Strategic business planning is more than just tracking your profit and sales - you need a more general view of your financial health. This is where cash flow comes into play. It shows how you gain and spend money and pushes you to correct decisions.

To understand why cash flow is essential, you must know what it is and how to manage it. This article sheds light on cash flow for small businesses and provides best practices for its management. Plus, we enlist the best cashflow apps for small businesses.

What Is Cash Flow for Small Businesses?

Cash flow in small business means the money going in and out of your company. You receive money from sales and spend it on things necessary for your business. How to know your cash flow is healthy? The common formula is comparing your income and expenses: if your income surpasses expenses, then you manage your cash flow the right way; if vice versa, you’ll need to look for an alternative way to get more money and cover the debts.

Accounts Receivable vs Accounts Payable

The difference between accounts receivable and accounts payable is often vague to starting business owners. But those are the accounts that actually represent your cash flow, so knowing how to manage them is a must. Now, let’s put a strict line between those financial terms.

Accounts receivable is what your customers owe to your company. Those are immediate or pending payments made through invoices and recorded as your assets. If you fail to keep up with your invoices, the customer payments may get late, so your income gets stuck in the middle of nowhere. Thus, late payment reminders, recurring invoices, and follow-ups can help you stay on top of your receivables. Cashflow apps for small businesses can provide you with those possibilities.

Accounts payable is what your company owes to suppliers and vendors. It’s an account with your liabilities that tracks how much money leaves your business. Those include expenses like payroll, purchases, bank loans, and the like. Tracking your expenses is extremely important - it helps you improve your expense policy and keep your cash flow positive.

What Is the Difference Between Profit and Cash Flow?

When you can differentiate accounts receivable and payable, calculating your business profitability is a matter of a minute. Simply subtract your total accounts payable from accounts receivable and get the net profit.

Yet, you can’t equate profit and cash flow. While cash flow is the balance showing your cash movements, profit is the money your company gets per particular period after all expenses are made. So, even if you get much profit, your business still may undergo a negative cash flow or vice versa - all depends on your income-expenditure equation.

How Crucial Is Cash Flow for Small Businesses?

Cash flow can establish a precise diagnosis of your business health. It gives deep insights into your financial management and provides important numbers for your business. Therefore, it helps you to

- Make smarter business decisions

- Improve relationships with your suppliers and contractors

- Understand your expenses

- Define the best time for growing your business

How to Plan Cash Flow?

It is essential to make regular cash flow forecasts to be always prepared for further updates. Whether you are running out of money or your sales have increased twice since the last week, cash flow planning gives you hints on what to do next.

So how to plan your cash flow? Let’s elaborate on each stage.

1. Generate a cash flow statement

A cash flow statement helps you identify your cash flow patterns and define how those affect your business. It consists of three core parts:

- cash flow from operations

- cash flow from financing

- cash flow from investing

We’ll shed more light on the cash flow statement a bit later.

2. Forecast your outgoings

With a cash flow statement, you can determine when your business spends more or less money so that you can plan your expenses appropriately. Estimate how much funds are necessary to cover your upgoing expenses, such as payroll, rent, bank fees, etc. These estimates prevent your business from unexpected breakdowns and financial challenges.

3. Plan ahead

Be sure to have a plan A and a plan B to keep your business finances safe in case of abrupt changes. If the slow season is coming, save money to cover your regular expenses and still have a stash. A calendar with your income and expenses can come in handy.

How to Understand Cash Flow for Small Businesses?

In small businesses, cash flow management involves working with cash flow statements, income statements, and balance sheets. How do they differ?

The cash flow statement breaks down cash flow performance into three sections: operating flow, investing flow, and financing flow. Let’s define each.

- Operating flow shows the net cash from regular business operations like manufacturing, distributing, and selling products or services.

- Investing flow means investments in property or equipment that increase your business profitability.

- Financing flow covers the transactions used to fund the company. These include dividends, debts, and equity.

An income statement shows your revenue curve and lets you check whether you’re making a profit or loss for a given period. It helps business owners improve their financial strategies and make more accurate forecasts.

The balance sheet gathers your assets and liabilities for a specific time so that you and your stakeholders can check your financial health. Comparing balance sheets for several periods can show a bird’s eye view of your business growth.

How to Calculate Small Business Cash Flow?

Do small business owners need an accountant to calculate their cash flow? Not necessarily. Knowing several cash flow formulas makes this accounting operation more straightforward. For example, how much free cash flow do you have? FYI, Free Cash Flow (FCF) is cash that exceeds your working capital needs so that you can use it freely and safely.

Free Cash Flow (FCF) = net Income + depreciation/amortization - change in working capital - capital expenditure

where

- Net income is the amount of money your business makes after subtracting the expenses.

- Depreciation defines the value of a physical asset for the company; amortization refers to spreading the cost of a non-physical asset over its useful life.

- To calculate your working capital, subtract your current assets from your current liabilities.

- Capital expenditures are your investments into long-term assets like equipment and its maintenance.

Here’s the list of other core formulas to calculate cash flow for small businesses.

- Operating cash flow = total cash received for sales - cash paid for operating expenses;

- Net cash flow = operating activity cash flow + investment activity cash flow + financing activity cash flow;

- Financing cash flow= cash inflows from issuing equity or debt - (dividends paid + repurchase of debt and equity);

- Investing cash flow = purchase/sale of property and equipment + purchase/sale of other businesses + purchase/sale of marketable securities.

What Is Cash Flow Management Software?

Cash flow software ensures you are on top of your cash inflows and outflows. It provides a detailed picture of your financial position and helps you polish your business strategies.

These tools automatically connect to your bank accounts and track each transaction. You can find this information well arranged in cash flow statements, income statements, and balance sheets in your cash flow management software. Plus, cash flow forecasting is another common feature of such solutions.

Why Should You Use Cashflow Apps for Small Businesses?

If the above benefits of cash flow management software are not enough, check more reasons to automatize your cash flow tracking.

1. Analyze real-time data

Cash flow software provides real-time data reports on your financial health. You can visualize this data in tables, charts, and diagrams to better understand your cash position. Advanced tools offer customizable report templates that allow you to pull specific business data.

2. Make better decisions

With accurate information at hand, it’s much easier to make smart decisions. Cash flow software performs faultless calculations, so you simply check through the numbers and do the strategic work.

3. Save time with automations

Cash flow software provides feeds from your bank accounts, enlists statements to reconcile, and makes automatic reports and calculations. Sounds like much saved time, right?

What Are the Best Cashflow Apps for Small Business Cash Flow?

Choosing the right cash flow software can be tricky unless you clearly understand your business requirements. To narrow down the choice, we offer a list of the best budgeting apps for small business cash flow tracking.

- QuickBooks

- Wave

- Xero

- Float

- LivePlan

- Fluidly

Is QuickBooks the Best Budget App for Small Business Cash Flow?

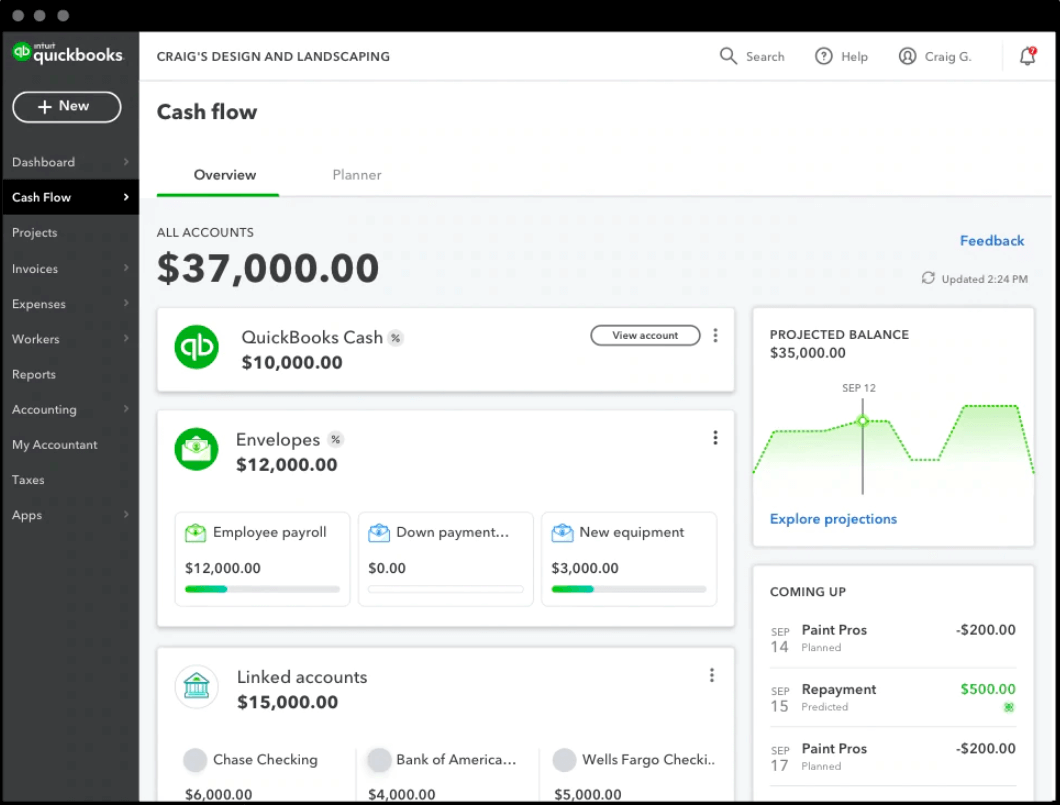

QuickBooks Online is cloud-based accounting software that helps business owners track their income and expenses. Its Cash Flow Center allows you to

- Forecast cash flow up to 90 days ahead

- Monitor all your business balances on the dashboard

- Get deposit at no extra charge

- Store cash in virtual envelopes

- Generate cash flow reports

Source: QuickBooks

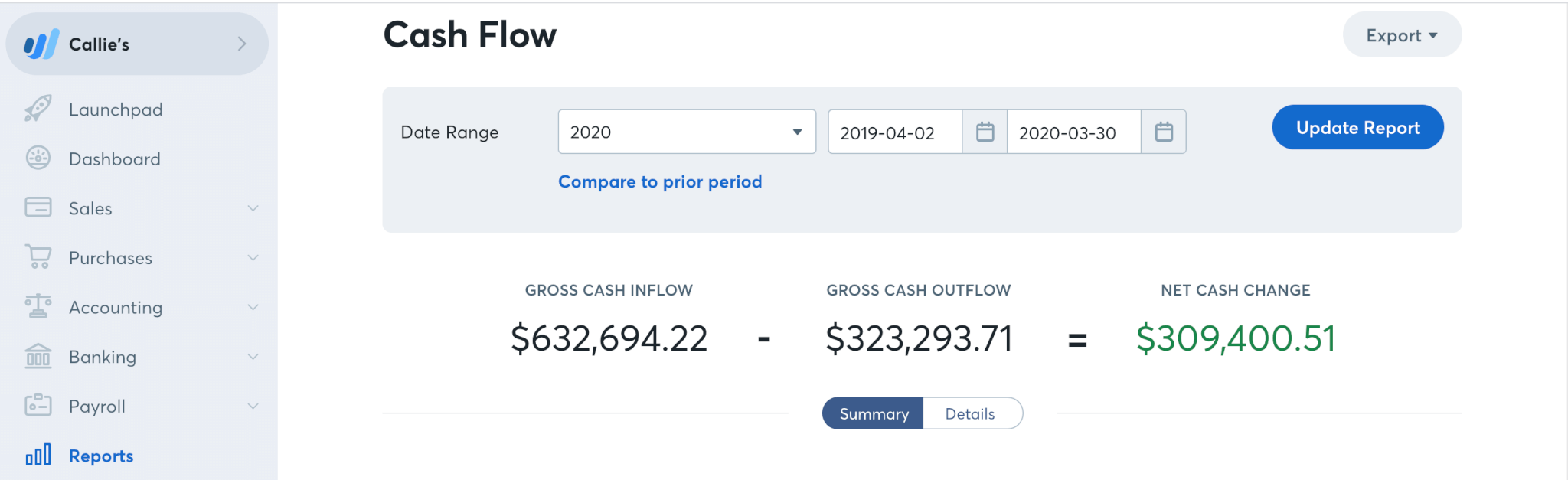

How Does Wave Tracks Cash Flow for Small Businesses?

Wave provides accounting software for small businesses and includes invoicing, billing, and finance management. You can connect it to unlimited bank accounts and pull data to financial statements. This tool allows you to check monthly or yearly comparisons to figure out your cash flow trends.

Source: Wave

Besides, Wave offers a free cash flow calculator to assess how much money goes in and out of your business.

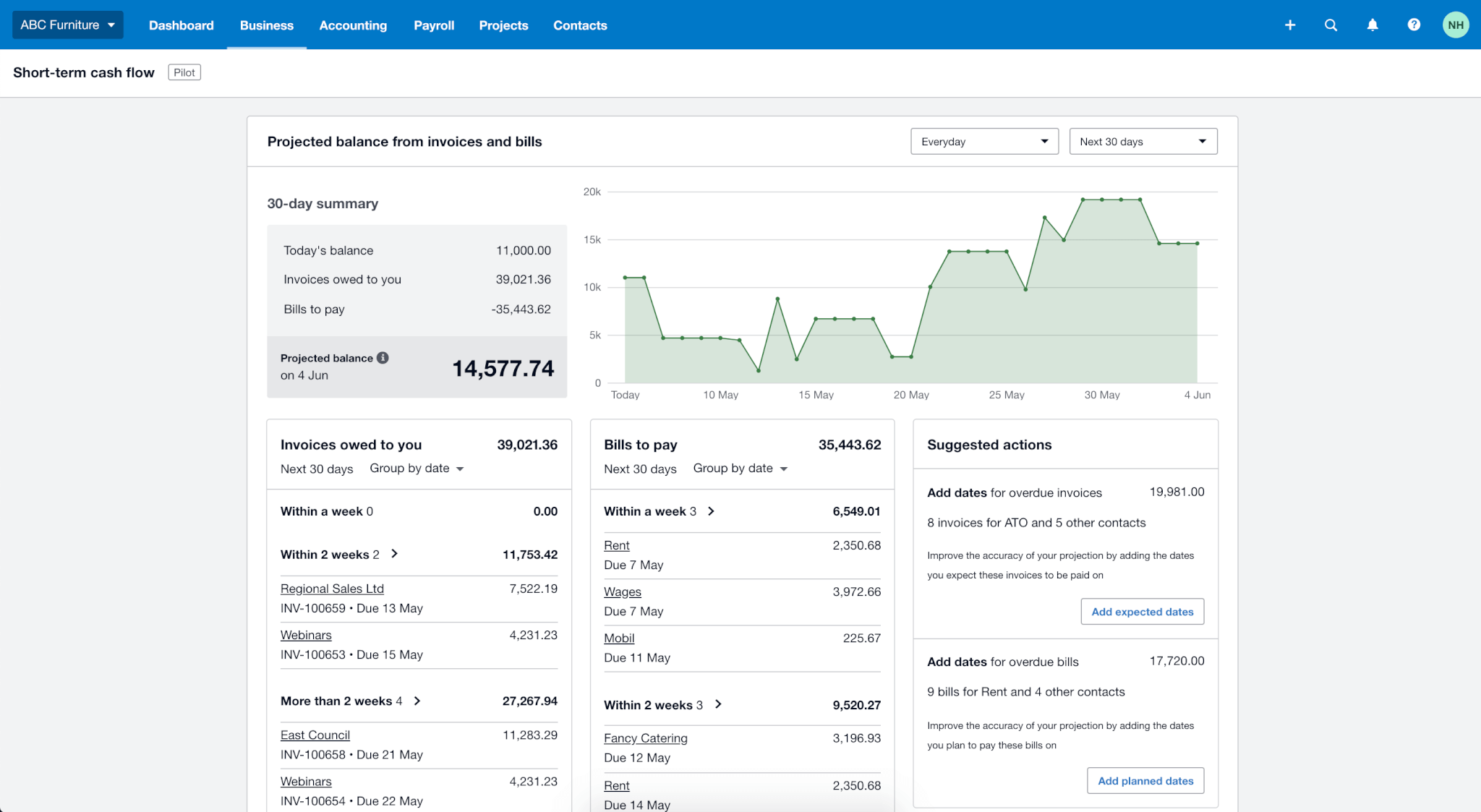

How to Use Xero for Small Business Cash Flow?

Xero designs cloud-based accounting software for small businesses. It’s easy to use and integrates with over 1000 apps. How to use it for cash flow analysis?

- Monitor your business accounts in real-time and visualize your cash flow for the next 7 or 30 days.

- Track your invoice due dates and bills to be paid.

- Run cash flow scenarios and use suggestions for the right decisions.

- Drill down into details with Statement of Cash Flows and Cash Flow Summary.

Source: Xero

With Xero Analytics Plus, you can make cash flow forecasts for longer periods, check predicted recurring transactions, and manually add one-off amount to see how it changes the cash flow.

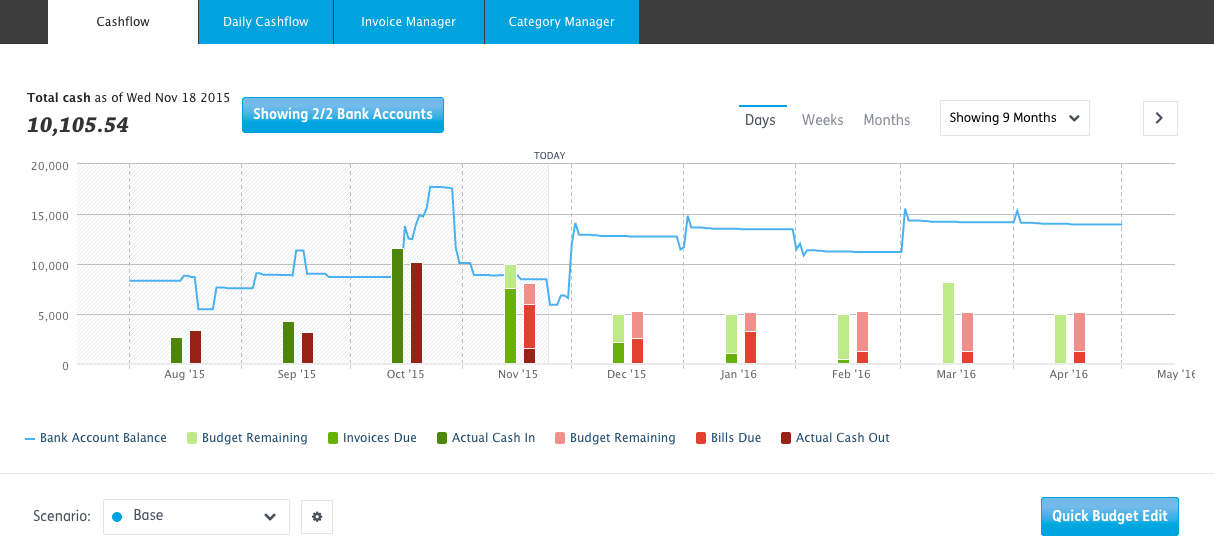

Cash Flow Management with Float

Float is a cash flow tracking tool that enables detailed cash flow analysis with the following benefits:

- A activity dashboard to track financial numbers and create budgets

- Automatic syncs with your accounting software

- Scenarios based on your current and future financial position

- Cash flow management for projects

Source: Float

Float integrates with third-party accounting tools, including QuickBooks, Xero, and FreeAgent. It pulls data from your software and provides reports and forecasts to improve your financial management.

How Does LivePlan Stand Out from Other Cashflow Apps?

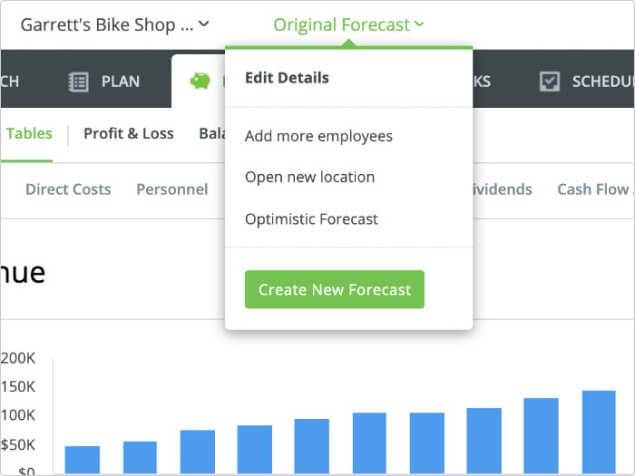

LivePlan is business planning software that helps small business owners and entrepreneurs make more informed decisions. What does it offer?

- Built-in formulas for accurate financial projections

- Performance dashboards with key business metrics

- Customizable cash flow forecasts

- Benchmark data analysis

- Financial statements to facilitate business plan creation

Source: LivePlan

You can integrate LivePlan with QuickBooks and Xero and sync accounting data to create and projections.

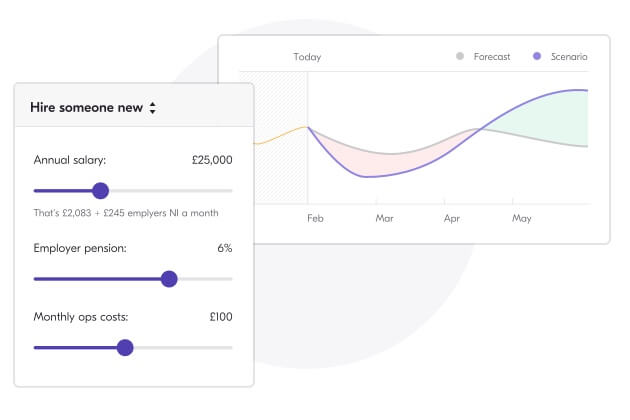

Is Fluidly Good to Manage Cash Flow for Small Businesses?

Fluidly is a cash flow budget app that helps plan and grow small businesses. Here’s how it works: it syncs with your Xero or QuickBooks and generates cash flow forecasts based on your accounting ledger.

In Fluidly, you can run scenarios and check how your revenue or expenses impact your cash flow. Besides, it lets you chase late payments and offers funding options for secured loans.

Source: Fluidly

Already know what cash flow management software is best for you? Start your journey smoothly with automated accounting data import to or from QuickBooks, Xero, and FreeAgent.

What Are Common Cash Flow Mistakes?

Mistakes in accounting are inevitable, but knowing your enemies by sight can be helpful. So how NOT to manage cash flow for small businesses?

Don’t Be Too Optimistic

Excessive optimism and self-confidence can be a shortcoming in facing cash flow challenges. So, stay cool-minded and stick to the realistic perspective of your cash position. Here’s a good practice: subtract around 10% of your income to be prepared for potential shortages. Also, regardless of your experience in cash flow management, it’s better to have an industry expert by your side to avoid wrong decisions.

Watch Your Spending

Overspending is often the result of making the previous mistake. A detailed business plan with goals and milestones can help you prevent it. Create a budget for each milestone and regulate it according to your cash flow trends.

Chase Late Payers

It’s important to gain new clients and retain existing ones but compromising their overdue payments is the wrong way. So monitor your outstanding receivables and chase late payers with invoice reminders.

Use Cash Flow Statement For Budget Planning

Cash flow statement provides you with crucial information, so use it when planning your budgets. Once you know how much money you earn and spend over specific periods, it’s easier to plan.

Have a Cash Flow Buffer

Do you have an account with your business savings? Be sure to create one. When a business encounters financial challenges, a cash flow buffer is often a panacea. It’s recommended to accumulate at least two months of operating expenses to cover unexpected shortfalls.

Summing Up

We hope that now you understand the importance of cash flow and have ideas for improving your financial management. Still, let’s make a summary of what is necessary to keep your cash flow healthy:

- Regular reporting & analysis

- Cash flow tracking software

- Forecasts and planning

- An accounting expert

Those are the core must-haves to stay on top of your payables and receivables and make your business successful.

Have already chosen your accounting platform?

Leave the accounting records migration to us!