Efficient and accurate accounting is essential for any small business, but it can often be time-consuming and overwhelming. In fact, managing financial tasks such as cash flow, tax filing, and reporting can easily become a hassle. To avoid this, it's crucial to simplify your accounting processes and focus on what truly matters.

8 Tips to Simplify Accounting with Automation

Evidently, manual tasks complicate accounting and limit its accuracy, velocity, and security. This challenge makes businesses look beyond spreadsheet accounting and use efficient and secure billing tools to eliminate manual processes from their workflows. Thus, cloud accounting software has become a trivial business instrument to automate such accounting tasks as data entry, payroll, invoicing, and financial reporting. While work is getting done, your accounting data is safe from fraud and leakage.

Let’s go through the benefits of cloud accounting software for small business accounting to figure out whether it is really indispensable. Here are some ways in which bookkeeper software helps effectively manage your finances:

- Automate manual tasks: To eliminate errors, enhance accuracy, and increase security, consider using cloud accounting software. These tools help automate data entry, payroll, invoicing, and financial reporting, thus reducing the need for manual processes.

- Streamline invoicing and billing: Take advantage of automation and templates to simplify your billing processes. This saves time and ensures consistency and accuracy.

- Automate routine accounting tasks: Automating tedious and repetitive accounting tasks such as data entry and reconciliation saves time and reduces bookkeeping mistakes.

- Gain real-time financial insights: Cloud accounting software provides up-to-date financial data, allowing you to make informed decisions about your business.

Track business expenses and revenue: It's crucial to keep track of all business expenses and revenue. Accounting software makes this task simple and efficient. - Facilitate tax compliance: Generating reports and organizing financial records makes tax filing a breeze.

- Integrate with other business software: Integrating accounting software with other business tools creates a seamless workflow and saves time.

Enhance team collaboration: Accounting software enables shared access to financial data, making it easy for teams to collaborate effectively.

From Chaos to Clarity: Simplify Your Accounting with Organized Record-Keeping

Establishing a smart bookkeeping system is critical for any business, but it can be a daunting task. Fortunately, following a few essential rules can simplify the process and help you stay on top of your finances. Here are some key practices to keep in mind:

| Practice | Description |

| Keep a separate business bank account. | Separate business and personal funds to avoid confusion and legal/tax issues. |

| Maintain detailed journal entries. | Track all financial transactions to enable double-entry bookkeeping and monitor business finances. |

| Categorize records. | Organize invoices and receipts to efficiently manage payables and receivables. |

| Use billing and invoicing software. | Automate accounting tasks such as invoicing to save time and reduce errors. |

By following these essential practices, businesses can establish a smart bookkeeping system that simplifies the process and helps them stay on top of their finances. Accurate recording and reporting of financial transactions enables informed decision-making and ensures compliance with regulatory requirements. Additionally, maintaining well-organized records can reduce the stress and cost of accounting audits.

Master Your Money: How Tracking Expenses Can Simplify Your Accounting

Managing business expenses is crucial for effective cash flow management. Tracking your daily expenses helps you evaluate your financial health and refine your budget strategy. However, managing and storing paper receipts can be tedious and time-consuming. This is where automation can make a significant difference. By using an accounting system, you can automatically track and categorize your business expenses, giving you a clear picture of where your money is going. You can easily upload expense receipts, and the system will scan and record the information for you, eliminating the need for paper receipts.

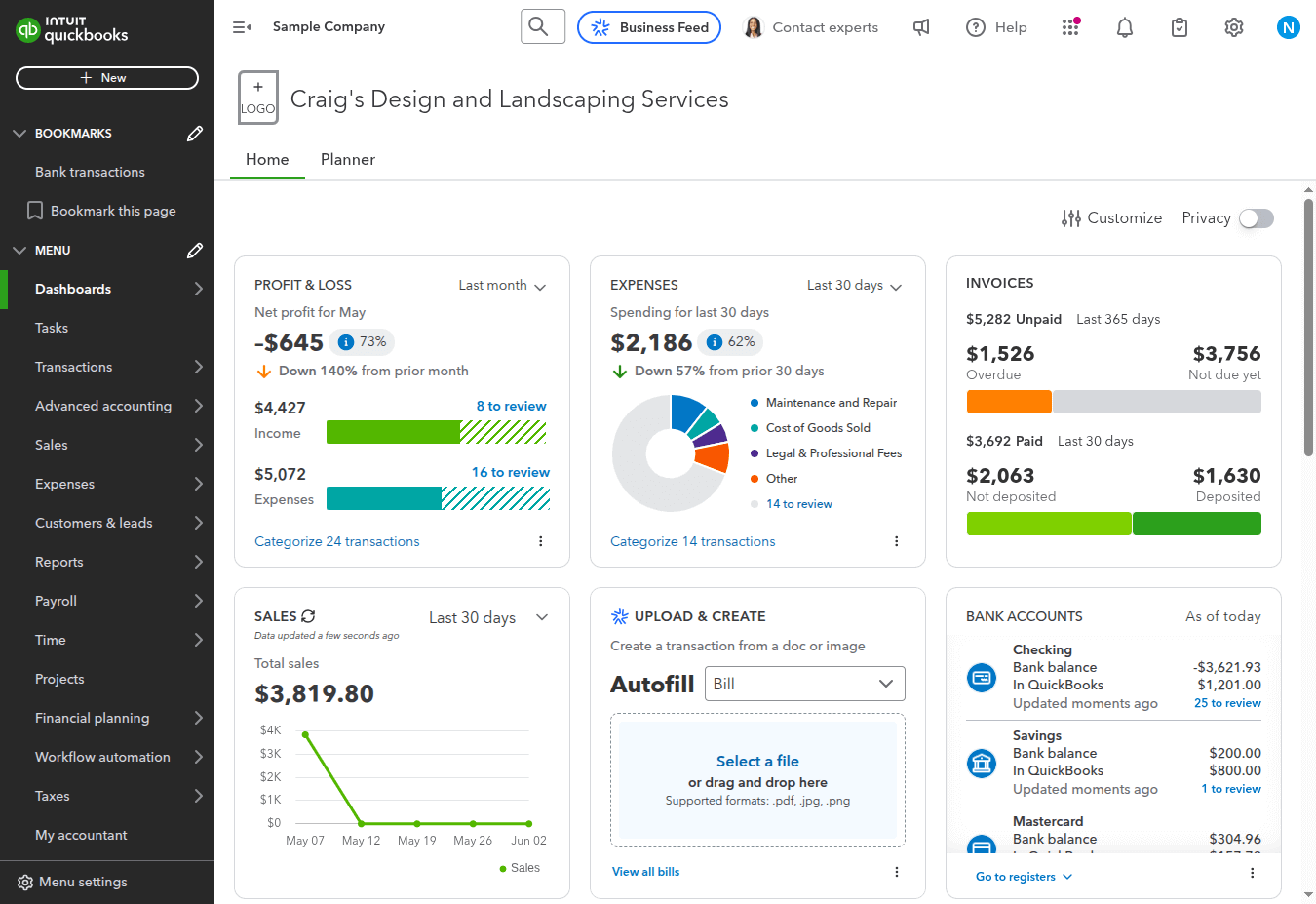

Generating expense reports is essential for resource management and enables you to accurately forecast your future business expenses. It's crucial to generate financial statements such as balance sheets, profit and loss, and cash flow statements to assess the health of your business. Online accounting software can be a valuable tool for generating these reports. In addition to these vital accounting reports, the software also provides custom reports and financial dashboards, displaying charts with your cash flow, business performance, and the total count of your payables and receivables. With these features, you can effectively manage your expenses and make informed decisions about your business finances.

Source: QuickBooks Online

Why a Separate Business Bank Account Is a Must-Have

Effective financial management is essential for the success of any business. One crucial aspect of this is keeping personal and business bank accounts separate. There are several reasons why this is important:

- Seamless transaction tracking: Keeping separate accounts ensures that all transactions related solely to your business are easily identifiable. This makes it easier to track your business's financial health and plan for future expenses.

- Proper expense recording: By separating your personal and business expenses, you can accurately record your business expenses and ensure that they can be properly deducted from your tax returns. This helps to avoid any legal or financial issues down the line.

- Professional image: Maintaining a separate business account can also help you convey a professional image to your stakeholders, such as investors or clients.

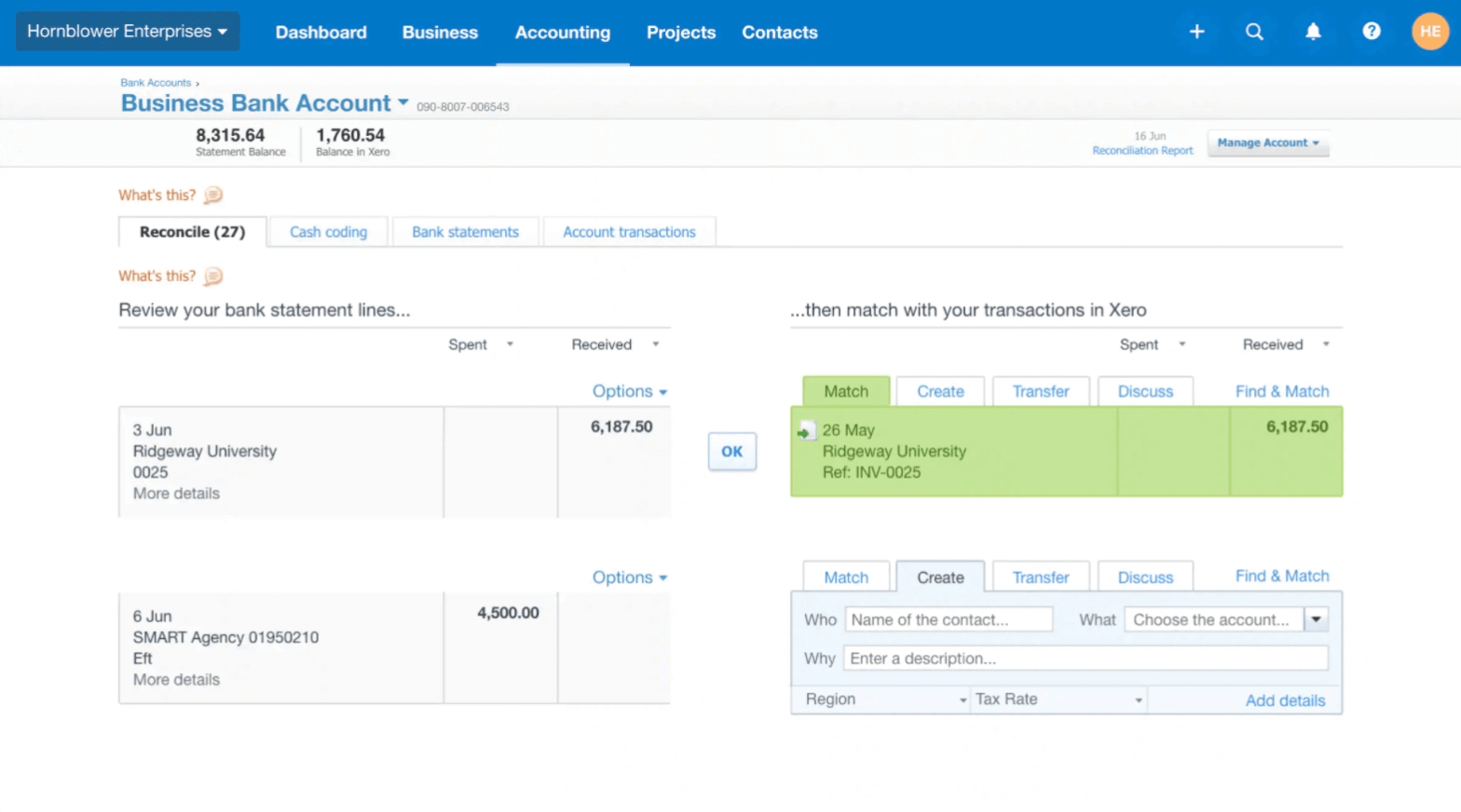

In addition to keeping separate accounts, it's also important to regularly reconcile your bank statements with your accounting records. This process ensures that all transactions are accurately recorded and helps to prevent errors or discrepancies. By using cloud accounting software such as QuickBooks Online or Xero, you can simplify this process and save time. These tools automatically suggest matches for reconciliation, making the process quicker and more efficient.

Source: Xero

Implement Efficient Billing and Payment Procedures

To simplify your accounting processes, there are several billing and payment measures that you can implement. These measures include:

- Recurring billing: This option can save you time and ensure that payments are made on time, especially if you make regular payments. By automating this process, you can eliminate the need to manually create and send invoices each time.

- Automated payment reminders: Many billing and invoicing software offer this feature, which can help you get paid on time by sending automated reminders to customers. This can help reduce the risk of late payments and improve cash flow.

- Accept multiple payment methods: By accepting multiple payment methods, such as credit cards, bank transfers, or online payment systems, you can encourage customers to make timely payments. Using billing tools like FreshBooks and Zoho Books, you can seamlessly accept payments through PayPal and Stripe, which can help you get paid faster and improve your cash flow.

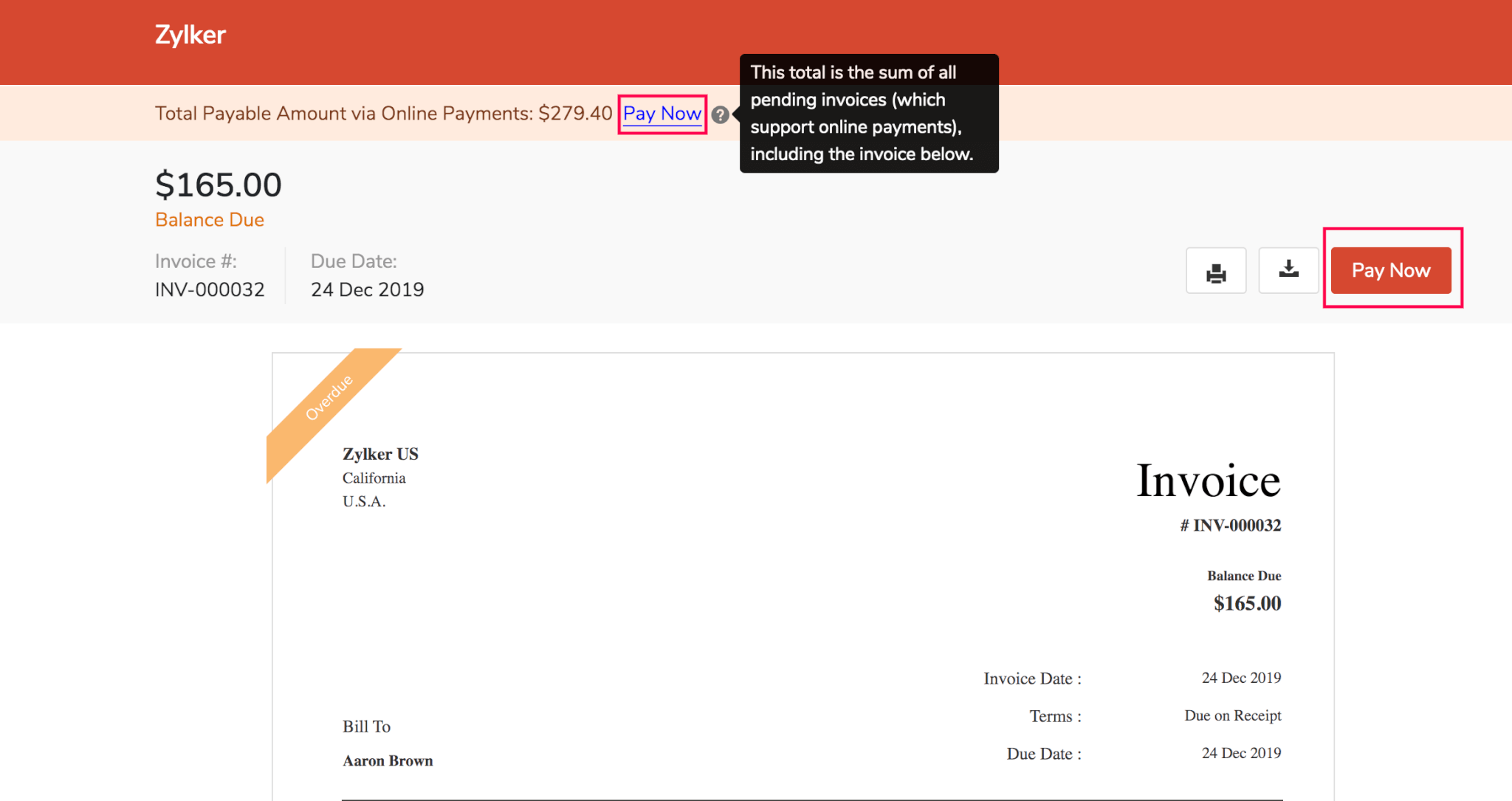

- Use invoice templates: To speed up and add consistency to your invoicing process, you can use invoice templates. With billing and invoicing software, you can create professional-looking invoices containing your company logo and even a “Pay Now” button. This can help you streamline your invoicing process and improve your cash flow.

Source: Zoho Books

Establishing efficient billing processes lets you get ahead of the game and optimize your organization's financial health. This practice helps reduce mistakes, disputes, and late payments while improving cash flow and customer satisfaction.

Top Accounting Tips: Adopt or Migrate to Cloud Accounting Software

Maximizing efficiency in accounting is crucial for any business, and one of the most practical tips is to adopt or migrate to сloud accounting. With this technology, you can scale your financial management up or down to suit your business needs, while also enjoying benefits such as accessibility, cost-effectiveness, and improved collaboration. Cloud accounting software allows you to access financial data anytime, anywhere, from any device, and offers advanced security features to ensure compliance with security standards. Some of the top cloud accounting software options for small businesses include QuickBooks Online, Xero, FreeAgent, FreshBooks, Zoho Books, and Odoo Accounting.

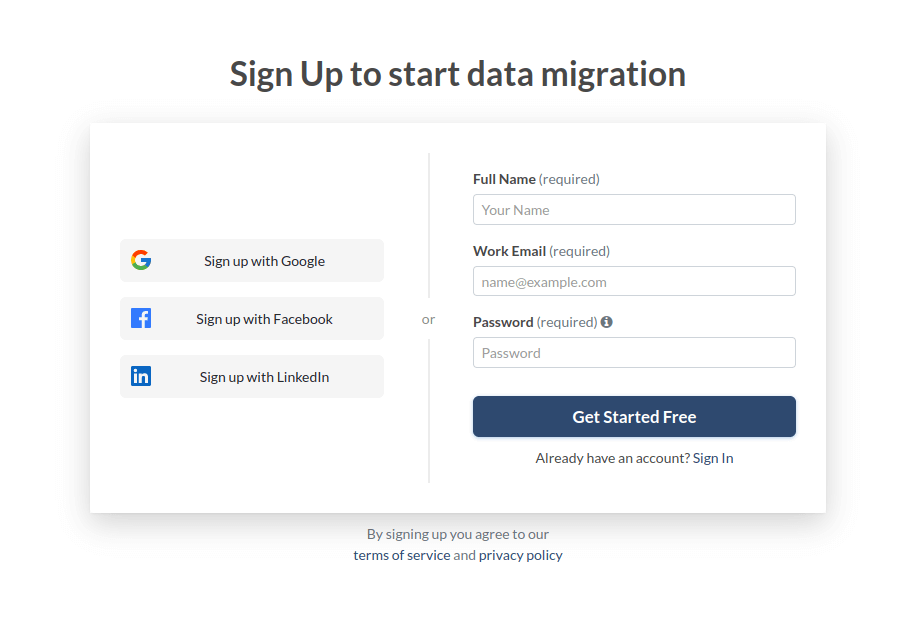

After selecting your preferred accounting system, the next step is to use an Accounting Migration Wizard to import accounting data automatically and streamline the data migration process into several simple steps. Here's how it works:1. Sign up with Relokia Migration Wizard. For registration, you can use your work email or sign up with your Google, Facebook, or LinkedIn account.

2. After registering your Relokia account, choose your migration option: Free Demo Migration (migrating a batch of data yourself) or Concierge migration (passing the migration to technical experts). You can check the video guide on Migration Wizard to understand how it works.

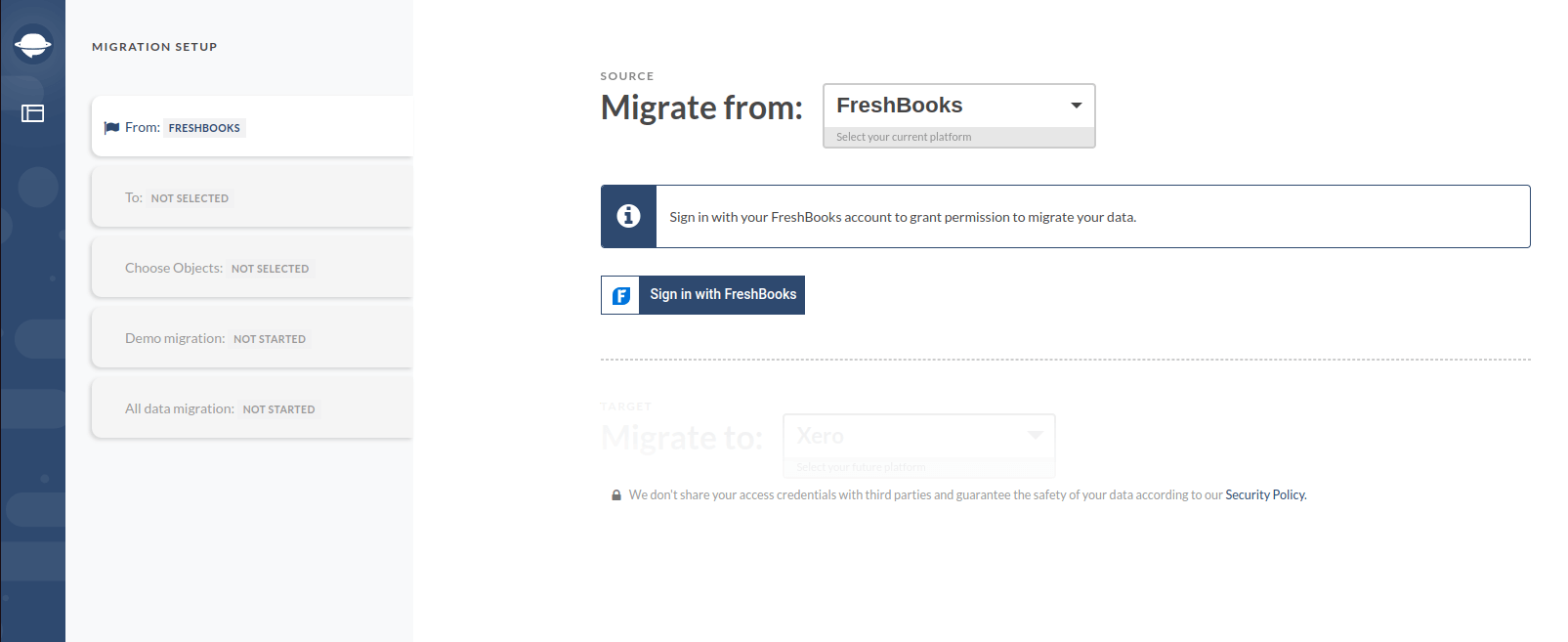

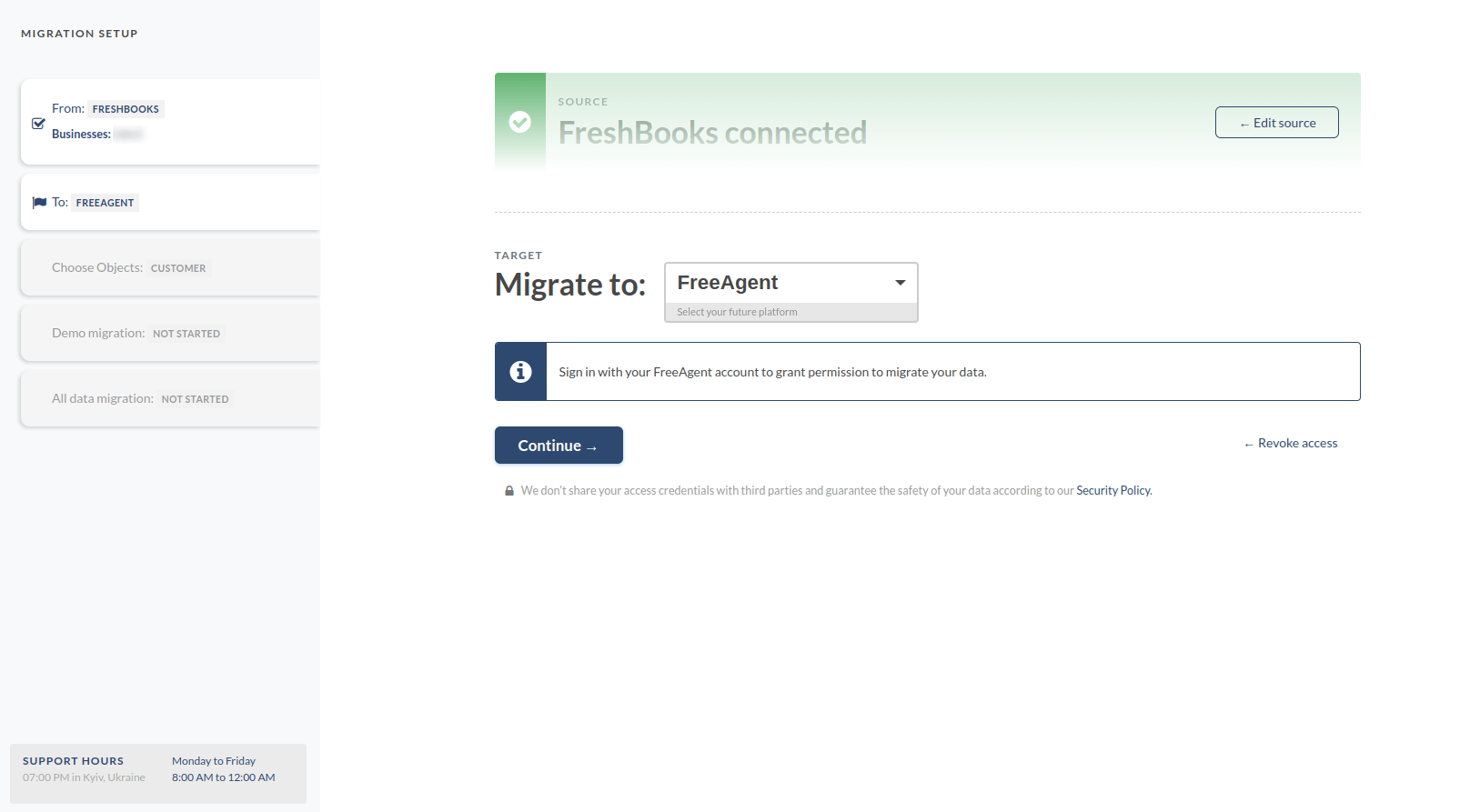

3. Connect your source accounting platform to the Migration Wizard or upload the CSV with your accounting data. If you want to migrate from a platform, sign in to it using the “Sign In with…” button.

Then connect your target platform.

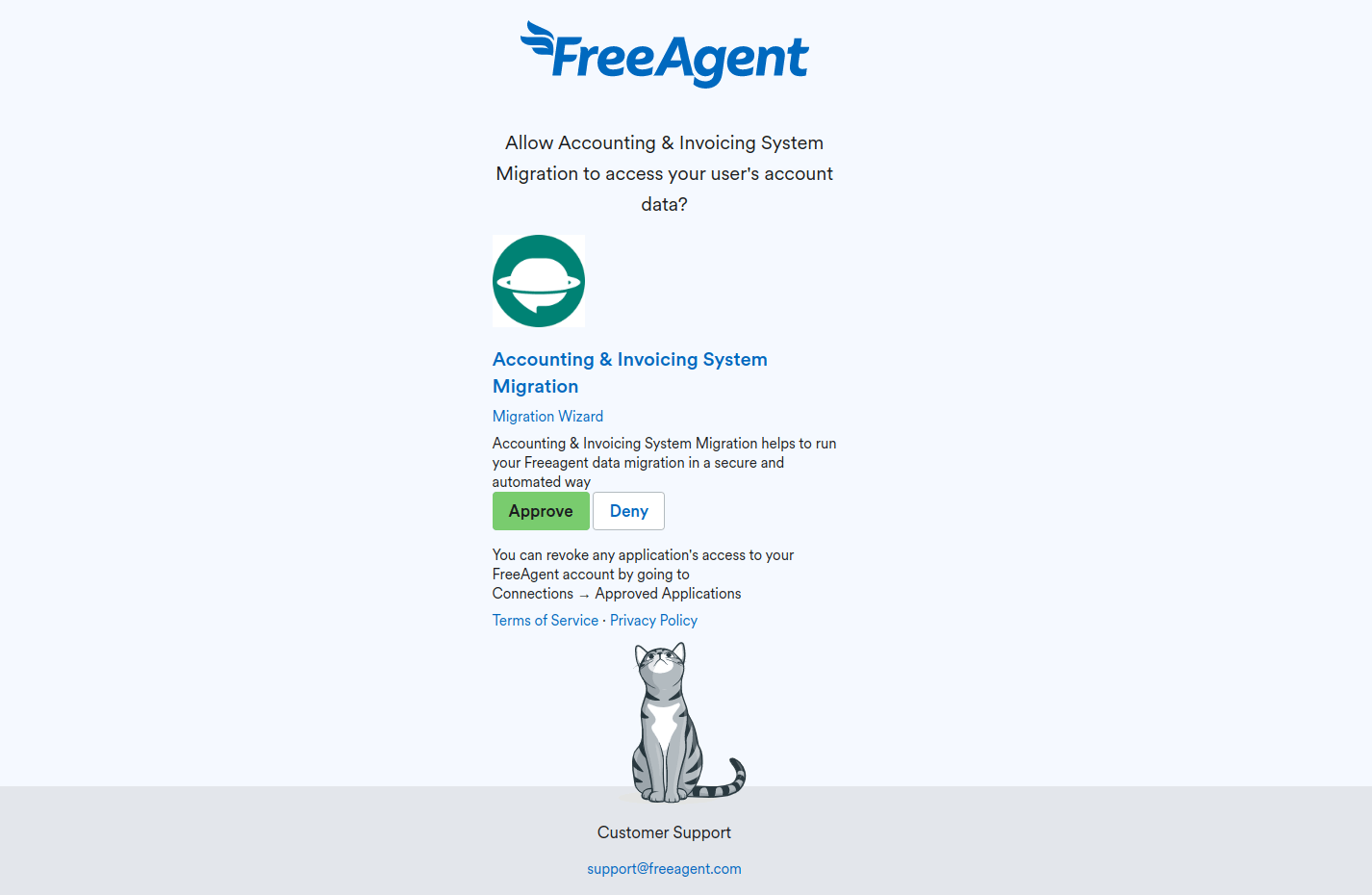

Some platforms require to approve giving Migration Wizard access to your accounting data. To proceed with migration, click Approve.

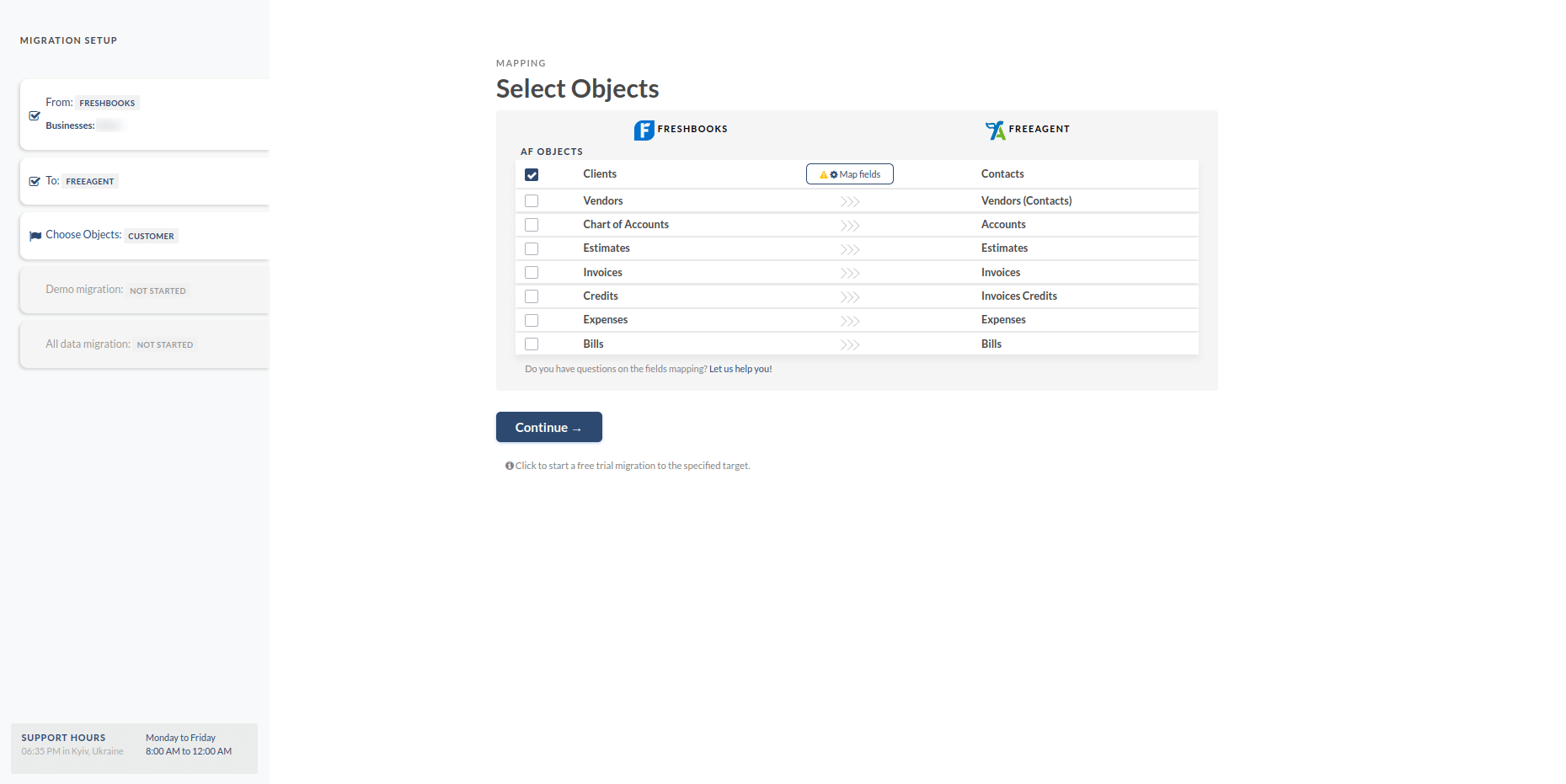

4. Tick the objects you want to import

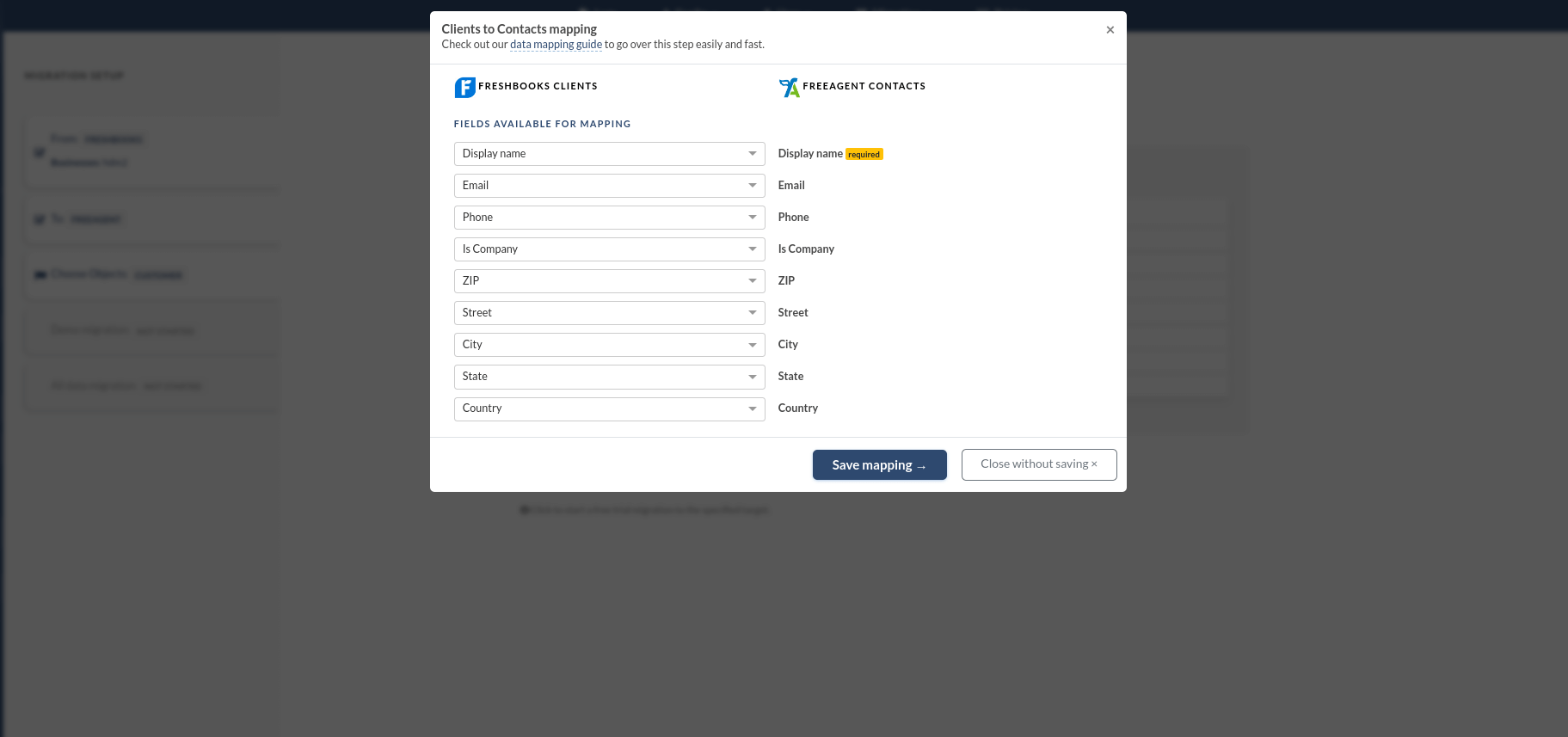

and map data fields.

5. Start a Free Demo and download the reports with your account data import results.

6. If the results are satisfying, then make a payment and proceed with your Full Migration.

Automated data import reduces the risk of errors, maintains data relations, saves time, and ensures the secure and consistent migration of your accounting records. By following these tips, you can simplify your accounting processes, increase efficiency, and help your business thrive.

Why Regular Bank Reconciliation Is Crucial for Small Business

Regular bank reconciliation is important for all businesses, regardless of their size and industry. It involves matching your transactions and statements to ensure that your records are accurate and consistent. Failure to perform regular reconciliations can lead to errors, which can result in inaccurate accounting reports. Additionally, bank reconciliation can help you identify fraudulent transactions, such as duplicated or altered checks, unauthorized transfers, and missing deposits. This process is particularly important for small businesses, which need to know their exact cash flow position to manage their budget effectively.

How Implementing Internal Controls Can Simplify Your Accounting

Small businesses are vulnerable to cyberattacks and fraud due to limited budgets and lack of advanced security skills. Implementing internal controls can help improve financial integrity, prevent fraud and errors, and increase accountability. Internal controls include mechanisms and procedures such as segregation of duties, reconciliations, policies and procedures, transaction audits, and security measures. Comprehensive internal controls ensure that your business complies with the law and aligns with your goals, making your team more consistent and responsible.

Improve Your Financial Management with Tax Regulation Tracking

Properly categorizing expenses and maintaining accurate records is crucial for tax purposes as it helps businesses comply with tax laws and regulations, avoid penalties and fines, and make informed financial decisions. Accurate and detailed records of income and expenses are essential for tax compliance. Proper categorization of expenses can help businesses claim all the deductions they are entitled to, reducing their tax liability and increasing after-tax profits.

Additionally, accurate records provide a clear picture of a business's financial performance, which can help with decision-making about pricing, expansion, and investment opportunities. To stay updated with tax laws and regulations, regularly check the IRS website for the latest information, subscribe to tax news outlets, and consult a tax professional for maximizing after-tax profits.

Why You Need to Follow Tips to Simplify Accounting?

Inaccuracies and delays are common in small business accounting workflows. However, you can improve these statistics by following the tips above to simplify accounting. Regular reconciliations, compliance with tax regulations, and smart internal controls will free you from redundant work, while cloud accounting software will turn your financial management into a piece of cake. Additionally, automated data transfer with the Migration Wizard can help you start implementing your best accounting software today.

Have already chosen your accounting platform?

Leave the accounting records migration to us!