Financial reporting stands as a pivotal process, serving as the financial compass for businesses and investors alike. It unfolds vital insights into an entity's financial journey over time. Not only do corporations and investors rely on these financial disclosures, but governmental and private regulatory bodies also keep a watchful eye to uphold fair trade, equitable compensation, and transparent financial dealings.

Let's delve into the heart of financial reporting. What are its core goals, and which reports are essential? Join us on this enlightening journey as we uncover its importance, decipher common financial statements, and explore financial reporting solutions.

What Is Financial Reporting?

Financial reporting is standard in businesses of all sizes, whether for regulatory compliance, industry standards, or internal decisions. Large public companies follow SEC regulations, private firms report to lenders or owners, and even small businesses report for tax purposes.

Reporting occurs throughout the year, with annual reports at the fiscal year-end and interim statements covering shorter periods, like months or quarters. It's a versatile practice adapted to each business's needs.

These reports help chart a course for future profitability and industry standing and allow the public to scrutinize financial performances. Essentially, they're the financial compass guiding company strategies and public perception.

Diving into the Primary Types of Financial Statements

As a business owner, your financial reporting methods may vary based on your current needs and objectives. Let's explore some of the key and frequently used types of financial reporting:

|

Financial Statement |

Purpose |

Key Information Provided |

| Income Statement | Shows profitability during a specific period | Revenue, expenses, and net income. |

| Balance Sheet | Provides a snapshot of financial position | Assets, liabilities, and shareholders' equity. |

| Cash Flow Statement | Details cash movements | Cash inflows and outflows from operating, investing, and financing activities. |

| Statement of Retained Earnings | Tracks changes in retained earnings | Dividends, net income, and retained earnings. |

| Financial Dashboard | Visualizes key financial data | Various financial metrics, often in real-time. |

| CFO Dashboard | Focuses on data for CFO's needs | Working capital, accounts receivable, cash flow, etc. |

| Statement of Shareholders’ Equity | Displays changes in equity | Issuance of stock, stock buybacks, and other changes. |

| Notes to Financial Statements | Provides additional context | Significant accounting policies, methods, and explanations. |

Figure 1. Types of financial reports

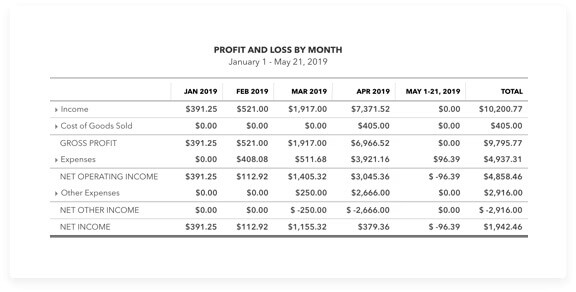

Income Statement

This financial statement, sometimes called an Income Statement or Profit and Loss report, unveils the intricate dance of your company's earnings and expenditures within a defined timeframe. It paints a vivid canvas, showcasing the tapestry of profits and losses that shape your financial landscape.

Creditors and investors often merge data from the P&L with insights gleaned from the other trio of financial reports. They use this information to render their judgment on whether your enterprise is a promising venture or a worthy recipient of financial backing.

An example of a Profit & Loss statement in QuickBooks Online. Source: QuickBooks Online

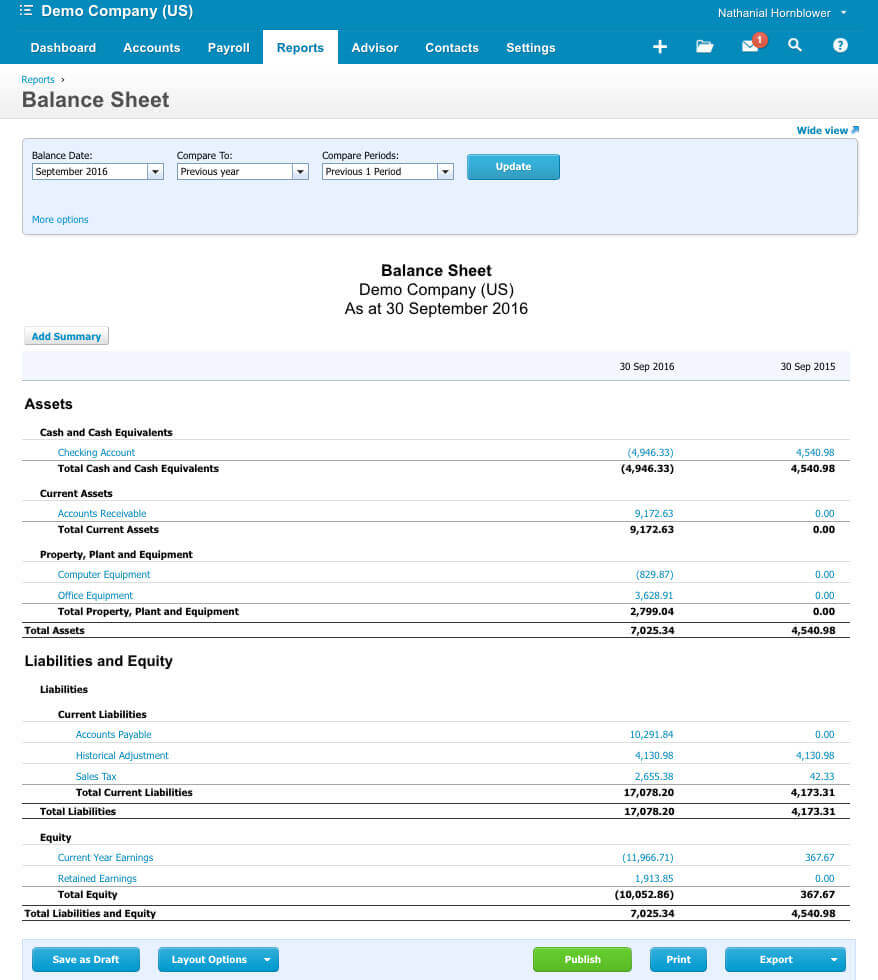

Balance Sheet

Think of a balance sheet as a snapshot of your business's financial health on a specific date. Many consider these reports among the most crucial because they display your business's equity, offering a comprehensive view of its financial status. A classified balance sheet separates current and noncurrent assets and liabilities, enhancing its clarity and utility.

An example of a balance sheet in Xero. Source: Xero

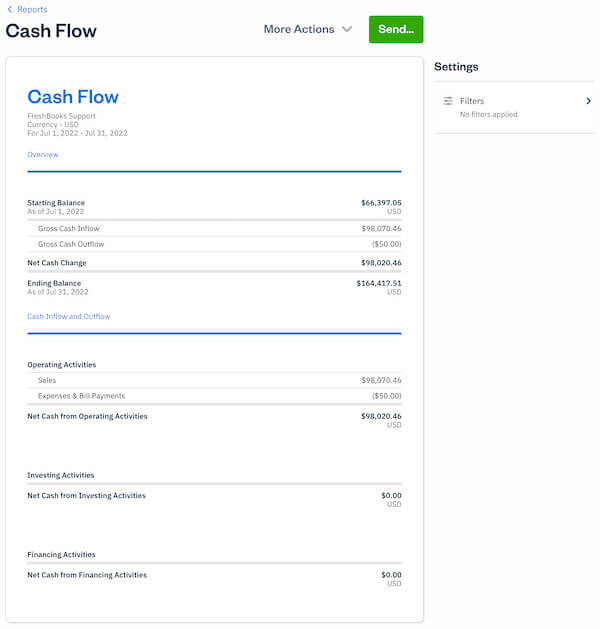

Cash Flow Statement

The cash flow statement is a financial narrative that exposes how a company manages its cash and cash equivalents during a specific timeframe. It skillfully categorizes the origins and destinations of cash into three distinct chapters: operating activity, investing activity, and financing activity.

This type of financial report effectively filters out noncash elements like depreciation from the net income, providing a clear view of the company's liquidity sources. Stakeholders, acting as financial detectives, depend on this statement to decipher whether a company possesses the cash superpower it needs to thrive in the business world.

An example of a cash flow statement in FreshBooks. Source: FreshBooks

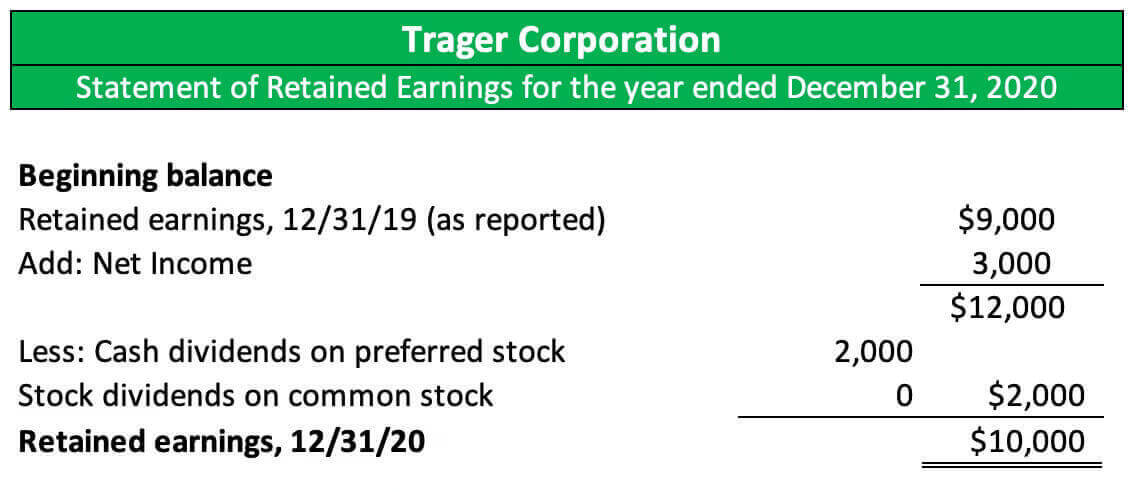

The Statement of Retained Earnings

A statement of retained earnings is like a financial time machine, revealing the twists and turns in a company's journey. It captures the changes in a company's retained earnings, those profits that stayed close to home rather than venturing out as dividends to shareholders.

Why is this statement so crucial? It's because it's like a financial storyteller, narrating how a company's retained earnings have evolved over the years. It's a window into the company's financial prowess, showcasing its ability to generate profits and fuel its own growth.

The statement of retained earnings in QuickBooks Online. Source: QuickBooks Online

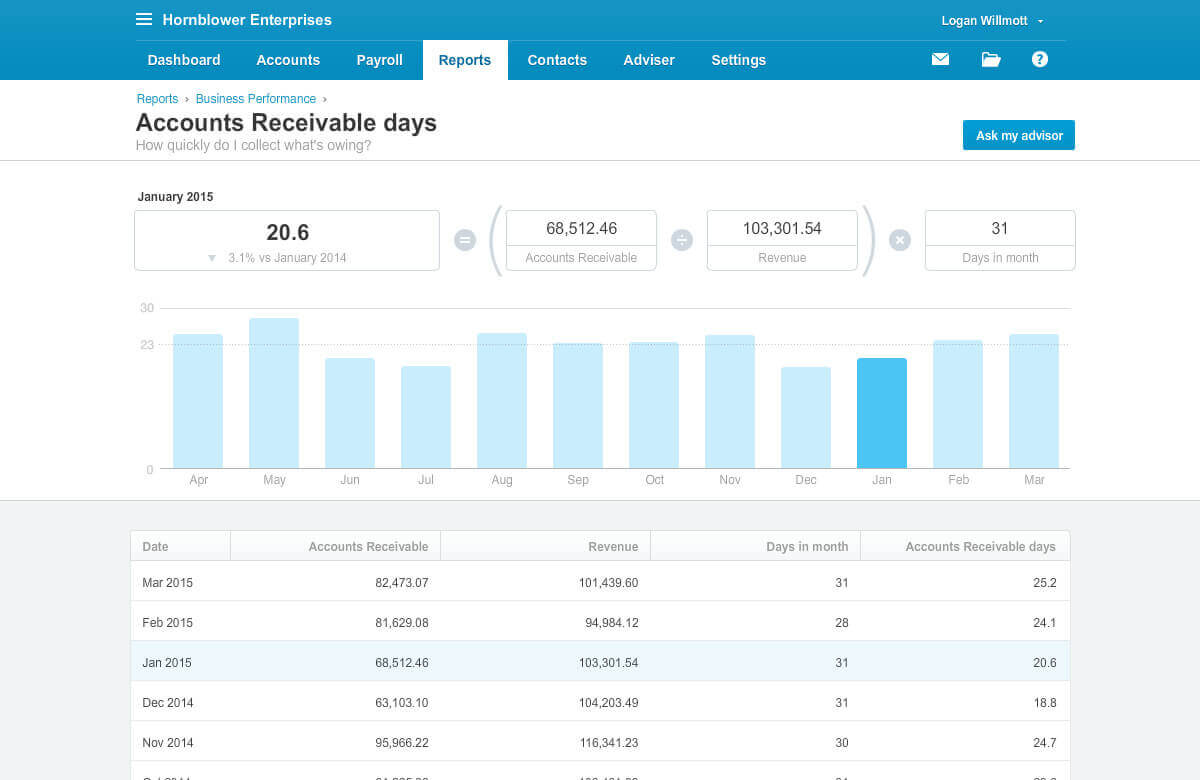

Financial Dashboard

Think of a financial dashboard as your business's control centre. It's a live, customizable display of your financial and operational data. Like a dashboard in a car, it shows you the vital signs of your business, but you get to choose which gauges matter most to you.

These dashboards aren't static reports; they're dynamic and real-time. So, whether you're a manager or executive, you can have a dashboard that puts the crucial information right in front of you. It's like having the financial heartbeat of your business at your fingertips.

Business Performance Dashboard in Xero. Source: Xero

CFO Dashboard

A specialized CFO dashboard is the financial cockpit, offering a comprehensive view of your company's fiscal health. It presents crucial metrics like working capital, accounts receivable and payable turnover, credit utilization, payroll insights, and financial trends. This dashboard empowers your CFO to make well-informed decisions and navigate your company's economic course.

Statement of Shareholders’ Equity

Consider the statement of shareholder equity your financial compass, guiding business owners through retained earnings after dividends have been shared with shareholders. Its purpose? To provide a clear account of changes in shareholders' accounts, tracking investments by owners, distributions, net income, and other comprehensive income.

It's not just about numbers; it's a roadmap. This statement unlocks valuable insights for those financially supporting the business. It unveils the intricacies of equity withdrawals and dividend payments, offering a detailed snapshot of your company's financial performance.

Notes to Financial Statements

Financial notes are essential to financial statements, providing valuable insights and context to the numbers. They're like the guidebook that helps you navigate the economic landscape of a company.

In these notes, you'll uncover significant accounting policies, including details about methods like LIFO or FIFO for inventory measurement. They also clarify whether the company follows cash or accrual accounting methods.

But it doesn't end there. These notes go the extra mile, offering a detailed breakdown of how the figures were calculated. Plus, this type of financial report provides transparency and credibility to your financial statements, ensuring they're not just a collection of numbers but a reliable account of your business's financial journey.

Why Is Financial Reporting Important?

Financial reporting primarily aims to assist finance professionals, business partners, department heads, and stakeholders in making strategic decisions regarding a company's operations, expansion, and future profitability. Public companies must provide quarterly and annual reports, while internal assessments can be monthly.

Regularly assessing a company's financial performance and stability serves the following purposes:

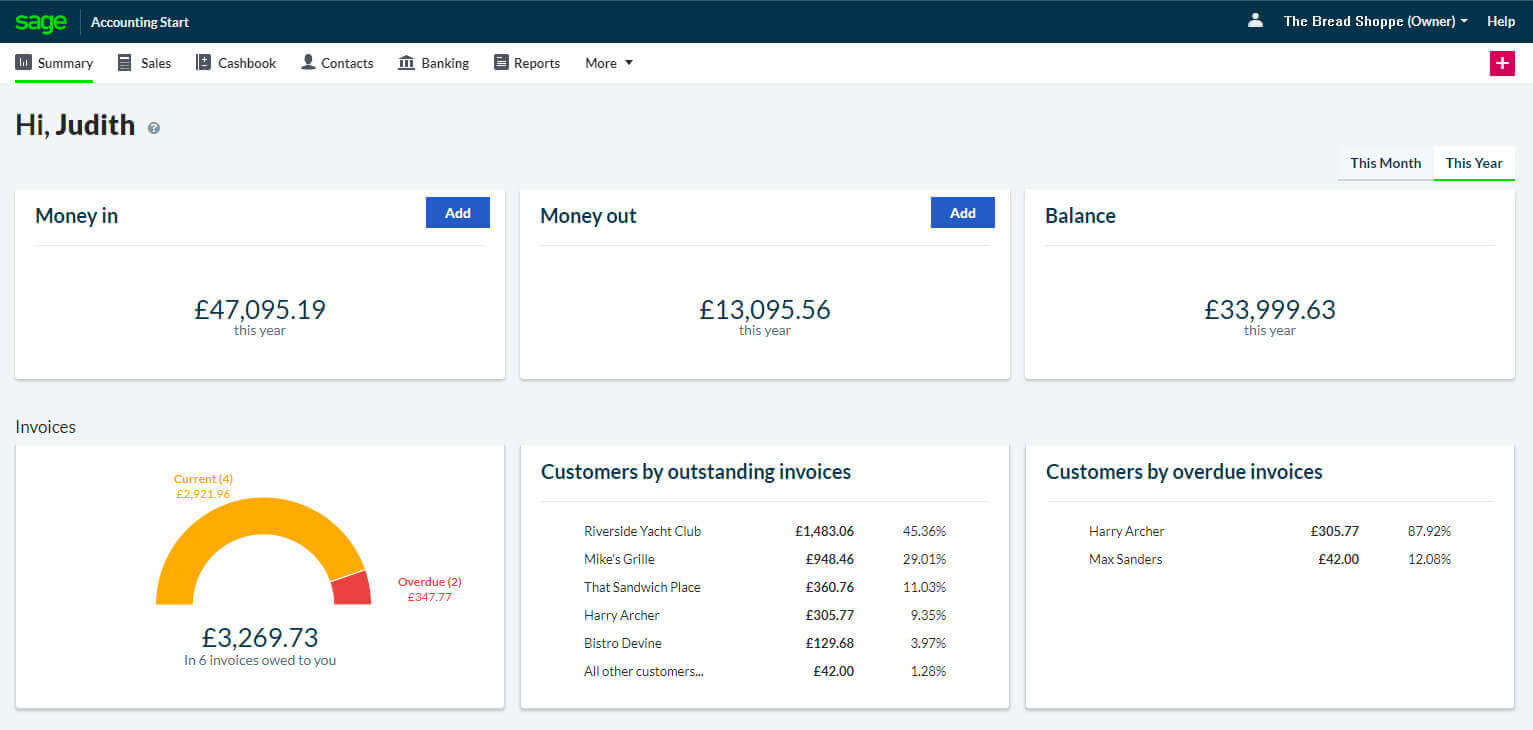

Examine and Analyze Cash Flow

A company's income statement tells about its profits but doesn't show its cash movements. Cash comes in and goes out from various activities, like day-to-day operations and other investments and loans. Investors want to see the cash flow statement because it reveals how much cash a company has and if it can cover its expenses and purchases.

A cashflow dashboard in Sage 50cloud. Source: Sage

Ensure Tax Compliance and Optimize Liability

One key reason for using financial reports is legal compliance. The law, including the Internal Revenue Agency, requires businesses to provide these reports to ensure they pay the correct taxes. Proper financial reporting helps companies to lower their tax bills and manage their resources effectively.

Show Financial Condition to Potential Investors

Potential investors and lenders want to understand a company's financial health before investing. They rely on financial reports, especially the balance sheet, to get a clear picture of the company's assets, debts, and equity. Financial statements help them decide if it's a good investment.

Examine and Distribute Information on Shareholder Equity

The Statement of Shareholders' Equity is essential for investors interested in a company's ownership. It reveals how different ownership parts, like retained earnings, change over time.

Shareholder equity equals a company's assets minus its debts, reflecting its overall value. When a business's equity grows consistently due to increased retained earnings, it leads to better returns for existing shareholders rather than bringing in more shareholders.

Mitigate Financial Reporting Errors

Precise financial reporting aids businesses in identifying expensive mistakes and internal errors at an early stage. It is a potent tool for uncovering illicit economic activities, often through discrepancies in financial statements.

Companies can pinpoint accounting errors or any unauthorized alterations within their operations by meticulously reconciling their accounts and scrutinising journal entries. This thorough process helps maintain the integrity of financial data and safeguards against potential financial misconduct.

Compare Actual Results to the Budget

Financial reporting compares the outcomes to a firm's budget to assess how closely actual performance aligns with planned values. This information aids in fine-tuning ongoing operations and bringing future results in line with the plan. It becomes crucial when actual results fall short of the covenants mandated by lenders since this breach can lead lenders to call outstanding loans.

Help with Business Decision-Making, Planning, and Forecasting

Examining and comprehending financial statements is crucial when businesses face significant decisions. Financial reports enable management to spot trends and potential issues and closely monitor their financial health. Maintaining a good grasp of your financial statements provides the basis for making swift and well-informed decisions when necessary.

Benefits Of Financial Reporting

Curious about the advantages of establishing a robust financial reporting system for your business? Beyond the initial setup efforts, effective financial reporting brings a multitude of benefits to your company:

|

Benefits |

Description |

| Better Debt Handling | Improve debt management for financial stability. |

| Instant Insights | Access real-time data for quick decision-making. |

| Spotting Trends | Identify and forecast business trends. |

| Balancing Act | Keep liabilities in check with assets. |

| Easy Access and Sharing | Quickly access and share essential financial records. |

| Understanding Cash Flow | Gain insights into your money flow. |

| Attracting Investors and Creditors | Provide valuable information to investors and creditors. |

| Fraud Prevention | Implement safeguards to prevent fraudulent activities. |

Figure 2. Benefits of a financial reporting system

What Is the Objective of Financial Reporting?

Indeed, the core objective of financial reporting is to provide critical decision-makers, like business owners and shareholders, with the information they need to make informed choices for the company. It's all about ensuring that every financial aspect, from income to expenses, is accounted for. Financial statements help in:

- Tracking how the business is performing.

- Understanding its financial health.

- Managing cash flow effectively.

- Making decisions about investments and dividends.

Overall, financial reporting is a tool that ensures everyone knows where the company stands financially and can make the best decisions to move it forward.

What Does Financial Reporting Include?

Financial reporting is like telling a company's financial story. It's the process of sharing important financial information with different groups, like managers, investors, and government agencies.

Here's what financial reporting includes:

- External Financial Statements: These are key financial documents, like the income statement and balance sheet, that show how the company is doing.

- Notes to the Financial Statements: These are extra details that help explain the numbers in the financial statements.

- Quarterly Updates: Consider these regular check-ins, where the company shares how it's doing during the year.

- Annual Reports: These are like the big yearly summaries, showing the company's financial journey.

- Online Info: Nowadays, you can often find financial reports on a company's website.

- Reports to Government: Companies also share financial info with government agencies to follow the rules.

- Securities Documents: When a company sells stocks or other investments, there are special documents to explain what's happening.

The Best 6 Financial Reporting Software

Today, businesses rely on sophisticated financial reporting software more than ever before. These tools not only simplify complex financial tasks but also offer valuable insights. Let’s explore the top seven financial reporting software that can empower your organization with data-driven decision-making.

| Accounting Tool | Features and Capabilities | Suitable for Businesses of | Pricing (Starting)* |

| FreshBooks | User-friendly, Invoicing, Expense Tracking, Time Tracking | Small to Medium-sized Businesses | Starting at $15/month |

| NetSuite | Comprehensive, Financial Management, ERP | Medium to Large Enterprises | Contact for Pricing |

| Xero | Cloud-based Invoicing, Payroll, and Inventory Management | Small to Medium-sized Businesses | Starting at $20/month |

| QuickBooks Online | Invoicing, Expense Tracking, Tax Preparation | Small to Medium-sized Businesses | Starting at $25/month |

| Sage 50cloud Accounting | Accounting, Invoicing, Cash Flow Management | Small to Medium-sized Businesses | Starting at $50.58/month |

| SAP ERP | Enterprise Resource Planning, Financial Management | Large Enterprises and Corporations | Contact for Pricing |

Figure 3. Comparing financial reporting solutions

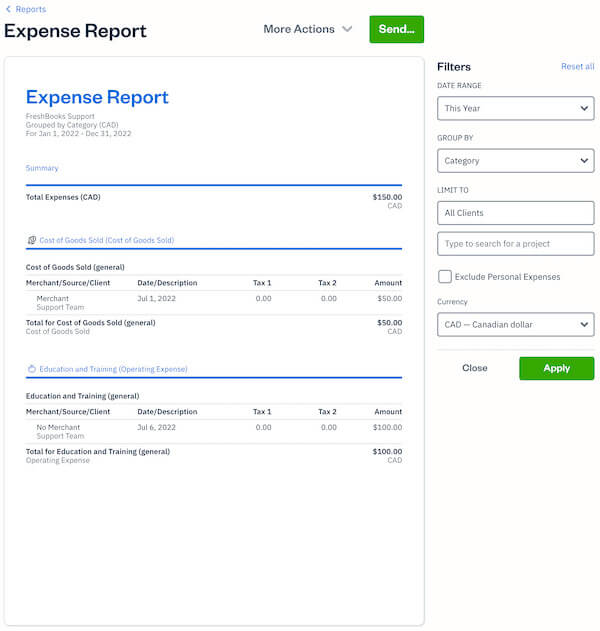

FreshBooks

FreshBooks is a versatile financial reporting tool tailored for small businesses. FreshBooks simplifies financial management with various features, including financial reporting templates, real-time profit and loss reports, expense tracking, and mileage monitoring. Its mobile app streamlines tasks like invoice creation and mileage tracking, making it a comprehensive solution for small businesses' financial needs.

Expense report template in FreshBooks. Source: FreshBooks

Core Features of FreshBooks

- Invoice and expense tracking: Create and track invoices, expenses, and receipts in one place.

- Automated financial reports: Easily generate reports like profit and loss statements and balance sheets.

- Time tracking: Track billable hours and incorporate time data into financial reports.

- Tax preparation: Simplify tax season with reports designed for tax filing.

- Client portal: Share financial reports with clients through a secure portal.

- Bank reconciliation: Seamlessly reconcile bank transactions with your accounts.

- Expense categorization: Categorize expenses for accurate financial analysis.

- Integration options: Connect with various payment gateways and accounting software.

Pricing: It typically starts with a Lite plan at $15 per month and goes up to Premium and Select plans that offer more features at higher costs.

Verdict: FreshBooks is an excellent choice for freelancers, small business owners, and self-employed professionals. Its user-friendly interface and invoicing capabilities make it perfect for those who need simplified financial reporting without the complexity of a full accounting suite.

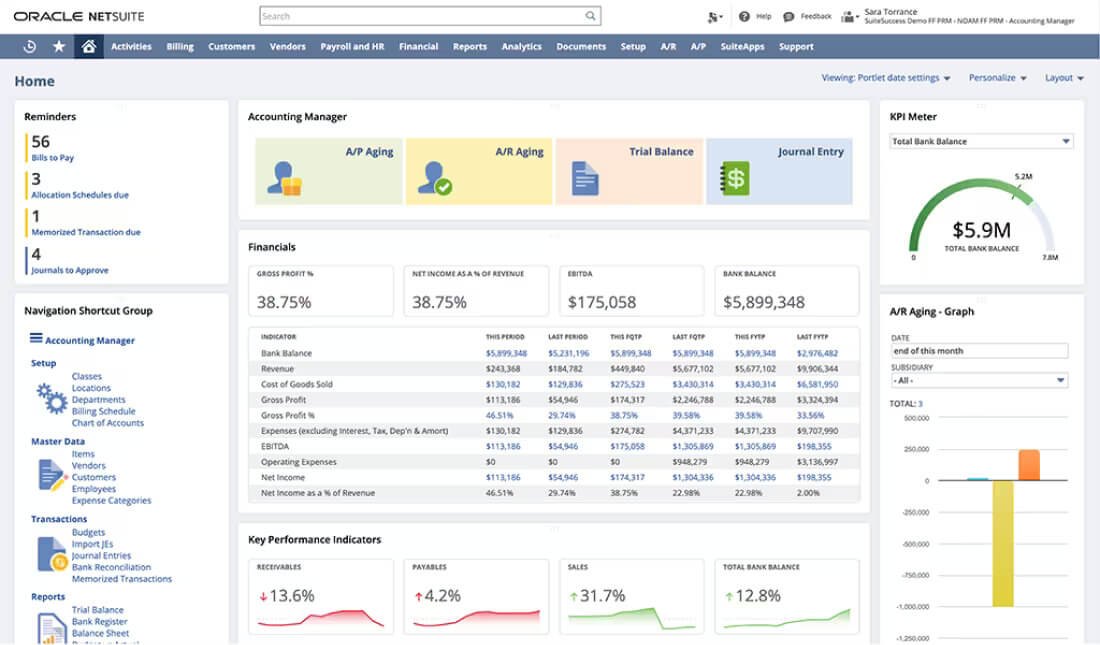

Oracle NetSuite

Oracle NetSuite is a versatile financial reporting solution ideal for large enterprises. This financial reporting tool seamlessly combines financials, inventory management, ERP, commerce, and supply chain management.

Its embedded analytics, customizable dashboards, and robust data handling capabilities set it apart, making it an excellent choice for managing substantial volumes of data. NetSuite offers role-specific dashboards for personalized insights and empowers large organizations with valuable operational performance insights.

Financial reporting sample in NetSuite Oracle. Source: NetSuite

Primary Features of Oracle NetSuite

- Integrated financials: Streamline financial management across your organization.

- Customizable dashboards: Tailor insights to user needs for quick decision-making.

- Embedded analytics: Make data-driven decisions with in-depth analytics.

- Data export: Easily access and analyze data for specific timeframes.

- Scalability: Handles large data volumes and complex reporting.

- Role-specific dashboards: Customize user dashboards for relevant information.

- Supply chain integration: Seamlessly connects with supply chain management.

- Commerce management: Facilitates e-commerce sales and financial tracking.

Pricing: It usually involves a licensing fee and additional costs for implementation and support.

Verdict: Opt for NetSuite if you manage a midsize to large enterprise. It's a comprehensive cloud-based ERP system ideal for businesses that require robust financial reporting, scalability, and integrated features across various departments.

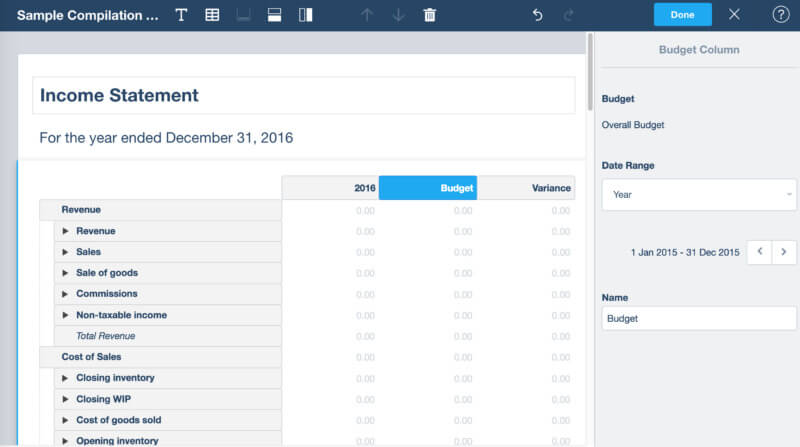

Xero

Xero is a cutting-edge small business software designed to enhance the operations of small companies and their advisors, fostering growth and success. This online accounting platform is a central hub, connecting businesses to their banks, accounting tools, payment services, and third-party applications, ensuring secure and accessible access from any device, anytime.

Client reporting in Xero. Source: Xero

Main Capabilities of Xero

- Virtual accounting: Access financial data anytime, anywhere.

- Bank reconciliation: Automatically categorize and reconcile bank transactions.

- Invoicing: Create and receive payments for invoices online.

- Expense tracking: Manage expenses, capture receipts, and process claims.

- Financial reports: Generate detailed reports like P&L, balance sheets, and cash flow.

- Inventory management: Track and control inventory, pricing, and orders.

- Payroll: Streamline payroll tasks and tax calculations.

- Integration: Connect with third-party apps and financial institutions for a complete financial solution.

Pricing: Plans start at $11 per month and go up depending on the level of functionality and the number of users.

Verdict: Xero suits small to medium-sized businesses that desire easy-to-use, cloud-based accounting software. It's attractive for its extensive third-party app integrations, making it versatile for various business needs.

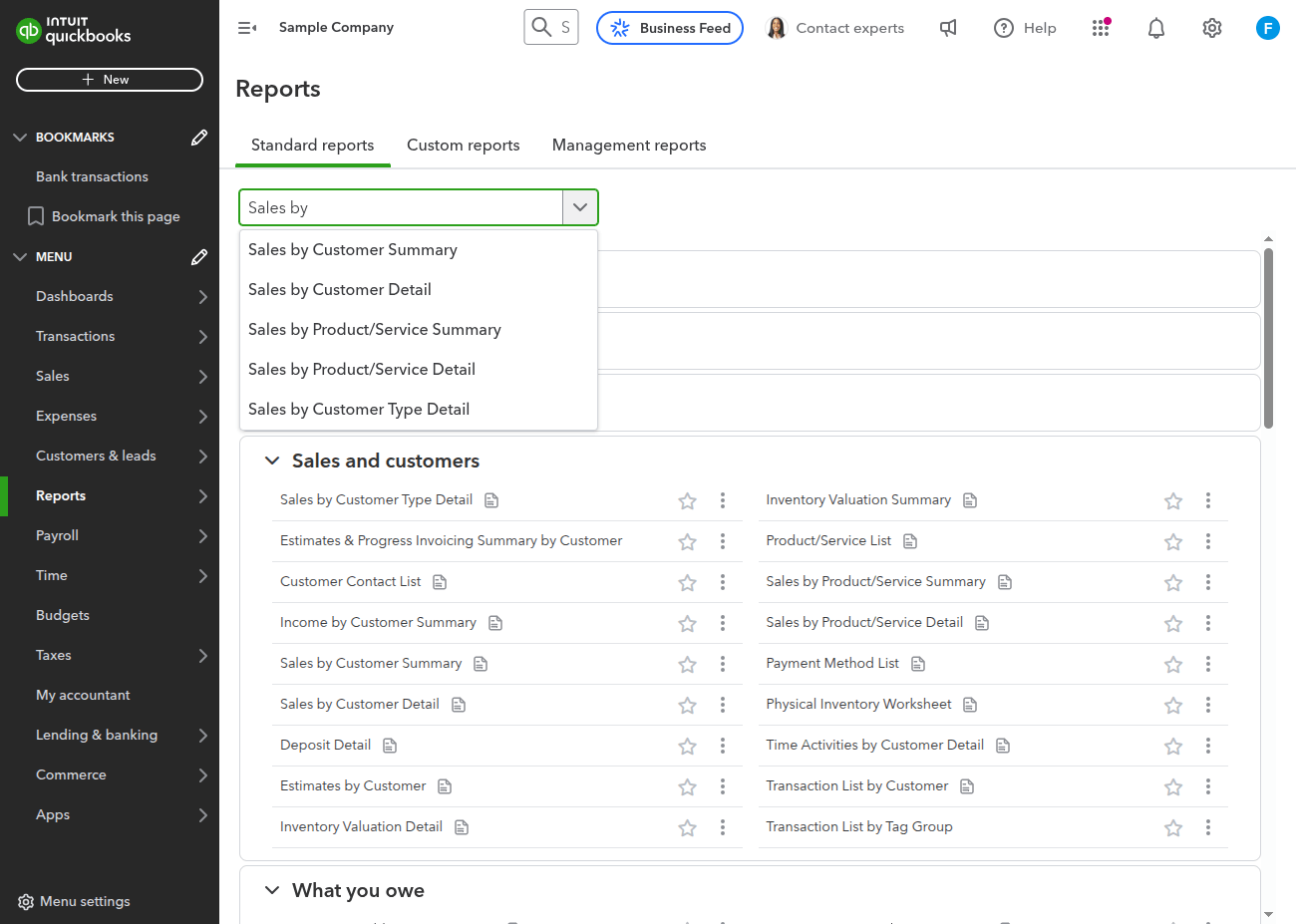

QuickBooks Online

QuickBooks Online is a versatile accounting software designed for small businesses, offering essential financial management tools such as payroll processing, invoicing, bookkeeping, and robust reporting capabilities. It simplifies critical business tasks with features like time tracking and payroll processing.

This financial reporting solution lets you create professional invoices and efficiently manage payments. Or gain insights into cash flows through instant profit and loss statements, providing valuable financial insights when needed.

Sample financial reporting in QuickBooks Online. Source: QuickBooks Online

Primary Functions of QuickBooks Online

- Real-time financial reports: Instant access to financial statements.

- Expense tracking: Efficiently manage business expenses.

- Invoice management: Create and send professional invoices.

- Bank reconciliation: Automatically sync and reconcile transactions.

- Tax preparation: Simplify tax-related tasks and reporting.

- Multi-user access: Collaborate with varying permission levels.

- App integration: Extend functionality with third-party apps.

- Mobile accessibility: Manage finances on the go with the mobile app.

Pricing: It typically begins with a Simple Start plan at $25 per month, followed by Essentials and Plus plans with more features at higher costs.

Verdict: QuickBooks Online is a top choice for small businesses and startups. Its straightforward interface, budget-friendly plans, and features like automatic categorization of expenses make it an efficient financial reporting solution.

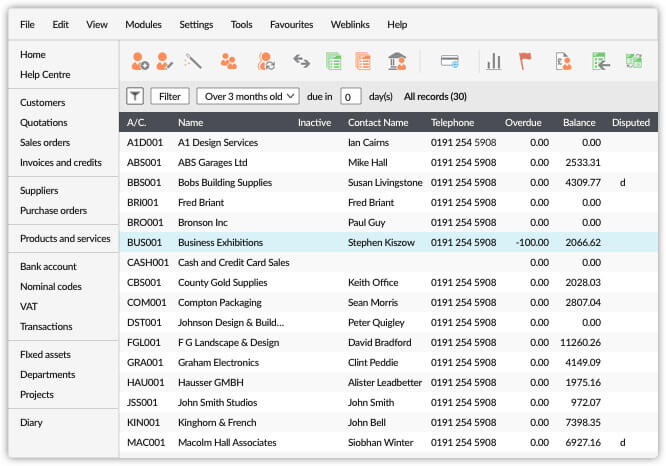

Sage 50cloud Accounting

Sage 50cloud Accounting empowers CFOs to quickly access combined financial and management data for their business units. It's the AICPA's favoured financial management solution, perfect for mid-sized businesses. It helps automate critical processes, reduces spreadsheet use, and provides a clearer view of your business's performance, enabling faster growth.

Cash flow in Sage 50cloud Accounting. Source: Sage

Key Features of Sage 50cloud Accounting

- Financial reporting: Generate customizable financial reports for insights into your company's financial health.

- Multi-currency support: Handle transactions in multiple currencies.

- Bank reconciliation: Easily reconcile bank accounts for accuracy.

- Budgeting and forecasting: Create budgets and forecasts for future planning.

- Inventory management: Manage inventory costs and include data in reports.

- Payroll integration: Include payroll data in financial reports.

- Tax compliance: Generate tax reports and calculate liabilities.

- Multi-user collaboration: Collaborate with team members on reports.

Pricing: Pricing can start at around $50 per month, and additional costs may apply for advanced features and support.

Verdict: Sage 50cloud is well-suited for small businesses and offers robust financial reporting features. It's a great choice if you prefer a hybrid cloud solution with desktop functionality.

SAP ERP

SAP ERP is a robust financial reporting tool tailored for businesses deeply integrated with the SAP ecosystem. It excels in streamlining financial consolidation and closing processes, seamlessly merging operational and group reporting.

With versatile deployment options—on-premise, cloud, or hybrid—it offers unified entity, group close reporting, and continuous accounting functionalities. This solution grants real-time data access, accelerates financial closings, and harmonizes consolidation and transactional activities for enhanced financial management.

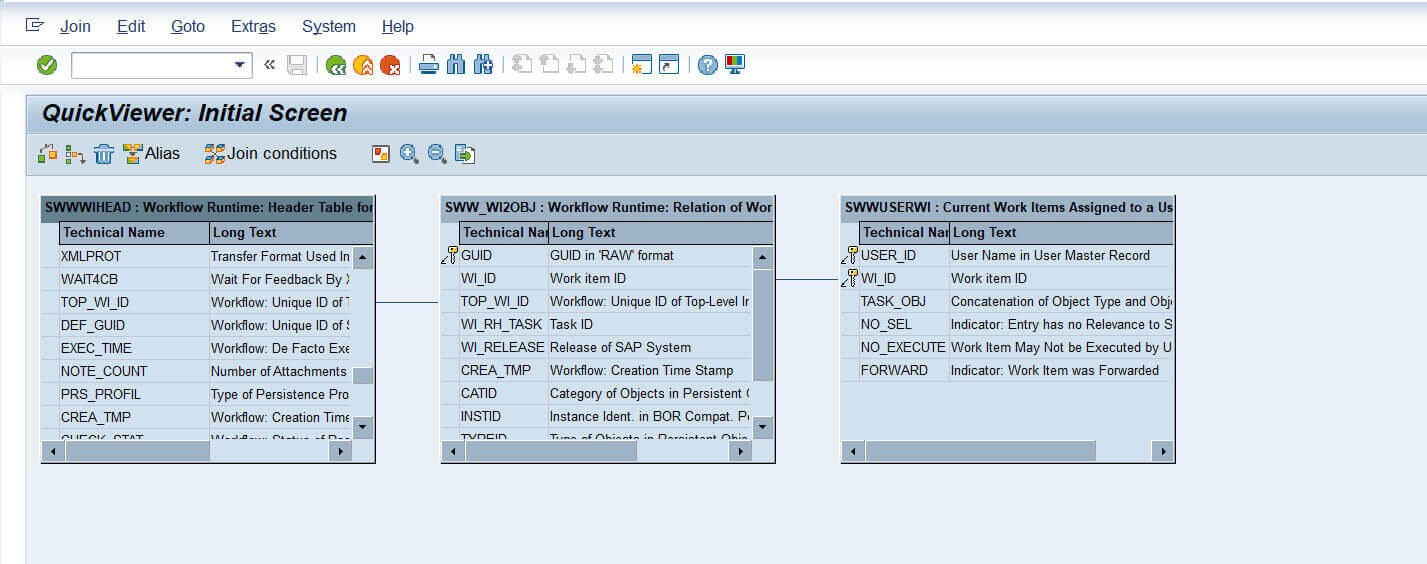

A SAP Workflow Report. Source: SAP

Core Functions of SAP ERP

- Flexible deployment: Offers on-premise, cloud, or hybrid options.

- Unified reporting: Simplifies financial consolidation and reporting.

- Continuous accounting: Ensures up-to-date financial processes.

- Real-time access: Provides instant access to critical data.

- Faster closings: Speeds up financial close processes.

- Harmonized activities: Combines consolidation and transactions.

- SAP integration: Seamlessly integrates with the SAP ecosystem.

- Advanced reporting: Delivers customizable reports and analytics.

Pricing: Costs can be substantial and depend on customization, deployment size, and ongoing support.

Verdict: SAP ERP is designed for large enterprises with complex financial reporting needs. If you require highly customizable, industry-specific solutions and have the resources for implementation and maintenance, SAP ERP is a powerful option.

Why Leverage Financial Reporting?

Financial reporting, while intricate, is a vital aspect of successful business operations. While each company tailors its reporting system, commonalities exist across the board.

For simplified financial reporting, a financial reporting system is your ally. Choose any suitable cloud-based accounting software to streamline essential tasks like generating cash flow and income statements. And, if you are considering a new tool for financial reporting and accounting, Migration Wizard can import your financial data automatedly and securely.

Frequently Asked Questions

The four fundamental financial reports are:

- Income Statement (Profit and Loss Statement)

- Balance Sheet (Statement of Financial Position)

- Cash Flow Statement

- Statement of Changes in Equity (Shareholders' Equity)

Financial reporting involves collecting, recording, and summarizing financial data, then presenting it as financial statements. This process adheres to accounting standards and regulations, ensuring accuracy and transparency.

Reading financial statements involves analyzing the numbers and key components within each statement. Key points to consider include revenue, expenses, assets, liabilities, equity, cash flow, and any significant trends or changes over time. It's often beneficial to compare statements over multiple periods to identify financial health and performance.

Financial statements typically include:

- Income Statement: Revenue, expenses, net income or loss.

- Balance Sheet: Assets, liabilities, shareholders' equity.

- Cash Flow Statement: Operating, investing, and financing cash flows.

- Statement of Changes in Equity: Changes in shareholders' equity, including dividends and net income.

Financial reporting and accounting are related but not the same. Accounting involves the recording and organizing financial transactions, while financial reporting focuses on summarizing and presenting this financial information to stakeholders.

A financial reporting example includes preparing financial statements such as the balance sheet, income statement, and cash flow statement.

Accountants or financial analysts typically prepare financial statements within a company. In publicly traded companies, these statements are also subject to external audits by certified public accountants (CPAs).

Financial reporting skills include proficiency in accounting principles, financial analysis, data interpretation, and the ability to use financial reporting software and tools effectively. These skills are essential for accurately preparing and presenting financial information.

Have already chosen your accounting platform?

Leave the accounting records migration to us!