Gone are the days when you could run your financial transactions in an Excel doc. These days the cloud solutions take over the stage in accounting too. If it happens that you’re looking for the best small business accounting software, we got you covered and prepared a post about accounting trends, software review, and few insights from the actual users.

What you’ll find in this article:

- What are the recent accounting trends?

- Why do small businesses need accounting software?

- How many small businesses use accounting systems?

- Review of the five best small business accounting software

- The insights from people who actually use accounting software

Let’s get started!

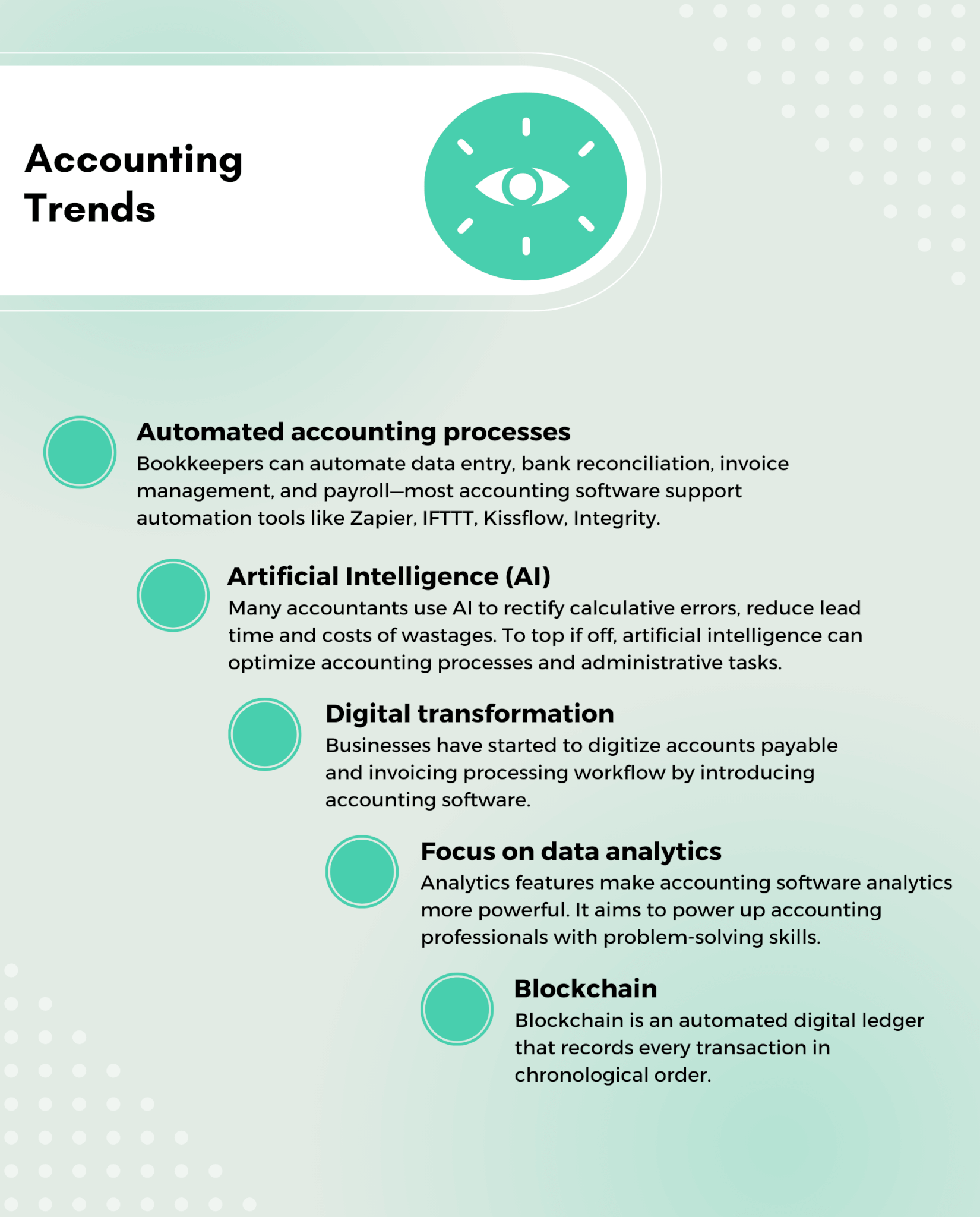

What Are the Recent Accounting Trends?

Every accounting professional needs to recognize and understand the importance of accounting software trends in 2021. This way, they can simplify the execution and control of transactions. So the most prevailing accounting software trends this year are the following:

#1 Automated accounting processes

Automation is a crucial trend in the accounting industry. It minimizes human errors. That’s why small business owners have so much interest in automated solutions. For example, bookkeepers can automate data entry, bank reconciliation, invoice management, and payroll—most accounting software support automation tools like Zapier, IFTTT, Kissflow, Integrity. According to the Finance Online report, over 50% of small business owners expect the further development of automated accounting software.

#2 Artificial Intelligence (AI)

Many accountants use AI to rectify calculative errors, reduce lead time and costs of wastages. This way, accountants have more time for analytical insights. Artificial intelligence can optimize accounting processes and administrative tasks. For instance, Firm EY uses AI to collect such financial data as commencement date, termination, amount to be paid, and renewal options.

Accounting software offers AI applications to record data, sort transactions, and reconcile accounts. For example, QuickBooks Online supports an app, myadvisor.ai, that can generate automated reports. There are also AI-powered invoice management systems and AI chatbots to solve common questions.

#3 Digital transformation

Companies transform how they do accounting with the aid of accounting software. They implement cloud-based accounting systems with digital tools like artificial intelligence, robots, and chatbots. Right now, companies have started to digitize Accounts payable and invoicing processing workflow by introducing accounting software. The Clutch survey shows that 62% of small businesses do their accounting within a cloud-based accounting system.

#4 Focus on data analytics

Analytics features make accounting software analytics more powerful. While small business needs more digging into auditing, consulting, risk, and tax management, reporting tools aren’t enough. But the analytic option changes the analysis a lot. As evidence of the trend’s popularity, the Institute of Management Accounts (IMA) launched a Data Analytics & Visualization Fundamentals Certificate. The program aims to power up accounting and finance professionals with problem-solving and analytical skills.

#5 Blockchain

Blockchain is an automated digital ledger that records every transaction in chronological order. It can validate transactions automatically, so you don’t waste time going through different documentation. Four major accounting companies - Deloitte, Ernst Young, Price Waterhouse, and KPMG - use blockchain technology on their audits. Besides, QuickBooks Online and FreshBooks have adapted blockchain technology in their platforms.

In the last year, the following trends shaped the accounting industry, according to the Zoho blog:

- Artificial intelligence (AI)

- Automated accounting processes

- The changing roles of the accountants

- Digital transformation

- Real-time connections

- The adoption of blockchain

Comparing 2020 and 2021, we can say that artificial intelligence, digital transformation, blockchain, and automated accounting processes are still popular today. Due to COVID-19, the rise of accounting solutions got a higher position while automation has become the most wanted feature of all.

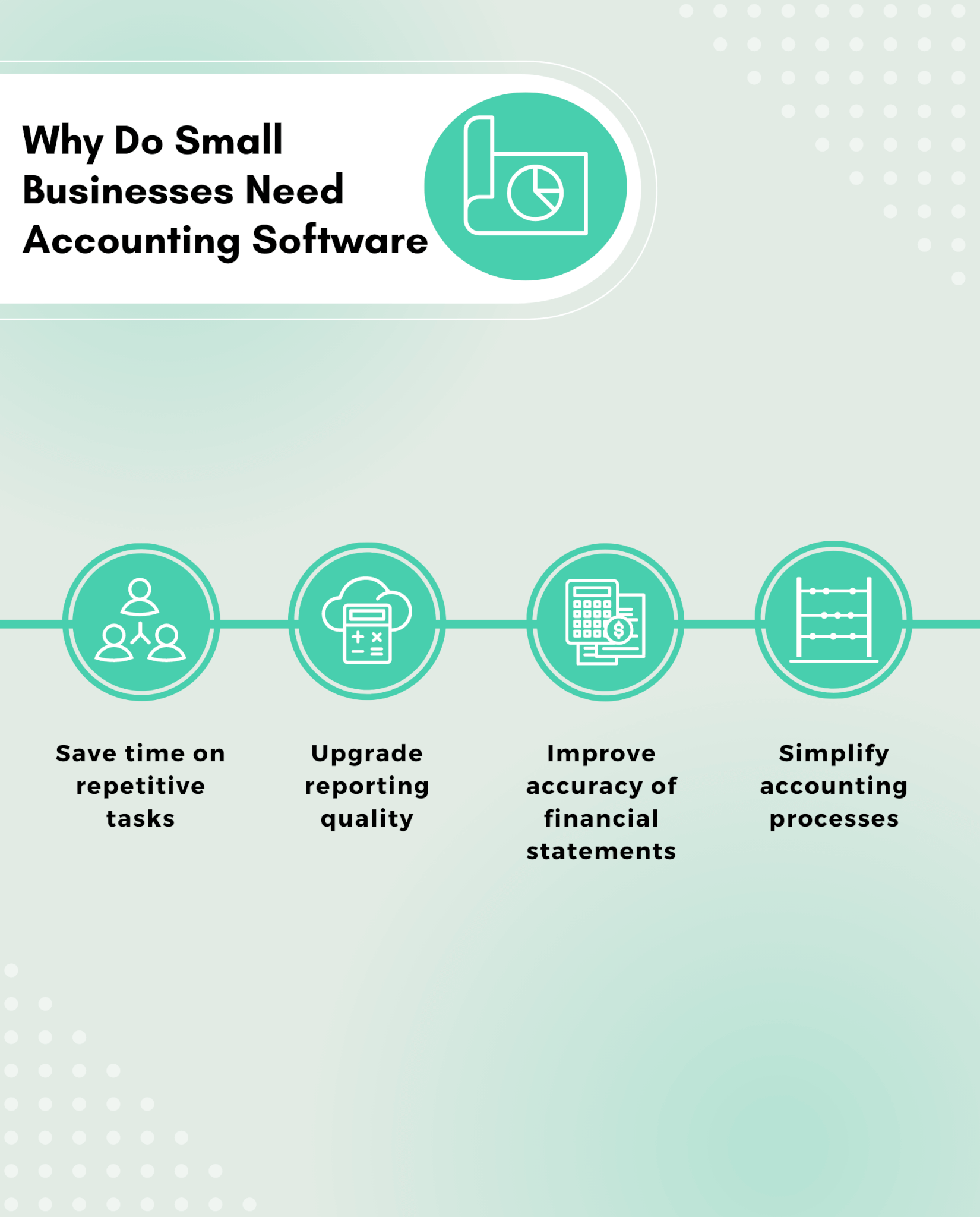

Why Do Small Businesses Need Accounting Software?

Here are the reasons why owners introduce an accounting system into their business:

- Save time on repetitive tasks

Time is the most valued currency in business. So, it is no surprise that the main reason to switch to an accounting system is to save time on repetitive tasks. According to QuickBooks case studies, users preserve hours on manual accounting processes like payroll, record-keeping, and handling finances. The business owners report that setting up an accounting system has paid off by increasing revenue and reducing employees’ frustration.

- Upgrade reporting quality

The following reason for the need for accounting software is upgrading reporting quality. Small businesses use basic reports such as balance sheets, income statements, and cash flow statements. However, accounting software provides between 30 financial, payroll, tax, and time tracking reports. According to the Software Advice survey, financial reporting is the most requested feature by accounting software users.

- Improve accuracy of financial statements

Small business owners also adapt accounting software to improve the accuracy of financial statements. Using a spreadsheet program like Excel is still a manual process. Various studies have shown that 88% of all spreadsheets contain human errors. As accounting systems automate the primary accounting process, this leads to the decrease of manual mistakes and, as a result, improves the accuracy of financial statements.

- Simplify accounting processes

Lastly, when a small business begins to grow, the accounting operations become more complex to handle. That is why companies set up an accounting system to simplify accounting processes. According to a case study conducted by Accounting Today, companies that implemented QuickBooks Online and FreshBooks run their clients’ books more effectively and accurately.

How Many Small Businesses Use Accounting Systems?

To keep up with the developing world of technology, small businesses across the globe introduced accounting software. The number is increasing each year, mainly due to the COVID pandemic. But the question appears: how many small business owners set up an accounting system?

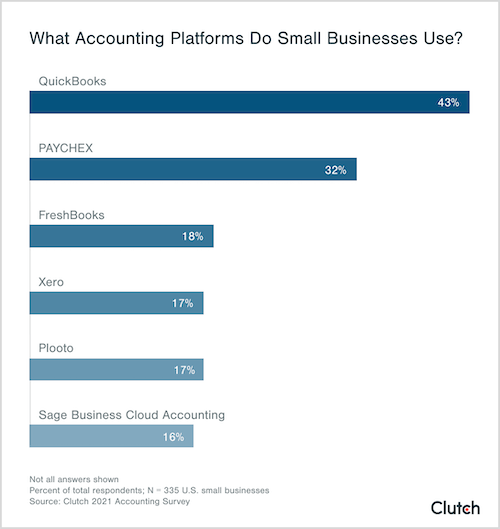

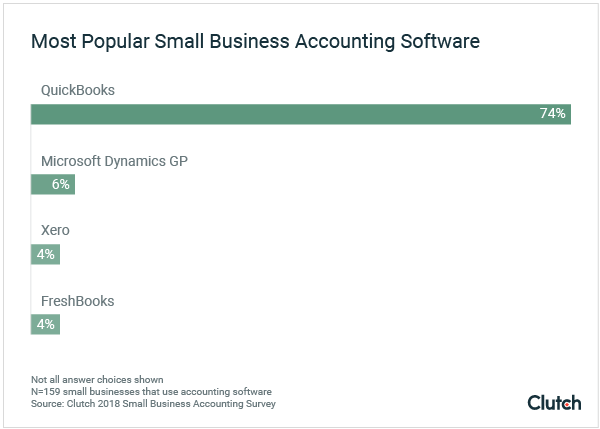

In March 2021, Clutch held a survey where the team questioned over 335 small business owners and managers across the USA. According to their report, over 62% of small business owners use accounting solutions to manage their income and expenses. The number is higher by 9 percent compared to the 2018 results (53%). Still, the percentage of users stays on the high level if we compare it to the Statistic survey in 2016, which shows 64,4 % with 104 responders.

The results of the 2021 survey also show that QuickBooks (43%), Freshbooks (18%), Xero (17%), and Sage (16%) are among the most popular small business accounting software. Compared to the 2018 results, Xero, Freshbooks, and Sage increased the number of their users. Besides, Sage is more popular as businesses grow.

The Clutch experts say that small business owners have chosen these accounting systems due to their simplicity and integrations. Moreover, the research conducted by Xero has shown that accounting software users have more clients than enterprises that don’t use cloud accounting, and increased their revenue by 15%.

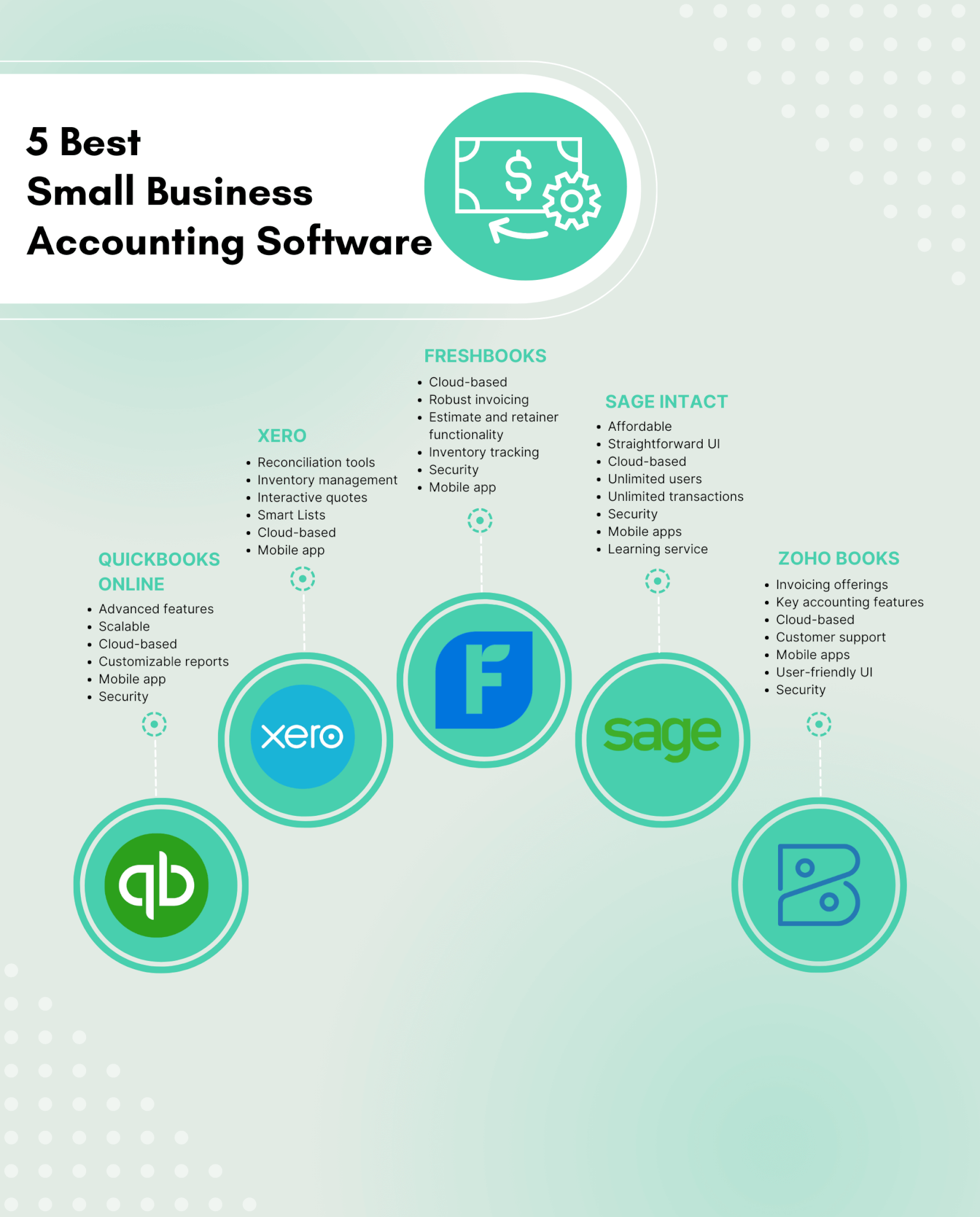

5 Best Small Business Accounting Software

How to choose accounting software that suits your business requirements? First, identify the pain points in your accounting processes. That way, you get the outline of go-to features and automations. Then, check out the following review of accounting platforms.

QuickBooks Online

QuickBooks Online remains one of the most popular accounting software for small businesses. Users value the platform thanks to its scalability, well-designed interface, and flexibility. The platform offers online training resources to help you or your accountant to manage the transactions efficiently.

What Are the Strong Sides of QuickBooks Online?

- Advanced features: QuickBooks offers bank reconciliation, a chart of accounts, receivable and payable accounts, tax support, and inventory management.

- Scalable: You can tailor QuickBooks Online settings to match your business requirements.

- Expert help: You can find certified accountants to provide you a consultation or fix issues.

- Cloud-based: You can access your financial reports whenever you need them. On condition, there is an internet connection available.

- Customizable reports: You can select which accounts, suppliers, customers, or products appear on the report. Choose rows, columns, headers, or footers to be on your statement.

- Mobile app: You can access QuickBooks Online with any mobile device when you install the app.

- Security: The platform has password-protected login, SSL Certificate Authority, and firewall-protected servers.

Has QuickBooks Online Any Shortcomings?

- Occasionally synchronization problems: You can face syncing issues with bank accounts and credit cards sometimes.

Integrations

QuickBooks Online provides more than 650 integrations and add-ons to meet nearly any business need. Here’s included such as

- Receive all your data into your account (PayPal, Square, Amazon Business, Shopify)

- Automate accounting tasks (SOS Inventory, TSheets, Fathom)

- Upgrade QuickBooks’ functionality (Method: CRM, BigTime, Gusto)

- Scale up your productivity (Ecommerce Sync by Webgility, Buildertrend, Housecall Pro)

Why it is worth your attention

QuickBooks Online is well-known and well-designed accounting software with numerous satisfied users. The platform offers a wide range of advanced features to automate accounting processes and reduce manual mistakes. Plus, QuickBooks Online has online resources for small businesses without their accountants. Moreover, users can simplify lots of operations with countless integrations and data entry between other business tools.

Xero

Xero helps companies that seek simplicity. This platform has a clean interface and supports main financial elements: bills, expenses, inventory, purchases, sales, and payroll. Xero also has a two-step authentication to keep your data secure.

What Are the Xero Benefits?

- Reconciliation tools: You can confirm all your transactions in bank accounts.

- Inventory management: This feature is handy for eCommerce businesses.

- Interactive quotes: You can create interactive quotes in online or PDF formats to send them instantly.

- Smart Lists: Smart Lists is an advanced feature to help you search over your current customer base.

- Cloud-based: You can manage and track all financial transactions and operations in real-time.

- Mobile app: Access your Xero account from your mobile device anywhere you go.

What Are the Xero’s Setbacks?

- Lack of Exchange Trade Products: Xero doesn’t support Exchange Trade Products.

- Customer self-service: Xero offers just a knowledge base with articles, online courses, and resources.

Integrations

Xero has built and owned a vast number of apps and add-ons, so you can:

- Accept payments (Stripe, GoCardless, Pay with Wise, PayPal)

- Automate accounts receivable and accounts payable (ApprovalMax, ServiceM8, Practice Ignition, WorkflowMax)

- Manage your staff and increase their productivity (Xero Payroll, Deputy, BrightPay, KeyPay)

- Control orders and inventory in real-time (DEAR Inventory, simPRO, Vend, RepairShopr)

Why it is worth your attention

Users choose Xero for solid accounting and great features, integrations, and reports. Xero provides an unlimited number of users so all your team members can receive access to financial statements. You can also set up numerous user permissions and manage feature access. Besides, the platform offers tons of automations such as automatic sale tax lookup, default email templates, and group invoicing to save your business time.

FreshBooks

FreshBooks is a well-rounded, intuitive accounting system that anticipates the needs of small businesses. The platform’s key focus is on sending, receiving, and paying invoices. FreshBooks continues to gain popularity due to its smart selection of features.

Why is FreshBooks Good?

- Cloud-based: You can access your financial information anytime.

- Delightful user experience: FreshBooks has a user-friendly work-frame, so it’s easy to use.

- Robust invoicing: The accounting software offers advanced invoicing features to get detailed customer records.

- Estimate and retainer functionality: You can bill your end-users for a fixed amount in advance.

- Inventory tracking: This feature enables you to add, edit, and review inventories within your accounting system.

- Security: The platform is protected with SSL encryption, and the servers are scanned regularly by Sikich LLP.

- Mobile app: Keep track of your financial statements with the FreshBooks mobile accounting app.

What Are the Cons of FreshBooks?

- Expensive: If you don’t use all the available features, the platform can become too expensive.

- Limited mobile app functionality^ The application doesn’t integrate well with some features.

- Manual enumeration: Freshbooks doesn’t enumerate your invoices automatically.

Integrations

FreshBooks divides all of its apps and add-ons into several categories, more than just invoicing programs. For example, you can find the app to:

- Organize and analyze financial data: Cash Flow Frog, Apiphemy, Strapped, Roger.

- Get support from professional bookkeepers: FB Apps, Mazuma, Bench.

- Sync your transactions: MMC Receipt, Revolut Business, Dropbox, Everlance.

- Receive payments: TransferMate, Checkeeper, Partial.ly, CollBox.

Why it is worth your attention

FreshBooks gains popularity due to a strong feature set. Apart from project management, automated invoice reminders for unpaid bills, it provides a vast integration marketplace for small business accounting. Besides, you can use FreshBooks without having previous experience with accounting software.

Sage

Sage Business Cloud Accounting is well-known for providing different products to assist small businesses. The platform aims to accelerate and improve compliance management, expense management, and accounting with a rich feature-set. With one dashboard, it’s easy to switch between numerous companies.

Source: Sage

Why Is Sage Good?

- Affordable: Sage starts at $10 per month and includes all key accounting features.

- Straightforward UI: The accounting system has a comprehensive UI, so it’s easy to set up and operate.

- Numerous automation options: You can streamline your accounting processes to reduce repetitive tasks.

- Cloud-based: You can easily access your financial data in real-time with an internet connection.

- Unlimited users: You don’t need to upgrade your account to get extra users.

- Unlimited transactions: You’ll see all transactions without any limits.

- Security: The system also had adaptable software to safeguard ERP security.

- Mobile apps: You can use the Sage Business Cloud mobile app to access your business data anytime and anywhere.

- Learning service: The platform offers learning courses to get familiar with the platform.

What Are the Cons of Using Sage?

- Limited features: Sage doesn’t have time-tracking and project management.

- Limited customer support: The accounting system has a rich knowledge base but no phone or email support.

- Fewer payment options: The platform has only three payment gateways. AutoEntry integration is one of the essential ones as it helps you automate bill, receipt, invoice extraction, and processing into Sage Accounting.

Integrations

Sage supports over 65 integrations available so you can:

- Create accurate reports and forecasting: Roveel, True Sky, Castaway Advisor Edition, ProForecast for Sage 50cloud.

- Automate all processes with expenses and invoices: Paperless, Software, Basecone, AutoEntry, Eworks Manager.

- Receive direct payments to your bank accounts: Stripe Invoice Payments, Ordo Accounts Plus, A2X for eBay.

- Streamline the sharing of financial information: Superscript, nettTracker, Way2Vat, Deputy.

Why it is worth your attention

Many small business owners choose Sage Business Cloud Accounting thanks to its basic income and expense tracking. The platform offers automatic sales tax entry and advanced inventory tracking. With numerous integrations, users can easily automate the key accounting processes reducing manual mistakes. Moreover, business owners can simply learn how to use the platform with learning courses and a rich knowledge base.

Zoho Books

In terms of features, Zoho Books keeps up with QuickBooks Online. This accounting platform offers contact management, expense tracking, inventory, tax support, and invoicing. The bigger the plan, the larger number of features, contacts, and users you receive.

What Are the Strong Points of Zoho Books?

- Invoicing offerings: There are 16 customizable invoice templates and recurring invoices.

- Key accounting features: Zoho Books supports reporting, bank reconciliation, and account payable.

- Cloud-based: Access your platform from anywhere and anytime, and check your financial statements on demand.

- Customer support: Email and phone support are available for all users. Most customer reviews are positive.

- Mobile apps: You can easily access and monitor your processes status and update.

- User-friendly UI: It’s easy to set up and use Zoho Books.

- Security: The admin can edit other users’ roles and change their access to Personally Identifiable Information (PII).

What Are Zoho Books Weak Spots?

- Limited contacts: There are limitations of the number of contacts.

- Pricing checks: Zoho Books offers only one vendor.

Integrations

Zoho Books supports a smaller number of integrations that allows you to

- Manage your customer relations: Salesforce Service Desk, Dudsado, WHMCS, Wix Automations.

- Accept online payment: Square, PayPal, Instamojo.

- Control and organize your projects: Trello, Asana, ClickUp, Monday.com.

- Speed up your accounting by integrating with other accounting systems: Wave, Xero, QuickBooks Online.

- Automate repetitive work: Zaps, automated triggers, and actions.

Why it is worth your attention

Zoho Books is an excellent option for small business owners who want a cloud-based tool with a rich feature-set and an exceptional user experience. The platform provides capabilities to automate accounting processes with numerous integrations and add-ons. With Zoho’s client portal, it’s easy to enhance collaboration between accountants and clients. Besides, the platform offers unlimited support so that you can contact agents for free, 24 hours a day.

Expert’s Insight: How to Choose the Best Accounting Software?

Pick up the right accounting software is hard for many small business owners. How to select functionality that you would actually use for your financial operations? The feedback from the actual users will help you a lot. For this reason, we’ve decided to ask founders and co-founders, CEOs, and CFOs the following questions:

- What is the best-performing accounting software? Why?

- What are the most important & useless features these systems offer?

- Are integrations so important for the efficient process running?

And here’s the insight and tips they’d shared:

What is the best-performing accounting software? Why?

Sage50 cloud is the best for me as this is the one being used by our company. It gives us everything that we need, from customer management to financial reporting.

What are the most important & useless features these systems offer?

It doesn't consume large bandwidth as the software is hard drive based but can also be integrated in the cloud so data is shared across the company. Microsoft Office is also compatible with it so that makes this software a good one.

Are integrations so important for the efficient process running?

Of course, it is very important. All data available should be used as it can tell us what is really happening on the financial aspect of our company.

What is the best-performing accounting software? Why?

For numerous reasons, I picked *QuickBooks Online* as the best option for small companies. Create professional invoices, collect payments, manage costs, and keep a close watch on your cash flow with this accounting software. And that's just with the Basic plan; the higher-priced plans give you access to the professional accounting staff, batch invoicing, and extensive analytics.

What are the most important & useless features these systems offer?

You may also set up the program to run and send reports to you on a regular basis, such as daily, weekly, monthly, or quarterly, and schedule them for a certain time and frequency. *QuickBooks has some of the most advanced reporting capabilities of any accounting software we looked at.

Are integrations so important for the efficient process running?

Yes, of course.

What is the best-performing accounting software? Why?

I'm sure this is the answer most people will give, but I still prefer Quickbooks. It's simple to use, can flag errors, and is organized in such a way that it's easy to find things.

What are the most important & useless features these systems offer?

The most important, in my opinion, is the many integrations. In terms of uselessness, I don't think any one feature is useless, they just may not be valuable to a particular company.

Are integrations so important for the efficient process running?

Absolutely. I think in today's age of integrated technology, not offering this is a death knell for software developers.

What is the best-performing accounting software? Why?

There is no one-size-fits-all solution, so the best system will be different based on the situation. For us, the best fit is Xero because we have a large number of transactions, and Xero has tools to help automate the reconciliation process.

What are the most important & useless features these systems offer?

Unfortunately, budgeting is often an afterthought for most accounting solutions, so you’re likely going to need another service to help manage your forward-looking finances.

Are integrations so important for the efficient process running?

Yes, there are simply too many moving pieces when it comes to managing money in business. We process transactions through multiple payment gateways, and it would be far too time-consuming to import all of the data manually. Any suitable accounting solution should offer integrations with the rest of your financial tech stack.

What is the best-performing accounting software? Why?

I've used multiple accounting software systems over the years across multiple jobs and have found Sage 50cloud to be the best by far. I find its interface and functionality to be much more user-friendly than competitors like QuickBooks, which is great for experienced accountants and inexperienced entrepreneurs alike. It also has full functionality, allowing us to compile and track financials, pay bills, invoice customers, generate reports, and integrate with Microsoft Office.

What are the most important & useless features these systems offer?

The most important feature of Sage 50cloud by far is its ability to invoice customers directly from within the program, which allows for helpful integration and minimization of work. The most useless feature of this program is its inventory management; it's just not that robust.

Are integrations so important for the efficient process running?

I love that Sage 50cloud integrates with Microsoft Office, which really streamlines our internal team communications. Sage 50cloud's robust integration abilities made it appealing to us in the first place.

What is the best-performing accounting software? Why?

To be honest, I’m not a complete rookie in things related to accounting. I’ve got a Master’s degree in Banking and Financial Support Services so when I need to choose accounting software for our company - I’d made a thorough research. QuickBooks Online was my choice, and it has proved to be the right choice. The feature pack is just what we need, and it performs great all the time.

If you want to run clean and accurate accounting - QuickBooks is your go-to accounting platform.

What are the most important & useless features these systems offer?

Ultimately, I was surprised at how many things I can figure out with QuickBooks reports. Especially, it performs excellent at multiple budget management. Accurate statistics have stolen my heart.

The story so far: I haven’t found useless features up to this time. And I hope I won’t come across one in the future.

Are integrations so important for the efficient process running?

The good news: software integrations save your time, effort, and nerves. QuickBooks Online comes up with many useful options like PayPal, TSheets, Gusto, and the like. Optimize your time and use your efforts to do more efficient tasks than a manual data entry.

What is the best-performing accounting software? Why?

I have yet to find anything that performs better than Quickbooks for accounting.

What are the most important & useless features these systems offer?

For me, there are just features I don't use, personally. Lots of people love QB Payments but I don't use it because we handle payroll through other software. In terms of most useful, definitely the integration support.

Are integrations so important for the efficient process running?

Integrations allow me to import and flow between apps I need to use for accounting so that I save time when compiling things.

What is the best-performing accounting software? Why?

While we offer training in Xero, QuickBooks and MYOB, Xero has gained significant traction in recent years, and, in my opinion, it’s by far the most user-friendly accounting software of the three.

What are the most important & useless features these systems offer?

In my opinion, the tool is only as good as the user, and Xero places significant focus on educating its users by providing informative and interesting online training tools and 24/7 online support. They also remove most accounting jargon and instead uses simple terms so that business owners without an accounting background can easily understand. Unfortunately, however, Xero has weak inventory management software, and it cannot automatically calculate commissions. So, if you want to track your inventory and have multiple payroll structures, Xero might not be the best solution.

Are integrations so important for the efficient process running?

Yes, because integrations are a great way to supplement existing software. For example, if your company is growing and your accounting software can't keep up with your payroll requirements, you can check out the software's integrations before having to change software completely.

What is the best-performing accounting software? Why?

The best-performing accounting software is QuickBooks. This is the best software because it is straightforward and easy to use. Also, it provides flexibility, easy templates, and it automatically backs up your data. Every feature on QuickBooks is great to use, however it is important to note, it does have a limit to how many people can access the system. Integration is essential to have great running software and luckily QuickBooks provides that through hundreds of third-party applications, mobile apps, and desktops. Overall, QuickBooks provides high-quality content and huge satisfaction.

Button Line

- Automated accounting processes, digital transformation, artificial intelligence (AI), and focus on data analytics, blockchain are the top five accounting trends in 2021.

- Adopting accounting software helps improve accuracy, reduce repetitive tasks, and upgrade their reporting capabilities.

- Over 62% of small businesses use accounting software to meet their accounting needs.

- QuickBooks Online, Xero, FreshBooks, Zoho Books, and Sage are the top five best accounting software for small businesses due to their feature-set and integrations.

- Real users use accounting software for numerous integrations, learning resources and courses, and automated reporters. Mainly, all users consider all accounting features essential.

FAQ section

How Does Accounting Software Work?

When you set up accounting software, you synchronize bank accounts and credit cards with it. After that, all transactions appear in a system, and you can put them into corresponding categories on the chart of accounts. Once you’ve placed your transactions into appropriate categories, they begin to fill in financial statements.

How Much Does Accounting Software for Small Business Cost?

The cost of accounting software varies in the type of plan and the set of features. Basic plans range from $0 to $40 per month. A basic plan allows for tracking income and expenses, sending invoices, and, most importantly, prepare financial statements. However, when your business grows, you need to upgrade your plan to meet your new requirements. Most accounting systems offer customized features like payroll services, CRM, inventory control, and state tax compliance.

How to Choose Accounting Software for Small Business?

Make a list of features a small business requires and study your budget. Also, you need to consider the type of business and the number of employees before choosing accounting software for small businesses. However, as the company expands and its accounting needs increase, scalability becomes vital in upgrading your current software or switching to a new accounting solution.

Have a data migration in mind?

Let's migrate accounting data together!