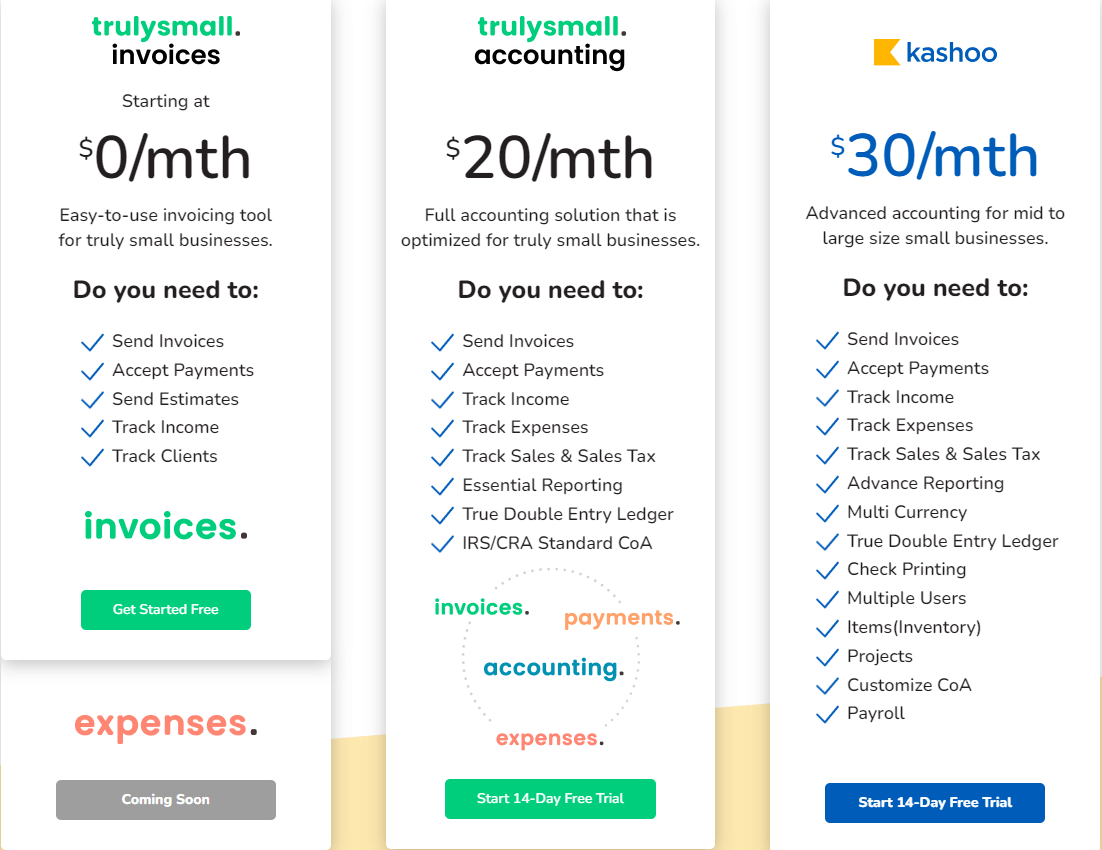

How Much to Pay for Kashoo?

Kashoo offers three pricing options, including a free plan specifically for invoicing. Besides, you can try out paid packages with a 14-day trial. Let’s look at your options in detail:

- TrulySmall Invoicing is suitable for users who only need basic invoicing. It includes sending invoices & estimates, and tracking income & expenses.

- TrulySmall Accounting has essential reporting and true double-entry ledger.

- Kashoo adds customizable CoA, items, projects, and multiple users.

Pricing of Kashoo. Source: Kashoo

Why Buy Kashoo?

If you need bank account connections, client and supplier contacts, and various payroll integrations, think of Kashoo. In addition, you can use an iPad app and a free invoicing plan like in Zoho Books.

Odoo Accounting

Odoo Accounting might be a good option for business owners who need an app that connects with various native integrations. This accounting system is a part of Odoo ERP, and you can integrate it with applications for inventory, invoicing, expenses, and others. Frankly, Odoo Accounting is one of a few open-source accounting solutions on the market.

What Odoo Accounting Functions to Consider?

While the solution mainly focuses on accounting, it still includes all necessary options. Here’s the list of the best features:

- Invoicing: Set up professional invoices, track payments, and manage recurring bills.

- Bank reconciliation: Import files and sync bank statements automatically.

- Bill & expenses: Forecast bills for the future and manage supplier invoices.

- Easy reconciliation: Automate reconciliation.

- Reporting: Set up cash flow statements, balance sheets, and earning reports.

- Automated follow-ups: Get paid quickly and save time.

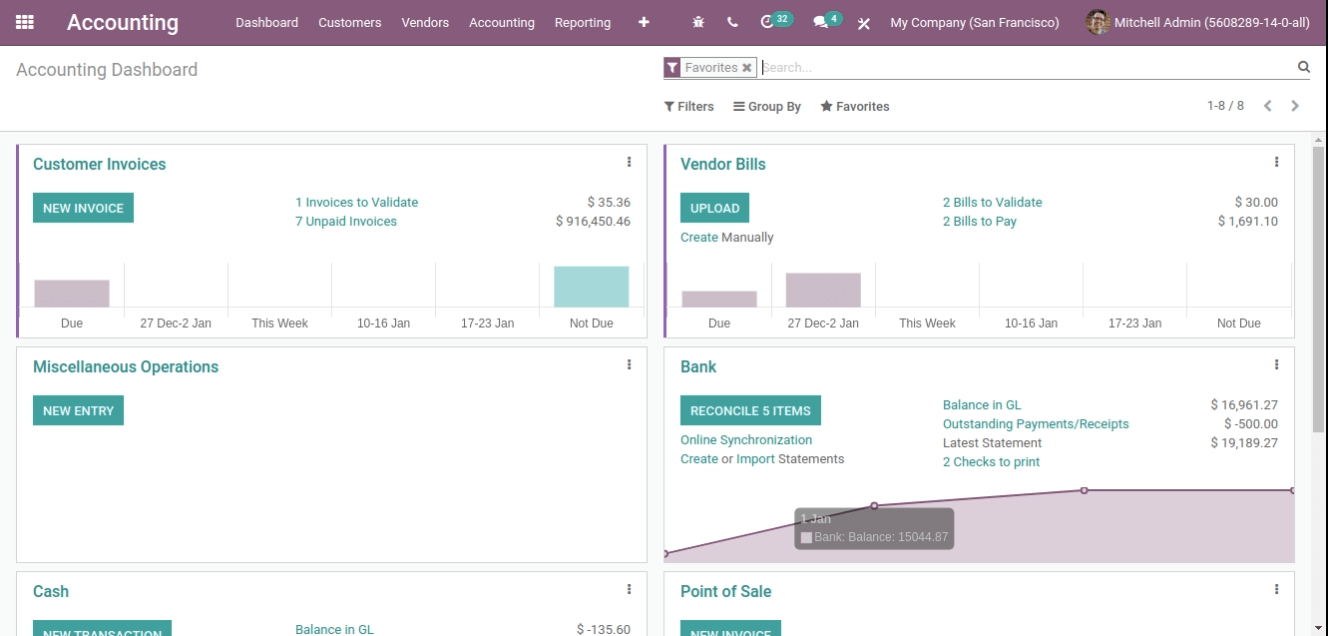

A dashboard in Odoo Accounting. Source: Odoo Accounting

How Much Does Odoo Accounting Cost?

Odoo Accounting has distinct pricing, unlike other Zoho Books alternatives. If you use only Odoo Accounting, you get it for free. However, if you want to use other apps, you get charged from $6/month per user to $24/month per user, depending on a specific application.

Why Choose Odoo Accounting over Zoho Books?

Odoo Accoutning is an option for those who need an open-source accounting system. It’s highly scalable due to various Odoo apps and customization capabilities. Moreover, it includes up to 16 different reports, more than some Zoho Books competitors.

Free Zoho Books Alternatives to Choose

The price matters, especially when deciding on a new accounting system. But what to do if you use a free Zoho Books account? Here are your free options:

- Kashoo: Its free package, trulysmall.invoices, includes features to accept payments, send estimates, and track clients & income.

- Wave: Free invoicing, accounting, and banking power you to track unlimited income and expenses, access Instant Payouts, and set up customized invoices.

- Zoho Invoice: It’s a free Zoho app to help you deal with creating invoices, collecting payments online, and generating invoice reports.

- myBooks: With a free plan, you get one user, one branch/division, an Android app, limited inventory, and 25 monthly transactions.

- Dolibarr: It’s a free open-source platform that includes not only features for accounting (bank reconciliation, invoicing, billing, and payment) but for CRM & Sales, Marketing, HRM, and Productivity.

- Crunch Accounting: The accounting software offers the Crunch Free plan, including unlimited invoices and expenses, self-assessment filling, VAT submission, and open backing.

How to Migrate Data from/to Zoho Books?

Imagine you need to import accounting data from or to Zoho Books. What options would you have?

For starters, Zoho Books has built-in options to export and import such records as a chart of accounts, customers, vendors, items, transactions, projects, tasks, timesheets, purchase & sales transactions, and manual journals. The cool thing is that you can map fields while importing data. But here’s the problem: you need to do it all manually, and Zoho Books only support CSV, XLS, and TSV file formats for importing data.

Another option is to integrate a new accounting system. Zoho Books support billing solutions like Wave, FreshBooks, Tally, and QuickBooks Online. But if you want to export Zoho Books data to a different system, consider an automated migration service as Accounting & Invoicing Data Migration. The app maps your fields automatedly and imports data to any supported platform. Or you can request the needed one.

Recap

It’s up to you which Zoho Books alternative to choose. There are plenty of options depending on your business needs. For instance, if you need more advanced features, you might consider QuickBooks Online. FreshBooks or FreeAgent are your options if your business requires unlimited users. Or, if you need fixed asset management, you can switch to Xero.

Still, if you are unsure which accounting system, try out a free trial. And when you are ready, migrate to any accounting system of your choice with Migration Wizard.

Frequently Asked Questions

It has a free pricing plan suitable for businesses with revenue less than 50K USD per annum. The package includes one user and one accountant, the option to manage up to 1,000 invoices annually, automate payment reminders, etc.

For starters, you can integrate Zoho Expense into Zoho Books as both apps share the same core. However, Zoho Books offers some basic expense tracking while Zoho Expense focuses on providing comprehensive expense management.

No, Zoho Books is a cloud-based accounting system. However, the app offers an option to integrate any third-party services using Zoho APIs.

Yes, Wave and Zoho Books are both billing systems that focus on accounting & invoicing. However, Zoho Books has more features to offer.

Yes, Zoho Books is easy to learn. The platform offers various means for users to learn how to use the accounting system. That includes Help Center, blog, FAQ, and a video section on general and specific topics.

To record income in Zoho Books, go to the Banking module. Then pick up the account where you want to create the transaction. After that, press Add transaction > Money In > record the transactions in the suitable option.

To create a ledger, open up the Reports module in the sidebar. Under the Accountant section, click on General Ledger. Then press on Customize Repor and pick the needed date range. Finally, choose Export Detailed Report and define a file format. When a ledger is ready, you’ll get a notification.

Yes, you can integrate QuickBooks into Zoho Books. To do so, go to Integrations, then Accounting. Click on Connect QuickBooks. Sign in and pick which organization you want to integrate.

Yes, Zoho Corp offers a separate application for payroll, namely Zoho Payroll. It has a free pricing plan and you can connect it to any Zoho app.

You can export Zoho Books to QuickBooks Online in two ways: a) by exporting CSV or XL files to QuickBooks; b) with an automated migration service such as Accounting & Invoicing Data Migration.

No, you need to integrate a supported CRM app into QuickBooks Online. The list includes such software as Pipeline, Freshsales, Agile CRM, etc.

Have already chosen your accounting platform?

Leave the accounting records migration to us!