It is no surprise that changing accounting software systems can lead to many issues. Expectedly, your financial business operations will be halted, and all paid systems will be stopped. To avoid such inconveniences, a well-thought-out migration plan is a must. Which is what we will help you with today.

Migration is always a complex set of operations, but we managed to cram everything down to just 10 steps. When writing this guide, our goal was to make it as simple as possible, so let’s not waste any time and dive into the process itself.

Best Time to Swap Systems

We are often asked when to move your data to a new system, and almost in 99% of cases, the answer is to move your stuff at the tail end of the fiscal year. This is when most, if not all, financial operations are already completed, and you have just enough time to use your transitional plan.

However, don’t go on running away, as you must also create a functional backup in advance. That’s right, no migration is good without a backup. If things go haywire, the backup will serve as a restore point, a footprint. While at it, you might also want to take a closer look at the data itself. See whether it is in a good state, accessible, and error-free. You might also find some duplicates and old records irrelevant to your business.

As a reminder, the above is just prep work for your accounting system migration. In other words, we didn’t even discuss the plan, but you must do everything we’ve mentioned in advance, as it will determine the quality of the migration itself. Alright, now on to the plan itself.

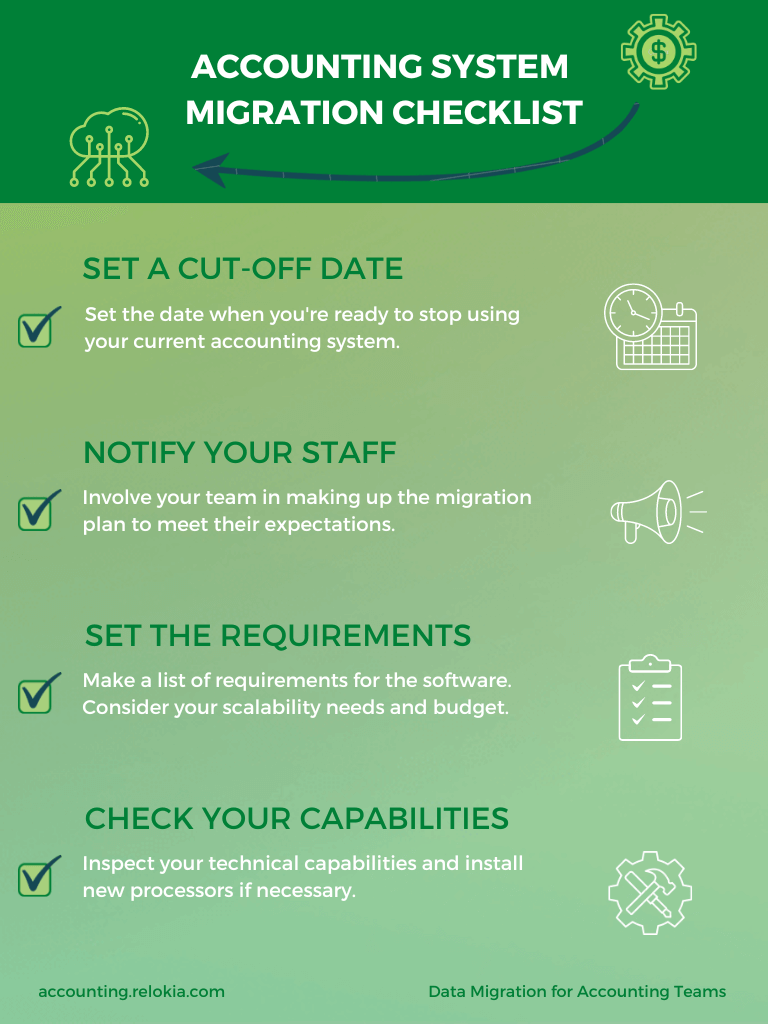

1. Set a Definitive Cut-off Date

This might seem impossible, but no, you absolutely must set a cut-off date. Otherwise, you’ll extend the accounting system migration over and over. Knowing when to stop using your current system will allow you to finish all your financial operations much sooner. Also, you might want to do your bank reconciliation at the end so that you can use your new solution as soon as the start of the next month.

2. Notify Your Staff

When planning an accounting data migration, it is vital to your business that you keep your accountants up-to-date. After all, they are the core user of the system, and their input is essential. Your main accountant will help you select the right plan, as well as the right amount of features.

Your accounting staff will also be the ones who use the system, meaning that they will be the ones who will decide whether the system is comfortable or not. Your work will slow down immensely if the complex tool doesn’t meet your staff’s expectations.

3. Settle on Requirements First

Having a shortlist (or a long list) of requirements and “nice to have’ things will help you focus on the features you need the most. If you don’t know exactly what you need, refer to your accountant again. Sit together and pile up a list. Once done, we also suggest that you make good use of free trials and demo presentations.

Another good thing to remember when starting an accounting system migration is scalability. See what other tiers offer (even if you don’t have the budget to use them) and what reviewers might say. All of this will help you pick the best tool for your company.

4. Inspect Your IT Infrastructure

If you’ve used any modern accounting tool, you probably know that software is just part of it. You need to make sure that your hardware is also up to snuff. The last thing you want to find out is that your brand-new solution chugs your hardware. Some of you might be stating that cloud computing is done remotely without strain on your hardware, which would be correct.

However, the entire user interface, animations, local calculations, and data traversal operations are done on your hardware. The more complex the system, the more it will push your systems. Carefully study your technical capabilities and, if necessary, install better processors, add more RAM, you name it.

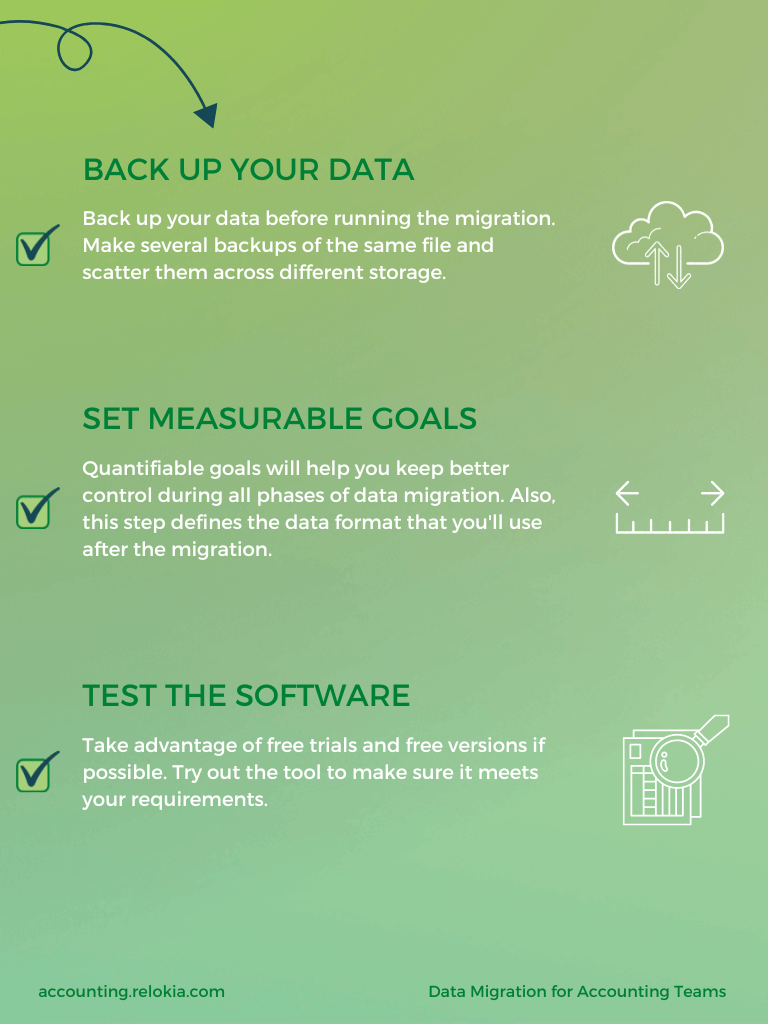

5. Back up your current data

We briefly mentioned in the introduction that it is best to backup your stuff before doing anything. Well, we just want to reinstate this again. Your current data is valuable, and it will help you grow; losing it is not an option. Make multiple backups of the same file and scatter them across different storages so there will be no disaster recovery in the future.

6. Set on Quantifiable Goals

Also known as business performance metrics, quantifiable goals will help you keep things tidy across all phases, including implementation and post-launch support. This step is also responsible for setting up a data format you’ll use later to achieve the objectives, so take your time with it.

7. Test Drive Before Buy

If the vendor offers a trial run, use it. If the vendor offers a free plan, register it. If the vendor doesn’t have either, ask for a demo. Don’t buy a cat in the bag; you have the right to know what you spend your money on. If you feel like it is the system for you, we suggest you send a small portion of data to the system using our migration wizard. It will send a small chunk of your stuff to the target platform, free of charge, mind you, and see whether the tool processes the data correctly.

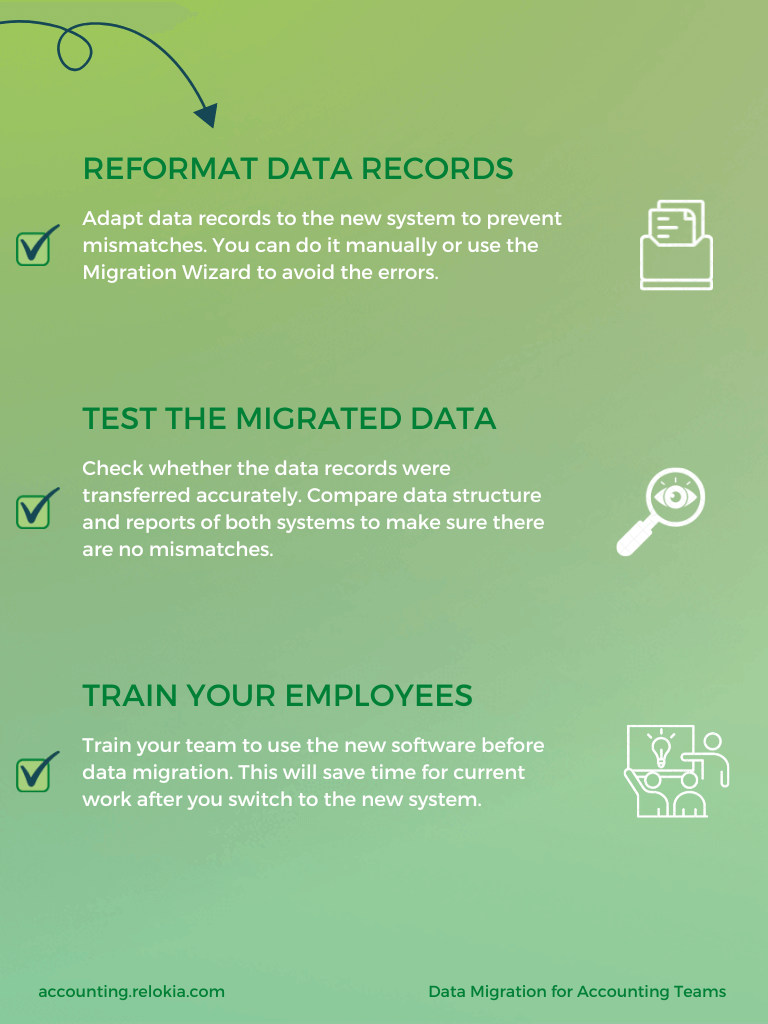

8. Formatting and Mapping Process

It doesn’t matter that your chosen system does the same thing. The way it was built is always different. Code, just like features, cannot be reused as it’ll be deemed plagiarism and intellectual property theft. Your new system will process incoming records differently, or worse, not at all. To help avoid these issues, you can adapt the records yourself to the new system or refer to our migration wizard again. Our tool knows precisely how to adapt them appropriately and will do it automatically.

As a word of advice, if you have a lot of records, it will take a lot of time to get them to work on the new system. And if time is of the essence, then why not opt for our service? It is not only fast but will do everything for you. It comes at a reasonable fee, that is you pay only for the stuff you’ve moved, and you get support before, during, and after accounting data migration.

9. Test Transferred Data

This accounting system migration phase is crucial as not doing so, means that you aren’t 100% sure your records will be usable in the new system. We understand that checking everything manually can take forever, but if one day you find out that you lack data on a certain client, you might lose customer trust, which is far worse than you think it might be. We suggest that you compare the data structure and reports of both systems and see if there are any discrepancies.

10. Train Your Employees

And the last part is to train your people to use the system. You can do this whenever you like but we suggest that this is done before the migration phase. You will have a lot of work on your hand as-is and tackling training sessions will surely put a strain on your human resources.

Final Notes

Accounting data migration is a process that will never be easy, especially regarding accounting systems. Accounting tools are getting increasingly complex, and the more data you have to deal with, the more time it will take you to move things. Having a plan will help you keep things tidy and timely. However, if you don’t have time, you should use an automated accounting migration tool.

It will move your stuff accurately and will not cost you a fortune. To learn more about the system, we suggest that you give us a call or schedule a demo. But for now, thanks for joining, and we hope to see you again.

Accounting System Migration FAQs

- Assess Needs: Identify what you need from your new system.

- Choose a System: Select a new accounting tool that fits your requirements.

- Plan the Migration: Develop a detailed migration plan and timeline.

- Prepare Data: Clean and organize your existing data for transfer.

- Backup Data: Ensure you have backups of all your financial data.

- Set Up New System: Configure the new system according to your needs.

- Migrate Data: Transfer your data to the new system carefully.

- Test the System: Verify that all data and functionalities work correctly.

- Train Staff: Provide training for users on the new system.

- Go Live: Officially switch to the new system and monitor its performance.

- Manual to Automated: Transitioned from paper-based, manual bookkeeping to automated digital systems.

- Desktop to Cloud: Shifted from standalone desktop software to cloud-based solutions for remote access and collaboration.

- Basic to Integrated: Advanced from basic transaction recording to integrated systems offering real-time data, analytics, and automation.

- Single to Multi-Functional: Expanded from handling simple accounting tasks to providing comprehensive financial management including budgeting, forecasting, and compliance.

- Static to Dynamic: Evolved from static, rigid systems to flexible platforms with customizable features and AI-driven insights.

- Switching Systems: Transitioning to a new accounting software or platform.

- Methodology Updates: Adopting new accounting methods or standards, such as moving from cash to accrual accounting.

- Process Improvements: Implementing new procedures or automations to enhance efficiency and accuracy.

- Regulatory Compliance: Adjusting practices to meet updated financial regulations or standards.

- Desktop Accounting Software: Installed on local computers (e.g., QuickBooks Desktop).

- Cloud-Based Accounting Software: Accessible online, offering remote access and collaboration (e.g., Xero, Zoho Books).

- Enterprise Resource Planning (ERP) Systems: Integrated systems for larger organizations, covering broader business functions (e.g., SAP, Oracle ERP).

- Industry-Specific Accounting Systems: Tailored for industries with specialized features (e.g., construction, retail).

- Open Source Accounting Software: Free or low-cost systems with customizable features (e.g., Odoo, GnuCash).

The exact number is hard to pin down due to the constant evolution and new entries in the market.