Successful business has to keep every process and aspect intact. And a good accounting system makes the foundation of the proper finance running for your company. If you landed at the choice Zoho Books vs Odoo Accounting, this comparison of accounting software appears in time. We’ve nitpicked Odoo Accounting and Zoho Books to see their features, pricing, pros, and cons.

Key Takeaways

- Zoho Books is popular because of its free plan, client portal, multiple payment getaways, and customizable invoice templates. Odoo Accounting, on the other hand, is excellent for businesses that need unlimited users, on-premise accounting software, and various customization options.

- Zoho Books is limited in the number of invoices sent per month and users. As for Odoo Accounting, it lacks time tracking, advanced invoicing, and inventory management.

QuickBooks Online, Xero, and FreshBooks are the most popular Odoo Accounting alternatives and Zoho Books alternatives. - You can import the specific records to Zoho Books and Odoo Accounting in CSV or XML files. Or use a third-party app like Accounting System Migration Service to migrate the data directly.

A Sneak Peek at Zoho Books

Zoho Books is the cloud-based accounting software built by Zoho Corp. This accounting system tries to meet the lion’s share of business needs by offering workflow automation, time and project tracking, sales and purchase orders and inventory management. In addition, the balance of affordable price model and multiple functions makes Zoho Books a good option for managing all accounting operations.

Transaction locking in Zoho Books. Source: Zoho Books

A Short Odoo Accounting Review

Odoo Accounting is a fully integrated accounting app designed by the Odoo Suite. It helps businesses deal with their daily financial process in a simple way. You can connect up to 24,000 banks to your Odoo app to easily link payment to the statement and reconcile your accounts.

Payment acquires in Odoo Accounting. Source: Odoo Accounting

Zoho Books Key Features

Zoho Books includes several capabilities to handle your accounting tasks quickly. Below is a brief overview of what we’ve found efficient for managing the finances.

Dashboard

Zoho Books’ dashboard is highly interactive. It gives you a 360-degree view of all accounting processes. At the top, you can see overdue and current payables/receivables. Below, you get a customizable chart that compares both expenses and income. There you can also monitor the accounting of your top expenses. In addition, you can access various Zoho Books’ functional areas through the left vertical pane.

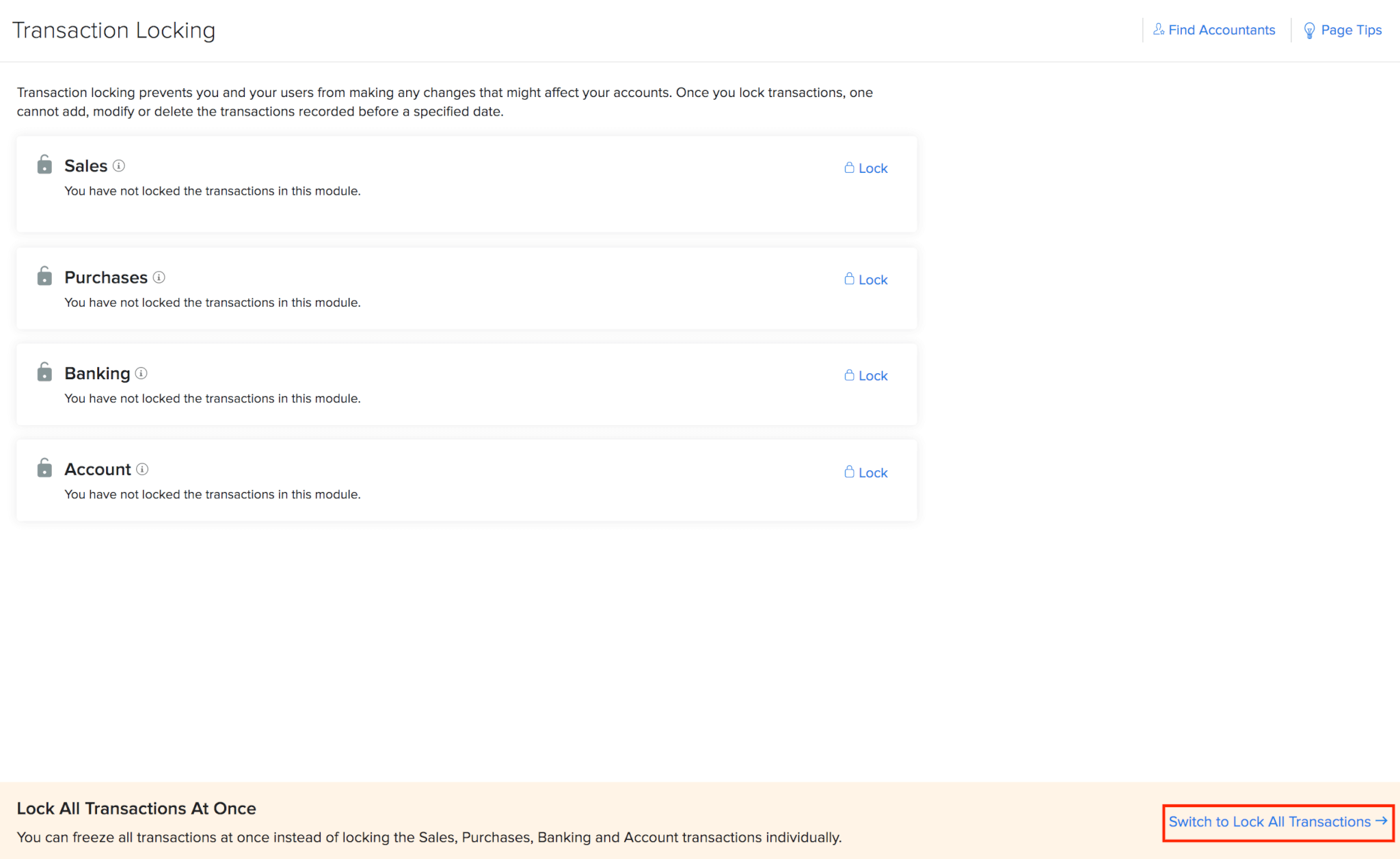

An example of purchase in Zoho Books. Source: Zoho Books

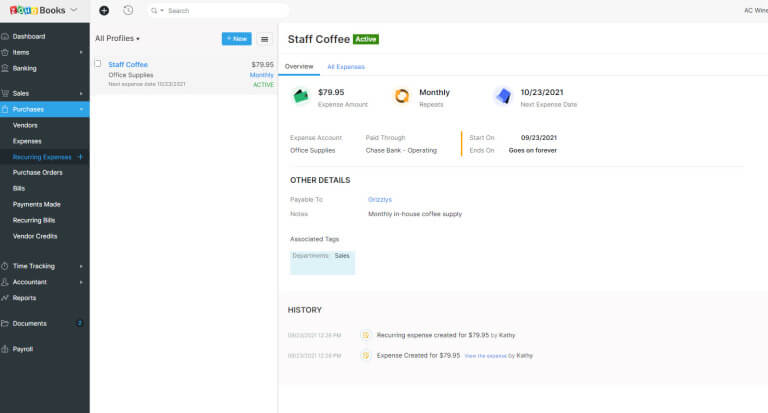

Invoicing

When it comes to invoicing, Zoho Books offer basic and advanced functions. For starters, you can set up projects, track the time spent on them, and charge customers for billable time. Moreover, you can also monitor and invoice billable expenses.

If the default invoices don’t meet your needs, Zoho Books has over 16 customizable templates. You can

- adjust fonts or choose a language from supported ones

- add a logo and a background image

- change the color for the background, company name, customer name, and the rest of the text

Customize an invoice template in Zoho Books. Source: Zoho Books

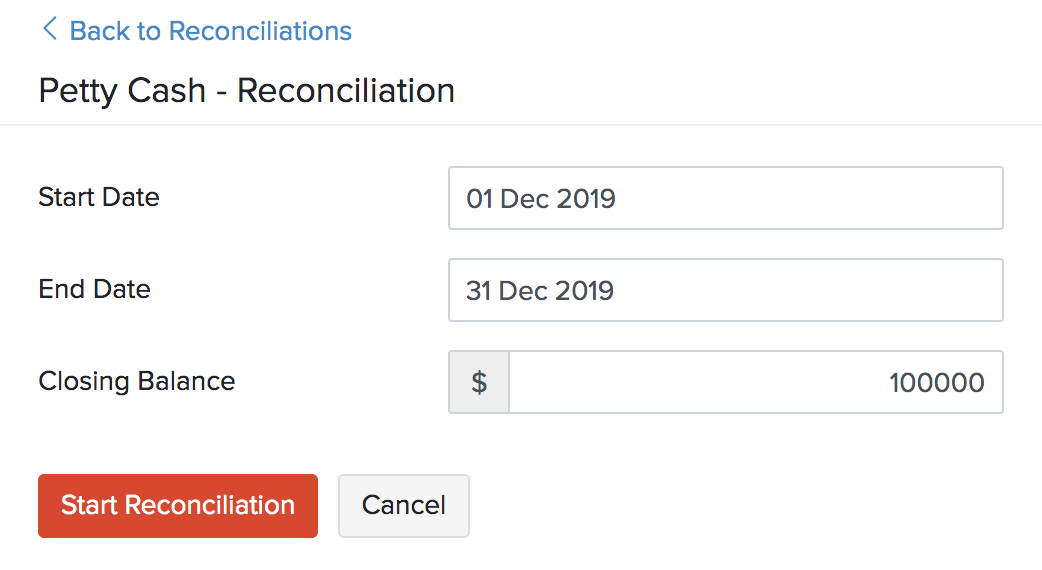

Bank reconciliation

Easily reconcile an account, so the transactions made in Zoho Books coincide with the transactions in your bank account. Beyond that, the accounting software lets you set up the period for account reconciliation. Then again, you can connect multiple bank accounts to Zoho Books and view all transactions on your dashboard.

Reconcile an account in Zoho Books. Source: Zoho Books

Customer service

In contrast to other accounting tools, Zoho Books provides multiple support options. Contact the customer service team via phone, email, or live chat.

If you are starting with Zoho Books or have a free plan, you can reach customer support via email only, but you also can check Help Docs and FAQs for an answer or fix.

User access

As a cloud-based accounting system, you can access Zoho Books anytime and anywhere (if you have an internet connection). But, depending on your pricing plan, you can get a limited number of users. Zoho Books’ highest tier includes up to 15 users, while the Free plan is accessible for one user and one accountant.

The additional user comes with a fee of $2.50 per user/month. You can add them to any plan. In addition, Zoho Books has a mobile app for iOS, Android, and Windows.

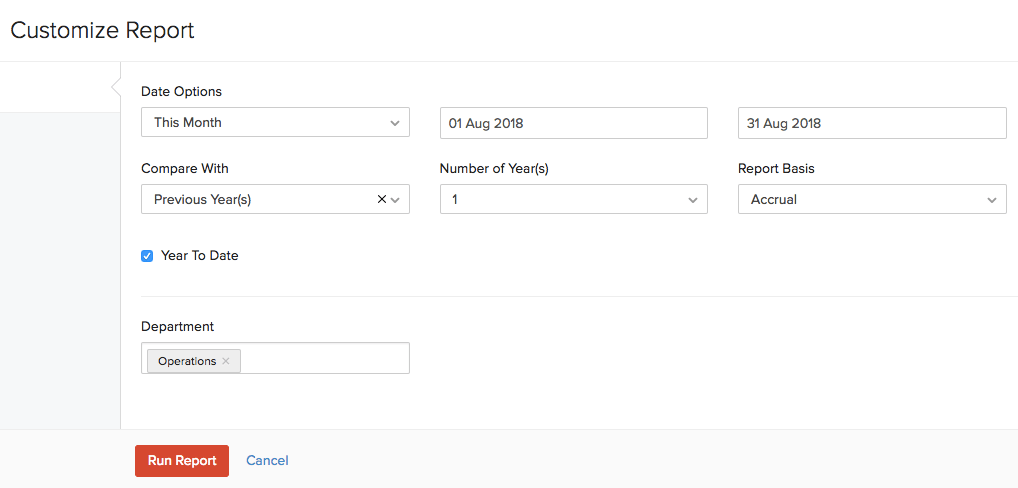

Reporting

Access over 50 reports with Zoho Books, including the most basic accounting and helpful sales reports. For instance, you can

- create custom reports

- organize reports with tags

- share reports with your team

Automated report generation enhances collecting reports weekly, monthly, quarterly, or annually. You can receive them in XLS, CSV, or PDF format via email.

Customize a report in Zoho Books. Source: Zoho Books

Automated reports can give you an overview of your company’s performance with summaries of active projects, cash flow, and more.

Time and mileage tracking

With time tracking, you can create a project and connect a built-in timer to it and monitor time spent on this project. The timing can be added manually as well. Mileage tracking would be useful for recording traveled distance and odometer readings.

Accounts payable

Generate payment reminders, bills, and recurring bills through Zoho Books. What’s more, you can

- add internal notes or attachments to bills

- auto scan bills and expenses

- match POs with invoices

- set up recurring invoices

- approve payments

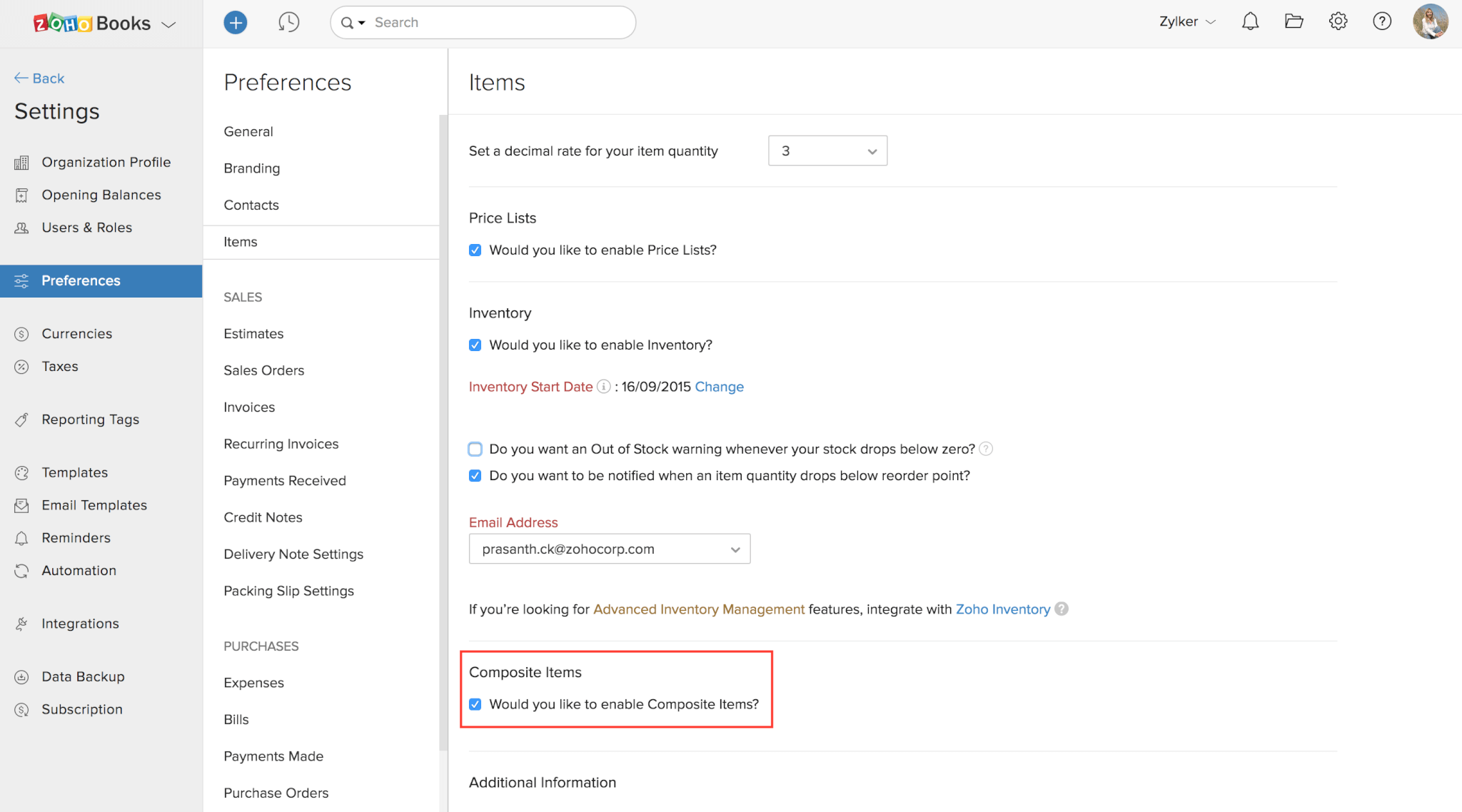

Inventory management

In Zoho Books, each plan offers an essential item list, but the Elite Plan and higher tiers offer complete inventory management. Here each inventory item can include an item name, sales cost, rate, unit, and a link to a specific account. You select if the item is taxable or not. Similarly, you can use the “Price List” function to create numerous pricing levels for the items.

Enable Composite Item in Zoho Books. Source: Zoho Books

Security

Zoho Books follows strong security measures, including two-factor authentication, data encryption, and virus scanning. Also, Zoho makes a data backup regularly and preserves it on multiple servers. Zoho’s accounting software complies with the EU-US Privacy Shield Framework.

What Features to Consider in Odoo Accounting?

Odoo Accounting offers a rich list of functions to a) improve productivity and b) save time on manual processes. For instance, you can automate follow-ups, manage expenses and recurring bills. Here is an insight into other prominent Odoo Accounting functionality.

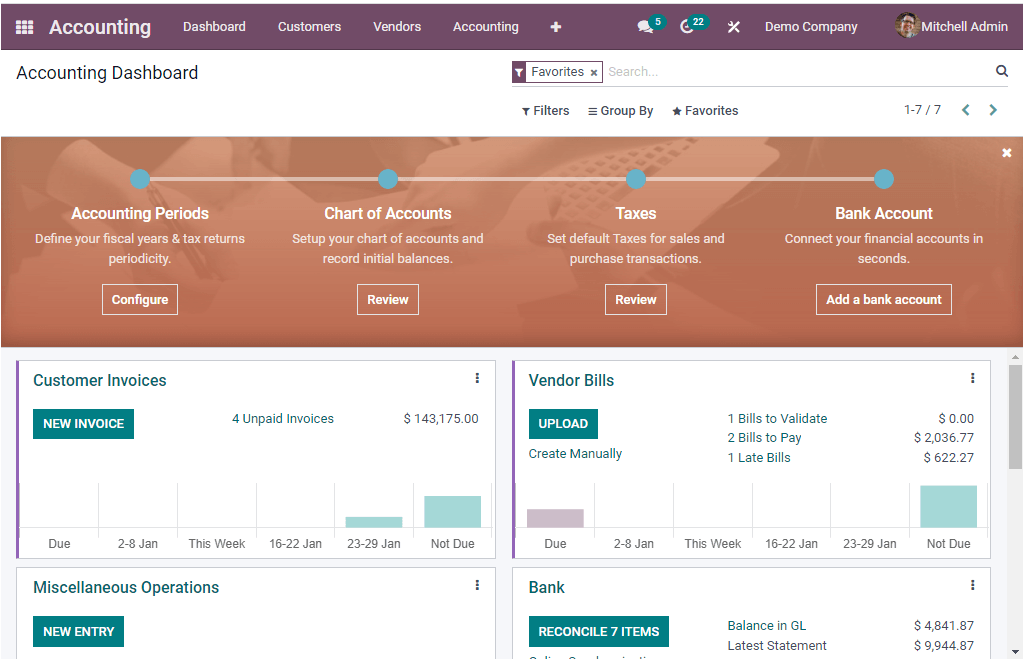

Dashboard

The basic dashboard offers a quick overview of all financial processes. You can also access detailed reports on customer invoices and vendor bills via the menu navigation.

Similarly, you can set up your dashboard, including all custom reports, and share it across departments for better team collaboration. Or you can create a revenue dashboard to collect and analyze such SaaS metrics as CLT, ARR, CAC, MRR, Churn, etc.

Accounting dashboard in Odoo Accounting. Source: Odoo Accounting

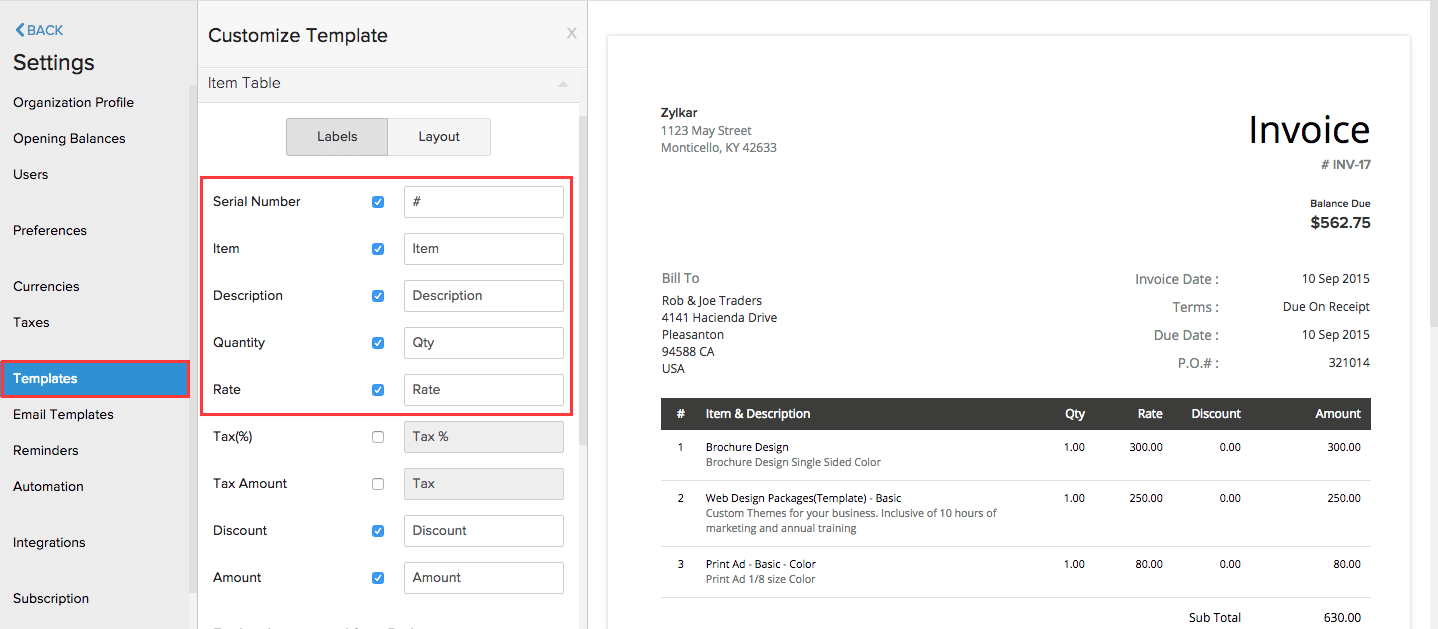

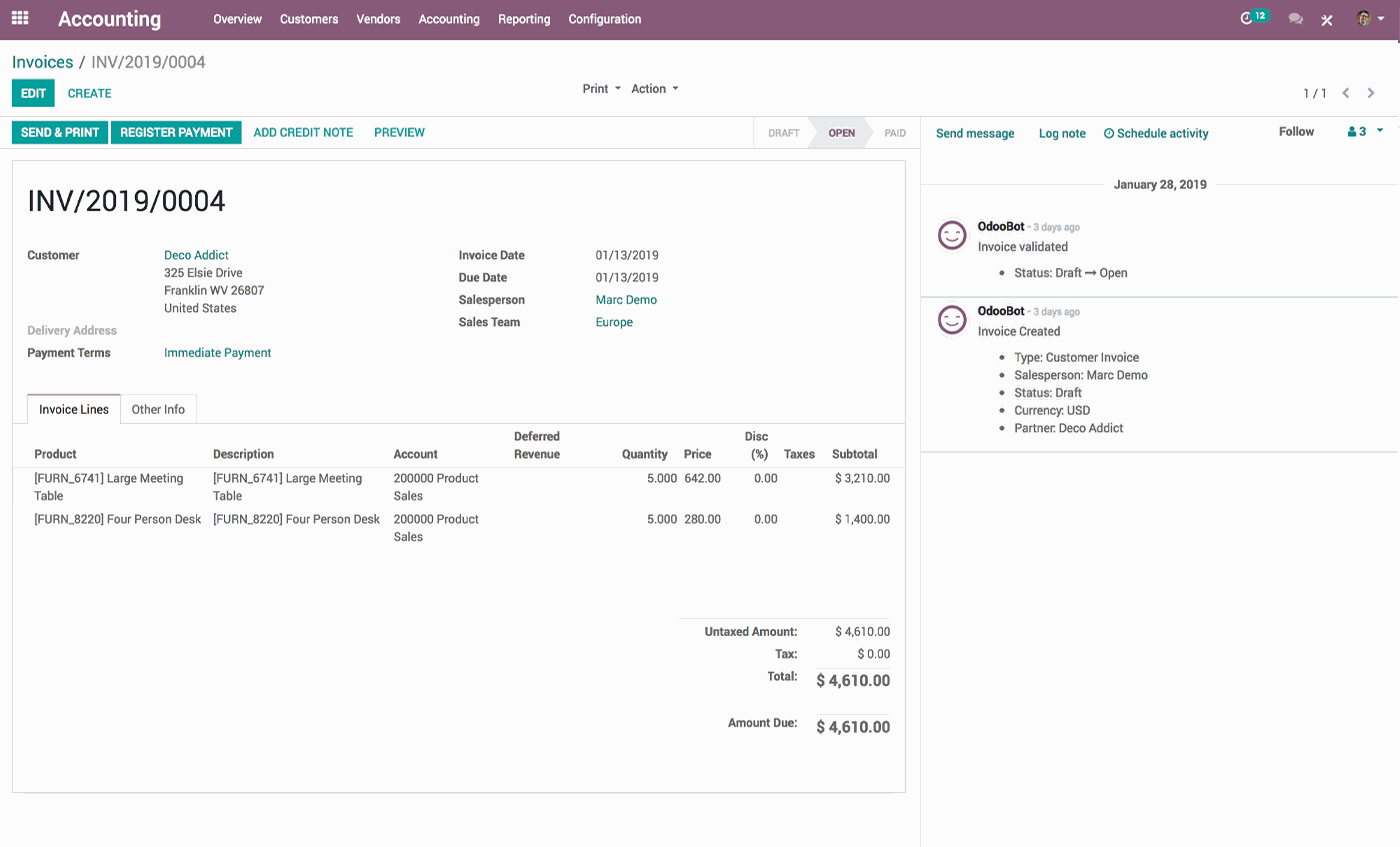

Invoicing

Create full-featured invoices that include price lists, multiple taxes, payment terms, and discounts. In addition, you can set up draft invoices based on delivery orders, timesheets, or sales orders.

Odoo Accounting suggests payments when you create invoices. This way, you don’t need to reconcile it later.

An invoice example in Odoo Accounting. Source: Odoo Accounting

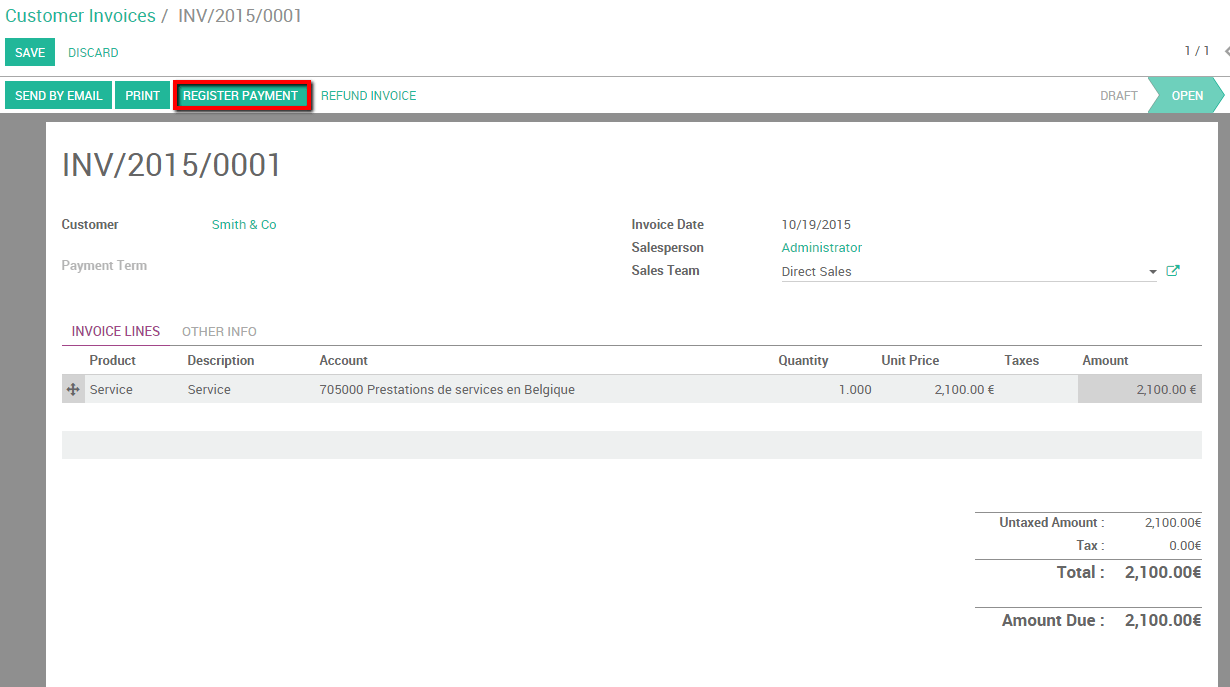

Bank reconciliation

Receive a full or partial reconciliation directly from the invoice or bank statement. With Odoo Accounting, you can audit your accounts and bank statement balance to spot any differences.

Deposit ticket helps you simplify the bank reconciliation process. In general, a deposit ticket combines several payment orders (usually checks) deposited at the same time at the bank.

Bank reconciliation in Odoo Accounting. Source: Odoo Accounting

Customer service

Need help? Create a ticket on the Contact Us page or call the suitable Odoo Office directly. Odoo Accounting has a Community Forum where you can ask questions, find answers in solved issues, or connect with Odoo experts. If your case is specific, arrange an appointment with the Odoo support rep to get

- a custom demonstration

- answers to your questions about Odoo

- recommendations based on your needs

- details about pricing & methodology

User access

Odoo Accounting is available in two versions: cloud-based and on-premise accounting systems. If you use a Free or Standard pricing plan, you can only use a cloud accounting solution with a unlimited number of users. To set up the on-premise version, request a Custom package.

Odoo Accounting also has a mobile app so that you can access all accounting functions whenever you are.

Reporting

Odoo Accounting has numerous report types to get insights into all accounting processes. To enlist a few

- advanced customer statement to understand every customer use case

- aged receivable balance to monitor treasury forecast and overdue payments

- business intelligence reports, including cash reports, Profit & Loss, and cash flow statements

- balance sheet to watch your current year earnings

- tax reports per the right country and in accrual or cash based

Both reports and charts of accounts are available for over 80 countries worldwide and can be exported to PDF or XML files.

Time and mileage tracking

Odoo Accounting has no built-in features for time and mileage tracking. You can integrate Timesheet, a native app by Odoo, or seek any suitable third-party application.

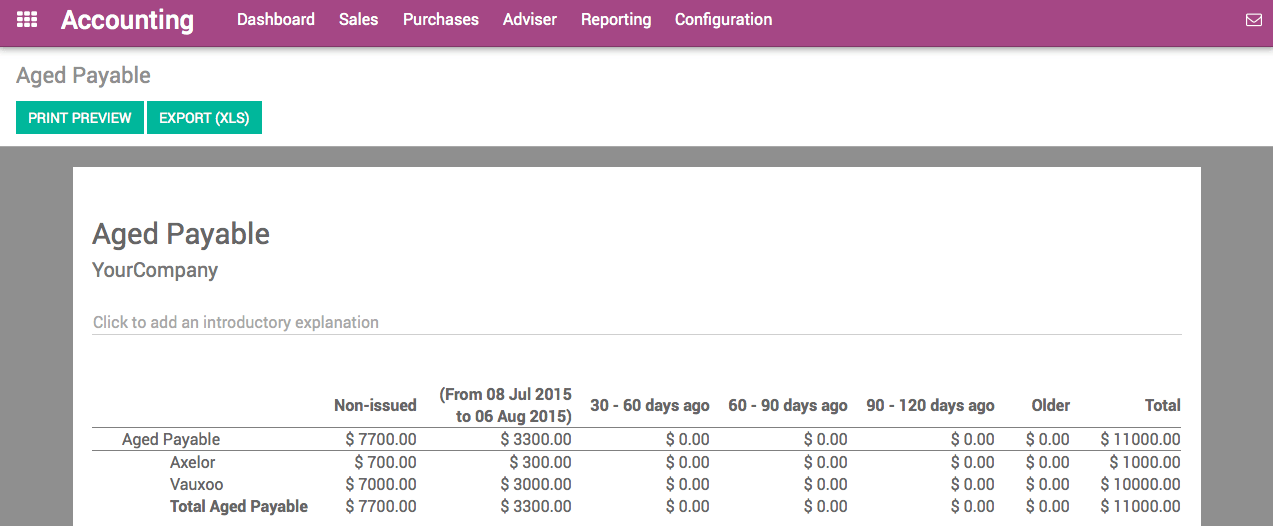

Accounts payable

Manage vendor bills and payments from a single place. You can also configure payments by check, with SEPA, and several bills simultaneously.

Odoo Accounting lets you forecast future bills to manage payment orders to vendors. For that, you can use the Aged Payable report. You can see a summary of each vendor's payment amounts and due dates.

Aged payable report in Odoo Accounting. Source: Odoo Accounting

Inventory management

Odoo Accounting includes basic features to manage inventory. If you need a full-fledged inventory management, you can integrate Odoo Inventory. It lets you work in perpetual or periodic inventory valuations and create accounting entities in the standard price automatically.

Security

Odoo Accounting takes several security measures to protect your data. Its accounting app keeps 14 full backups for up to 3 months in at least 3 locations. Besides, sign-in credentials are always transmitted securely over HTTPS.

For its cloud-hosted version, Odoo Accounting keeps your financial information secure with the following:

- Regular security audits

- 256-bit SSL encryption

- Server facilities with controlled access

The accounting software never saves credit card information inside your account.

Zoho Books vs Odoo Accounting: Pricing

Odoo Accounting and Zoho Books approach pricing plans in different ways. Odoo has just one option, Zoho includes six packages to fit any business. So let’s dig a little deeper.

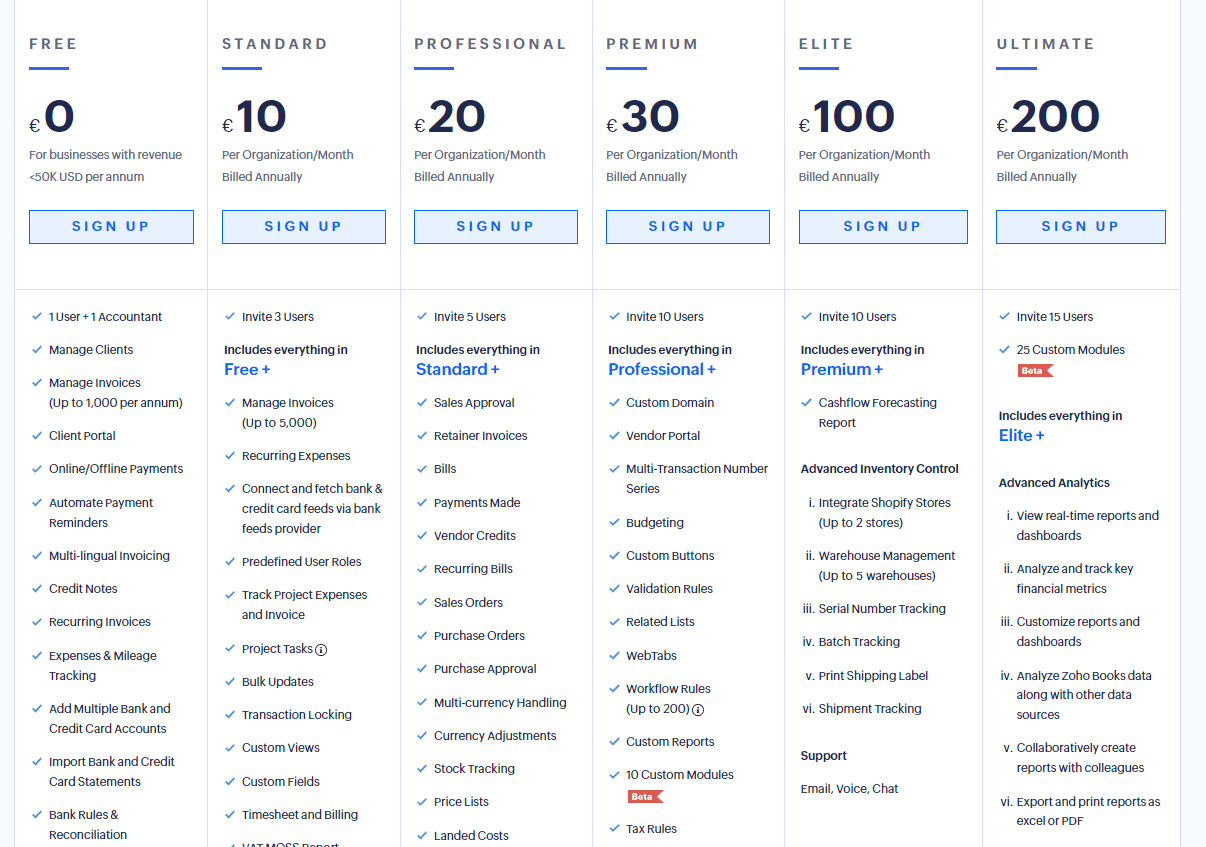

How Much to Pay for Zoho Books?

Zoho Books’ pricing consists of six pricing plans, along with a freemium. You can start with a free plan or sign up for a 14-day trial of any paid plan. Note: no credit card or banking information required. So what does each of these options offer?

- Freemium supports 1 user and 1 accountant. It offers a robust feature set, up to 1,000 annual invoices, a client portal, automatic payment reminders, and email-only support.

- Standard plan includes 3 users and up to 5,000 invoices. The tier is suitable for reconciling accounts and creating invoices and projects.

- Professional plan welcomes 5 users. It advances the previous plan with multiple currencies, sales orders, and purchase orders.

- Premium plan is accessible to 10 users. You can integrate Zoho Sign and Twilio, get a vendor portal and set a custom domain.

- Elite plan also supports 10 users and provides advanced inventory control.

- Ultimate tier includes 10 users, 25 custom modules, and advanced analytics.

Pricing of Zoho Books. Source: Zoho Books

For non-profit businesses like charities, societies, and trusts, Zoho Books offers a 15 % discount.

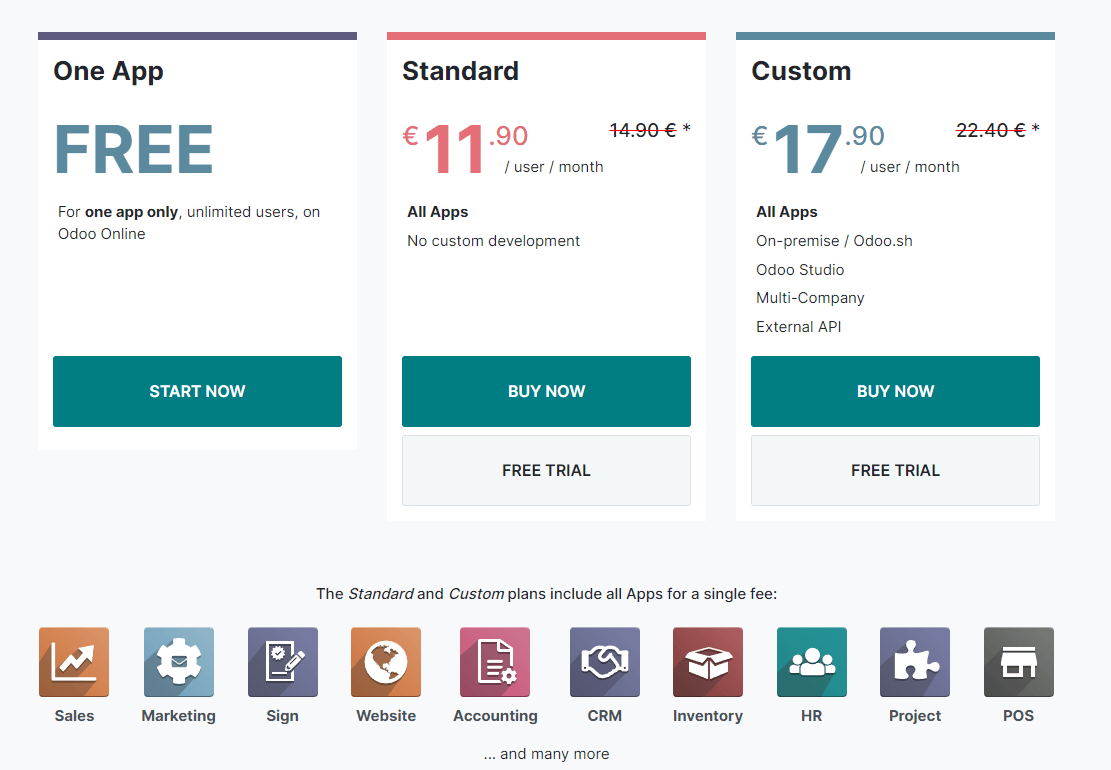

How Much Does Odoo Accounting Cost?

Odoo Accounting is completely free until you don’t integrate any other Odoo apps. No need to upgrade or buy additional users. However, if you want to use another Odoo app, you must pay €11.90 per user/month.

If you require custom development or want to run your on-premise accounting system, opt for the Custom plan.

Odoo Pricing. Source: Odoo

Odoo Accounting vs Zoho Books: Comparing Pricing

When compared side by side, Zoho Books vs Odoo Accounting have peculiarities in pricing. Here are the key differences:

- If implemented alone, Odoo Accounting includes unlimited users while Zoho Books is available to 15 users maximum in the Ultimate plan.

- Zoho Books and Odoo Accounting have a free plan.

- You can integrate more built-in apps with Odoo Accounting.

- Zoho Books includes essential inventory management in any package while you need to integrate Odoo Inventory with Odoo Accounting.

- Odoo Accounting doesn’t offer project management, time and mileage tracking. On the other hand, Zoho Books provide these features starting from the Free plan.

Which Platform Is Better: Zoho Books vs Odoo Accounting?

Actions speak louder than words. But in our case, it’s the users’ option that matters. So let’s see what real-time Odoo Accounting vs Zoho Books end users have to say about these accounting tools.

Pros & Cons of Zoho Books

While Zoho Books comes with many great features, it may meet but doesn’t exceed expectations–so be sure to consider its advantages and disadvantages.

|

Pros |

Cons |

|

|

Odoo Accounting Benefits & Drawbacks

While most Odoo Accounting reviews are positive, several complaints are worth considering.

|

Benefits |

Drawbacks |

|

|

Who Uses Zoho Books and Odoo Accounting?

Zoho Books and Odoo Accounting’s users are scattered across the globe. Based on the Enlyft data, Zoho Books meets the needs of accountants in the US, India, Canada, and the UK, and Odoo Accounting’s users are usually located in US, UAE, and Belgium. Both accounting tools are suitable for companies with up to 50 employees and serve companies that work in IT and services, advertising, and marketing.

How to Migrate Data to Zoho Books or Odoo Accounting?

You’ve made a decision: you want to import to Odoo Accounting or Zoho Books your accounting data. So, how would you manage the migration process?

On one hand, Zoho Books lets you import CSV, TSV, and XLS files. And the list of supported data is pretty vast: customers, timesheets, manual journals, vendors, items, etc. On the other hand, you need to do it all manually.

Odoo Accounting doesn’t offer clear instructions on the data import process. Instead, you can just transfer the lists of customers, vendors, assets, products, and trial balances.

Save your time and effort and, use a third-party app like Accounting & Invoicing Data Migration for an accounting system migration. And it comes with the following benefits:

- You can import all the needed accounting data.

- Automated migration process, so you don’t export and edit CSV or XML files.

- Support agents help you to tune your accoutning transfer.

Zoho Books or Oddo Accounting: Which Financial Tool Should You Choose?

It’s up to you which accounting app to pick: Zoho Books vs Odoo Accounting. But if you’re looking for a feature-packed accounting system that won’t break the bank, choose Zoho Books. The invoicing system is scalable and can fit your business, especially if you a SMB company.

If you want to go over limitations on invoices and users or need extended integration options, Odoo Accounting is your choice. It’s a excellent tool for those who require a variety of customizations. But whatever choice you make, Accounting System Migration Service is on your radar for painless data migration.

Have already chosen your accounting platform?

Leave the accounting records migration to us!