Choosing the right accounting software for your small business can be challenging. With options like QuickBooks vs Kashoo, the decision becomes even tougher. Both platforms are highly regarded and tailored to meet the needs of small businesses. So, how do you determine which one is the best fit for your organization?

In this blog post, we'll dive into a detailed comparison of Kashoo vs QuickBooks Online, evaluating their features, cost-effectiveness, and customer reviews. By the end of this article, you'll have the insights you need to confidently select the accounting solution that aligns perfectly with your unique business requirements. Let's get started!

A Sneakpeak at QuickBooks Online

QuickBooks Online is like a superstar in the world of small business accounting apps. It's well-known and trusted by many accountants around the globe. What sets it apart is its convenient access from anywhere, anytime—something the older desktop version lacked.

So, if you're running a small or growing business, QuickBooks Online is a solid choice. The best part? It seamlessly integrates with hundreds of third-party apps, making it suitable for all kinds of businesses.

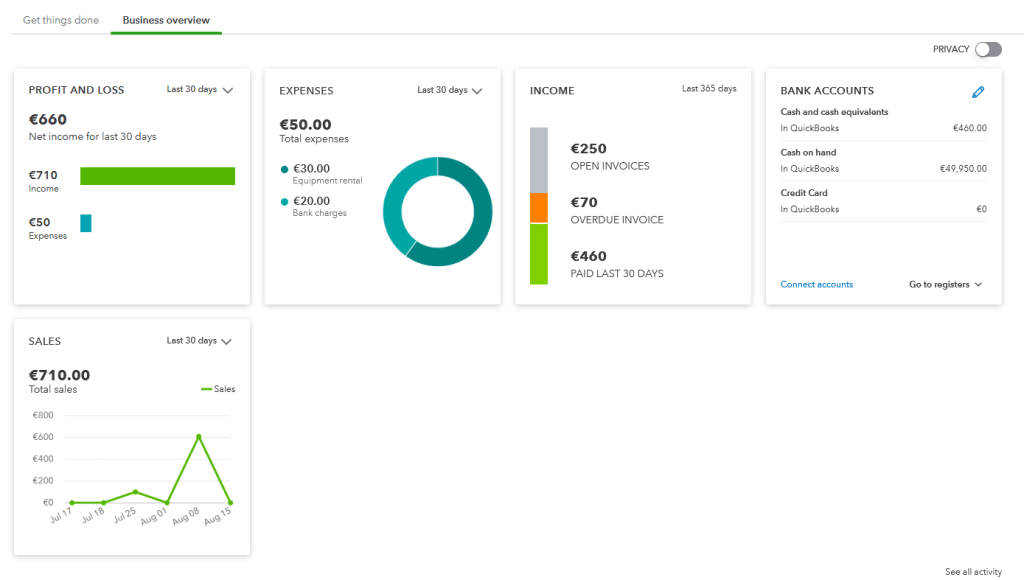

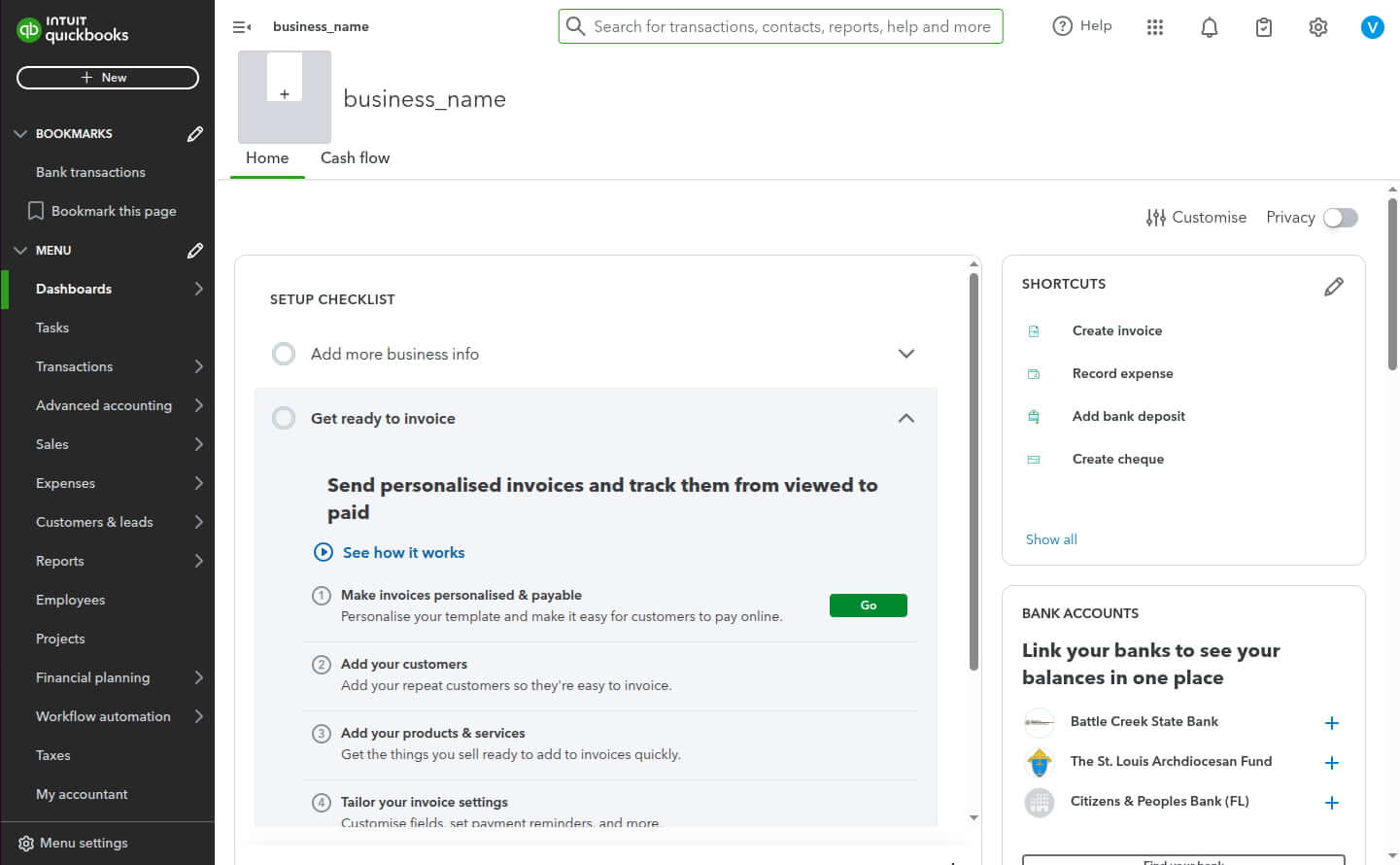

An example of QuickBooks Online dashboard. Source: QuickBooks Online

Kashoo Review in a Nutshell

Kashoo is designed to cater to a wide range of users, from consultants and sole proprietors to small businesses. It offers a solid foundation of bookkeeping basics and has expanded its features to provide a complete accounting solution. Whether you're a consultant needing efficient invoicing or a small business looking for comprehensive accounting capabilities, Kashoo Cloud Accounting has you covered.

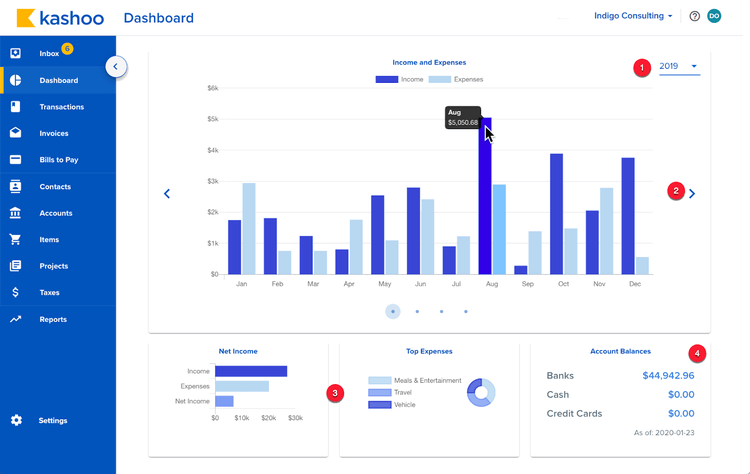

An example of Kashoo dashboard. Source: Kashoo

Checking out QuickBooks Online Core Features

When it comes to QuickBooks Online, the features differ based on the plan you choose. The pricier plans tend to have more advanced functionality, while the basic ones have a more limited set.

No matter your plan, you'll enjoy online banking connectivity, which now even supports third-party payment processors like PayPal and Square. Plus, there's a handy receipt capture feature for hassle-free expense reporting and solid expense management functionality.

Dashboard

Setting up your company and personalizing QuickBooks Online is quick and easy. You can configure various options from the Accounts and Settings page like company information, billing, sales transactions, expenses, and advanced settings to match your specific needs.

QuickBooks Online offers two viewing options: Business view and Accountant view. You can switch between them anytime without affecting your accounts or data.

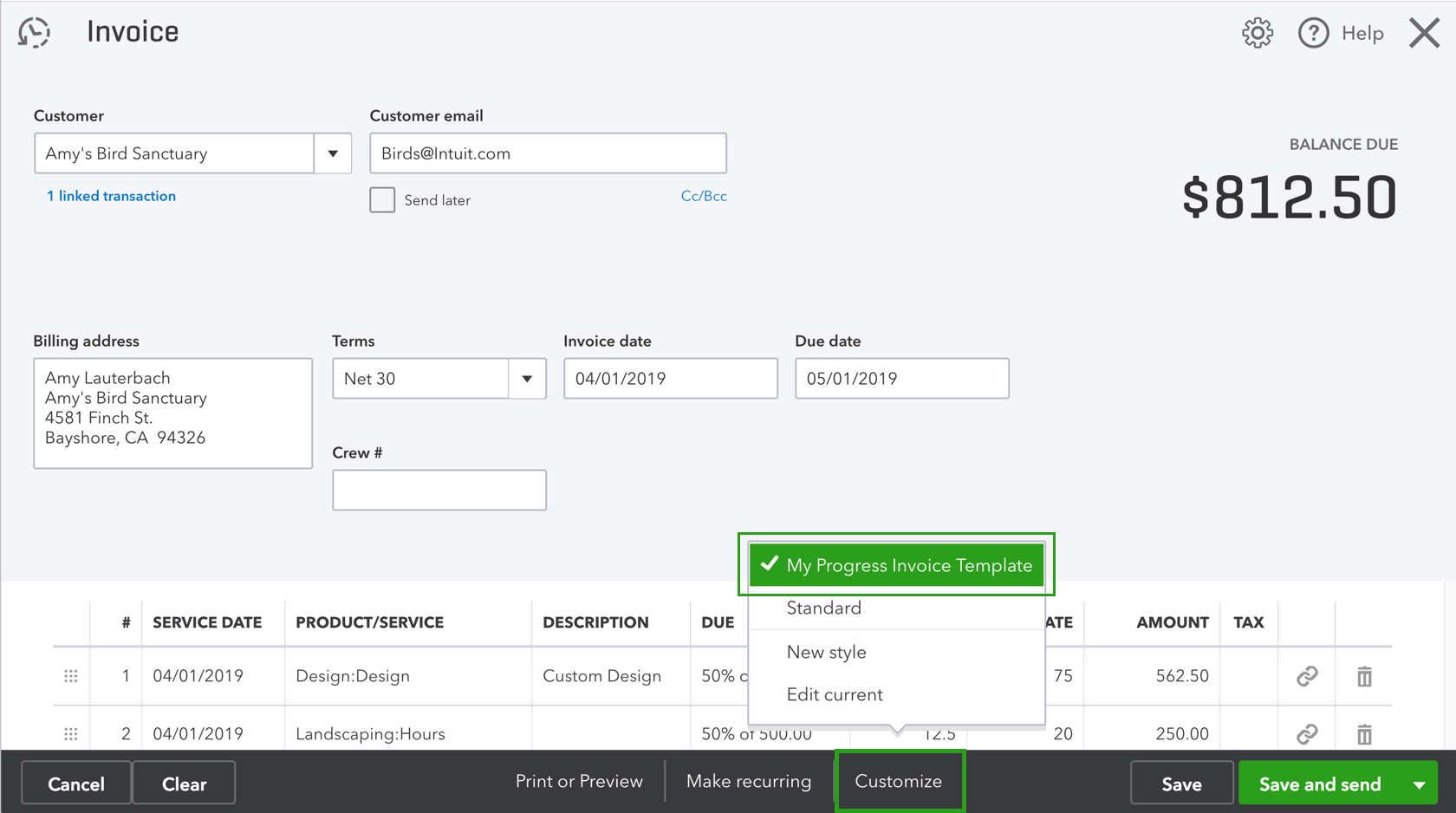

Invoicing

QuickBooks Online offers a seamless invoicing experience that brings a touch of personalization to your business. Choose from a range of templates, add your logo, and customize colors to match your brand. With the ability to set up recurring invoices, you can save time and automate your invoicing process. Whether you prefer to print and mail invoices or send them via email, QuickBooks Online provides the flexibility you need.

An invoice in QuickBooks Online. Source: QuickBooks

Bank reconciliation

Simplify bank reconciliation with QuickBooks Online. This accounting system takes the sting out of this chore by pulling in your bank statements and transactions, making it easier than ever to reconcile your accounts.

But why stop there? You can take proactive steps to make reconciliation even smoother. When new transactions appear in your account registers, QuickBooks Online allows you to verify and add them, find matching transactions in your records, or record them as transfers.

Income & expense tracking

Automatically bring in transactions from your bank, credit cards, PayPal, Square, and other sources effortlessly. Expenses are intelligently sorted into tax categories, and you have the freedom to accept or modify them as needed. We adapt and learn from your preferences as you interact with the system. You have full control and can establish rules to customize how expenses are categorized, putting you firmly in charge.

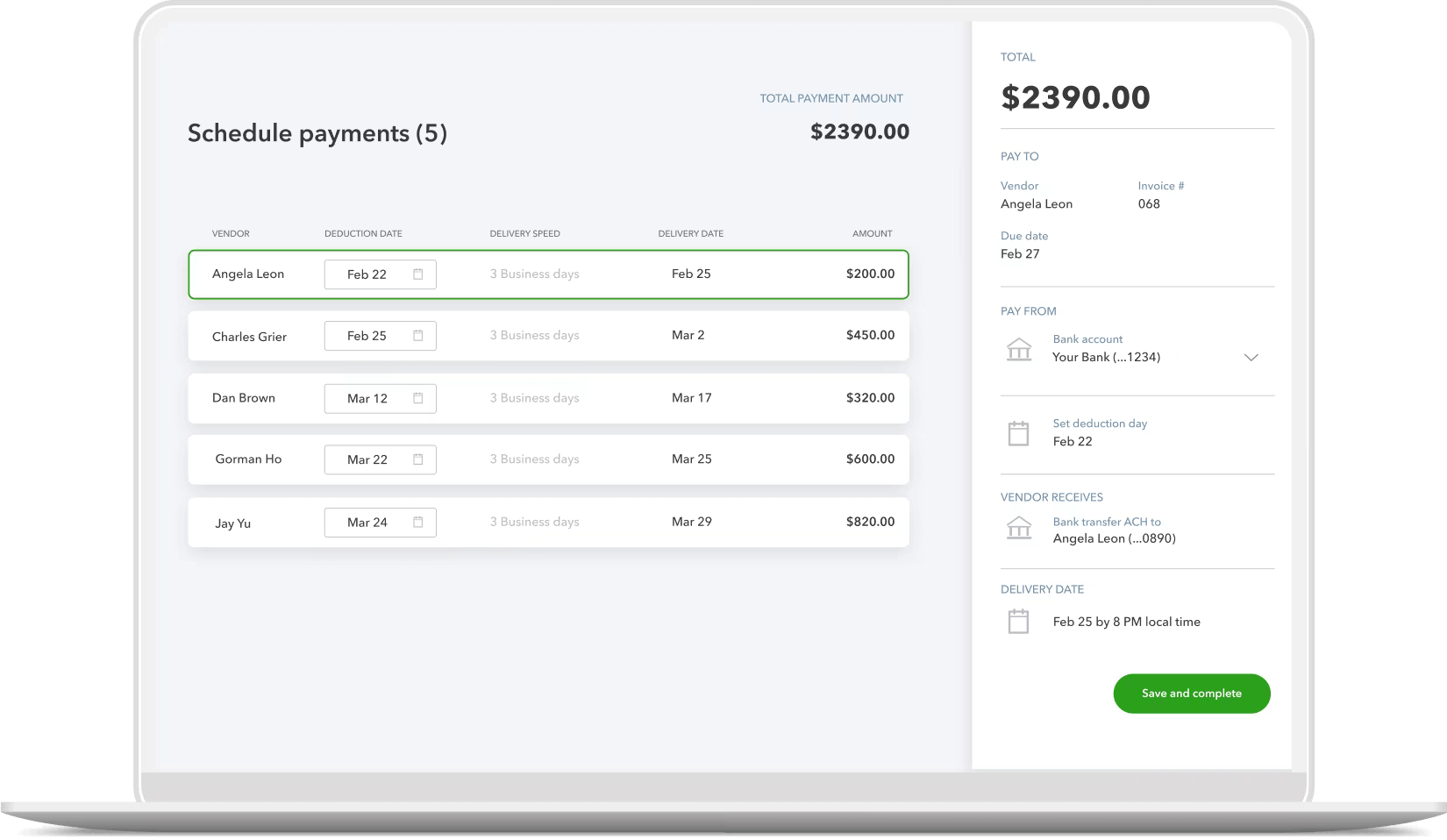

Manage and pay bills

Efficiently track unpaid bills and easily record expenses without payment. Attach receipts, create recurring transactions, track inventory items, and even print checks right from the dashboard's + New button.

Simplify bill management with QuickBooks Online's user-friendly interface and enjoy seamless expense tracking. Get started by entering a new bill through the intuitive Enter Bill screen.

Managing payments in QuickBooks Online. Source: QuickBooks Online

User access

In QuickBooks Online, you have control over user roles and access. You can assign specific tasks and limit what users can see and do in different areas of QuickBooks. User roles can be customized and categorized as billable or non-billable. Billable users count toward your user limit, while non-billable users don't. You can also invite your accountant as a firm user to review your QuickBooks company file.

Left navigation in QuickBooks Online. Source: QuickBooks Online

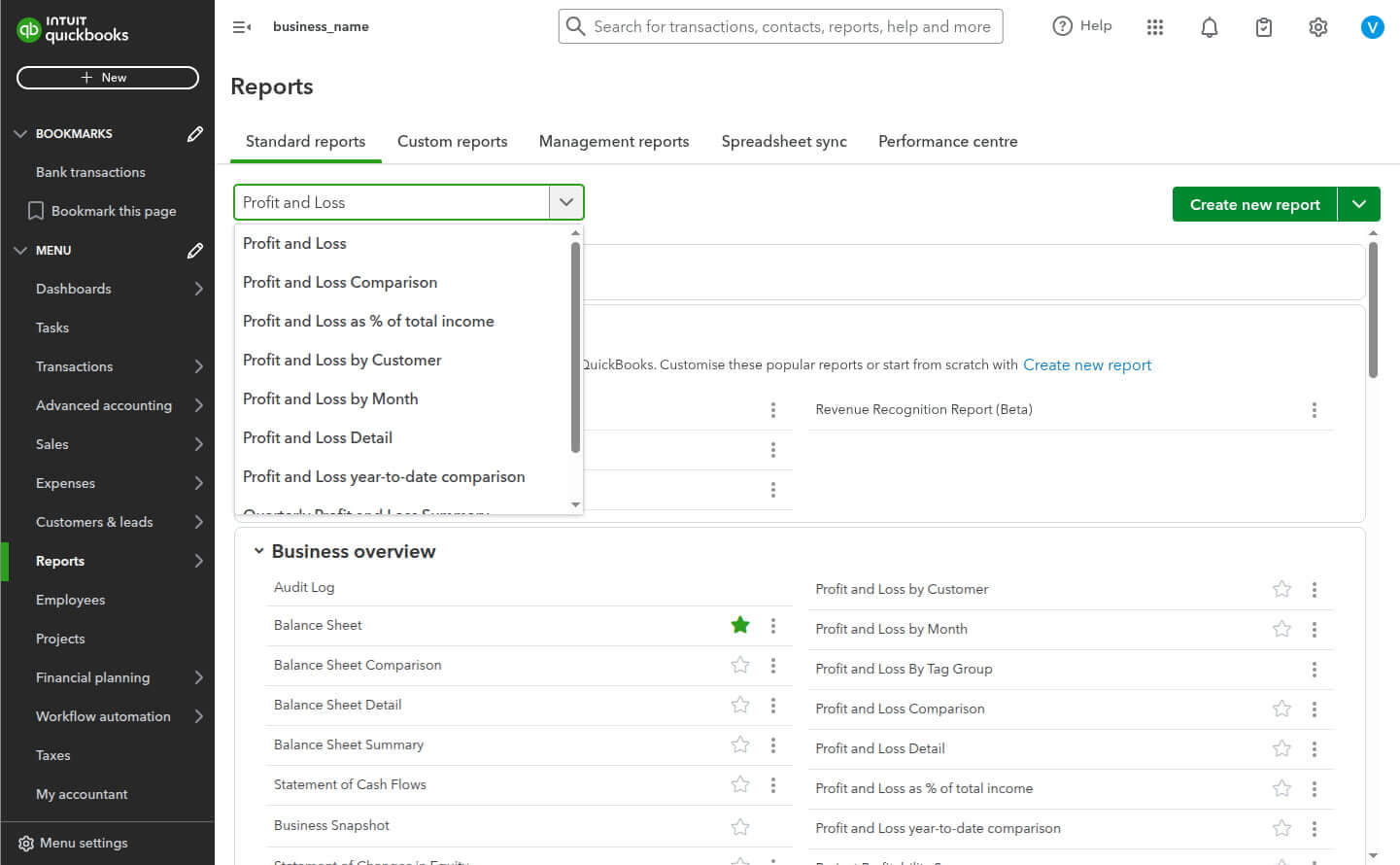

Reporting

With QuickBooks Online, you can access over 100 reports (depending on your subscription), enabling you to track and analyze your business data effectively. QuickBooks Online has covered everything from essential reports like balance sheets, P&L statements, and cash flow statements to detailed sales reports categorized by customer, location, or class.

Run a report in QuickBooks Online. Source: QuickBooks

Time and mileage tracking

With QuickBooks Online, you effortlessly track your mileage and calculate tax deductions. Using the convenient mobile app, you can effortlessly enter your trip's starting and ending addresses. QuickBooks Online takes care of the rest, automatically calculating the miles driven and the corresponding mileage deduction. Alternatively, if you prefer, you can manually input the number of miles driven for accurate tracking.

But wait, there's more! QuickBooks Online's mobile app goes the extra mile by offering an auto-tracking feature. Simply enable your mobile device's location services, and your mileage will be automatically recorded.

Besides, you get QuickBooks Time (formerly TSheets), a robust time-tracking application. It offers advanced individual activity time-tracking, employee time clocks, and shift scheduling. With QuickBooks Time, you can easily track and manage your team's time, ensuring accurate and efficient time management for your business.

Inventory management

Exclusively available in QuickBooks Online Plus and Advanced plans, this feature enables you to effortlessly track stock items and automate inventory updates. It also allows you to categorize items based on tax status, generate purchase orders, and receive alerts for timely restocking. With QuickBooks Online, managing your inventory becomes a breeze!

Editing an existing product in QuickBooks Online. Source: QuickBooks Online

Security

Intuit places a strong emphasis on security and has implemented multiple measures to ensure the protection of data. These measures include:

- rigorous testing of the routing

- utilization of a robust 128-bit SSL

- data security protocol

- implementation of a strict multifactor authentication process

- the establishment of multiple physical safeguards at the data center

What to Expect from Kashoo Functionality?

With its user-friendly interface and powerful tools, Kashoo makes bookkeeping and accounting a breeze. From easy invoicing and expense tracking to comprehensive financial reporting and seamless bank reconciliation, Kashoo has everything you need to stay on top of your finances.

Dashboard

Kashoo keeps you informed about your business's financial health with up-to-date insights. The dashboard is continuously updated in real-time, displaying crucial details like:

- income

- expenses

- net income

- cash deposits

- withdrawals

- overall net cash totals

It encompasses all transactions recorded in your general ledger, including those from connected accounts and any journal entries made within the app. Plus, you'll find informative graphs and charts right on the dashboard.

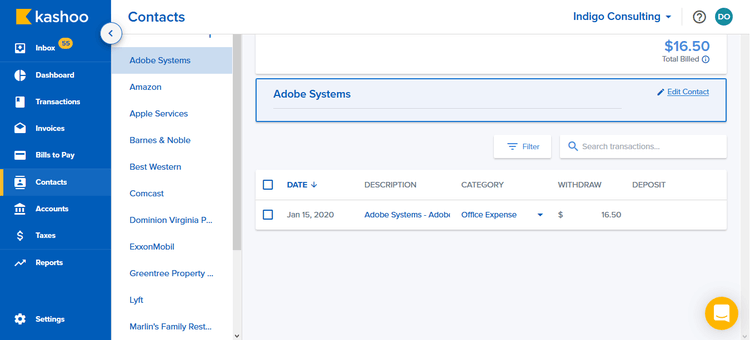

Contacts in Kashoo. Source: Kashoo

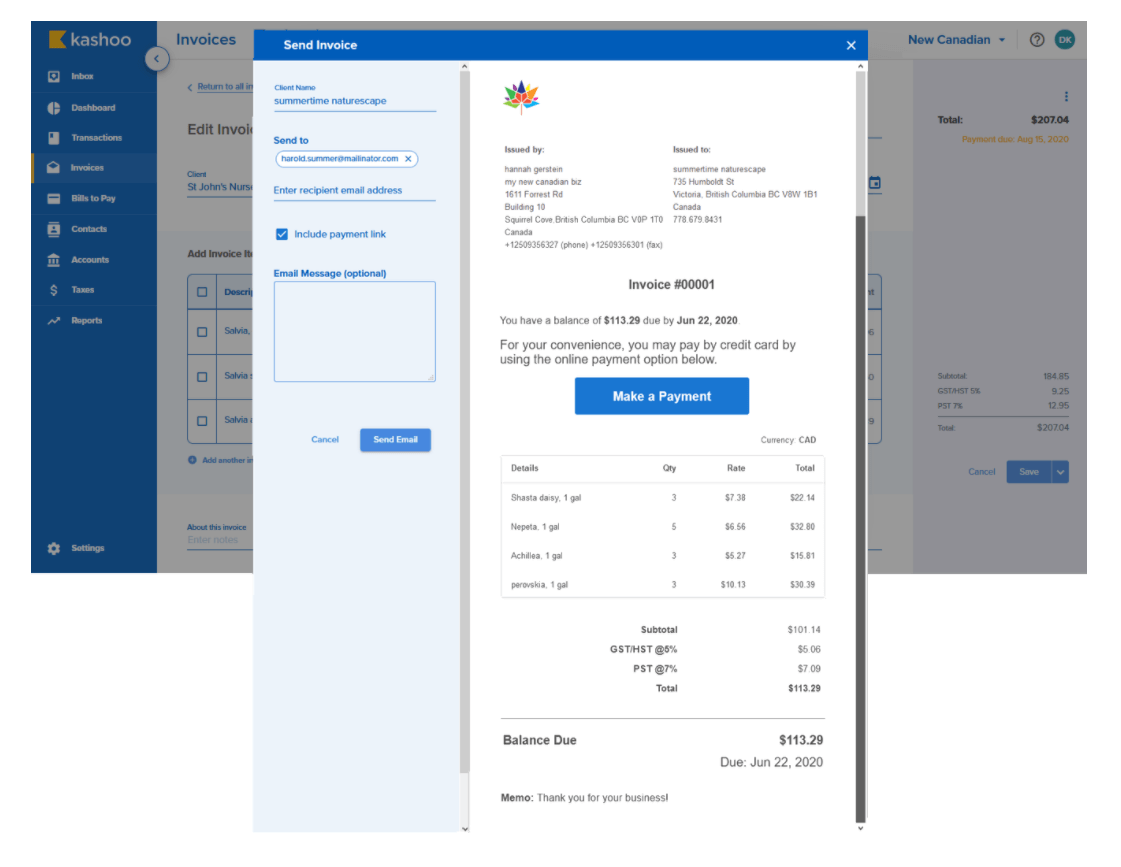

Invoicing

In Kashoo, invoicing is a breeze, taking less than a minute to complete. You can enter all client and item details on the spot if needed. Once the invoice is entered, the Save tab offers various options. You can save the current invoice and create a new one, save and exit, preview and send, view before sending, or make a duplicate.

To conveniently accept credit card payments, simply check the include payment link box. You can enable the credit card option during setup, but don't worry—you can still print and mail invoices if preferred.

Build an invoice with Kashoo. Source: Kashoo

Bank reconciliation

Kashoo's got your back with full bank reconciliation, simplifying the process of crunching those end-of-quarter or annual financial figures. Stay on top of your game with ease.

Income & expense tracking

Kashoo Cloud Accounting simplifies recording income and expenses, ensuring your transactions are categorized and sorted for tax purposes. Easily input the necessary details and numbers to clearly understand your business's financial health.

To top it all off, you can capture and attach digital receipts directly to expenses, making receipt management a breeze. It even supports multiple currencies for international businesses. And all your reviewed transactions are conveniently listed in the "Transactions" section, providing a centralized hub for monitoring your financial activities.

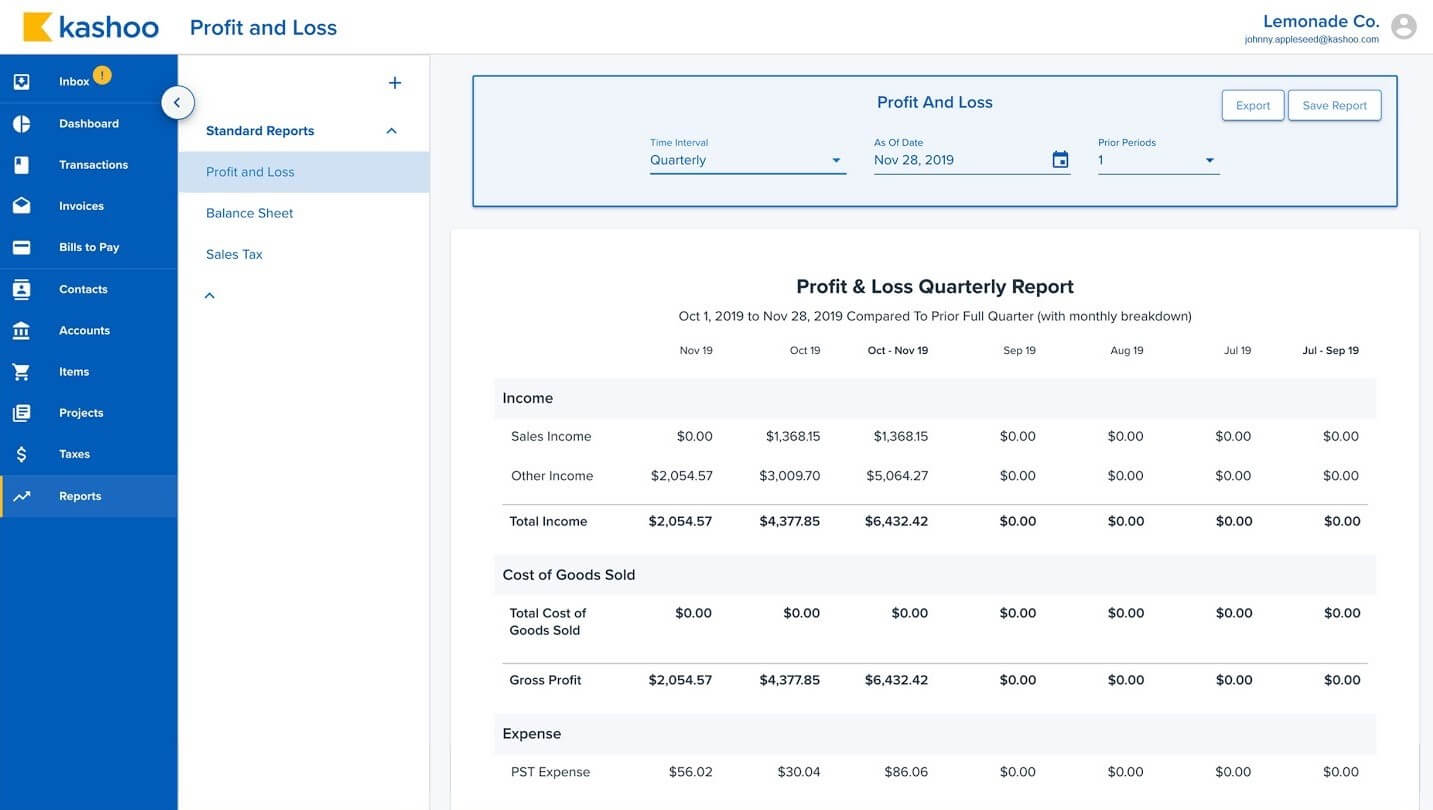

Tracking profit & loss in Kashoo. Source: Kashoo

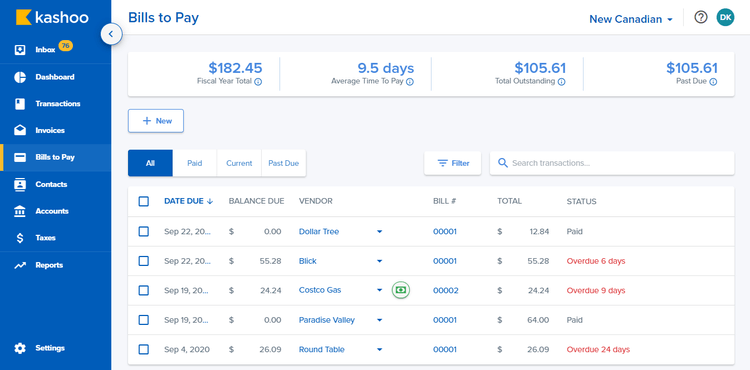

Bills to Pay

Simplify vendor bill management with the Bills to Pay feature. The top of the screen provides a concise summary, including total bill amounts for the year, average payment duration, outstanding amount owed, and overdue bills.

Adding new bills is straightforward within the Bills to Pay feature. Simply click on the New tab and attach any necessary invoices or documents to the bill. While there isn't a direct bill payment option, manual payments can be entered in this section.

Set up Bills to Pay for Kashoo. Source: Kashoo

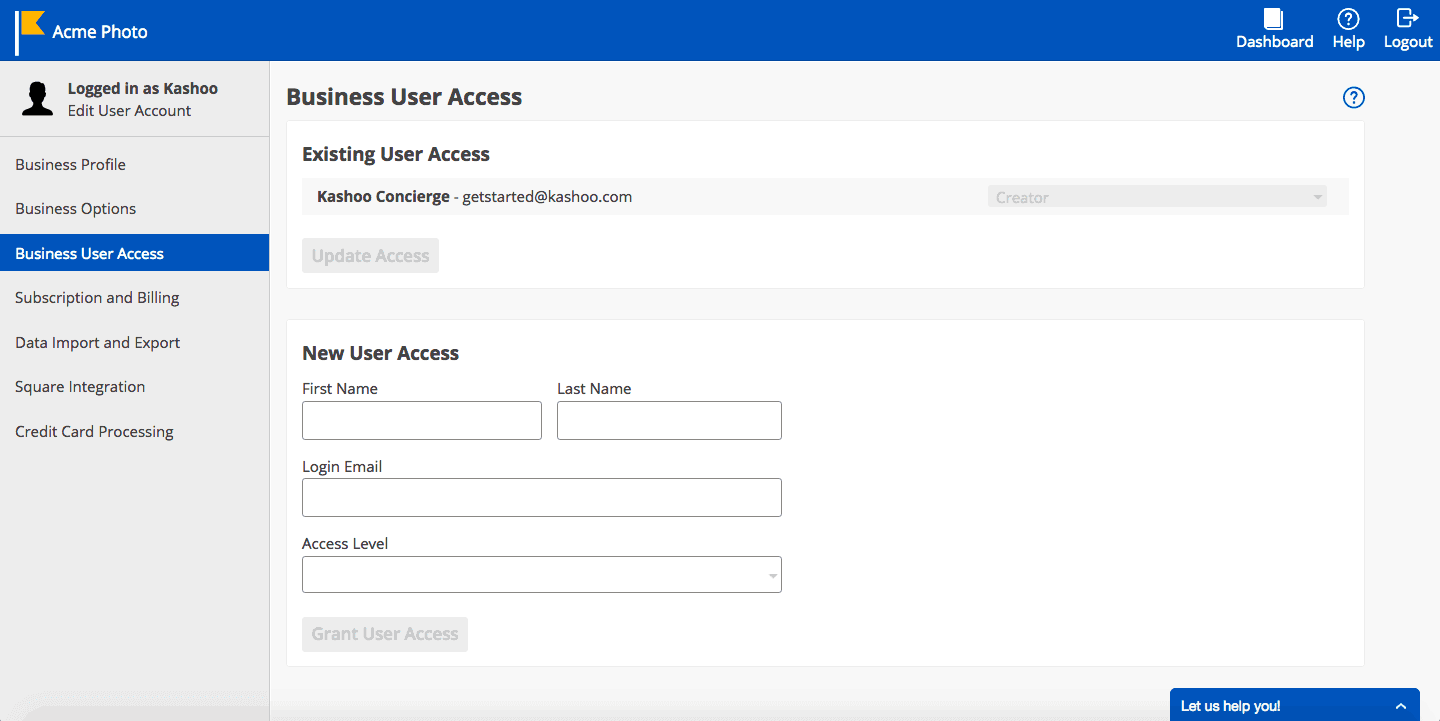

User access

Kashoo offers an incredible advantage - the ability to add unlimited users to your account. With four distinct user roles, you can fine-tune each individual's access levels and permissions. Whether admin and billing, admin, view/edit only, or view only, you have complete control over who can do what in your Kashoo business.

Business user access in Kashoo. Source: Kashoo

Reporting

Kashoo's report options are limited, offering only eight reports to choose from:

- Income statement

- Unpaid invoices

- Unpaid bills

- Trial balance

- Balance sheet

- General ledger

- All transactions

- History

While Kashoo provides essential financial statements, the availability of sales reports would enhance its reporting capabilities. Report customization options are limited, but if you require more flexibility, you can export them to Excel for further customization.

Time and mileage tracking

Advanced features like time and mileage tracking are unavailable within the Kashoo platform. However, don't fret! You can explore the option of integrating third-party tools to add these functionalities to your Kashoo experience.

Inventory management

Kashoo Cloud Accounting doesn't offer traditional inventory management, but you can still add items for sales and purchases. Associate them with income or expense accounts, though no inventory or stock tracking is provided.

Security

Rest assured with Kashoo's security measures: unauthorized access is a no-go, data availability is guaranteed, and you have the freedom to export your data. Their servers are fortified digitally, physically, and meticulously monitored with backups. And if you prefer having your backup files, effortlessly export your data to Excel whenever possible.

QuickBooks Online vs Kashoo: Pricing Overview

Whether you're a startup looking for basic functionality or a growing business needing advanced features, the price for cloud accounting software still matters. Let's explore the pricing details of Kashoo vs QuickBooks Online to find the best fit for your financial needs.

How Much Does QuickBooks Online Cost?

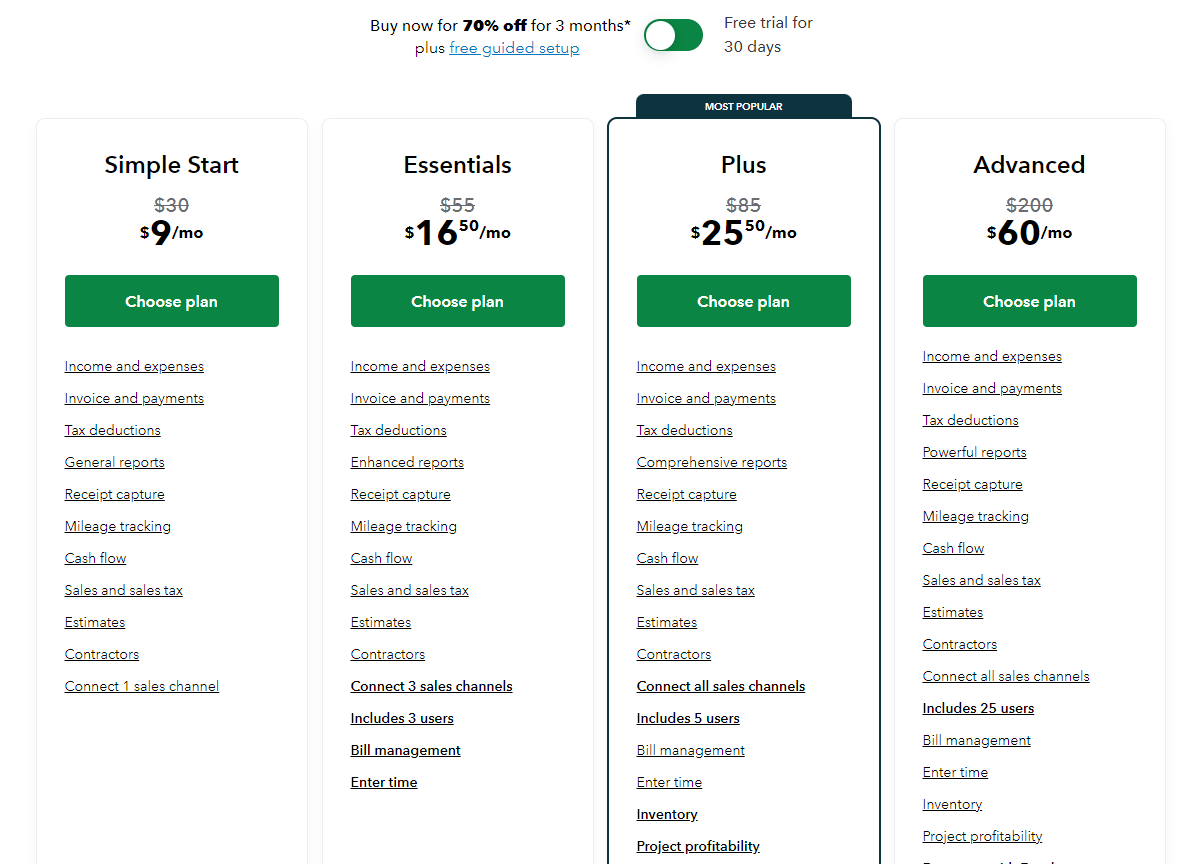

QuickBooks Online's pricing can be a bit tricky to navigate, as it offers promotional discounts for the first three months. The Simple Start plan, suitable for a single user, starts at $9 per month, but the price increases to $30 per month after the initial three months.

Another option is the Essential plan, which supports up to three users and initially costs $16.50 per month, later increasing to $55 per month. The Plus plan, designed for five users, has an introductory price of $25.50 per month for the first three months, which then doubles to $85 per month. Finally, the Advanced plan, capable of handling up to 25 users, starts at $60 per month and rises to $200 monthly after the initial three months.

QuickBooks Online pricing structure. Source: QuickBooks Online

How Much to Pay for Kashoo?

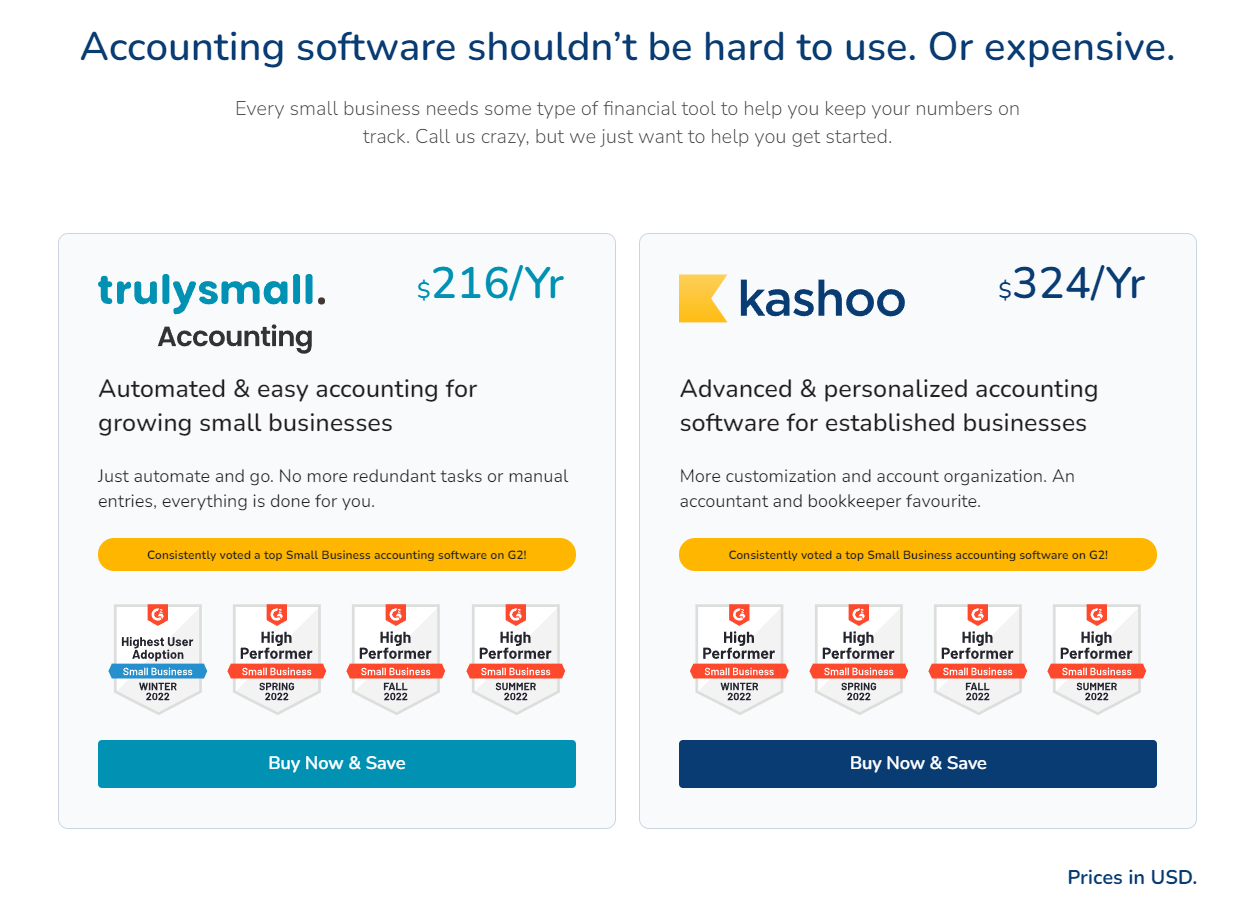

Unlike its competitors, Kashoo has made exciting changes to its plans, making it easier for you to choose the right fit. They now offer a plan focused on invoicing, one for small businesses, and a comprehensive accounting plan.

The Truly Small Invoices plan lets you get started at no cost, while the Truly Small Accounting plan is priced at $216/year. And if you need advanced features like detailed reports, multi-user access, and payroll, the Kashoo Accounting plan is available for $324/year. So, you have options that suit your specific needs and budget.

Kashoo pricing structure. Source: Kashoo

Comparing Kashoo vs QuickBooks Online Pricing

In the realm of subscription packages, QuickBooks and Kashoo offer different options to suit your needs. Kashoo provides a comprehensive package encompassing all the features you need, while QuickBooks provides four packages for added flexibility and scalability. Here's a visual breakdown to help you grasp the key packaging details:

Kashoo | QuickBooks Online |

Price:

| Price:

* without promotional discounts |

| Kashoo offers a risk-free 14-day trial, allowing you to explore their complete platform. | You can enjoy a 70% discount on your subscription for the initial 3 months. Or go for a 30-day free trial. |

| You get all the basic features in one package but you can’t upgrade to a more advanced plan. | QuickBooks' pricing is based on the number of features you require. While basic features like income and expense tracking, tax assistance, and estimates are included, more advanced features are available in their higher-tiered packages. |

Table 1. Comparing QuickBooks vs Kashoo pricing

To sum up, Kashoo is an excellent choice for startups, covering the basics. However, if you anticipate a higher volume of transactions and more advanced functionalities, QuickBooks may be a better fit.

Deciding between QuickBooks Online vs Kashoo: Pros & Cons

Still wondering which accounting software to choose between Kashoo vs QuickBooks Online? It's time to weigh the pros and cons of each platform to make an informed decision.

QuickBooks Online’s Strong and Weak Sides

You might ask: “Why choose QuickBooks Online?” Its user-friendly interface, robust invoicing features, and scalability make it a compelling option. However, it's important to weigh the pros and cons before making a decision.

Advantages

Wide range of features for comprehensive accounting needs

Robust reporting capabilities for in-depth financial analysis

Seamless integration with numerous third-party applications

Automated invoicing and payment processing features

Extensive customization options for tailored accounting workflows

Disadvantages

Higher pricing tiers may be costly for small businesses

Limited inventory management capabilities compared to specialized solutions

Steeper learning curve due to the extensive feature set

Advantages and Disadvantages of Kashoo

Let's dive into the advantages and drawbacks of using Kashoo for your accounting needs. Here's what you need to know:

Benefits

Comprehensive package for consultants and small businesses

Startup-friendly with a 14-day risk-free trial

Live support options included

Robust expense management and receipt capture features

Good invoicing capabilities with customizable templates

Drawbacks

Limited scalability for high transaction volumes

Limited integrations with third-party apps

Some users report issues with customer support

Limited advanced reporting options compared to accounting programs like QuickBooks

Who Uses QuickBooks Online vs Kashoo?

Both QuickBooks Online and Kashoo attract a diverse range of businesses and professionals. Let’s review this in more detail.

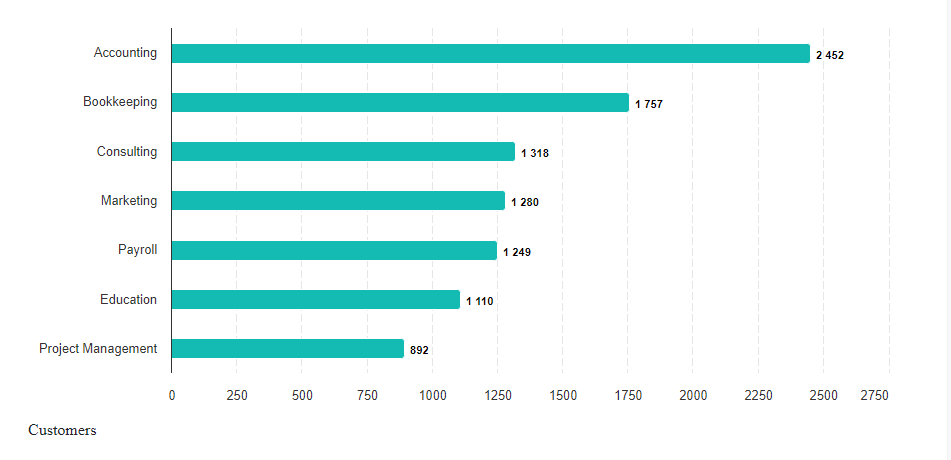

QuickBooks Online finds extensive usage across various industries, including Accounting, Bookkeeping, and Consulting. In terms of global usage, QuickBooks is popular worldwide, with a large customer base in the United States, followed by Canada and the United Kingdom. Plus, the invoicing software holds a significant market share of 84.52% in the small-business accounting market, competing with 61 other tools.

QuickBooks Online customers by industry. Source: 6sense

On the other hand, Kashoo is popular among businesses for budgeting and forecasting in industries like Bookkeeping, Management Consulting, and Payroll. The top geographies using Kashoo for budgeting are the United States (47.37% of customers), Canada (15.79% of customers), and the United Kingdom (10.53% of customers).

How to Migrate Data to QuickBooks Online or Kashoo?

In Kashoo, you can import your Trial Balance, customer and vendor lists, Uncleared Checks, Unpaid Customer Invoices, and Vendor Bills. On the other hand, QuickBooks offers an importer tool that supports transferring all your data in XML format.

Alternatively, you can choose a third-party migration service. Importing data to QuickBooks Online or Kashoo is made effortless with the Migration Wizard. Simply select what accounting data you want to move and configure your Free Demo. The Migration Wizard will guide you through data import to the new accounting software. Once the migration is complete, you can review and validate your data to ensure a smooth transition.

What Accounting System to Choose: Kashoo vs QuickBooks?

Kashoo and QuickBooks Online offer unique benefits for your business finances. Kashoo is user-friendly, and ideal for small businesses and freelancers, while QuickBooks Online provides advanced features for all business sizes.

Evaluate your specific needs and growth goals to select the perfect accounting tool. Then use the Migration Wizard to effortlessly switch to your preferred platform for seamless accounting. Get ready to level up your financial management!

Frequently Asked Questions

FreshBooks stands out as a top QuickBooks alternative thanks to its user-friendly interface designed with simplicity in mind. As a business owner, you'll appreciate the intuitive nature of FreshBooks, free from complicated accounting jargon. Plus, FreshBooks offers the flexibility you need, with no restrictions on the number of invoices you can send, making even the low-tier plan a practical and cost-effective choice.

With Kashoo, you can effortlessly enable credit card payments on every invoice, providing a seamless payment experience for your customers. This accounting software allows you to efficiently manage your clients, and suppliers and track the items or services you offer.

QuickBooks Online is the ultimate industry leader in accounting software, trusted by over 5 million users worldwide. With its extensive range of add-ons and powerful features, QuickBooks Online has become an essential tool for businesses in their day-to-day operations.

The top industries that use QuickBooks for Small Business Accounting are Accounting, Bookkeeping, and Consulting. These industries rely on QuickBooks to manage their financials efficiently.

QuickBooks Desktop and QuickBooks Online differ in their installation and accessibility. Desktop is installed locally, while QBO is cloud-based with no downloads needed. They also vary in pricing, features, and learning curve. The desktop can be more complex, while QBO offers a user-friendly experience.

QuickBooks Online is praised as user-friendly and comprehensive accounting software for small businesses. Its cloud-based platform, extensive features, and customer support make it a popular choice among entrepreneurs.

Kashoo offers a free invoicing plan, but to access additional accounting features, you'll need to subscribe to one of their two paid plans.

Have already chosen your accounting platform?

Leave the accounting records migration to us!