When you’re a business owner, you monitor accounting trends daily. Whether looking to see if your company is on the top or trying to keep up with technological development, you’re probably well-versed in spotting specific trends. But are you familiar with all current trends in accounting? Here are the top 10 accounting technologies to adopt in your business.

Key takeaways:

- Automation, artificial intelligence, data analytics & forecasting, blockchain, data security, online collaboration, and digital transformation are top trends in the accounting industry.

- To adopt current accounting trends and techniques, you require regular accountants’ training and updating existing tools.

- Implementing automation, data analytics, and AI depends on whether you have a suitable accounting system. Besides, it can help you to protect your financial data. If you consider switching to a new solution, Accounting Data Migration Service can handle your data transfer.

1. Automated Processes & Artificial Intelligence

Not long ago, artificial intelligence (AI) and automation have become the most popular trends in accounting. In fact, both of them are instrumental in helping businesses to reduce human errors in financial statements and increase work speed and productivity.

According to the Sage Practise of Now in 2020, nearly 58% of accountants stated they improved efficiency and productivity with automation. Similarly, 22% of business owners said that AI helped them to enhance their operations, mainly administrative duties.

But you’re probably wondering why you need to adopt automation and AI.

These accounting industry trends come in handy when dealing with repetitive and time-consuming tasks. For instance, you can automate invoicing, accounts payable, and account receivable processes. But that’s not all; automation can help you with bank reconciliation, journal entries, depreciation, and approval workflows.

On the other hand, AI focuses on handling client service tasks. This includes drafting engagement letters, billing clients, and scheduling meetings. And over 50% of accounts have already implemented it, according to the Sage report.

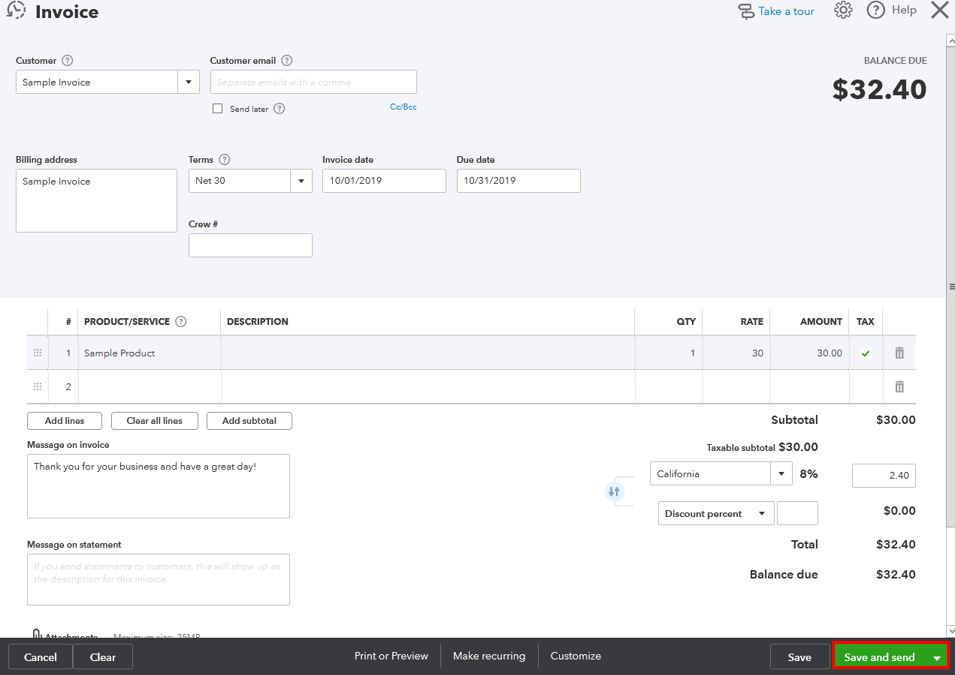

So, how do you adopt automation and AI? In this case, you need an accounting system with specific features. For example, QuickBooks Online lets you create routines to automate repetitive tasks or set up recurring invoices, credit card payments, and overdue payment reminders.

Recurring invoices in QuickBooks Online. Source: QuickBooks Online

2. Cloud-Based Accounting Software

Cloud-based accounting software has already made its way into the current trends in accounting. With the cloud accounting system, you have your data stored in different servers and in different locations. Besides, you get your data encrypted and various options to integrate banks and third-party apps.

The popularity of cloud accounting technology isn’t appearing out of the blue. For example, the McAfee Reports states that 87% of businesses have speeded up their financial processes by leveraging a cloud accounting system. And Deloitte surveyed business owners and 36,2% of them are planning to implement cloud-based accounting in the near future.

With a cloud accounting system, you can track inventory, time, and expenses, accept online payments, create tax estimates, and manage workflows. Moreover, your accountants can easily share reports and collaborate.

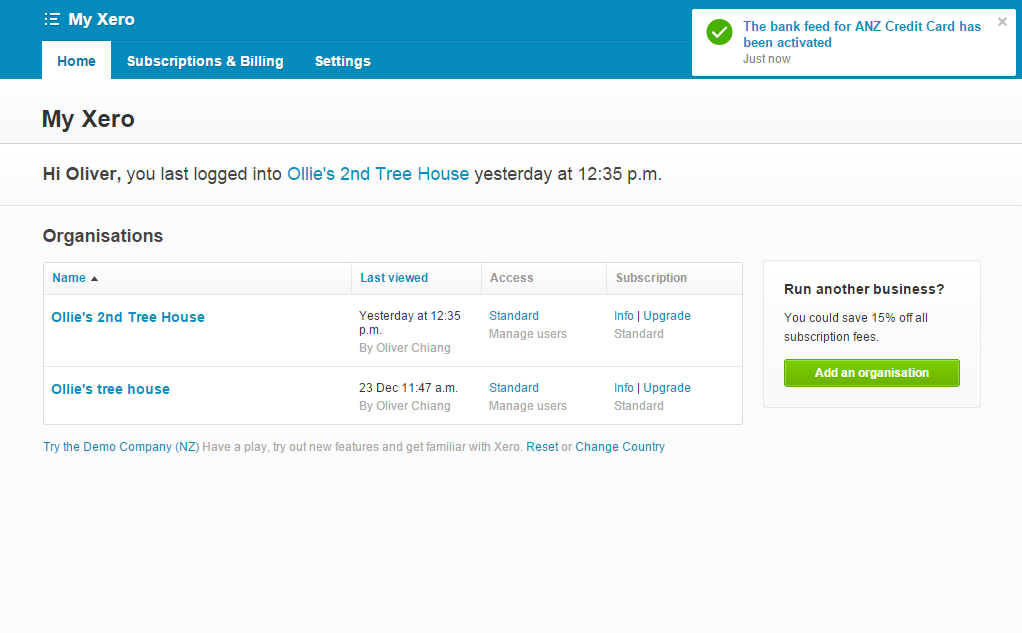

If you are considering implementing accounting software, there are plenty of options to choose from. QuickBooks Online, Sage Intact, Xero, Zoho Books, and FreshBooks. Before testing these bookkeeping systems, outline your requirements to a) pick up the most suitable software, and b) save time on checking software that doesn’t comply with your requirements.

3. Data Analytics and Forecasting Tools

No wonder data analytics and forecasting tools keep trending in accounting. The main reason is that they enhance auditing, tax consulting, budgeting, and risk management.

With analytical tools, you can better analyze and recognize weak sides and improve them quickly. Sage has run a report that shows: 43% of respondents have already seen an increase in productivity after integration, and 40% of surveyed businesses are investing or plan to invest in predictive analytics.

Recently, the use of data analytics helps to increase profitability and productivity. It lets you:

- track clients’ progress

- capture valuable financial data

- set up accurate forecasting

Implementing this accounting industry trend requires:

- accountants with solid analytics skills

- an accounting system that includes features for analytics

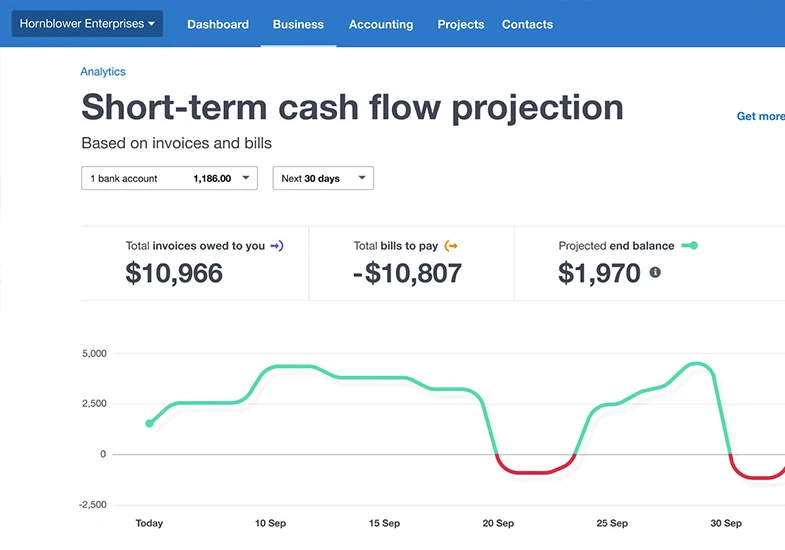

Consider investing in data science training programs for your accountants. Some accounting systems have built-in analytical tools. For example, Xero analytics can help you to track cash flow and check financial health.

Analytics in Xero. Source: Xero

4. Digital Transformation

Modern customers expect superior service with fast replies, timely action on requests, and immediate resolutions to their issues. And that’s one of the reasons why many organizations are in the process of digital transformation.

As the Wolters Kluwer survey reported, businesses rely on technology to improve client experience, drive higher productivity, and skyrocket staff engagement. In 2021, 94% of large corporations and 90% of small companies also looked for technology to advance their tax season.

Driving digital transformation is vital if you want to reduce operating expenses and inefficiency.

But how can you drive digital transformation? Start simple:

- adopt a cloud-based accounting system

- onboard the needed team members

- connect all bank accounts

- integrate payment getaways

5. Online Collaboration and Remote Workforce

Believe it or not, the COVID-19 pandemic influenced the economical aspects, healthcare – many sectors and functions have changed, and so have workforce management. For starters, many businesses shifted to work remotely and later go a hybrid schedule. That made all meetings and team cooperation switch to fully online.

Many companies started implementing new collaboration tools. Adopting technology helped 60% of large accounting firms to retain their staff.

If your team works remotely, proper collaboration and time management tools are a must-do. That includes apps for online meetings, file sharing, e-signature, etc. Great if your accounting system can integrate with the third-party tools you need. FreshBooks, for example, has project management features for better collaboration and a nice integration portfolio at their FreshBooks AppStore.

Project management in FreshBooks. Source: FreshBooks

6. Data Security to Stand up Cybercrime

Cybercrime statistics are shooting up to alarming levels in complexity and scale. Nowadays, the threats of data breaches affect companies of any size, from small businesses to SMEs and freelancers.

Accenture reports that 4,744 global respondents suffered an average of 270 cyber attacks in 2021. And, it is an increase of 31% compared to 2020. It means that companies worldwide need to implement a multi-level security strategy to protect their business data, including accounting.

With high-level cybersecurity, you can prevent data breaches and the stealing of sensitive information like:

- credit card numbers

- usernames and passwords

- bank accounts

- transaction details

- account numbers

- personal and private information

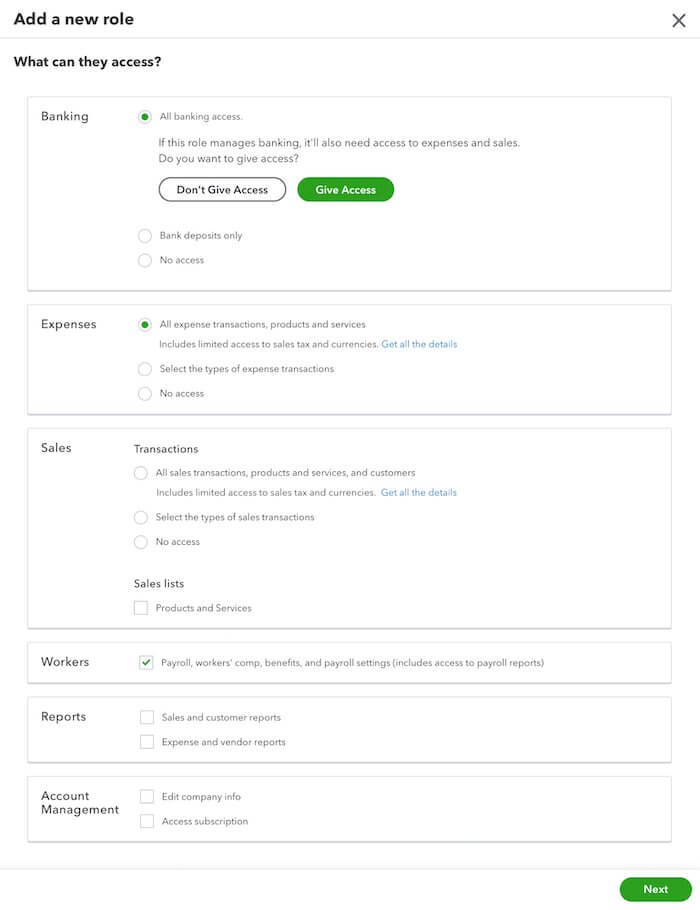

So, how can you adopt this accounting practice? First things first, work out with your CTO or IT department security strategy to prevent attacks and set up proper access to sensitive data. Then, teach your employees the core rules of working with emails so they recognize phishing and other harmful emails. The choice of accounting software matters too. Ensure your desired billing tool includes two-factor authentication, user permissions, approvals, user role hierarchy, and validation rules. Check, for instance, QuickBooks Online – it has a reputation as one of the most secure accounting solutions.

Custom user roles in QuickBooks Online. Source: QuickBooks Online

7. Evolution of the Accountant Role

Multiple accounting trends and recent technologies impact and change the role of the accountant. Accountants aren’t just specialists who work with spreadsheets and XML files; they should be tech-savvy and know how to work with accounting software.

The Sage report states that 57% of respondents think accountants should be familiar with technology literacy. In addition, they should have deep knowledge of business concepts to provide helpful insights to their clients.

As businesses can automate many accounting processes, bookkeepers are expected to have diverse skills for effective client communication and use various accounting trends.

Regular certification training in the critical areas of taxation, business forecasting, and financial management can help your accountants keep up with the current standard. Plus, if you are switching to a new accounting system, different vendors offer online courses and training too.

8. Environmental, Social, and Corporate Governance (ESG)

Over the last few years, customer behavior has evolved and become more sustainable. They focus more on recycling, reusing, and minimizing waste. This change impacts the decisions around finances and investments.

Now investors are interested in using their funds to finance businesses committed to the environment, social, and corporate governance (ESG). And according to the Statista report, investment in ESG has been growing since 2012. As for 2021, most of the big enterprises across the globe invest in businesses that share the same values on social responsibility and environmental sustainability.

But how can your business adopt ESG? First off, take measures to reduce waste, CO2 output, and pollution. It also requires a diverse and inclusive workforce at all levels.

9. Blockchain Technology

Blockchain is a newcomer among the recent accounting trends. The primary function of blockchain is to preserve a ledger account with financial data. Mainly, it uses decentralized computing software to secure and validate transactions in a digital ledger.

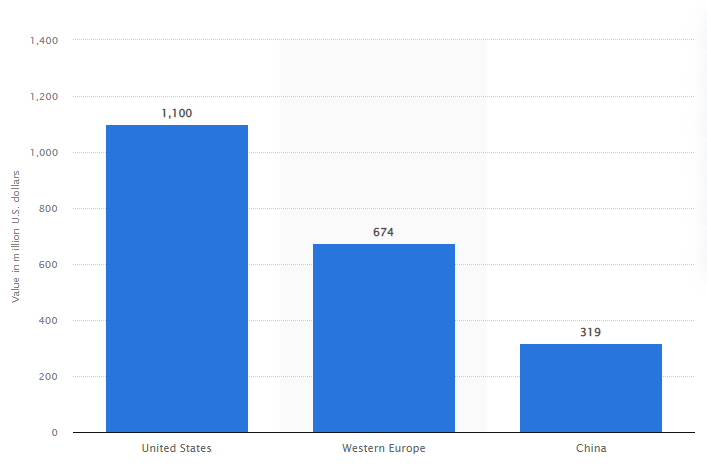

Needless to say that leading accounting companies like Deloitte, Price Waterouser and KPMG have already adopted blockchain. And as shown in the Statista 2022 survey, USA businesses might spend $1.1 billion on this technology by the end of the year.

Projected stepnding on blockchain in 2022, by region. Source: Statista

Blockchain is a game changer in the accounting world; it helps businesses to decrease the costs of reconciling. This technology sustains the needed accuracy in the history of assets and ownership. So, if you are considering adopting blockchain, research the available apps.

10. Proactive Accounting

Proactive accounting primarily focuses on leveraging machine learning and robotic process automation (RPA) to reshape the approach to financial processes running. This future accounting trend largely uses automation and other technologies to make end-of-year tasks into everyday activities.

The real benefit of proactive accounting lies in automating routine and manual tasks. It helps you enhance data integrity to free up time for your accountants for more complex tasks.

A wisely picked accounting system can help you reap the advantages of proactive accounting. For example, Xero is a good option to view key performance indicators and your financial data in real time.

Remind about notifications in Xero. Source: Xero

Why Keep Up with Accounting Trends?

No one can foresee the future. But one thing is for sure: more and more accounting trends are coming into the picture. So, to stay competitive in the accounting area, your business needs to monitor the trajectory of mentioned trends. And set up an accounting system to adopt most of them. This way, your business can keep growing and stay ahead of competitors.

Have already chosen your accounting platform?

Leave the accounting records migration to us!