Taking care of financial health can be difficult with no accounting software at hand. Xero proves itself as a reliable assistant in multiple accounting processes and boasts its large feature selection. In this Xero review, we will try to look at this tool from both general and internal perspectives, and give it a relevant estimate.

What Is Xero Accounting?

Xero accounting is cloud-based software that helps effectively manage financials within one program. It provides robust invoicing & bookkeeping tools, customizable reporting, project accounting, and numerous integrations.

Who Is Xero for?

Xero offers accounting services for teams ranging from self-employed to large businesses. Its flexible pricing structure allows choosing the most appropriate option to meet one’s requirements. Even if your budget is not that big, Xero's starting plan for $12 per month seems quite affordable.

Xero Review: Diving into Functionality

Dashboard

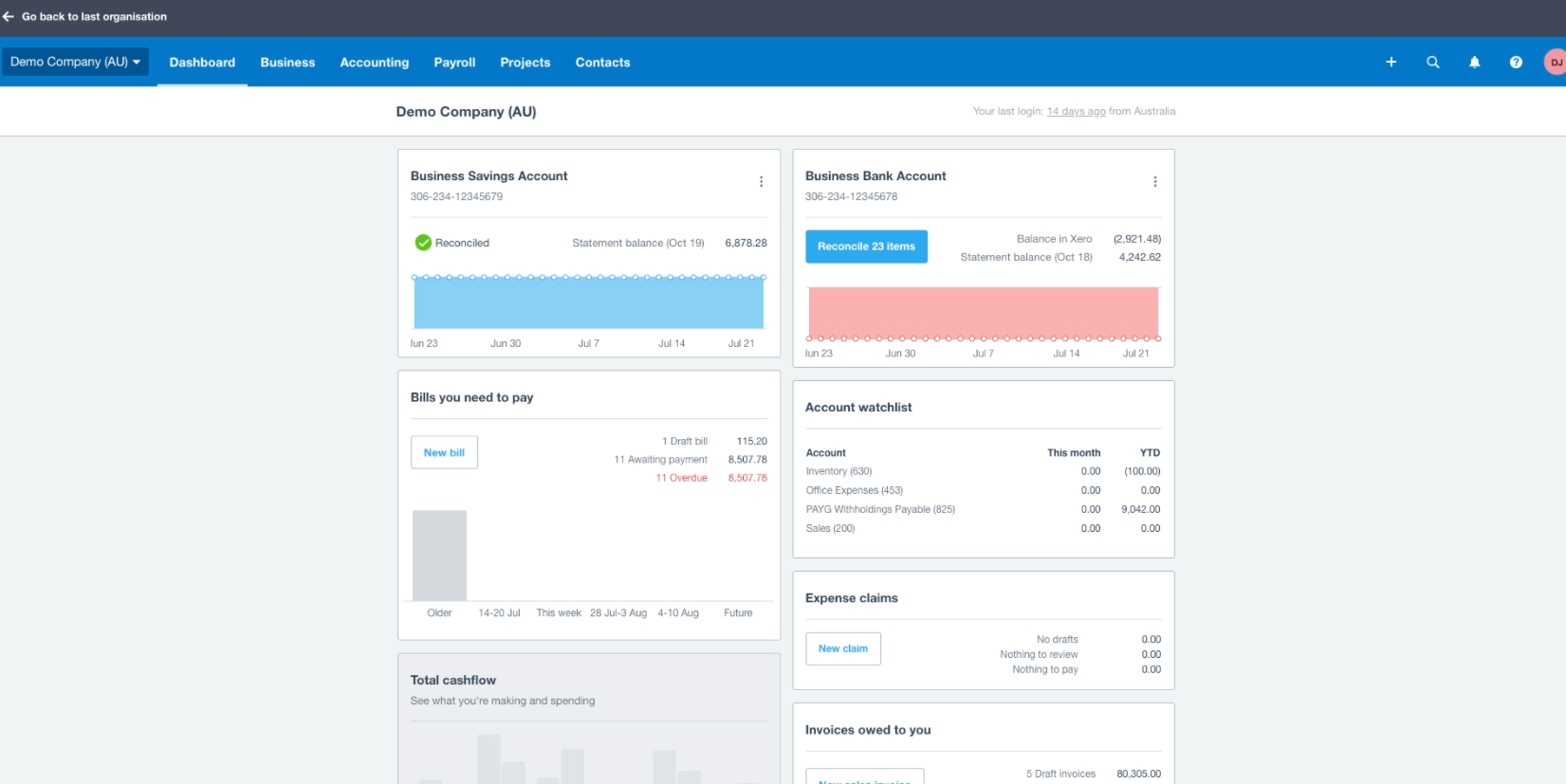

Xero Accounting Dashboard displays your cash flow, bank information, invoices, and other important details. You can customize the dashboard, so the charts and graphs will show the necessary data.

Xero Dashboard. Source: Xero

Sales Overview

Break down your sales into clear tables and graphs to monitor invoices and run expenses reports. Check customers who owe you the most and ones with the biggest value of billable expenses. You can create an invoice for the customer for billable expenses amount right away.

Xero Sales Overview. Source: Xero

Invoicing

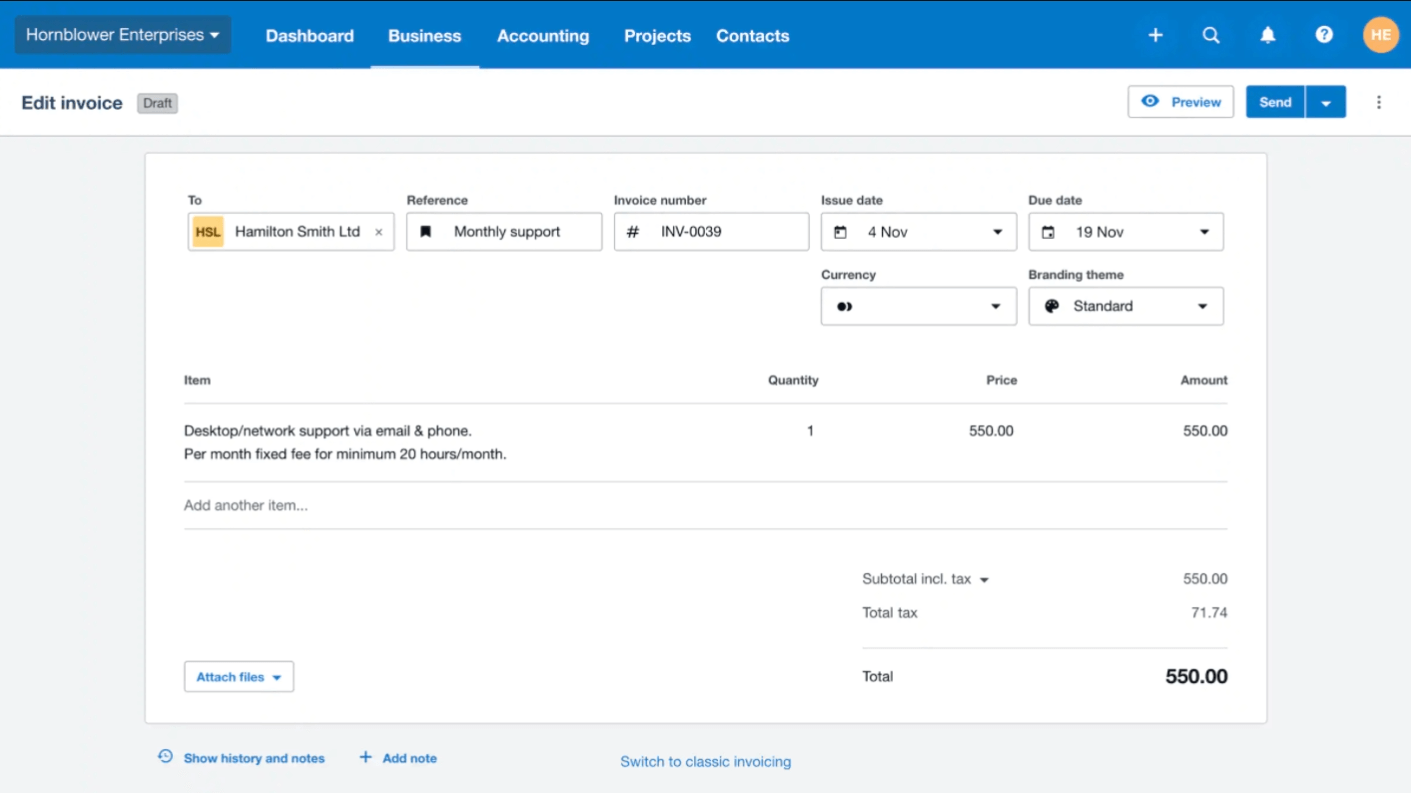

Xero provides a comprehensive way to manage invoices and customer details. It automatically saves all entered fields as a draft every few minutes. Once a credit limit is exceeded, you receive an alert when creating the next invoice for that client.

Xero offers only one ready-made invoice template, though you can generate custom templates using extensive design possibilities.

Xero Invoicing. Source: Xero

Quotes

Inform customers about the cost of the requested service by sending them a quote. You can edit, customize and copy existing quotes for future use. To make quotes more informative, add line-by-line details or attach additional files. Also, Xero allows creating an invoice from a quote, so you can skip entering the customer details.

Contact Management

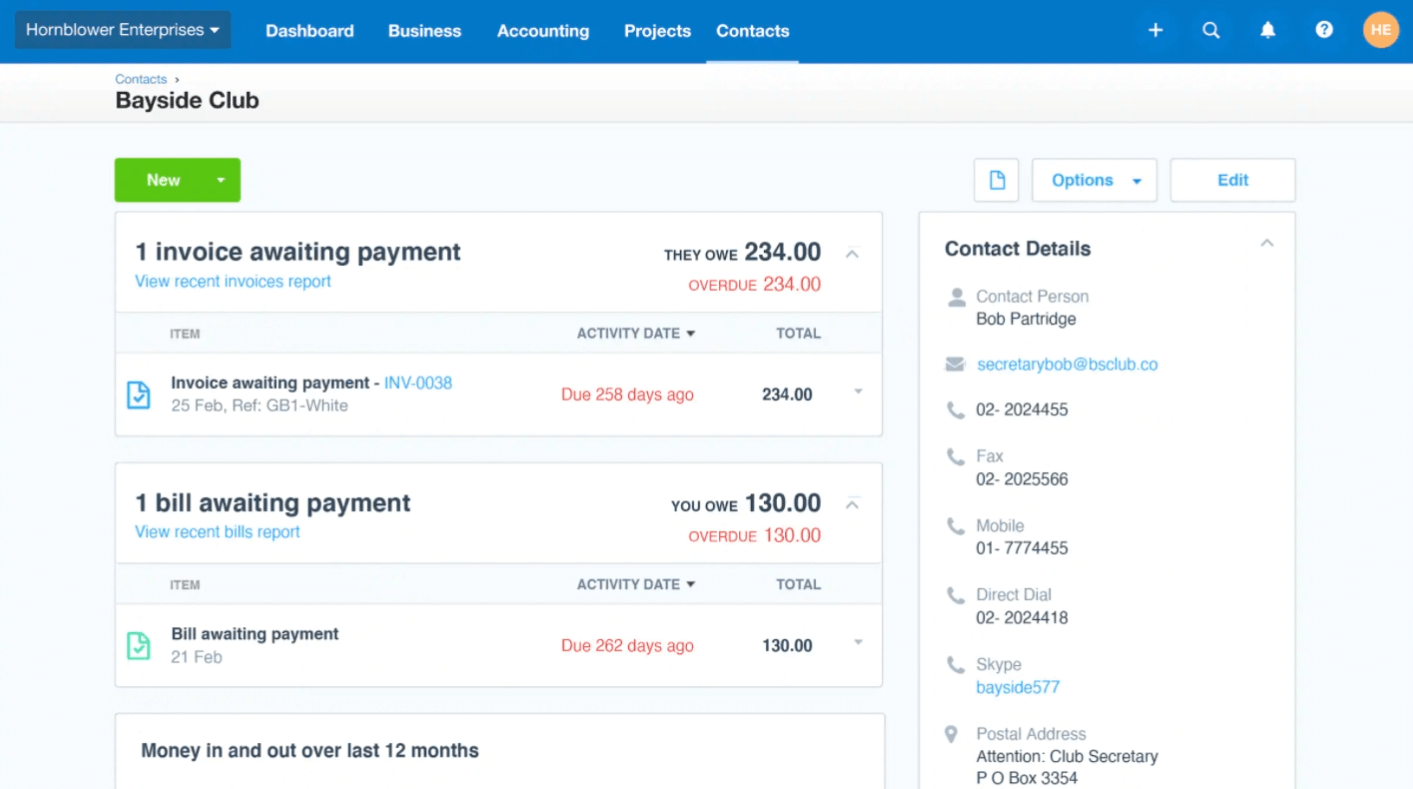

Get an overview of contact activity and history of invoices, payments, bills, and emails. You can check all email correspondence of both your clients and suppliers. For a more organized view, you can create search lists and classify your contacts into custom groups. It will help in reporting and creating invoices.

Xero Contact Management. Source: Xero

Expenses Tracking and Claim

Xero allows categorizing expenses and transactions, so you get reports sorted out by business areas. You can connect your bank accounts to Xero or import bank statements manually.

Also, you can track expenses by employee, status, account, and project for enhanced forecasting and budgeting. Employees can promptly submit claims with attached scanned receipts and expense descriptions. When someone submits a claim, you receive a notification and can manage reimbursements in one click even from your phone.

![]()

Xero Expenses Tracking. Source: Xero

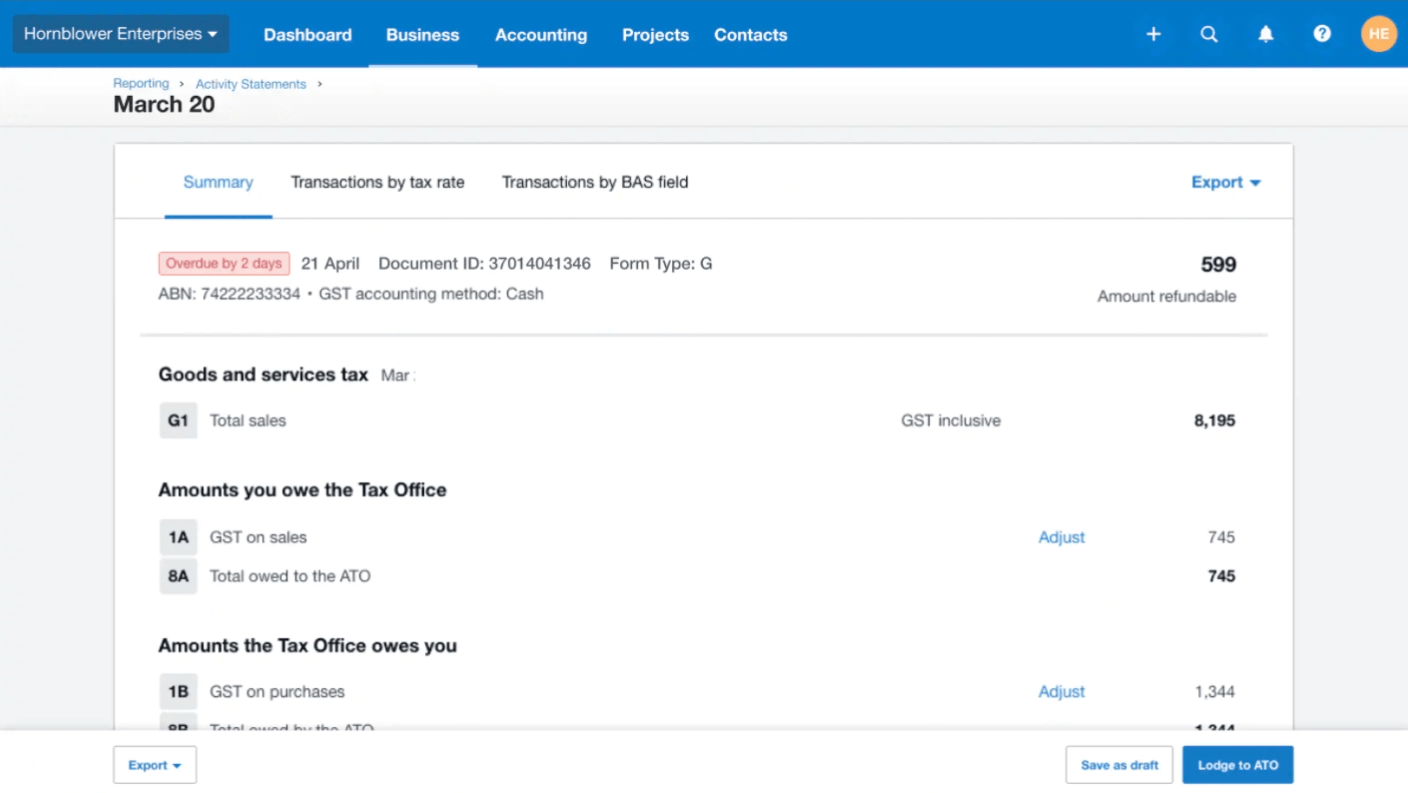

Sales Taxes

You can set default tax rates for purchases, sales, accounts, and contacts. Xero allows adding as many tax rates as you need for each item and calculates taxes for you automatically. You can run a sales tax report to get information on taxes by rate, component, or account and check individual transactions.

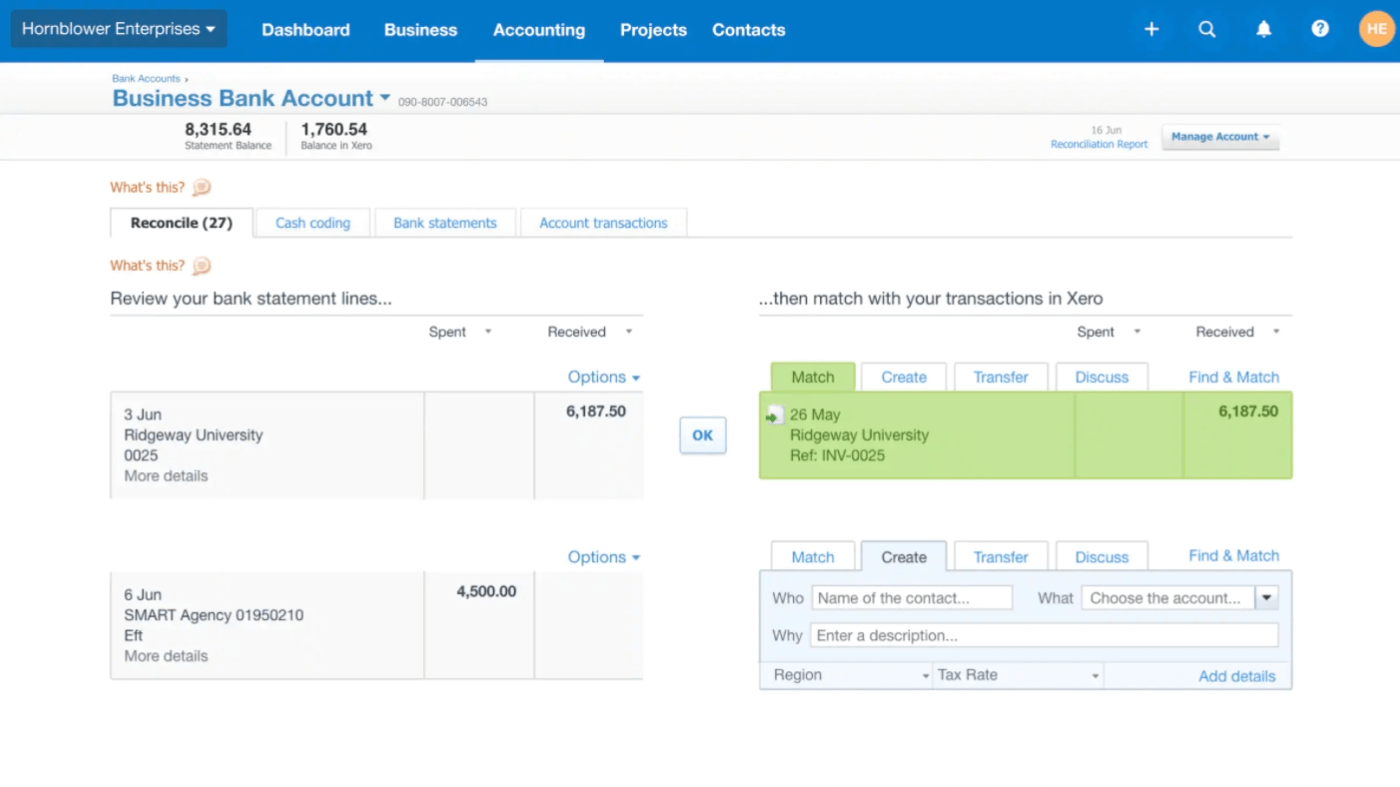

Bank Reconciliation

Xero keeps you up to date with your financials by daily bank reconciliation. To ensure that accounts were reconciled properly, use the suggested matches. You can match bank transactions to invoice or bill payments and create transactions on the go while you reconcile. If you use the Standard or Premium plan, Xero allows you to reconcile transactions in bulk and apply a bank rule to a group of transactions.

Xero Bank Reconciliation. Source: Xero

Accounts Payable

With Xero, you can manage your payables on time in accordance with your cash flow. Create, edit, and approve bills to pay in a preferable currency. You can use batch transactions to collect multiple bills from the same supplier into one payment. The Purchase Overview dashboard summarizes your bills and purchase orders and informs you about the upcoming bills.

Accounts Receivable

Xero provides a range of sales reports to monitor your receivables. You can view all approved invoices, credit notes, overpayments, and prepayments within a certain period. The Aged Receivables Summary report displays the outstanding payments based on the age of the transaction.

Asset Management

You can import all your fixed assets into Xero and set their types, depreciation methods, and default accounts. The tool automatically calculates the depreciation of your assets by selected method and rate. To get more information about your depreciation movements and disposed assets, you can run depreciation and disposal schedules.

Inventory Management

Xero keeps a count of your inventory and shows you the total value of the stock for a specific item. To get the detailed sales stats, run the report and find out your best and worst selling items and exact profit per item. You can create reusable item details like price or description to include them in invoices and quotes.

Journal Entries

Once you have the advisor or standard user role and have access to reports, you can create and import them to Xero. You can generate the journal from scratch or use a CSV template. You can also set up recurring Xero journals weekly or monthly and edit the details, if necessary.

Purchase Orders

Create online purchase orders using customizable templates and add the company logo and details. Print, post or email the orders as PDF files. Also, you can convert orders into bills once you receive the supplier’s bill and make internal notes on the delivery.

Cash Management

Set up feeds from your bank account, so all bank transactions will be automatically imported to Xero. You can set up multiple feeds from several bank accounts. Use the short-term cash flow tool to check your cash flow within 30 days with no manual setup. Besides, you can monitor and claim expenses on the go.

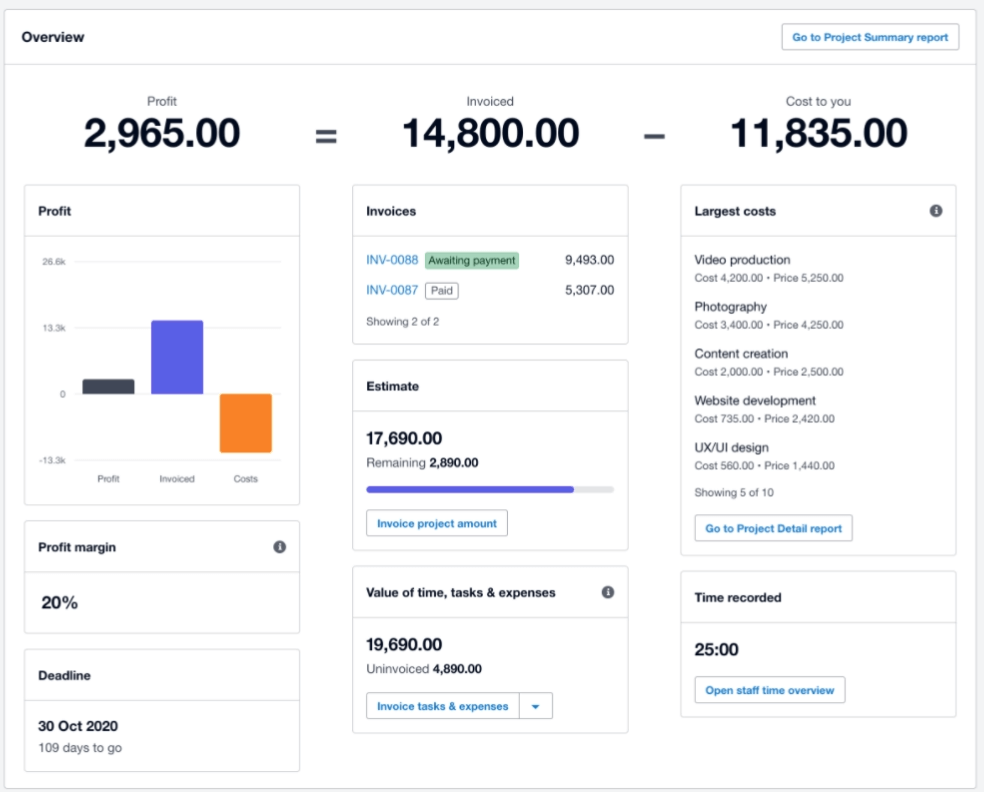

Project Accounting

Xero offers a job tracker to estimate resources spent on a task and build budgets properly. You can create invoices from quotes and send them as progress payments. To get paid faster, add the “Pay now” button to your online invoice. Also, you can monitor your financials broken down by projects, including the expenses and profit margins.

Xero Project Accounting. Source: Xero

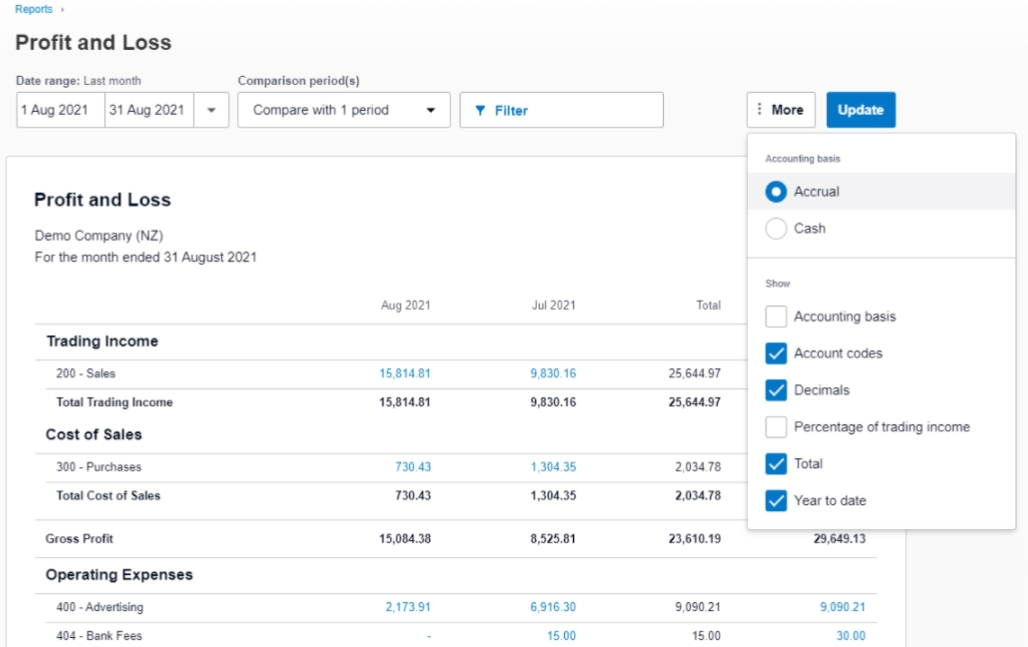

Reporting

Xero reporting allows you a deep dive into the real-time financial stats within any period of time. You can view, share and mark reports as favorites for quick access. To adjust the reports to your needs, add, reorder, or remove rows in one click. You can also add tracking categories to monitor the performance of certain business areas.

Xero Reporting. Source: Xero

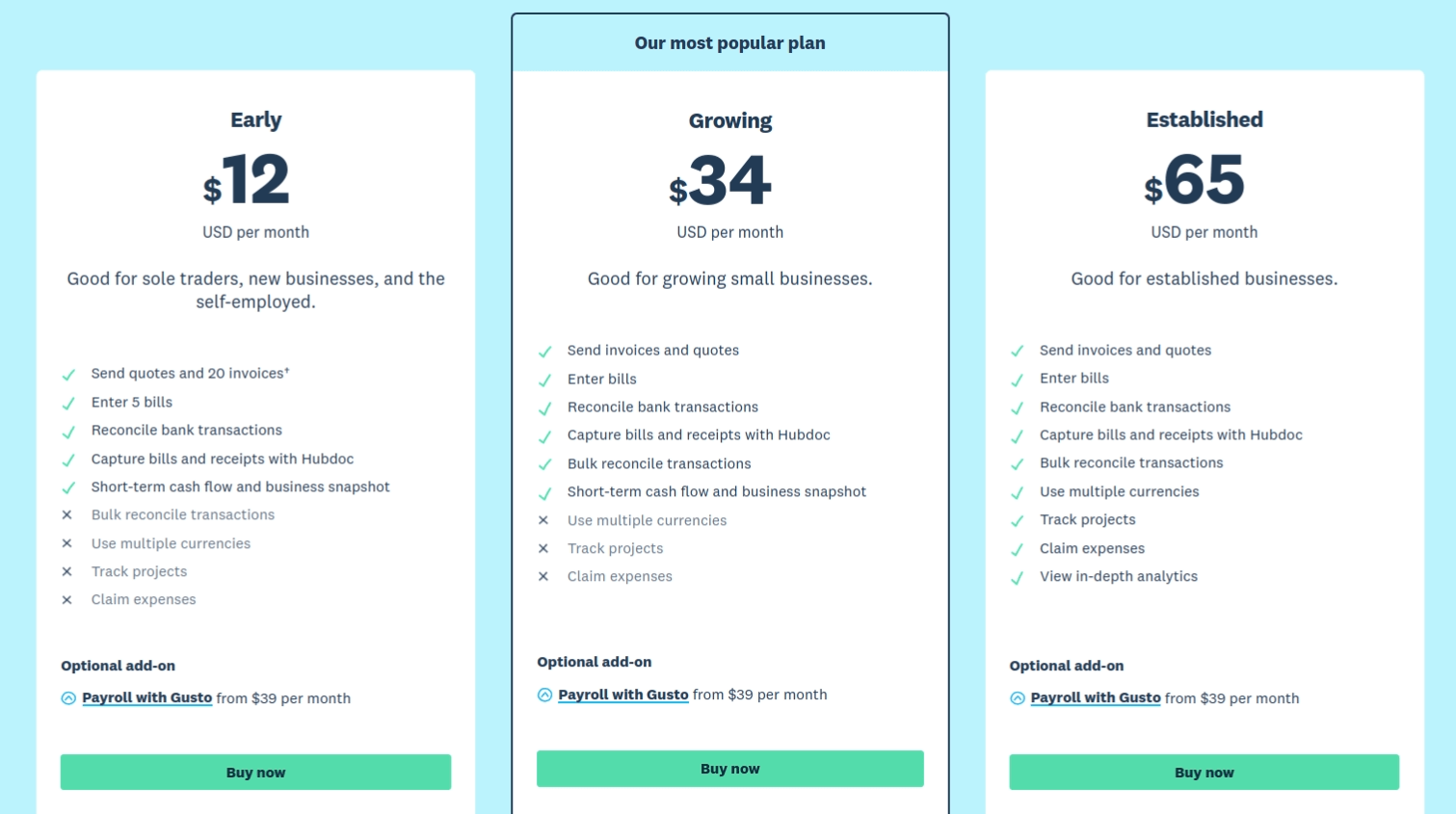

What Is the Price of Xero

Xero offers unlimited users and inventory management possibilities for each pricing plan. There is no annual subscription, so you can cancel your contract anytime. Before buying, you can test the software using a 30-days trial or check the demo.

Xero Pricing. Source: Xero

Let’s look at each plan more closely:

Early plan fits sole traders, starting businesses, and self-employed and includes:

- Quotes & 20 invoices

- 5 bills to enter

- Bank reconciliation

- Hubdoc to capture bills and receipts

- Short-term cash flow and business overview

Growing plan is designed for growing small businesses and provides:

- All Early plan features

- Bulk reconciliation of transactions

Established plan will be helpful for businesses having an established position. It offers:

- All Growing plan features

- Multicurrency support

- Project tracking

- Expenses claiming

- Detailed analytics

Xero Review: Pros & Cons of Accounting Software

Xero cloud-based software delivers comprehensive accounting capabilities for mid to large-sized businesses. Hence, it may appear too scalable for individual business owners. Check the correlation between Xero's benefits and drawbacks and reach the verdict yourself.

What Are the Advantages of Xero?

-

- Unlimited users

Xero offers unlimited users regardless of the subscription option. This is a great possibility accounting software providers rarely offer. In addition, you can set permissions for certain actions per user role. To ensure transparency, Xero shows you the full history of transactions and users' activities.

-

- Inventory management

Even if you use the Early plan, you can keep an eye on your stock and make adjustments on hand. To improve your inventory strategy, run sales reports and get a detailed real-time picture. Also, Xero nicely combines stock management with accounting. For instance, you can save information about items that buy or sell regularly and add it to invoices and quotes.

-

- Customizable financial reports

When it comes to Xero reports, you can improvise, build, and rearrange at full scale. Create a report from scratch or save it as a custom layout for repeatable use. Rearrange the columns, change groups of accounts, edit the schedules, and add your own formulas. As a result, you get an absolutely personalized diagnosis of your financial health.

-

- Project accounting

Xero successfully fills the gap between accounting and project management with multiple interrelated functions, such as invoicing, contacts, bills, and bank reconciliation. You can get an interactive report on the money and time spent on each job and manage your budget more efficiently.

What Are the Disadvantages of Xero?

-

- No phone support

If you have an issue with Xero, you need to describe it only in a text by email or chat. It may be more time-consuming and inconvenient than a real conversation via phone call.

-

- Limited features for non-profit businesses

The lowest plan includes only 20 invoices and 5 bills. Even a sole trader can find it too obstructing.

Xero Review of Add-ons and Customization Capabilities

Once you become a Xero user, you get access to more than 800 integrations to power up your accounting. And if you still need more, integrate Xero with Zapier and choose among hundreds of add-ons. Keep in mind that some add-ons are country-specific, so before installing one, make sure that it is available in your country. Also, Xero provides API to develop apps within the platform.

Is Xero Secure?

Xero’s security reaches an outstanding level. It provides multiple layers of data protection, including encryption, multi-factor authentication, access control, and unstoppable monitoring at different locations. Also, it performs daily data backups and regular auditing across multiple servers. On its official website, Xero claims to have 99,9% uptime and guarantees no disruption for your business activities.

What Are Xero Customer Service and Training Available?

Paying regard to Xero’s huge community of users, it is not that easy for the support team to respond to each and every request individually. Xero customer service has never offered assistance by phone and is available only by email. Nevertheless, there are multiple support options you can turn to in case of trouble, including email, live chat, help center, and numerous guides and training videos. In addition, Xero offers a range of online learning programs to get you onboard faster.

Xero Accounting Alternatives

To make this Xero accounting software review deeper and more versatile, we will compare Xero to other accounting tools. Regardless of all its benefits, it still may not meet the requirements of some users. We’ve gathered the most relevant Xero alternatives with similar functions and strong mobile apps.

Quickbooks Online

Currently, QuickBooks Online earned the appreciation of more than 2 million users, and not in vain. It is a handy app for small business owners that facilitates all-around accounting processes. You can send invoices, track sales taxes, manage unpaid bills, monitor inventory, and many more. Also, it provides live customer support via live chat and phone, while Xero support is available only by email.

FreshBooks

Besides multiple accounting features like customizable invoices, payment reminders, and multicurrency support, FreshBooks delivers enhanced time management. You can track team working hours and calculate time spent per client or project. FreshBooks reporting includes the general overview of all accounts and transactions, profit & loss calculations, invoicing history, and more. It is a good tool for freelancers and startups.

Kashoo

Kashoo lacks some features necessary for mid to large-sized businesses but provides a great accounting toolset for startups or individual entrepreneurs. You can use it to manage your payables and receivables, track profit and expenses, create a customer database, and that’s not it.

Zoho Books

Zoho Books makes another good alternative for small businesses. Besides its excellent customer service, it provides a full accounting package with online invoicing, bank reconciliation, inventory management, and automated workflows. On top of that, it offers an intuitive mobile app with basic accounting features.

Recap: Is Xero Good Accounting Software?

All in all, Xero cloud-based software can bring numerous benefits to business owners who need help with extensive accounting management, along with project accounting and administration. It is praised for its large feature selection, high-level security, and handy mobile apps.

If your business lacks a professional accountant to take care of these elements, you should try Xero software. Anyway, if this Xero accounting review is not enough for you, check the 30-days trial and test the tool yourself.

Frequently Asked Questions

Xero delivers multiple accounting tools to manage invoices, track cash flows, monitor projects & expenses, and run detailed reports.

Xero is designed to streamline accounting processes like creating and sending invoices, managing payables & receivables, keeping journals, and tracking all bank transactions.

Xero accounting software is highly-rated among business owners. It provides enhanced security measures and guarantees no disruptions during your financial operations.

Xero doesn’t offer a free plan, though you can use the 30-days trial version or check a demo.

Xero is relatively easy to use, but not for everyone. If you are confused about some features, contact Xero support or take advantage of numerous training articles and videos.

Xero got three price tags that vary in functionality: Early plan is $12/mo Growing plan is $34/mo Established plan is $65/mo

Xero is collaborating with Hubspot which ensures a prominent customer experience.

If you are a startup and need basic accounting tools, consider QuickBooks Online and FreshBooks.

Compared to QuickBooks, Xero looks more modern and is easier to use for many users.

Top Xero alternatives include QuickBooks Online, FreshBooks, Kashoo, and Zoho Books.

Have already chosen your accounting platform?

Leave the accounting records migration to us!