As a small business owner, you've probably encountered the term "virtual accounting" without fully understanding its implications. Enter the world of numbers in the digital era with virtual bookkeeping.

In this captivating article, we'll unveil the transformative power of virtual accounting services, uncovering how it's reshaping financial management for businesses. Delve into the benefits, strategies, and innovative tools driving this accounting revolution and propelling businesses to new heights of success.

What Is Virtual Accounting?

This approach offers unparalleled flexibility, eliminating geographical barriers and time constraints. Compared to in-house methods, virtual accounting cuts commuting enhances productivity, and reduces errors.

How Does Virtual Bookkeeping Work?

Virtual bookkeepers come in various forms: freelancers, remote firms, or even in-house experts working remotely. Their common goal is to provide essential financial information for up-to-date company accounts.

Traditionally, this involved delivering invoices and receipts to a local bookkeeper each month. However, the landscape has evolved significantly.

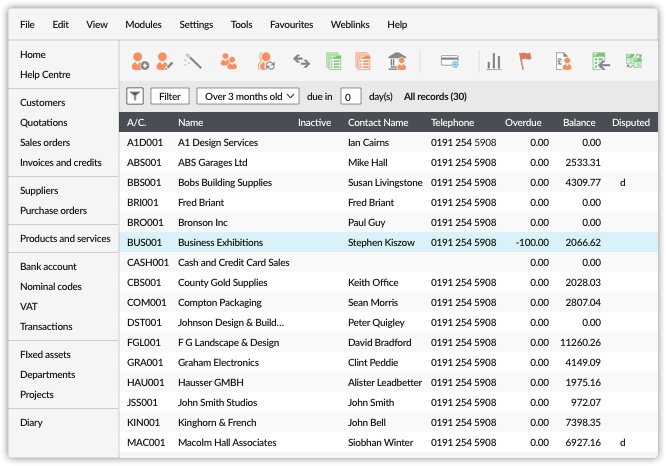

Today, virtual bookkeeping leverages digital tools like Sage 50cloud Accounting, Bill.com, Crunch Accounting, and Square, enabling real-time record-keeping without the monthly hassle. It's a transformation that empowers businesses in the digital era.

Responsibilities of a Virtual Bookkeeper

Virtual accountants and bookkeepers step into the modern accounting world, with their roles echoing traditional practices while embracing digital transformation. Picture this: a full-time virtual accountant navigating financial management, only now, it’s all in the digital realm. So, what are the responsibilities of a virtual accountant:

- Financial Reporting: Navigating the digital landscape to handle intricate financial reporting tasks.

- Daily Transactions: Recording day-to-day financial activities seamlessly, just as a traditional accountant would.

- Billing and Invoicing: Ensuring a smooth flow of funds through effective billing and invoicing processes.

- Sales Tax Management: Expertly managing the complexities of remitting sales tax returns in the digital realm.

Virtual bookkeeping redefines the game, offering the essence of traditional accounting in a more agile, accessible, and economical package.

Virtual Bookkeeping vs Traditional Accounting

But how does virtual accounting differ from a traditional approach? It all goes down to a few things: data entry, storage, accessibility, efficiency, and resource allocation.

While traditional accounting relies heavily on physical documents and manual data entry, virtual accounting harnesses the power of technology to streamline and optimize financial processes.

In traditional accounting, stacks of paperwork, physical storage, and in-person interactions dominate, often leading to inefficiencies and delays.

On the other hand, virtual accounting offers greater flexibility through remote accessibility, enabling real-time updates and collaboration from anywhere. The time-intensive nature of traditional bookkeeping meets its match in virtual accounting's time-saving automation and digitization.

Moreover, the cost-effectiveness of virtual accounting shines as it minimizes the need for physical storage and reduces resource allocations, which is particularly beneficial for small businesses.

| Aspect | Traditional Accounting | Virtual Accounting |

| Data Entry | Manual data entry with physical documents | Automated data entry with technology |

| Efficiency | Potentially slower due to paperwork | Faster processes with automation |

| Accessibility | Limited to a physical location | Remote access from anywhere |

| Storage | Requires physical storage | Digitized storage and accessibility |

| Interactions | Often in-person interactions | Online collaboration and sharing |

| Resource Allocation | More resource-intensive | Efficient use of resources |

| Suitability for SMBs | Less efficient for small businesses | Cost-effective and tailored solution |

| Time Savings | Generally time-consuming | Time-saving through automation |

Table 1. Comparing traditional accounting vs virtual bookkeeping

Benefits of Virtual Accounting

Embrace the perks of virtual accounting management for seamless bookkeeping advantages in your business.

1. Real-time Data

Virtual accounting ensures swift data input, slashing the odds of human errors. Plus, it empowers you to organize your books anywhere, smoothing global operations.

2. Boosted Business Agility

Efficient collaboration with your virtual accountant lets you manage your books on the move, which is vital for multi-location operations and growth plans. Virtual accounting adapts to your needs, delivering reliable records online.

3. Lightening the Load for Your Team

By automating basic accounting tasks, your finance team can focus on strategic growth instead. Less bookkeeping stress means more time for enhancing processes and elevating client experiences. Plus, you can effectively manage your time while boosting overall productivity.

4. Enhanced Flexibility

Virtual bookkeeping offers heightened convenience by mitigating the downsides of traditional bookkeeping. This not only benefits business operations but also provides staff with more flexibility. Moreover, the availability of virtual accountants through technology eliminates the need for constant physical presence to maintain efficiency.

5. Cost Reduction

Virtual accounting and bookkeeping software offers cost savings by eliminating the need for physical storage and retrieval of documents. This ensures swift access to records for your team. Unlike traditional accounting, virtual accounting minimizes internal expenses and resource allocation, streamlining online bookkeeping and accounting processes.

Which Toos to Usel to Streamline Virtual Bookkeeping?

Modern virtual accounting solutions significantly improve and optimize the bookkeeping process. They are versatile enough to be utilized by internal accounting teams, even in traditional office setups. With their remote capabilities, teams can effectively work with these tools from any location.

Now, the question arises: which specific tool best suits virtual accounting? Let's delve into some examples to explore further.

Bill pay automation

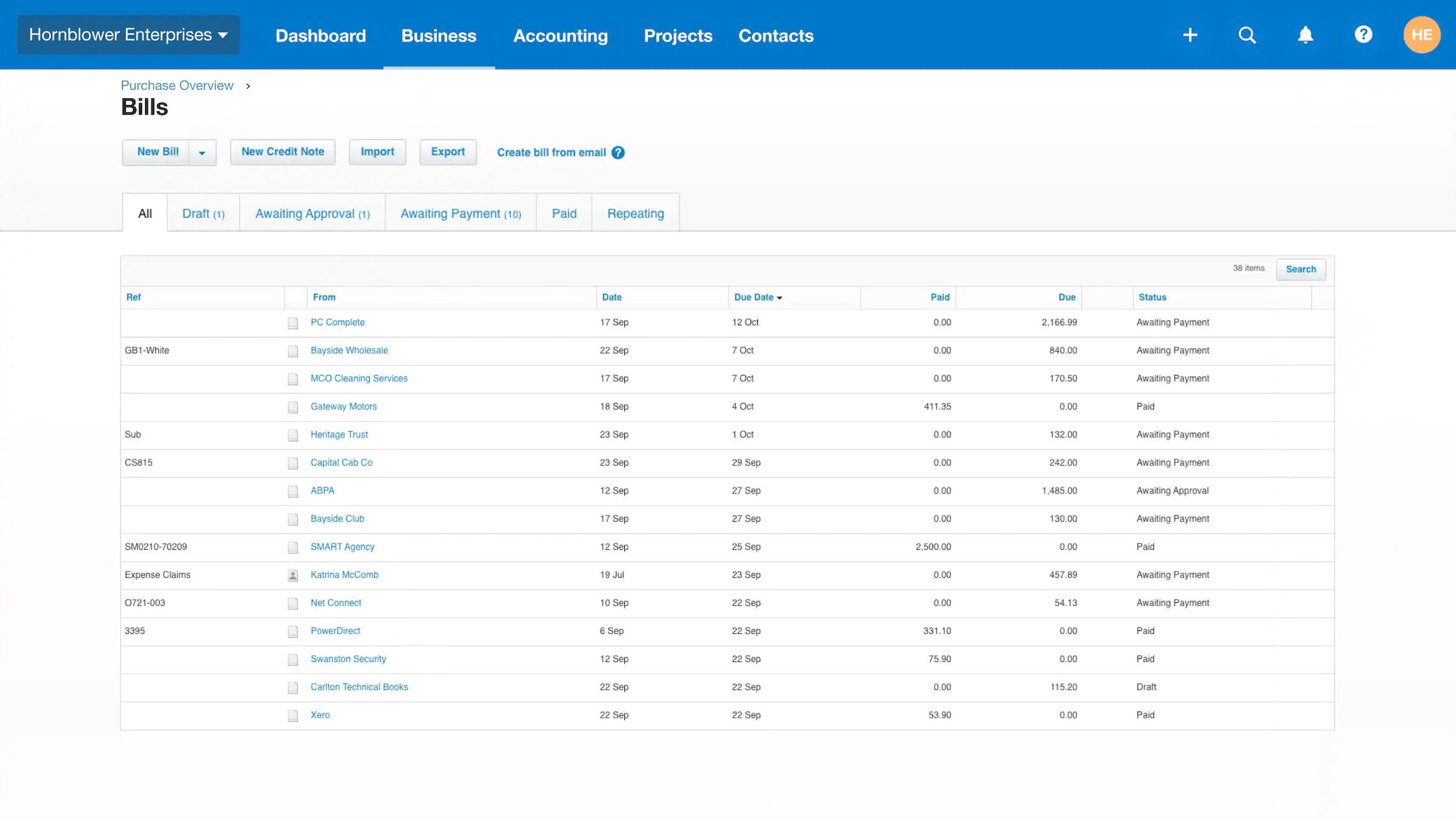

Imagine bill pay software as a wizard for handling bills. It automates how companies get, approve, and pay invoices. Bookkeepers can use it from anywhere and manage bills even if they're far away. This software also syncs with popular accounting tools like Quickbooks and Xero, ensuring a client's financial records stay accurate and current. It's like magic that keeps everything in harmony.

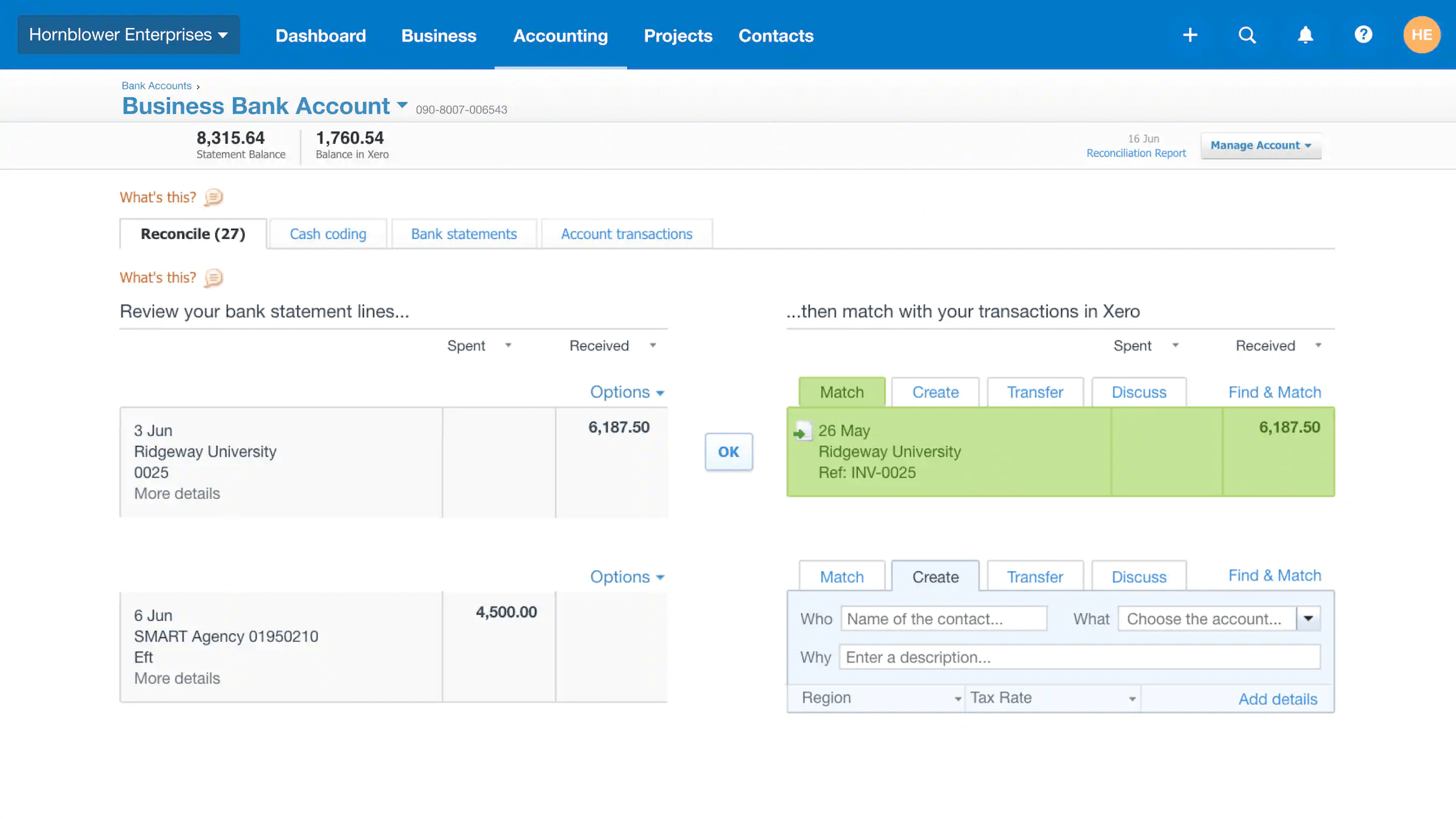

Automate bills in Xero. Source: Xero

Invoice automation

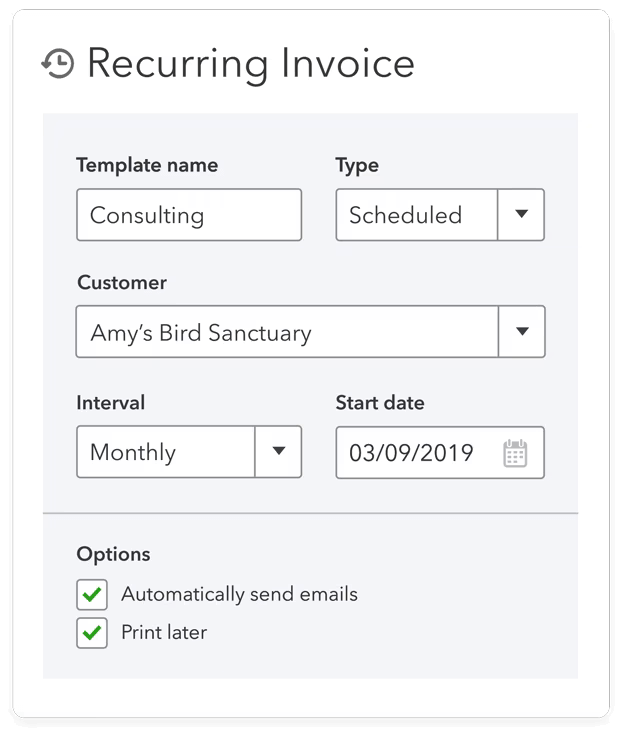

Beyond assisting with accounts payable, bookkeepers also tackle accounts receivable, managing invoicing and customer payments. Cloud-based invoice automation tools step in to streamline this entire process.

With these tools, bookkeepers can swiftly create, send invoices, and track payments, even sending timely reminders when necessary. For businesses using estimates, bookkeepers can seamlessly convert them into invoices as needed.

The best part? These invoice automation platforms smoothly integrate with popular accounting software like QuickBooks Online, simplifying the bookkeepers' task of entering invoice information across multiple platforms.

Set up a recurring invoice in QuickBooks Online. Source: QuickBooks

Document management

Bookkeepers often deal with documents like client contracts, tax returns, bank statements, and spreadsheets. Traditional document management tools can be costly, but some financial automation solutions provide unlimited cloud storage. Even better, these tools allow you to connect these documents to specific clients or vendors.

Having all your vendor invoices and records in one organized place can significantly simplify your financial operations, making accessing the information you need effortless.

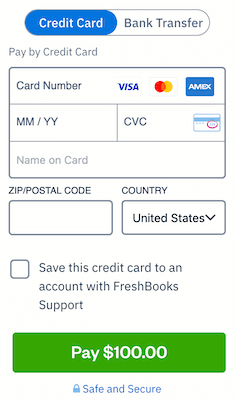

Credit card account management

Navigating credit card receipts has long challenged bookkeepers. Imagine heaps of receipts, each representing a past expense, needing organization. Categorizing expenses and funneling them to the right departments is like orchestrating a financial symphony.

Now, modern magic steps in. Expense management software transforms this into a breeze. It seamlessly integrates business credit cards with budget-tracking tools. Picture individual managers with unique cards, each preset with a budget. The system dances in harmony as they spend, automatically allocating expenses to budgets, ensuring real-time accuracy that eliminates month-end crunch.

Online payments with FreshBooks. Source: FreshBooks

Cloud accounting software

Unlike other virtual accounting solutions, a cloud-based accounting system can do it all: automate basic accounting tasks, store financial data, and manage expenses. What's more, your data is as secure as a dragon's treasure, thanks to strong security measures and backups.

The real magic happens when your business grows or changes shape – the cloud scales with you effortlessly. It's not just software; it's your trusty partner in the virtual financial world, keeping you ahead.

And let's not forget collaboration. Cloud-based software makes financial teamwork a breeze. Multiple users can access and update the same data simultaneously, no matter where they are. It's like a symphony of financial teamwork, with everyone in harmony, regardless of location.

6 Best Bookkeeping Systems for Virtual Accounting

Navigating the realm of virtual accounting requires a reliable bookkeeping system. Here are seven top-notch options that empower virtual accountants with seamless financial management:

| Company | Cost Range | Key Features | Mobile App |

| QuickBooks Online | $30 to $200/month | Financial integration, tax features, mileage tracking | Yes |

| Wave Accounting | Free + Fees | Double-entry accounting, multi-user support | Yes |

| Zoho Books | Free to $275/month | Invoicing, app integrations, client portal | Yes |

| Xero | $13 to $70/month | Financial integration, real-time cash position | Yes |

| FreshBooks | $17 to $55+/month | Time tracking, bank integration, invoicing | Yes |

| Sage 50cloud | Variable | Advanced accounting, inventory, and business insights | Yes |

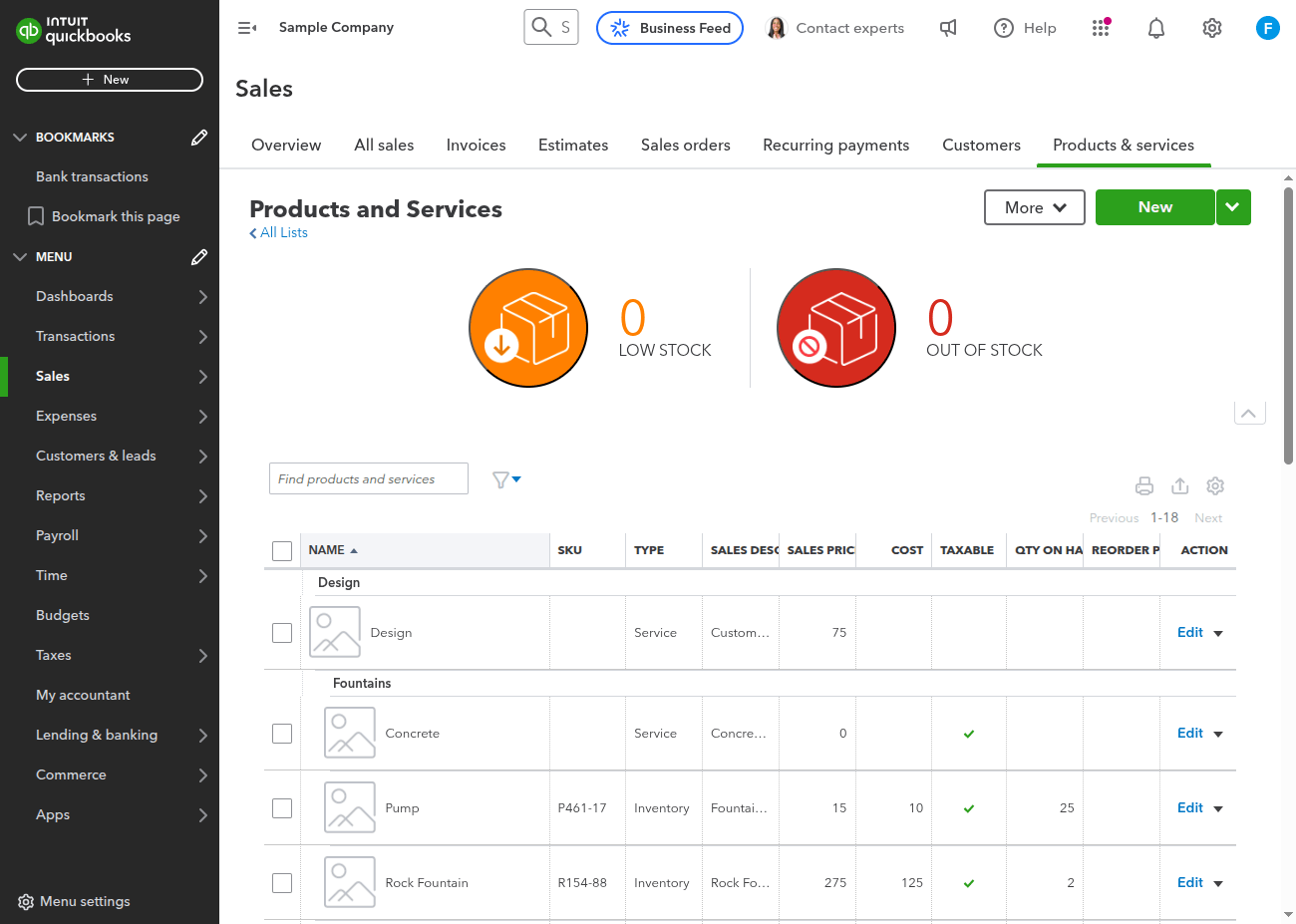

QuickBooks Online

Elevate your virtual accounting with QuickBooks Online—an accessible, versatile solution. Unlike the desktop version, it offers seamless access anytime, anywhere. Its integration with numerous third-party apps suits various business types.

While feature sets vary across plans, even basic versions offer online banking connections, receipt capture, and efficient expense management. Track sales, manage inventory, and experience top-notch functionality with the mobile app for iOS and Android. Although payroll isn't included, you can integrate Intuit payroll services.

Inventory management in QuickBooks Online. Source: QuickBooks

Key Features of QuickBooks Online

- Invoicing: Create and customize professional invoices, track their status, and send automatic client reminders.

- Expense tracking: Effortlessly categorize and track expenses, import transactions from bank accounts, and manage receipts.

- Bank reconciliation: Seamlessly reconcile bank transactions with real-time data syncing, ensuring accuracy in financial records.

- Reports: Generate detailed financial reports, profit and loss statements, balance sheets, and tax reports.

- Integration: Connect with various third-party apps, banking institutions, and payment gateways to streamline operations.

- Sales tracking: Robust sales tracking and invoicing features.

- Financial reporting: Generates various financial reports.

🏷️ Pricing: QuickBooks Online's pricing structure can be initially perplexing, as listed prices include an introductory discount for the first three months. Starting at $15/month for the Simple Start plan costs gradually increase after the initial period, with plans like Essential, Plus, and Advanced catering to various user needs and business scales.

Xero

Discover Xero, the virtual accounting wizard that transforms financial management. Whether in retail, IT, legal, e-commerce, or startups, Xero empowers you to conquer your books effortlessly. Enjoy automated bank syncs, elegant invoicing, basic inventory control, bill payment, and insightful new reports.

And if projects are your game, Xero's got your back – manage multiple projects, craft invoices on the fly, and track their success. Embrace the future of accounting with Xero and watch your business thrive.

Bank reconciliation in Xero. Source: Xero

Core Features of Xero

- Automated bank reconciliation: Effortlessly sync and reconcile transactions from your bank accounts.

- Efficient invoicing: Create, customize, and send professional invoices for timely payments.

- Inventory management: Seamlessly track and manage your inventory levels and movements.

- Insightful reporting: Gain valuable insights with Xero's powerful reporting tools.

- Project management: Manage multiple projects, create invoices, and monitor progress within Xero.

- Multi-currency support: Manage transactions in various currencies.

- Mobile app: Manage accounts on the go with the mobile app.

🏷️ Pricing: Xero offers scalable plans, starting with the Early plan at $12/month for beginners, progressing to the robust Growing plan at $34/month, and the Established Plan at $65/month. While Xero doesn't provide native payroll, it integrates with Gusto's payroll solutions starting at $39/month.

FreshBooks

Meet FreshBooks: your virtual accounting maestro for freelancers and soloists. Attorneys, accountants, and retainer pros groove with its Retainers feature.

FreshBooks bridges solo acts and team dynamics. Embrace auto-receipt magic and perfect time tracking. The FreshBooks Accounting Partner Program harmonizes data sharing.

From ACH payments to slick estimates, it's a symphony of features. While payroll isn't onboard, Gusto Payroll integration nails your team's rhythm. Plus, iOS and Android apps keep FreshBooks in tune with your business wherever you play.

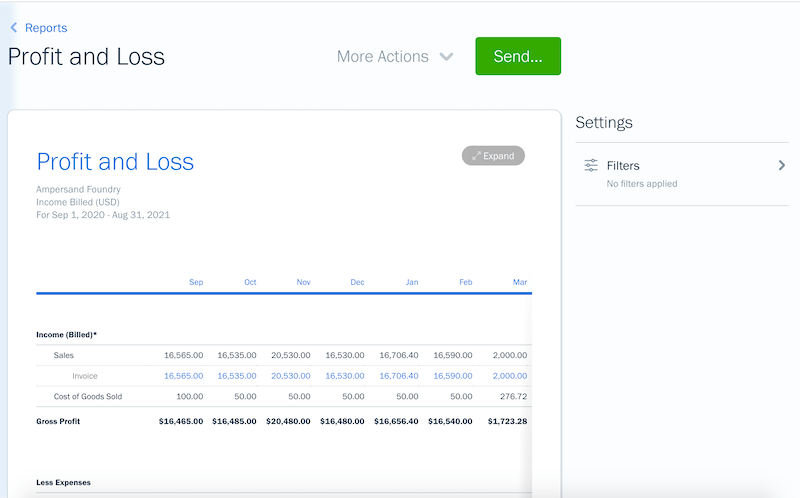

Profit and loss in FreshBooks. Source: FreshBooks

Key Functionality

- Retainers feature: Tailored for professionals with retainer fees, such as lawyers and accountants, allowing seamless management of client engagements.

- Team collaboration: Solo or ensemble, FreshBooks connects teams effortlessly for collaborative financial management.

- Auto-receipt capture: Say farewell to manual data entry as FreshBooks magically captures and imports receipt data.

- Time tracking: Pause and resume timers with finesse, ensuring accurate project time records.

- Accounting partner program: Simplify data-sharing with your accountant or CPA through FreshBooks' dedicated program.

- Online payments: Enable direct settlement, boosting cash flow.

- Integrations: Seamlessly connects with tools, enhancing business operations.

🏷️ Pricing: FreshBooks presents four plans: Lite, Plus, Premium, and Select. Lite starts at $15/month, Plus at $25/month, Premium at $50/month (70% off first 3 months), with custom pricing for Select.

Wave

Tailored for freelancers, solo workers, and contractors, Wave presents robust accounting tools, including invoicing, payment acceptance, expense tracking, and more. Seamlessly connect unlimited bank and credit card accounts for comprehensive financial management.

Wave's prowess extends to tracking cash flow, highlighting overdue invoices, and facilitating online payments (with a minor fee). Additionally, it offers an optional payroll feature, although tax services are currently limited to specific states.

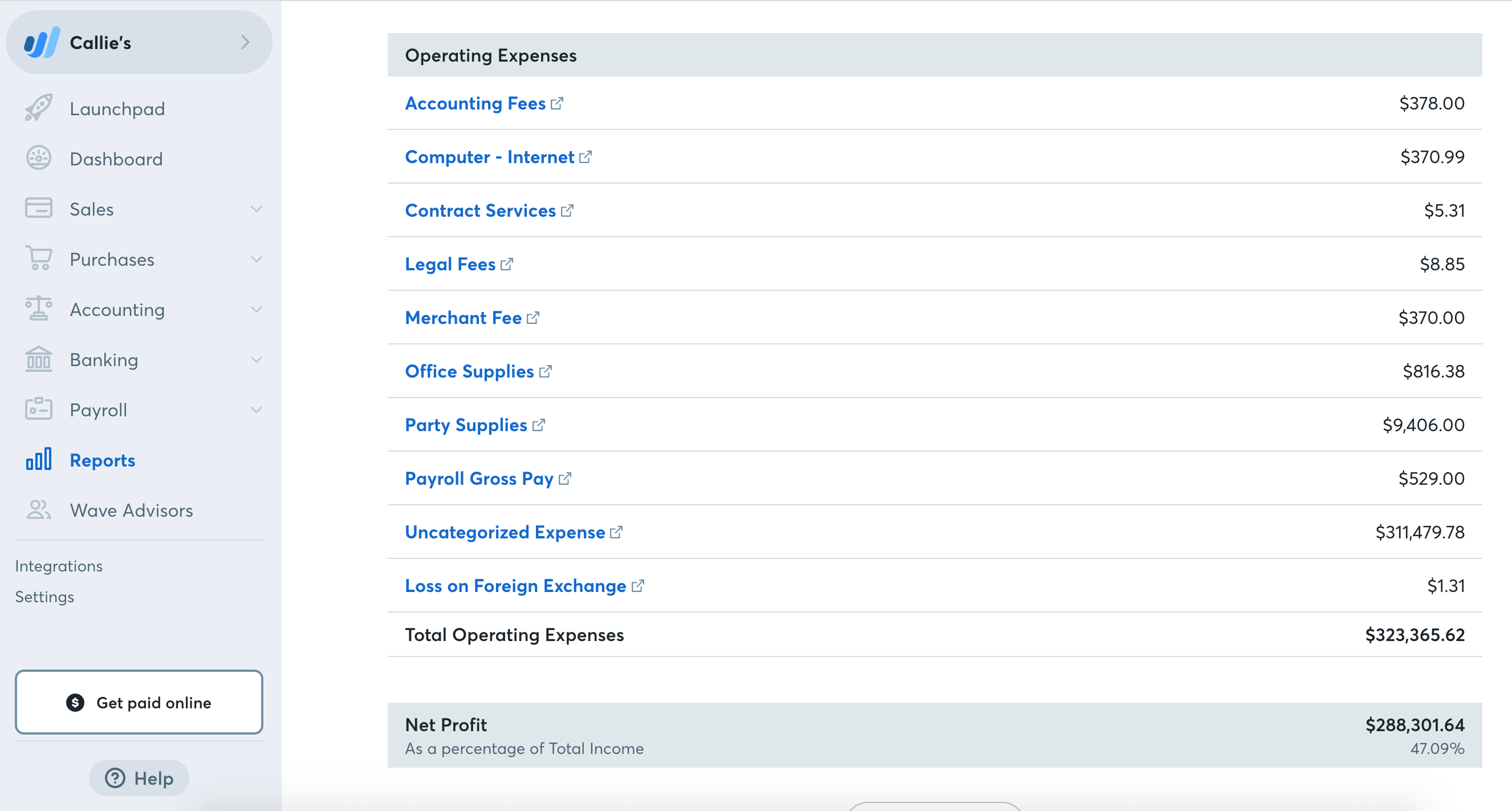

A profit and loss statement in Wave. Source: Wave

Main Functions of Wave

- Financial reports: Generate various financial reports, including profit and loss statements and balance sheets, for insights into your business's financial health.

- Tax preparation: Seamlessly categorize expenses and generate financial reports that facilitate tax preparation, saving time during tax season.

- Bank reconciliation: Effortlessly match your bank transactions with your accounting records, ensuring accuracy and timely identification of discrepancies.

- Receipt scanning: Capture receipt data digitally and attach them to expenses, reducing manual entry and increasing organization.

- Mobile accessibility: Access your financial data and perform tasks on the go using Wave's mobile app, available for both iOS and Android devices.

- Expense tracking: Efficiently manage expenses and categorize transactions.

- Invoicing: Create and send professional invoices with ease.

🏷️ Pricing: Wave Accounting provides a remarkable offer: all its features are free. However, costs are associated with credit card processing, payroll services, and bookkeeping support.

Zoho Books

Zoho Books is a budget-friendly virtual accounting solution that packs a punch. Solid inventory management and user-friendly step-by-step guidance make it perfect for startups on a tight budget, ensuring swift setup and operation.

Zoho Books shines with many features, mainly housed in the Professional plan. It's got you covered from automated workflows to comprehensive expense tracking, recurring transactions, and project management. Custom invoices and added tax preferences for customers and vendors offer enhanced flexibility. Plus, enjoy the convenience of saving custom reports and a bank account overview in the system.

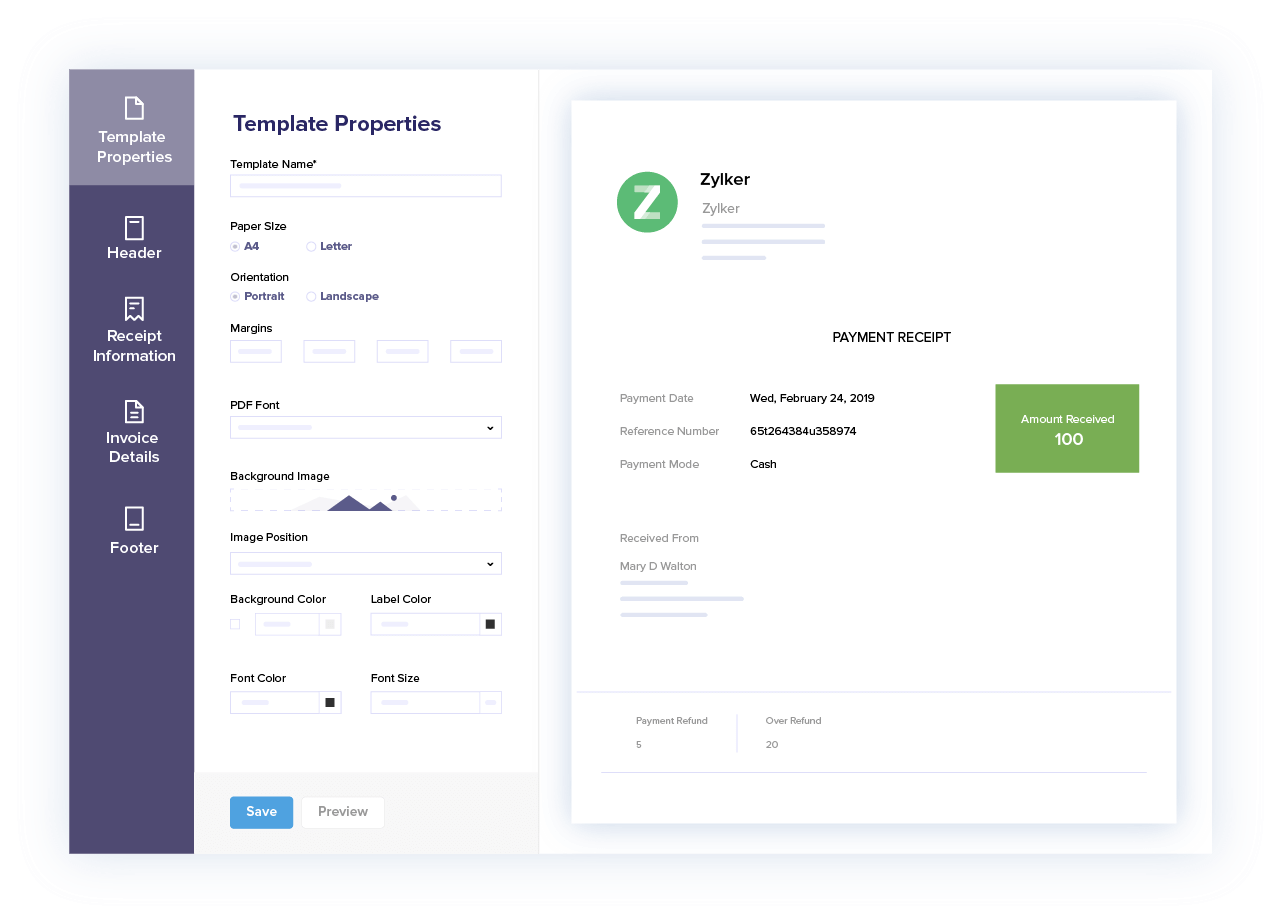

Online payment in Zoho Books. Source: Zoho Books

Core Functionality of Zoho Books

- Client portal: Easily share invoices with clients through the portal, now allowing self-sign-up for added convenience.

- Accountant version: Collaborate effortlessly with your CPA or accountant by sharing business details through Zoho Books' dedicated accountant version.

- Online payments: Simplify transactions for customers with convenient online payment options, enhancing cash flow.

- Mobile app: Seamlessly manage your finances on the go with Zoho Books' mobile app, accessible on iOS and Android devices.

- Inventory management: Maintain control over your inventory with Zoho Books' features, helping you keep track of stock levels and orders efficiently.

- Invoice customization: Tailor invoices to match your brand identity, presenting a professional image to clients.

- Project Management: Organize and monitor projects directly within Zoho Books, streamlining workflows.

🏷️ Pricing: Zoho Books offers six plans, including a free option for revenue under $50,000/year and the Ultimate plan supporting 15 users with 25 custom modules. Pricing starts from $10/month for Standard to $200/month for Ultimate on annual billing.

Sage 50cloud Accounting

Sage 50cloud Accounting is a versatile virtual accounting solution that combines on-premise installation with remote access flexibility. Ideal for small and expanding businesses, it offers various plans, a robust inventory module, and seamless integration with multiple point-of-sale (POS) applications, making it an excellent fit for retailers.

Plus, this virtual accounting system offers a seamless financial experience, from mastering cash flow to handling payments and invoices with ease. Access insights wherever you go, collaborate effortlessly with your accountant, and amplify your growth with versatile add-ons.

Sales management in Sage 50cloud Accounting. Source: Sage

Ultimate Features of Sage 50cloud Accounting

- Bank account integration: Seamlessly connect your bank accounts to track business expenses, providing accurate financial insights.

- Customer management: Enjoy excellent customer management capabilities, allowing you to track and engage with clients effectively.

- Sales management: Streamline sales processes with tools for efficient management, including the ability to accept online payments.

- Vendor payments: Choose your preferred payment method - electronic or printed checks - for seamless vendor payments.

- Inventory control: Utilize the Inventory module with multiple pricing levels and customizable fields to track vital inventory information.

- Flexible payroll: Opt for the Essentials or Full-Service options, accommodating your specific payroll needs.

- Comprehensive reporting: Access top-notch reporting options to gain valuable insights into your business's financial performance.

🏷️ Pricing: Sage 50cloud Accounting provides three plans: Pro, Premium, and Quantum, starting at $340/year for the Pro plan. The Premium plan, suitable for most small businesses, is priced at $554/year, while the Quantum plan is available for $919/year, all designed for single-user systems with the option to add extra users.

Recap

By adopting virtual accounting, you gain numerous advantages like increased flexibility, efficiency, and collaborative power. Utilizing advanced tools like cloud-based accounting systems makes remote financial management smooth and convenient. These tools allow real-time tracking, task automation, secure data storage, and seamless teamwork with colleagues and accountants. Embracing virtual accounting and the right tools empowers you to navigate the digital era with agility, achieving better financial control and success.

Frequently Asked Questions

Virtual solutions offer a refreshing departure from traditional in-house teams. By embracing virtual accounting, you not only trim costs and resource commitments but also unlock the magic of seamless online bookkeeping and financial wizardry.

The hunt for skilled virtual bookkeepers, whether for full-time dedication or a part-time dance, is in full swing. From companies posting enticing contract opportunities to kickstart your career journey, many chances await you to seize.

Bringing on a virtual accountant not only rescues you from the tangle of employment benefits, insurance, vacation logistics, and office space conundrums but also trims down software costs and payroll taxes. These savvy remote accountants come with a fixed fee specified in the agreement, waving goodbye to the hunt for an in-house accountant. It's like finding the financial wizardry you need without the hassle and overhead of a traditional setup.

Have already chosen your accounting platform?

Leave the accounting records migration to us!