How to Avoid the VAT Charge for Accounting Data Migration?

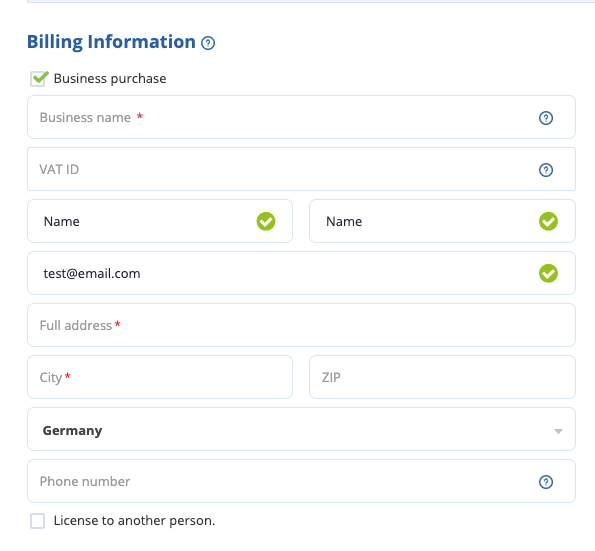

If your business has a valid VAT ID, you are exempt from paying VAT.

If you have already made the payment, simply send a letter to support@payproglobal.com with your order ID and VAT ID. You will then receive a refund for the amount of tax paid.

Since there is no standardized international framework for taxation regulations, PayPro may not have the tax regulations for the country where your payment was made. Therefore, the tax amount will not be refunded from the payment.

To resolve this, please send your TAX/VAT Registration Certificate to support@payproglobal.com. You will be contacted shortly after the validation process.