Most small businesses only consider accounting, financial statement preparation, and bookkeeping from a compliance point of view. They use these facilities mainly because they are required by law to do so.

Today, few businesses use manual paper-and-scale accounting methods. However, the problem lies in using redundant accounting software, mainly because typical accounting methods lack key features that an ideal accounting system should not miss.

Many people are unfamiliar with the concept of using accounting software to benefit and grow businesses. However, accounting software can help small businesses survive and grow. So, let's try to understand what accounting software is and how crucial it is for business growth.

Accounting software is an application software that records and processes accounting transactions. It manages all the functional accounts modules, such as accounts payable, accounts receivable, payroll, ledger, and trial balance.

As with most software, accounting systems can range from simple and user-friendly to complex and highly technical. As the functions and complexity vary, there is a broader range of costs. The corporate versions are expensive but are a significant investment in easing the tasks and management of accounting.

Custom Accounting Software vs Off-the-Shelf Solutions: What’s the Difference

When choosing between custom accounting software and off-the-shelf solutions, understanding their differences is crucial. Here’s a breakdown to help you decide:

Custom Accounting Software

Pros:

- Tailored Fit: Designed to meet your unique business needs, ensuring a perfect match for your specific workflows and requirements.

- Scalability: Adapts as your business evolves, allowing for future modifications and seamless integration with other systems.

- Competitive Edge: Offers features that can differentiate your business from competitors, providing a unique advantage.

Cons:

- Higher Cost: Typically more expensive to develop and maintain, including costs for development, ongoing support, and future upgrades.

- Longer Implementation: Development can be time-consuming, potentially delaying your ability to use the software.

- Complexity: May require specialized training and involve complex integration and update processes.

Off-the-Shelf Solutions

Pros:

- Cost-Effective: Generally more affordable with straightforward pricing, making it easier to fit within your budget.

- Quick Deployment: Ready to use right away, with minimal setup and fast implementation.

- Ongoing Support: Regular updates and support from the vendor, reducing the need for internal IT resources.

Cons:

- Limited Customization: Might not align perfectly with your specific needs, which may require adjustments to your processes.

- Scalability Concerns: While some solutions are scalable, they may not be as adaptable as custom options.

- Generic Features: Includes features that may not be relevant to your business, potentially leading to unnecessary complexity.

Making Your Choice

- Assess Your Needs: Determine if your requirements are highly specialized. If so, custom software might be the best fit.

- Consider Your Budget: Compare the total cost of ownership for both options and choose what aligns with your financial plan.

- Evaluate Timeframe: Decide how quickly you need the solution. Off-the-shelf options offer faster implementation.

- Plan for Growth: Think about future scalability and whether the software can evolve with your business.

Who can Benefit from Implementing Accounting Software

Professionals and business owners who manage a large amount of data must use accounting software. Advanced accounting tools do much more than record and process accounting transactions.

Anyone who is struggling to manage their business’s cash flow and inventory stocks must rely on accounting software. If a business is lagging behind its competitors in the market, it may also lack thorough accounting strategies. Again, businesses that lack effective financial analysis and strategic planning must get accounting software.

What are the Benefits of Accounting

Saves Time

Accounting software revolutionizes how much time you spend performing basic tasks. Your business requires fewer resources and time to manage coding transactions, payroll, and super payments. With so many features and functions in the software, it takes little time to get work done. You and your staff can quickly create ledgers, cashbooks, and balance sheets. Some accounting software can also automate your balance sheet to some extent.

The time you save will then help you cross-check and double-check all the work to eliminate any possible errors.

With in-house training and protocols, your staff can quickly use the system to manage day-to-day finances. Accounting software services provide a fast, secure, and robust tool for handling your business finances. The software also provides remote online access to review your financial data in no time from anywhere in the world.

Guarantees Accurate Accounting

Without software, it is impossible to maintain an accurate and transparent record of all your accounting data. When running a business, your account reports can’t afford any errors or miscalculations.

Another benefit of accounting software is that it automates the invoicing process with templates and timesheets. This avoids all the mistakes that are possible in manual invoicing.

Proper corporate financial software eliminates inaccuracies using advanced tools. These tools can double-check functions such as deductions, additions, and other complex mathematical calculations. You need to conduct complex tax collection calculations, which can easily go wrong. But with accounting software, tax collection calculations no longer remain on your to-do list.

Highly Secured Accounting

Accounting data is sensitive information. It’s not something that you would want to fall into the wrong hands. A wrongful party accessing your accounting data can wreak havoc on your business operations. Good accounting software has vital security considerations. Proper accounting software prevents third parties or unauthorized persons from reading, writing, or accessing your company’s account.

Build Realistic Profit Budgets for Future

Accounting software also helps business owners easily allot transactions for revenue and cost. This allows them to identify revenue trends and separate the fixed and variable costs of analysis. With such helpful information, owners can build a budget for the next 3, 6, or even 12 months. This is significant in predicting future conditions and will increase sales and profit.

Better Management Distribution

Accounting software provides instant access to financial reports and easy cash flow preparation. This engenders confidence in the business and improves resource management and profit distribution.

Effective Cashflow Management

Accounting software records and tracks your payables and receivables. This allows you to know the current cash flow status of your business. By closely monitoring cash flow, you see when your bank account runs the risk of running dry. With accounting software, you don’t have to fear a reduction in cash flow, even when the market goes down. However, for this, planning and an effective strategy are crucial, and without proper accounting software, plans and strategies fail to keep cash flow high during hard times.

Mobility

Accounting software offers mobile apps for iOS and Android. These apps allow you to access your finances anywhere and anytime. These apps can perform productive tasks like sending and viewing finances, reporting expenses, tracking bills, etc. Accounting software on a smartphone provides you access to all your finances on the go. This way, you stay connected to your accounts and can address any discrepancies instantly.

Inventory Stocks

Various accounting software has inventory tracking features. This feature accurately tracks all inventories and saves time. It helps to track and order required products according to your client’s demand. The software can automatically track product availability in stock and generate orders for good sale items.

Strategic Planning

Accounting software provides data for financial analysis and strategic planning. This data will help you or your accountant create a business plan and tax strategies. It will significantly assist you in staying ahead of your competitors. Financial software will also help you better analyze the impact of market trends.

What should you pay attention to during an accounting system change

When transitioning from manual accounting to computerized accounting software for your business, it's essential to consider several key factors:

- Business Needs: Assess how well the software aligns with your specific business requirements and workflows.

- Price: Evaluate the cost of the software, including initial purchase, implementation, and ongoing maintenance.

- Quality: Consider the software's reliability, performance, and the quality of its features.

- User-Friendliness: Ensure the software is intuitive and easy for your team to use, minimizing the learning curve.

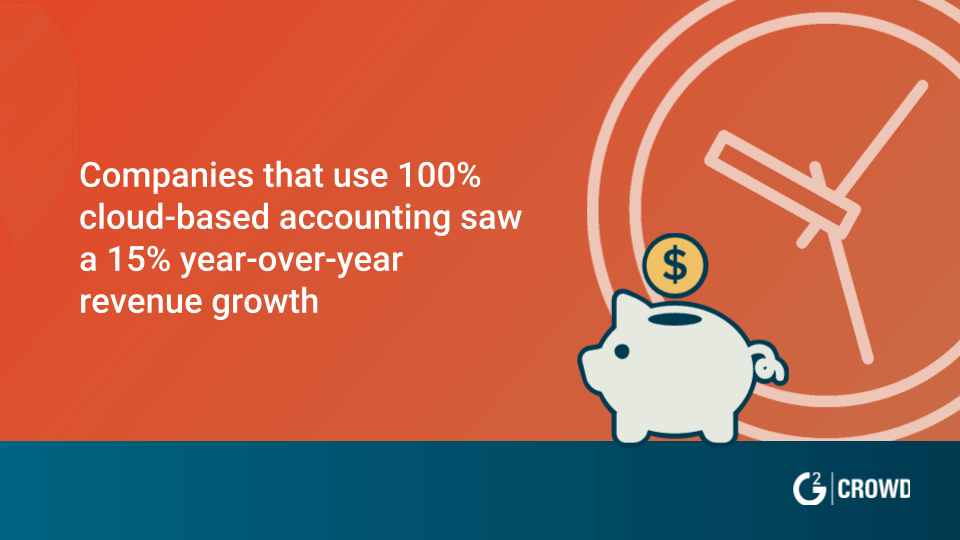

- Type: Decide between cloud-based solutions and traditional on-premises software based on your preference for accessibility and data management.

- Flexibility: Determine how easily you can switch to another software if your needs change.

You can choose the right accounting software to support and enhance your business operations by carefully evaluating these factors.

Our company specializes in importing data into the accounting tool of your choice and seamlessly migrating information from your old accounting systems to a more advanced solution. We offer a range of plans tailored to help you select the ideal accounting software to fit your business needs. Let us guide you in finding and implementing the perfect solution for your financial management.