Have you ever thought about adopting accounting software? How about checking out Kashoo as an option? Sounds interesting - then check out this Kashoo review.

Did you know that 25% of small businesses still use paper to record their finances? This is quite an anachronism for the digital 21st century, right? Not to mention the time needed to process everything manually. And the high possibility of human errors.

However, with the right accounting system in place, you can easily generate reports and balance your books even without a special financial background or expensive financial consultants. In our Kashoo Review, we will present you with all the necessary information about the popular billing and accounting software such as Kashoo and let you decide yourself whether it is time to automate your finances.

What is Kashoo Accounting?

Kashoo is a web-based and double-entry accounting solution with a quite limited number of features that will suit small businesses and self-employed. It is extremely easy to use and doesn’t require an accounting degree to take advantage of all its capabilities. However, it can’t be called feature-rich as it doesn’t offer time tracking, estimates, advanced reports, a vast variety of integrations, and invoice customization options.

Who is Kashoo for?

Being limited in functionality, Kashoo software will best suit small businesses, financial consultants, and freelancers who want to better their business management. This accounting solution is quite affordable and has an unlimited number of users. Kashoo can help you easily set up credit card payments, and track all your clients, suppliers, and items you sell. It also allows you to connect your bank accounts and track your banking transactions, or manually upload your statements to the program for bank reconciliation.

Kashoo Review: Digging into the Key Functionality

In 2020, the new 2.0 version of Kashoo was released with some major improvements to its user interface. Besides, all the features including contacts, accounts, bill payments, and many more were updated, too.

The current version of the Kashoo small business accounting solution is very easy to set up as it is cloud-based, and allows you to connect your bank accounts and add your tax payments. Among the key features of Kashoo are:

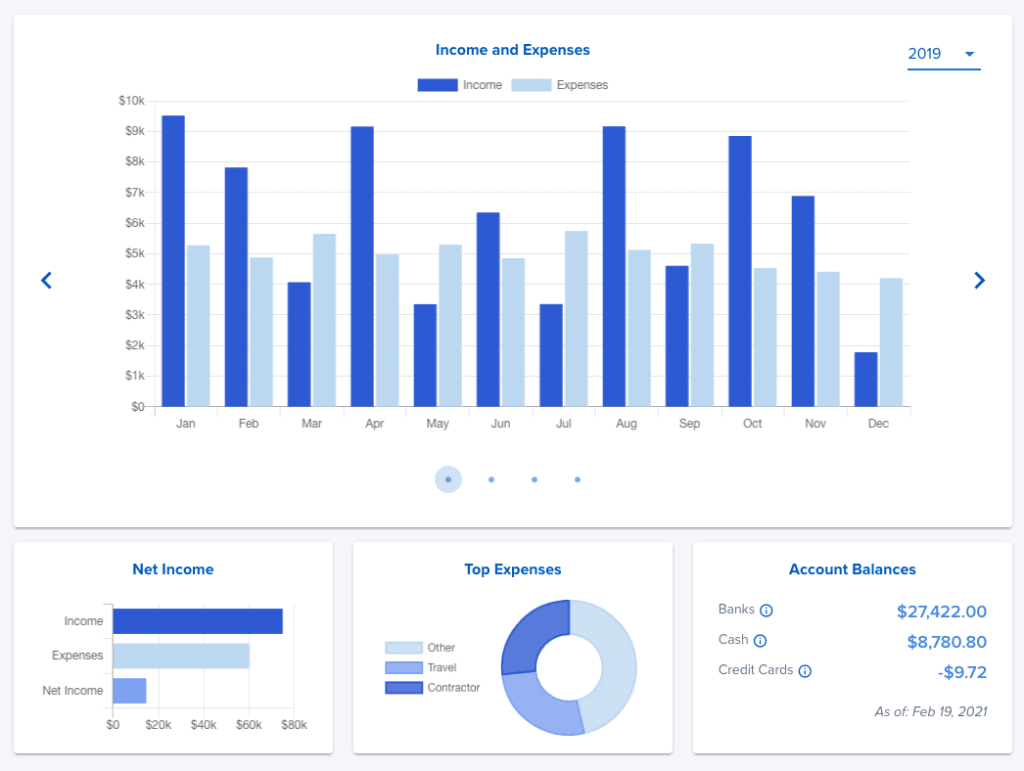

- Dashboard: Kashoo has detailed dashboards with such information as your income, expenses, cash deposits and your withdrawals, net income, and net cash totals. Plus, all the information is updated in real-time.

The dashboard totals contain all your transactions posted to the general ledger as well as those posted from the bank accounts you connected additionally. Besides, it shows the journal entries that you added to the app together with various graphs and charts.

- Invoices: Kashoo software has a very fast and effective invoicing system; it takes about a minute to create an invoice or add the needed information about the client to the item. Once you create a new invoice, you can choose one of the options under the Save tab — save your invoice, create a new one, save and return to the invoice feature, preview your invoice and then send, or duplicate your invoice.

If you need to accept credit card payments from your clients via credit card, the payment link checkbox will appear. You can also set the credit card option while setting up and have the possibility to print your invoices and bills or mail them.

The invoices offered by Kashoo are standard ones, and you do not have a lot of customization options — you can just add your logo or personalized message to your invoice.

- Bills to Pay: This feature allows you to easily manage your vendor bills. It shows the summary of such totals as total bills for the year, the total number of days you needed to pay a vendor bill, the total amount owed, and the total of bills past due. You can easily add the new bills under the New tab and attach the needed information or invoice to the created bill. Unfortunately, this feature lacks direct payment but you can add manual payments yourself.

- Journal Entries: Journal entries in Kashoo can be easily created using the Add Adjustment screen. There, you can add the description of your journal entry. If the debit and credit totals of your journal entry do not correspond, the warning message will pop up.

To make the process of adding lots of journal entries much easier, you can add bank accounts to the app. However, if you need to add the depreciation entry, then you have to use the Add Adjustment option.

- Accounts Payable: Kashoo software has a well-set up account payable where you can add your bills, set your recurring bills, or view all your unpaid bills.

- Accounts Receivable: Kashoo has enough accounts receivable capability that will fit small businesses with a global orientation.

- Bank Reconciliation: Kashoo supports the full reconciliation of your bank account.

- Billing & Invoicing: Kashoo accounting has very basic billing features — you can add bills and records manually; however, direct payments through Kashoo are not allowed. Regarding invoicing, you can easily create, customize, and mail your invoices directly from your account. Besides, you can add extra features to your invoices such as your sales taxes, or set up your recurring invoices to stay updated about your customers’ statements.

- Budgeting & Forecasting: using the Kashoo dashboard, you can get a decent forecasting capability that allows you to forecast for the following quarter. Besides, you can get the data about your totals — both monthly and annual, your expenses, and AP and AR balances. You can also easily compare the received data using prior-month and prior-year features.

- Cash Management

: in Kashoo, it is very easy to access your profit, loss, and cash flow statements. The Kashoo dashboard gives you a review of your current and future income, and expenses which helps small businesses better manage their cash.

- Client & Supplier Contacts: Using Kashoo, you can easily save information about both your customers and suppliers. Among the data you can add are default income accounts and sales tax rates.

- Users & Account Management: The most significant feature of Kashoo accounting is the ability to add an unlimited number of users for free. You can also add multiple businesses, however, you have to pay extra for each added business. What is more, you can assign the users four different access levels, which is very useful.

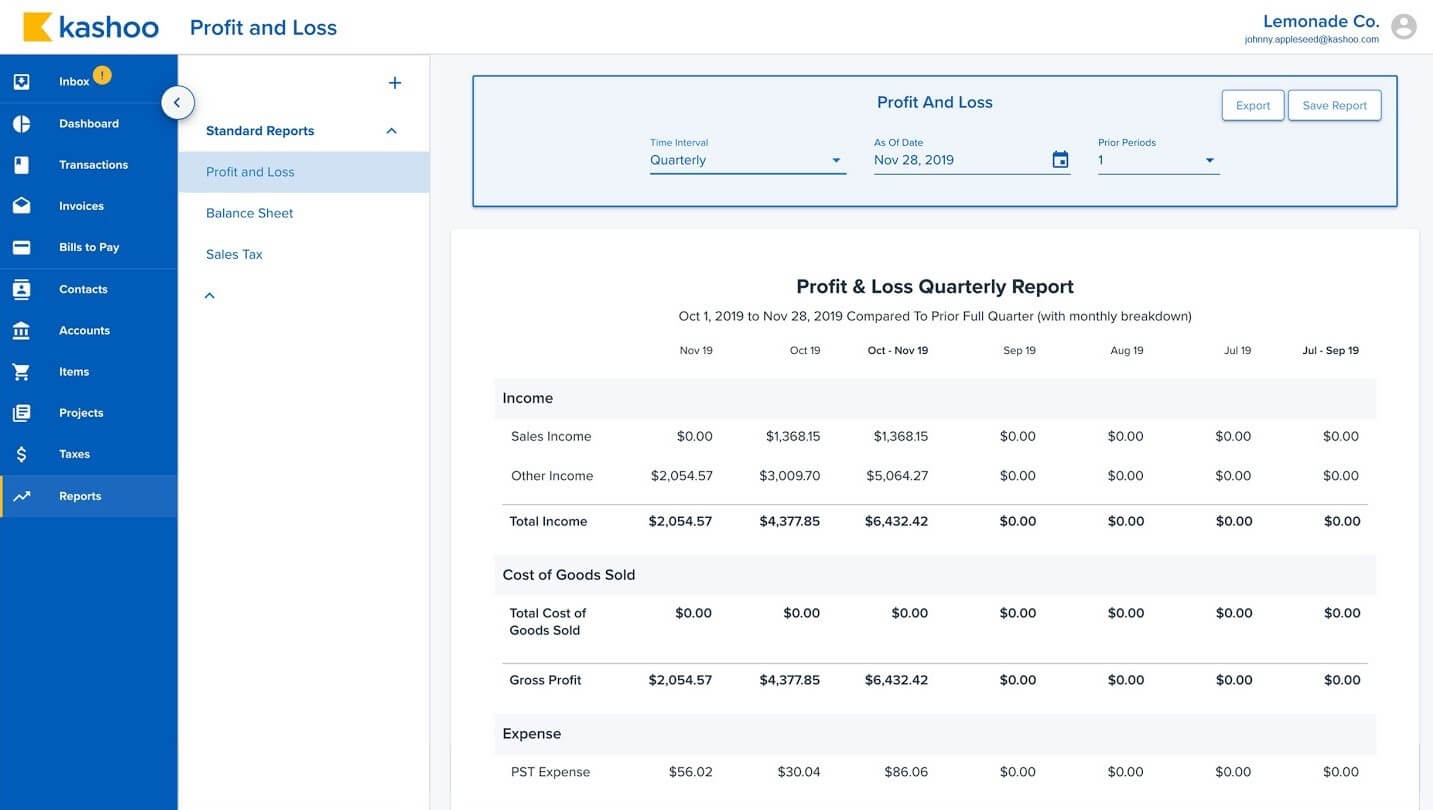

- Reports: currently, Kashoo offers eight different reports:

- History

- All your transactions

- Income statement

- Your unpaid invoices

- Your unpaid bills

- General ledger

- Trial balance

- Balance sheet

All the reports do not have lots of customization options, so to add your changes, you have to export them to an Excel file.

Dashboard in Kashoo. Source: Kashoo

What is the Price of Kashoo?

Kashoo accounting solution has several pricing plans:

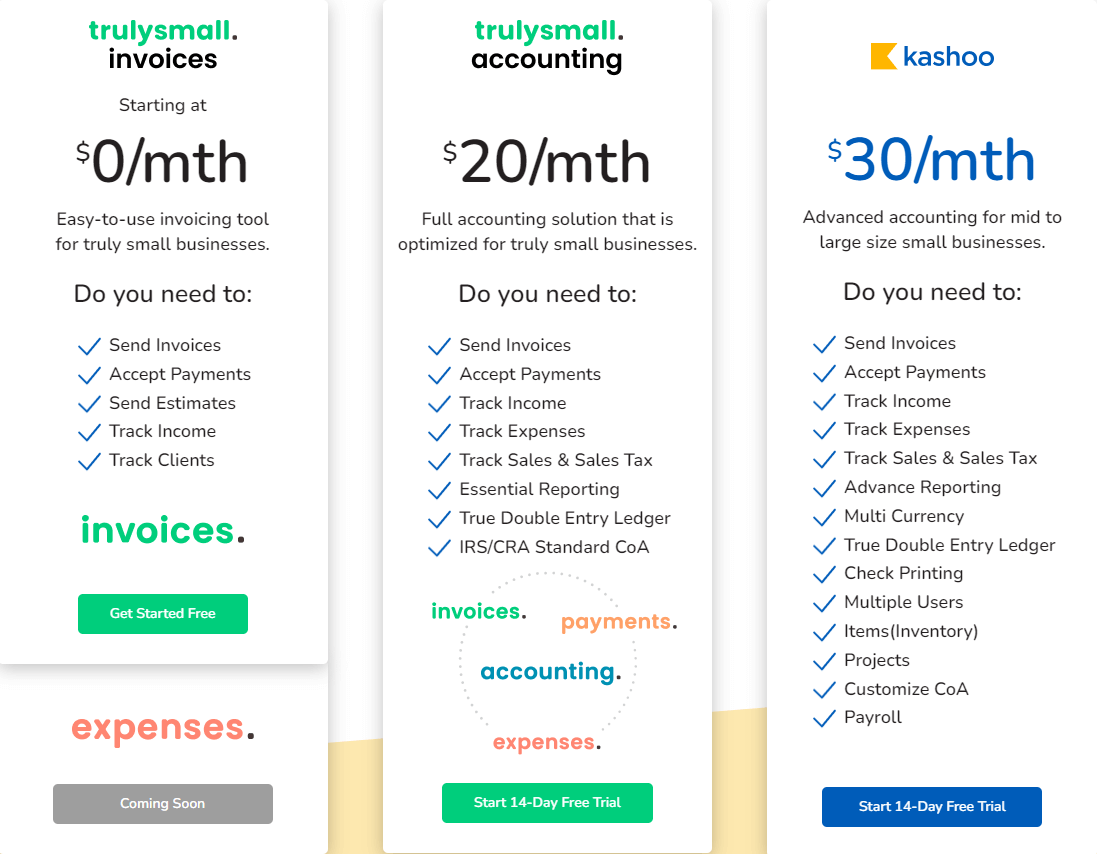

TrulySmall Invoices

Kashoo has a free pricing plan called TrulySmall Invoices with limited functionality that includes only sending invoices and estimates, accepting payments, and tracking your income and clients.

TrulySmall Accounting

TrulySmall Accounting pricing plan costs $20 per month. It is a great choice for small businesses as it has such features as invoicing, logos, CC payments, reconciliation, item lists, reports, the dashboard, and bulk editing.

Kashoo

Kashoo’s advanced pricing plan is ideal for SMEs. Paying $30 per month, you get a full arsenal of accounting and billing features — inventory, fully customizable layout, projects, multiple currencies, double-entry ledger, and multiple users.

Kashoo’s pricing. Source: Kashoo

Extra Spending

When opting for Kashoo, you should also be aware of some extra costs for additional functionality. They are:

- Payroll: if your company needs payroll, Kashoo supports SurePayroll with a 20% discount. The basic plan for payroll for up to 10 users will cost you $54.99 per month (this includes the unlimited number of pay runs, tax filing, and payments, direct deposit, 1099 reporting, and W2.)

- Multiple Companies: if you need to add more than one company, you have to pay extra for each of them. However, Kashoo offers its users discounts if you buy multiple subscriptions which is $13.95 per month for each user (you save $6 for each company or business.)

- Mobile App: Kashoo’s app is free of charge, however, you can use it only if you opt for the advanced pricing plan that costs $30/month.

N.B. Kashoo offers a free 14-day trial for new users. You can receive two free months as a bonus if you pay annually.

Kashoo Review: Advantages and Disadvantages

Pros

- Ease of Use: Kashoo was created to make the accounting and billing processes easier for small businesses and self-employed. You can take advantage of the web version of an app or download a mobile app to facilitate the process of collaboration between accountants and business owners.

- Fast and Comfy Navigation: Kashoo dashboard gives you a detailed overview of all your finances in one place. You can easily navigate it to set everything up, run reports, post banking transactions, and many more.

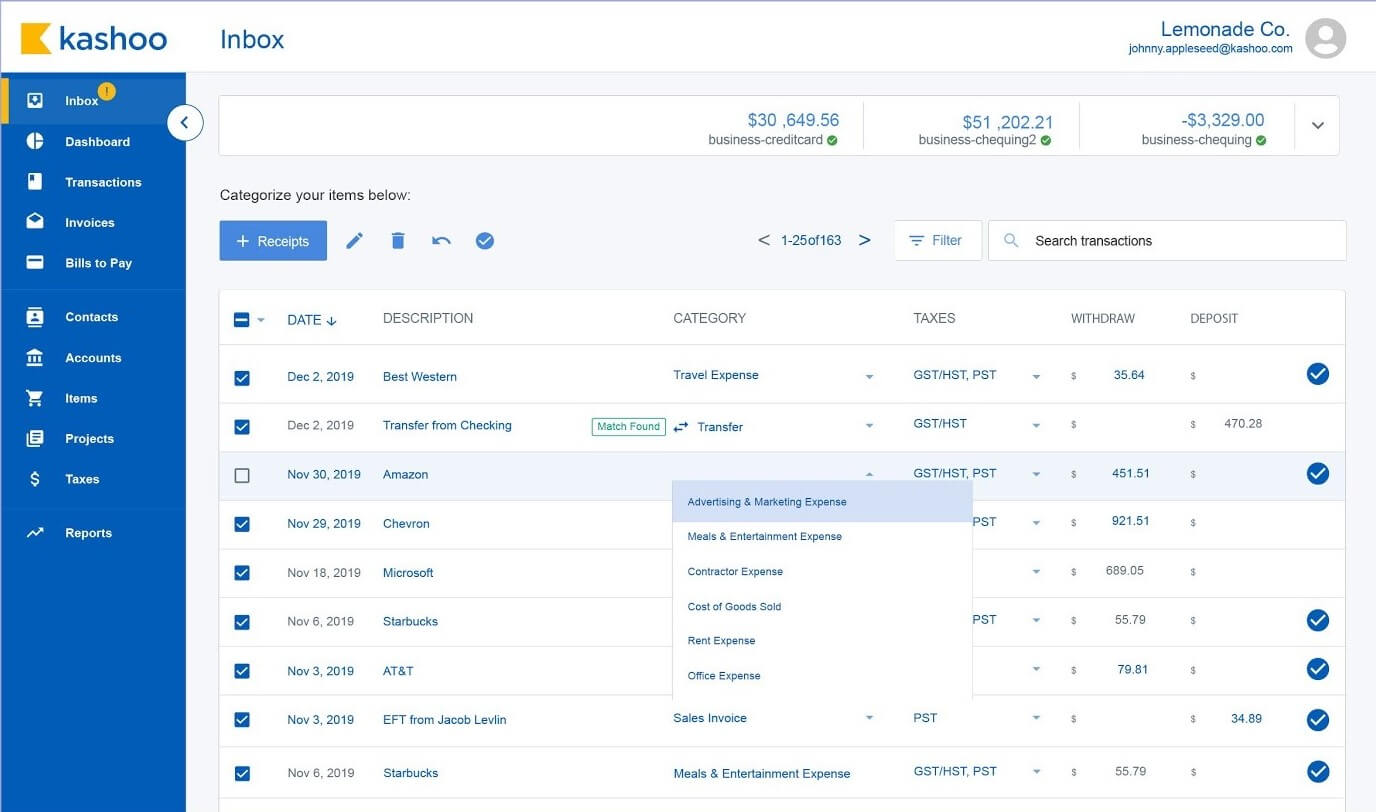

- Adding Your Income and Expenses: For the purpose of the full bank reconciliation, you can add all your banking and credit cards to your account. This will assist in the automatic input of your credits and debits to your accounts. However, you can add your income and expenses manually, too, and this won’t take more than a minute.

- Creating and Sending Invoices: You can easily create and send invoices to your customers with the help of Kashoo. Just add the necessary information and download it as a PDF file or email it directly to your customers. You can customize and brand invoices by adding your logo to them.

- Creating and Printing Your Checks: This is quite a unique benefit that many modern accounting software lacks. With Kashoo, you can create and print your checks or enter transfers made between different accounts.

Profit & Loss in Kashoo. Source: Kashoo

Cons

- Limited Integrations: unfortunately, Kashoo doesn’t have a lot of integration options as of now.

- Limited Number of Features: Kashoo lacks some useful accounting and billing features such as advanced reporting, full invoice customization, invoice notification, inventory, and many other important ones.

- Not Flexible: Kashoo is not scalable, which means if your business becomes bigger overtime, you can outgrow this software. That is why it is an optimal variant only for small companies and freelancers.

Add-ons and Customization Capabilities

As we already said, Kashoo is very limited in terms of integrations. As of now, there are four available integration options: Square, BluePay, Stripe, and Freshbook Classic. However, Kashoo API is available for development.

Is Kashoo Secure?

Kashoo takes security very seriously that is why they secure your data with:

- SSL data encryption

- security scanning

- firewalls

- various physical measures (24/7 monitoring, cameras, biometric scanning, and many more)

- data storage in undisclosed places

- regular data backup

What are Kashoo Customer Support & Training Available?

According to many users of Kashoo, outstanding customer support service is one of the best features you get when committing to this small business accounting solution. You can get help from Kashoo’s support reps every day, from 6 AM till 5 PM in one of the following ways:

- Phone: you can connect directly with Kashoo’s agents via phone

- Email: you can contact via mail and get almost an instant reply (usually, it takes from several minutes to a day)

- Live Chat: you can find a live chat in software or on the company's website.

- Social Media: Kashoo has Facebook, X, and LinkedIn accounts to help solve your problems.

Besides, you can troubleshoot your issues yourself by using some of the self-services:

- Help Center: Kashoo’s Help Center has numerous articles that can help you with your issues.

- YouTube: Kashoo has some visual assistance on their YouTube channel.

- Workshops: the company holds regular workshops where you can learn about accounting and ways to skyrocket the Kashoo solution and your business.

- Kashoo Guides: the company has a variety of guides on numerous topics that would help you get started with an app and learn more about accounting.

- Accounting Basics: Accounting Basics by Kashoo is a database with key accounting terms and basics.

- Blog: Know and Grow Your Business is Kashoo’s blog that has lots of business articles on how to improve your business operations.

Inbox in Kashoo. Source: Kashoo

Kashoo Review: Alternative Accounting Solutions

Oddo Accounting

Odoo Accounting is an open-source accounting and billing software that helps SMEs and big enterprises accurately track their finances. It offers various accounting features such as invoicing and payments, advanced reports, bank reconciliation, inventory, tax calculations, and many more. This solution can help you improve your operations and free your accountants from manual work to let them focus on more strategic goals.

Unlike the limited functionality of Kashoo and its zero scalability, this solution can be tailored with numerous add-ons and a vast variety of integration options to suit any of your needs. And different pricing plans make it affordable for many businesses.

QuickBooks Online

QuickBooks Online is a very flexible and affordable accounting solution in today’s market. Despite the fact that the Simple Start plan doesn’t have all the features that you can find in Kashoo, each of its features is much more detailed. But when you opt for a more advanced pricing plan, the features you get are more powerful than those of Kashoo. What is more, QuickBooks Online has hundreds of integration options so that you can create your own financial ecosystem effortlessly.

Verdict

To sum up, we should say that Kashoo is really a great choice for small businesses that don't have growth in mind. It is extremely easy to navigate, has double-entry accounting, a user-friendly mobile app, and some basic accounting and billing features. There are affordable pricing plans, a free trial period, and outstanding customer support. However, there are some drawbacks, too. Here, we should mention a limited number of reports, customization and integration options, no estimates, and time tracking features.

If you are a small business or freelancer who needs limited functionality, then you should give the Kashoo cloud accounting solution a try. Otherwise, get a free trial period and test this solution out to decide whether its functionality is enough for you.

Frequently Asked Questions

Today, you can find numerous accounting apps on the market, most of them are feature-rich and user-friendly. Among the apps that are most popular among the users are Xero, QuickBooks, FreshBooks, and Wave.

Among the most useful Kashoo’s features are unlimited users and projects, its cloud-based nature, multiple currencies, a real-time view of your finances, a free 14-day trial period, and the ability to create and print your checks.

Kashoo offers a free plan with limited functionality called TrulySmall Invoices, TrulySmall Accounting that costs $20/month and suits small businesses, and Kashoo advanced pricing plan that costs $30/month with a rich functionality onboard.

The Kashoo TrulySmall Invoices pricing plan is completely free of charge. Plus, you can get a 14-day free trial period if you opt for more advanced pricing plans.

Yes, Kashoo has a mobile app available for those who choose an advanced pricing plan.

Kashoo doesn’t have its own payroll but it supports SurePayroll which comes with a discount for Kashoo users.

Kashoo accounting solution has everything a small business needs — easy navigation, some basic accounting capability, and excellent support, however, it is limited in features and integrations.

Want to migrate to Kashoo?

Let's migrate accounting data together!