If you run a small business or work as a freelancer, you deal with many clients, invoices, and payments. To keep things organized, you need a good accounting tool. But which one should you choose: FreshBooks vs Odoo Accounting?

In this blog post, we'll compare Odoo Accounting vs FreshBooks, looking at what they offer, how much they cost, and what users think. By the end of this article, you'll have a clear idea of which accounting solution is right for your business.

What Is FreshBooks Accounting Software?

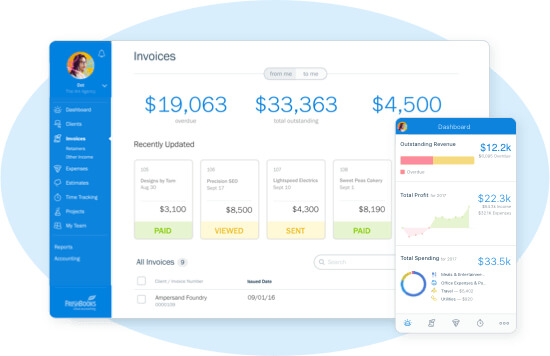

FreshBooks is a software made for small businesses to help them get paid on time. It's excellent for creating and sending invoices and even reminds you about late payments automatically. So, how does FreshBooks work?

While it has basic accounting features like tracking expenses, it focuses more on invoicing than full-fledged bookkeeping. You can send invoices, track mileage, and scan receipts. And its strong phone support and customizable invoicing features make it unique.

Source: FreshBooks

A Short Odoo Accounting Review

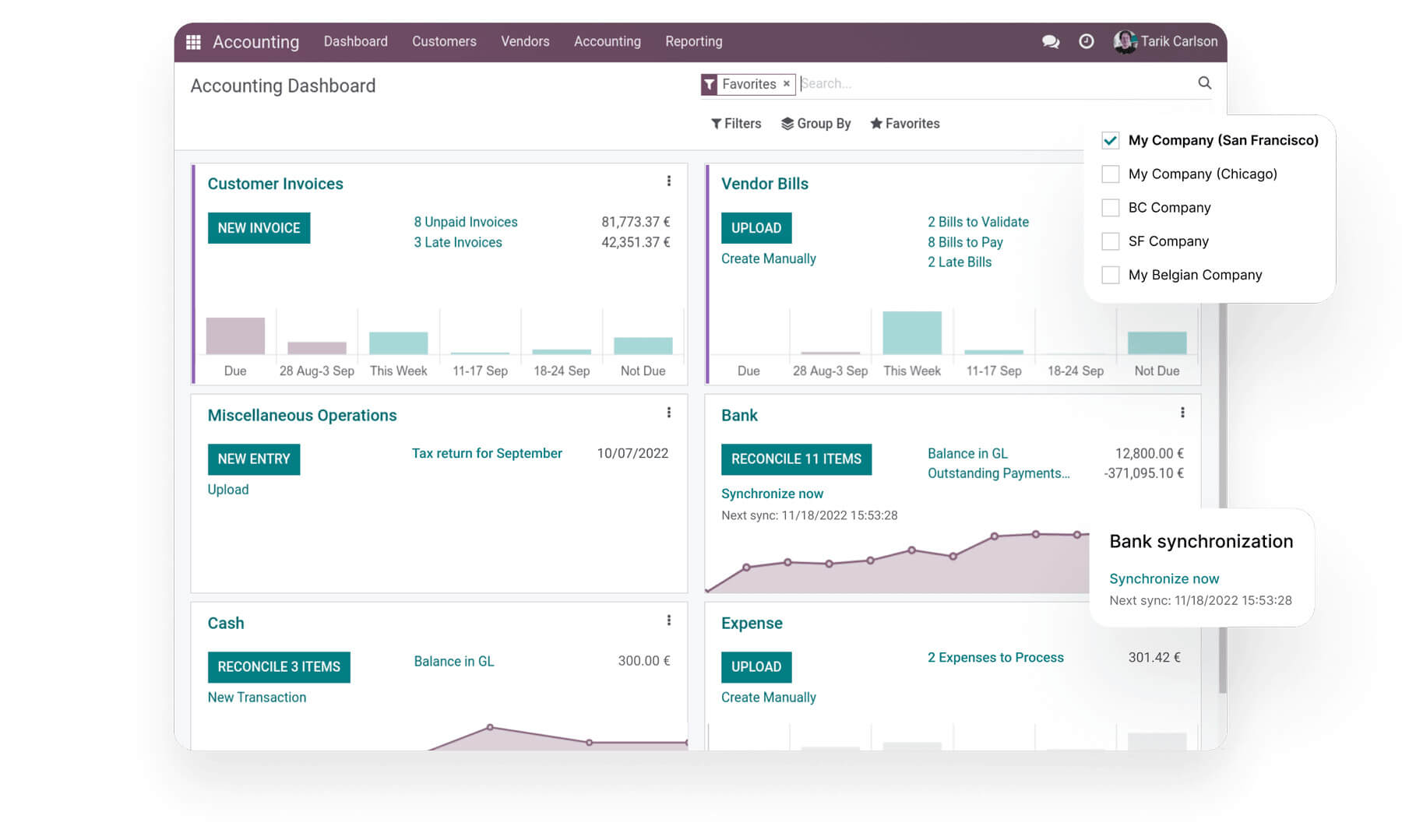

Odoo Accounting is part of an ERP system that simplifies daily financial tasks and offers a clear view of your business's state. It handles all your financial activities in one app, automating many routine tasks. It syncs with 24,000 banks, making it easy to match payments with statements. You can also reconcile by importing statement files (like OFX or CSV). The new List view enhances document tracking and future actions.

What makes Odoo Accounting great is its capability to integrate with Sales, eCommerce, Inventory, and other Odoo applications. Or even better, it supports many payment methods like Alipay, PayPal, etc.

Source: Odoo

Reviewing FreshBooks Key Features

In terms of features, FreshBooks provides the standard accounting tools that most software does. However, what makes it stand out isn't a special feature but its user-friendly design.

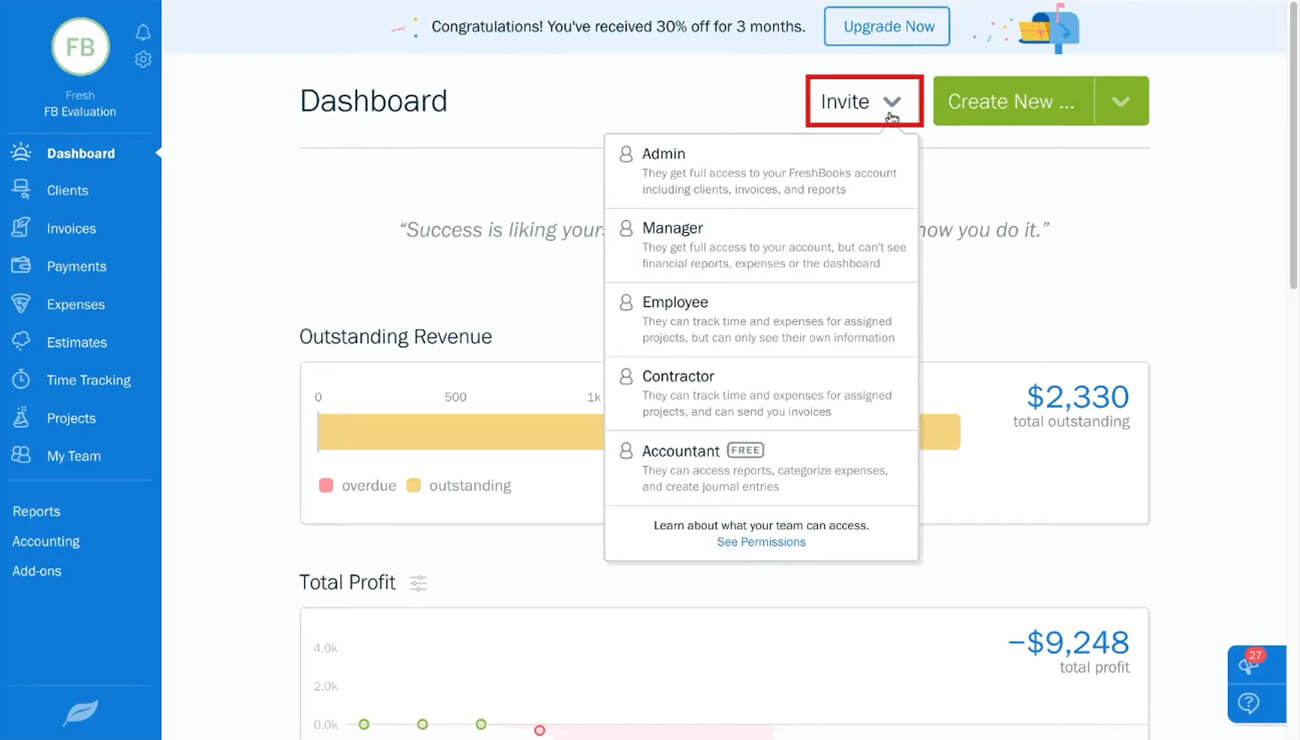

Dashboard

The dashboard offers a rapid overview of your business's financial status and cash flow. It also provides a simple method to invite Team Members or create new items in your account. Most importantly, Freshbooks’ dashboard highlights Outstanding Invoices, Monthly Recurring Revenue, Total Profit (adjustable by date range), and Spending (categorized expenses). Additionally, it features Revenue Streams and Unbilled Time charts for insights into your financial well-being.

Source: FreshBooks

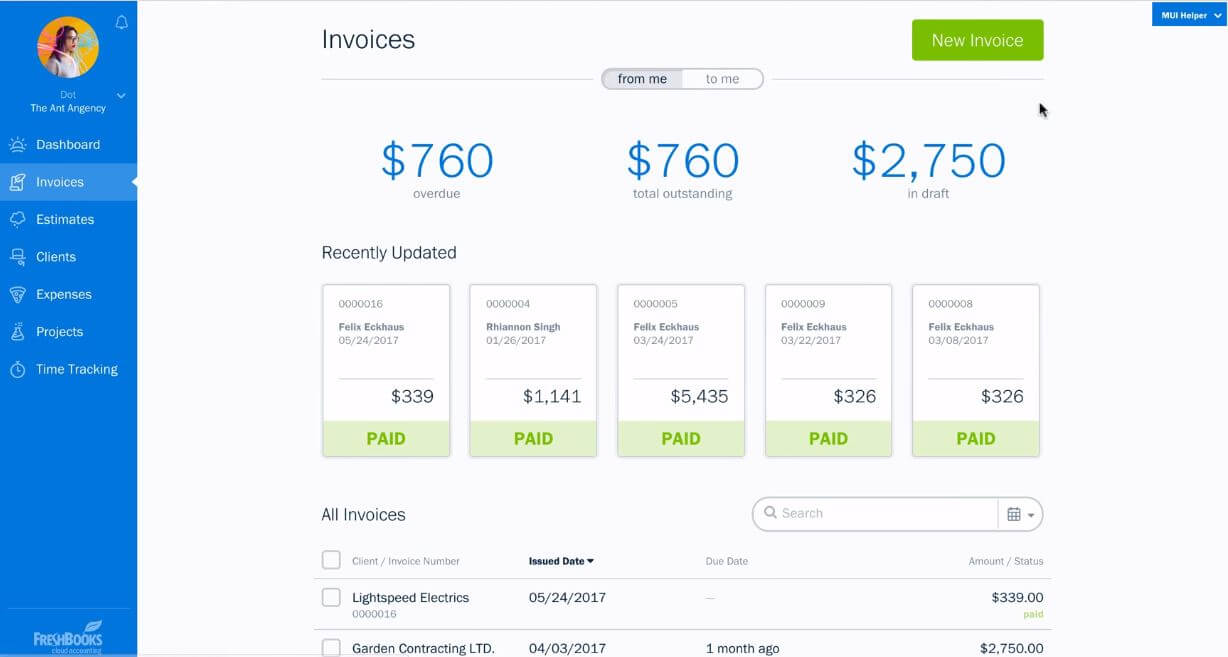

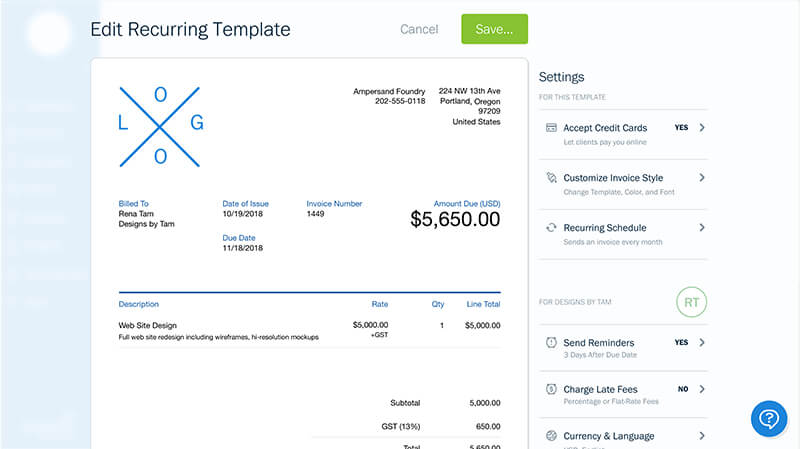

Invoicing

In FreshBooks, you can streamline your invoicing process for faster payments and better control over your business finances. Clients can easily pay online, reducing the hassle of chasing checks. With automation options, you can set reminders and securely charge clients' credit cards, saving time for your core tasks.

Source: FreshBooks

Request deposits upfront so you don't have to bear project expenses, ensuring a stable cash flow from the beginning. Plus, the FreshBooks invoice generator helps you bill accurately by including tracked time and expenses.

Bank reconciliation

Review your bank account transactions and cross-reference them with your financial records in FreshBooks for precise and consistent data. Also, you can align your bank statements with bank transfer entries to update your balance and make audits more efficient.

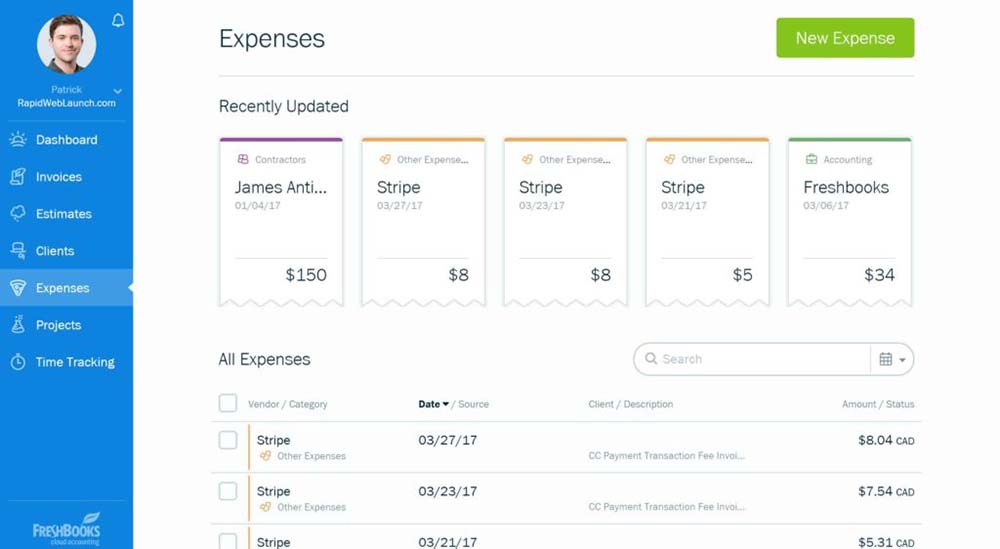

Income & expense tracking

In FreshBooks, recent bank transactions are under Expenses. The software tries to categorize them automatically but may only sometimes get it right. You can train it by correcting categories for better reports and taxes.

Source: FreshBooks

When you enter or edit expenses, you can add various details. Recent expenses appear at the top, and individual records below include vendor, category, date, and more. You can attach files, add receipt images, and mark expenses as billable.

Bill management

To manage your income better, you can collect payments upfront and track your work against that amount. FreshBooks automates recurring payments with auto-bills, allowing you to charge your client's credit card on a schedule securely.

Source: FreshBooks

Don't worry about different currencies; FreshBooks integrates with Stripe to handle global payments. And it helps you get paid on time with automatic late payment reminders.

User access

In FreshBooks, you can collaborate and invite others to work with you on your business. Just add them as team members to your account. You can invite users with different roles, such as admin, employee, accountant, contractor, and manager. In addition to that, you can personalize those roles with project manager settings and client access.

Reporting

Quickly view important financial reports in FreshBooks. Check out reports like profit and loss, sales tax summaries, aging accounts, invoice details, and expenses. These reports are vital for managing your business effectively.

Time and mileage tracking

With FreshBooks, you can be confident you're billing clients correctly. Add your logged hours to their invoices. Or even better, track how much time you spend on each client.

![]()

Source: FreshBooks

Similarly, keep your projects on budget by tracking time directly to them. Or let FreshBooks handle timing for you. Start the timer and focus on your work. Then again, you can collaborate with your team and have all hours in one place.

Inventory management

With FreshBooks’ inventory tracking, you can easily update the number of items by clicking on an entry. When you invoice for an item, the invoicing app automatically reduces the stock amount. Additionally, you can seamlessly connect to platforms like Shopify, Squarespace, BarCloud, and 2Ship and import your inventory into your FreshBooks account.

![]()

Source: FreshBooks

Security

FreshBooks is a safe choice for small businesses. It adopts Google Cloud Platform's security measures and follows OWASP security practices. The software uses strong firewalls and 256-bit SSL encryption to secure your data.

Odoo Accounting and Its Core Capabilities

While Odoo Accounting is just one of the multiple Odoo modules, it still includes some core features to help you with your bookkeeping. Yet, you can always integrate Odoo modules like Sales, Inventory, Purchase, eCommerce, and others to improve your financial performance.

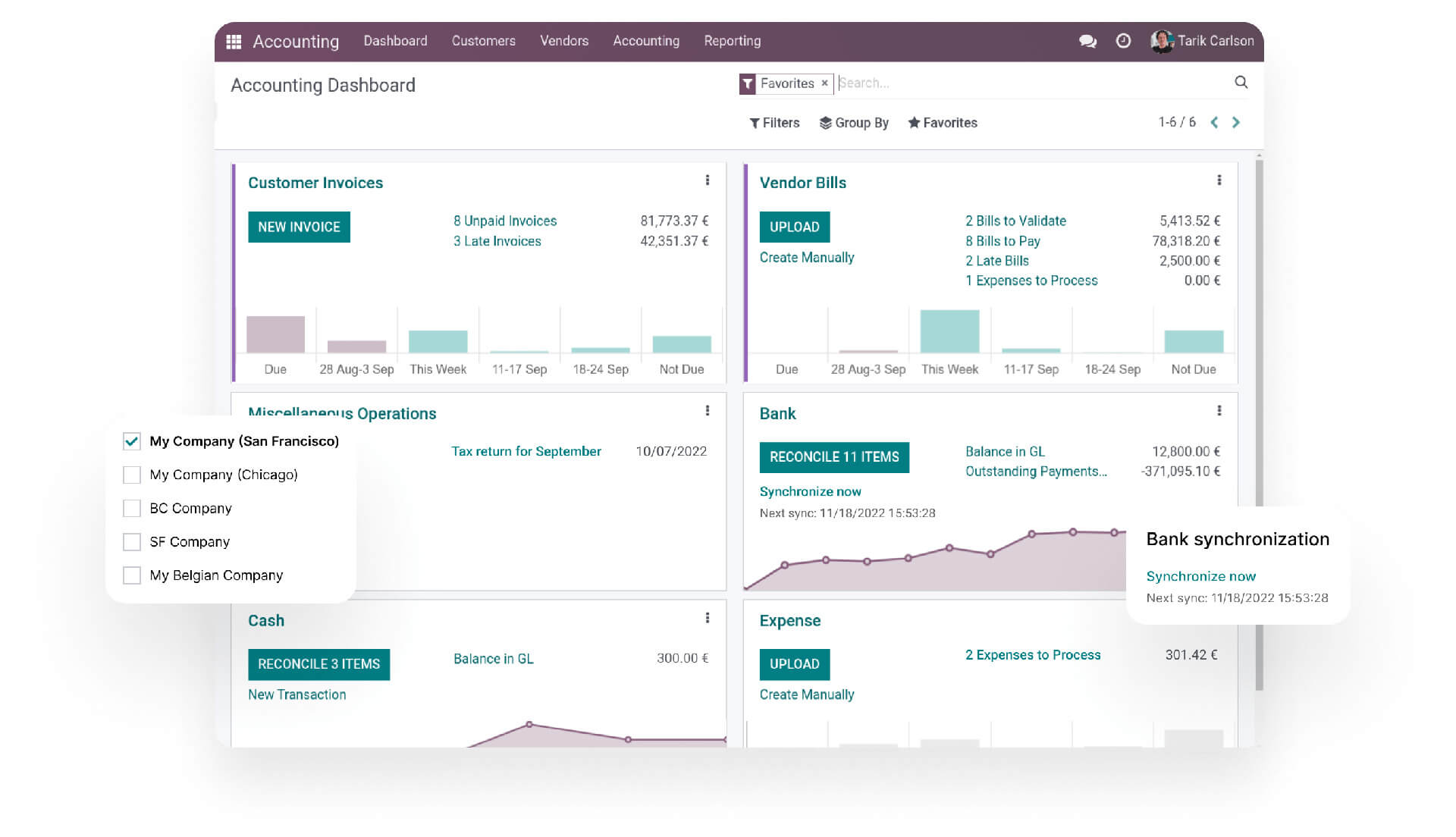

Dashboard

Access a comprehensive dashboard displaying key SaaS metrics such as MRR, Churn, ARR, CLT, CAC, CAC ratio, Growth forecasts, and CLTV. But that’s not all; handle multi-year contracts, automate deferred revenue entries, and gain insights through clear dashboards on recurring revenues.

Source: Odoo

Then again, you can tailor your dashboard with customized reports. Share filters and dashboards seamlessly among different teams for collaborative data analysis.

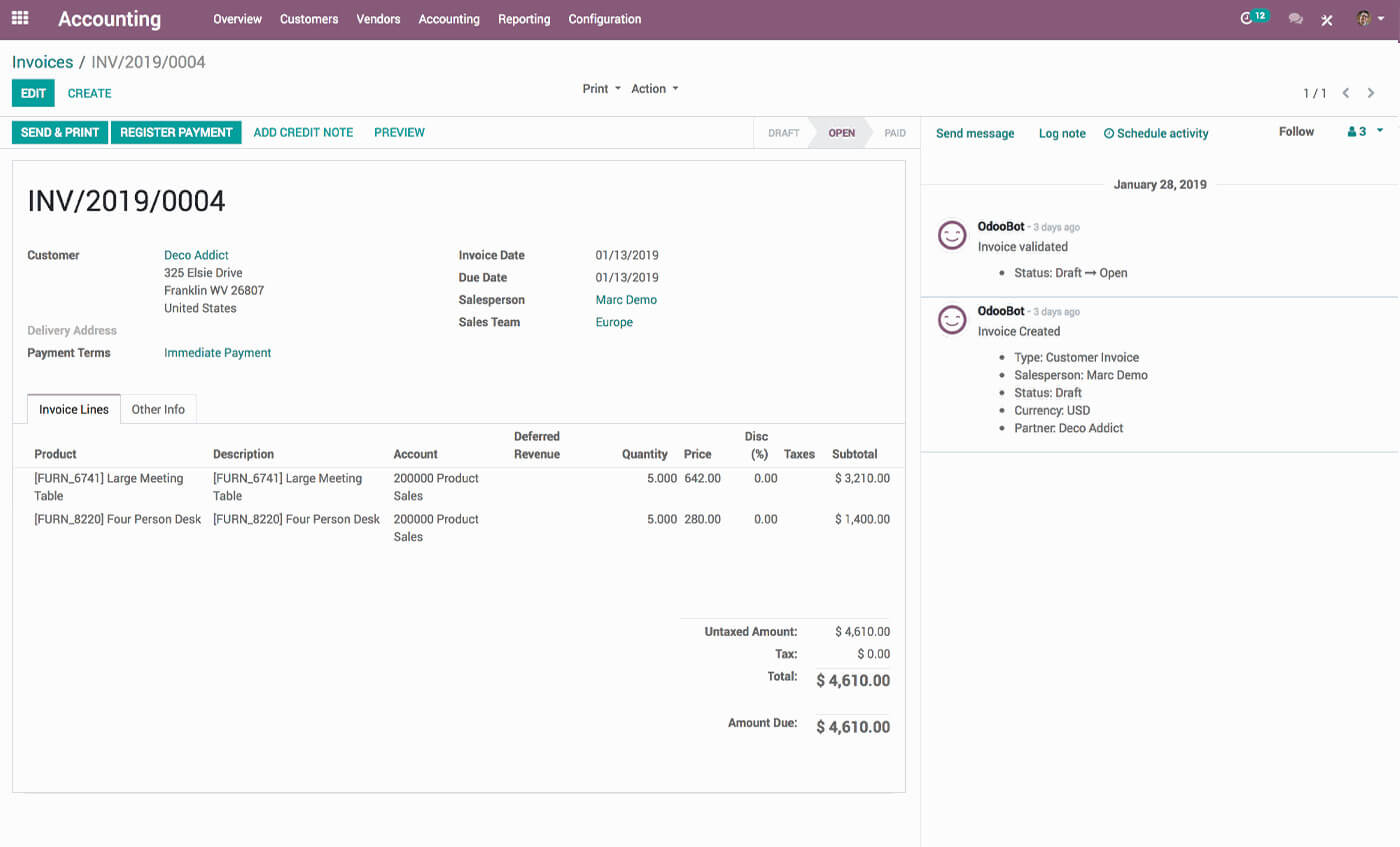

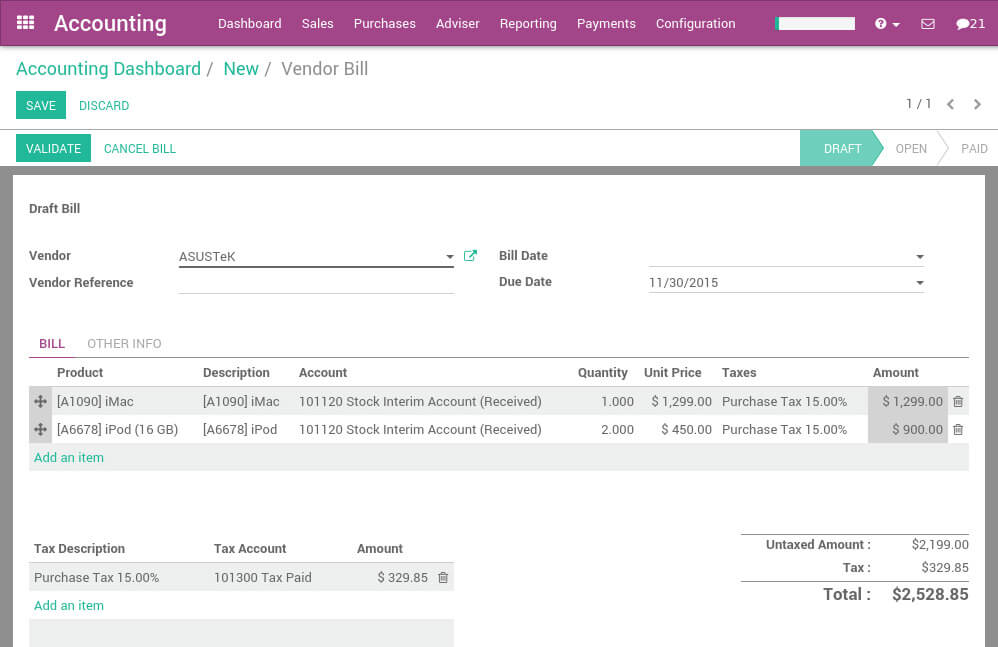

Invoicing

In Odoo Accounting, invoices include a rich feature set, including payment terms, multiple taxes, discounts, and price lists. Enjoy advanced payment terms like numerous payments, cash discounts, advance invoices, and partial reconciliations.

Source: Odoo

Moreover, you can generate draft invoices from sales orders, timesheets, or delivery orders. But if you want to upgrade your invoicing processes, install Odoo Invoicing for an additional fee.

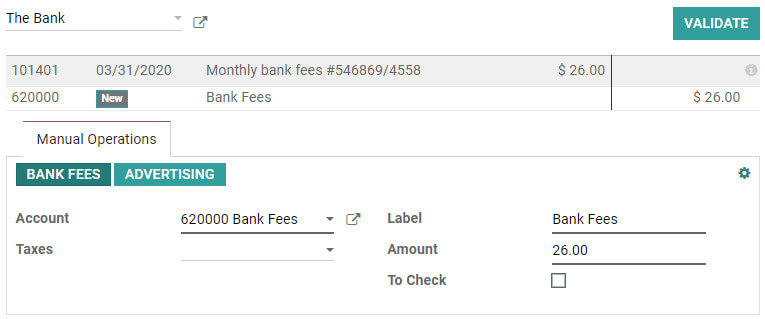

Bank reconciliation

Automate reconciliation, even in complex scenarios, with an intelligent tool. Streamline full or partial payments with direct propositions from invoices or bank statements.

Source: Odoo

But why stop there? Odoo Accounting also lets you use confirmed online transactions to set up a payment. You can check them as in the document’s chatter anytime. Plus, audit account differences easily through a reconciliation report.

Income & expense tracking

Odoo Accounting lets you cross-refer Purchase Orders, Vendor Bills, and Receipts to manage supplier bills for accurate payment. Besides, you can track employee expenses from recording to validation and reimbursement. Upload scanned PDF or image files, too.

Source: Odoo

Stay ahead with expense forecasting to anticipate future payments. Beyond that, you can use Artificial Intelligence to automate bill creation.

Bill management

Odoo Accounting makes it possible to print checks with ease, handle deposit tickets, and automate wire transfers for your supplier payments using SEPA. Organize your payment orders efficiently, with optional validation steps to support your payment flows.

Source: Odoo

User access

Is Odoo cloud-based? This app is an open-source platform. As for user access, Odoo Accounting lets you add three user types, including internal user, portal, or public. Here, you can form groups and assign users to each group based on your needs. To provide access, you can navigate to the "Access Rights" tab for a specific group.

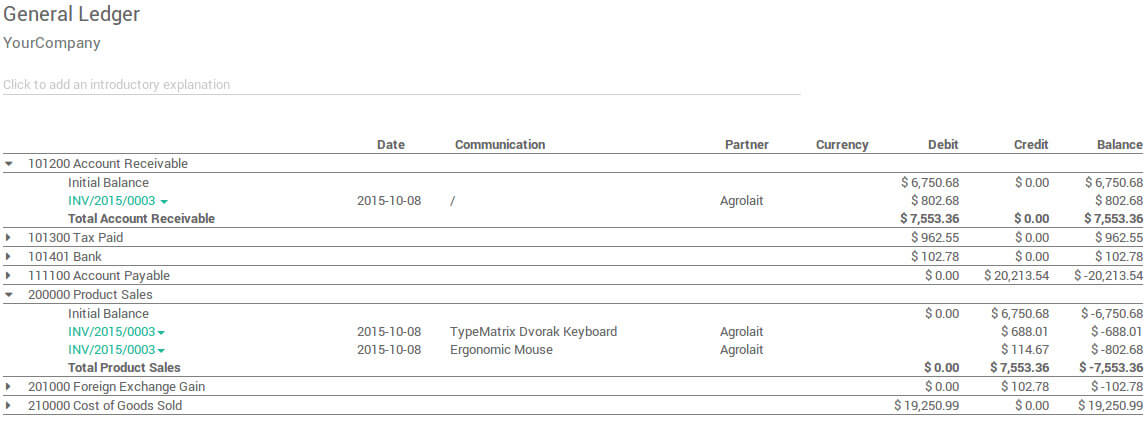

Reporting

With Odoo Accounting, you can get quick, customizable reports to annotate, export, and dive into for all your financial and legal needs. Access tax reports that comply with government standards. Or switch between accrual or cash methods.

Source: Odoo

To top it off, you can compare figures between different periods. Store and analyze your reports in spreadsheets, and access detailed data with a simple click on your report lines.

Time and mileage tracking

Advanced features like time and mileage tracking aren’t available within the Odoo Accounting app. But you can install another Odoo module, Odoo Timesheet, to track your working time and manage employees.

Inventory management

Like time tracking, Odoo Accounting doesn’t offer inventory management capabilities. However, you can set up the Inventory module. That app allows you to choose between periodic or perpetual inventory valuations. Let the system generate your accounting entries automatically based on standard price, average price, or FIFO methods.

Security

Odoo Accounting ensures robust data security with measures like 14 backups, hardware failover for quick recovery, and strict database and password security. The app implements restricted access and encrypted transmissions, and firewalls guard against threats. To top it all off, data centers provide redundancy and defense against DDoS attacks.

FreshBooks vs Odoo Accounting: Pricing Overview

When comparing pricing strategies, FreshBooks vs Odoo take different approaches. While Odoo Accounting offers a potential for free use, FreshBooks presents four distinct paid plans, each with its unique set of features.

Is Odoo Free vs Paid?

While each Odoo app comes with a cost, your initial app segment is free. It means if you only use Oddo Accounting, then the app is free for unlimited users. But, if you aim at more than one app, be ready to pay at least €11.90 per user/month. So, how much does Odoo cost?

One App Free | Standard | Custom |

|

|

|

Important note: If you require hosting, self-hosting and standard cloud hosting are free. For Odoo.sh cloud, you start at $22.40 per user/month, billed annually for 1 seat and 0.2 GB of storage with shared hosting but no staging environments.

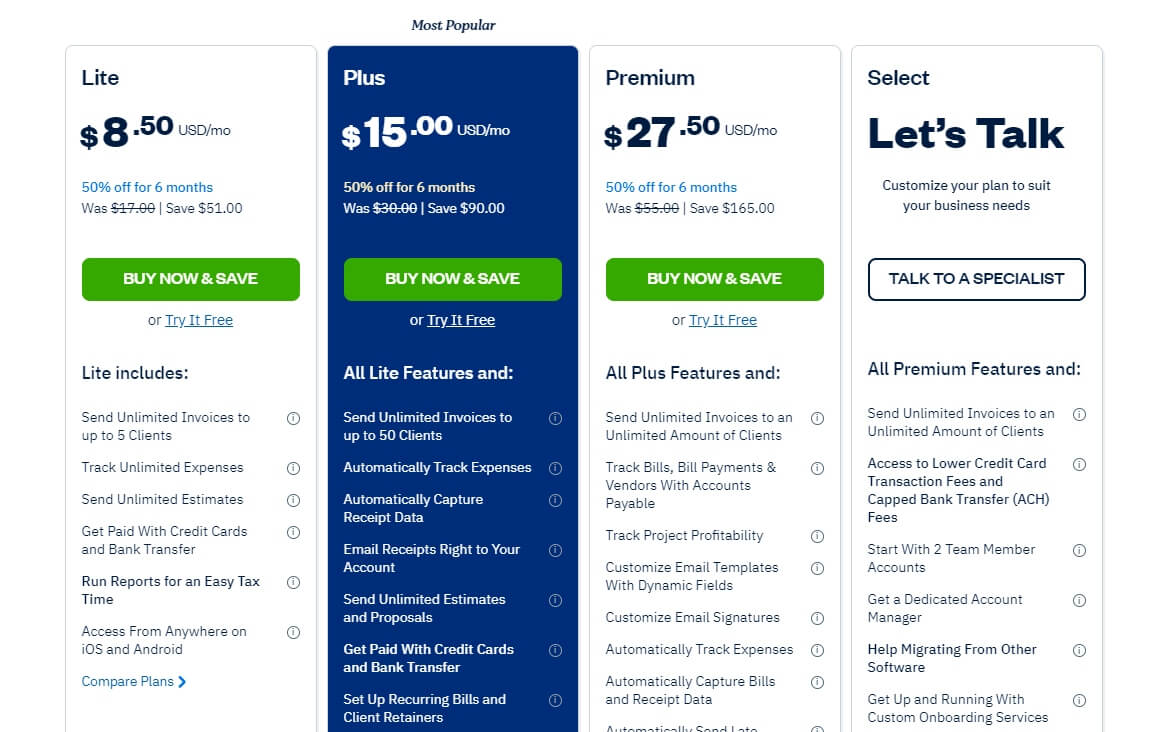

How Much Does FreshBooks Cost?

FreshBooks offers four plans: Lite ($15/month), Plus ($30/month), Premium ($55/month), and Select (custom pricing). Paying annually gets you better rates, and there's a 30-day free trial for any plan.

Source: FreshBooks

The Lite Plan is designed for businesses with just a few clients, offering unlimited invoices for up to five billable clients. If you're a freelancer or have a small operation, this plan covers your basic needs. It supports payments through credit cards and bank transfers and tracks unlimited expenses.

Stepping up to the Plus Plan comes with additional features suitable for solo business owners who handle more than five clients. With a capacity for up to 50 billable clients, this package introduces double-entry accounting reports, e-signatures on proposals and contracts, and the ability to set up recurring billing and client retainers.

The Premium Plan is perfect for those who require even more customization and advanced capabilities. It lets you personalize email templates and signatures and sends automated client emails with dynamic fields. You can delve into more detailed financial management with features like Accounts Payable, project profitability tracking, and subscription-based billing for your clients. Plus, this plan equips you with robust project profitability reports for effective business and project management.

But that’s not all; you can always opt for a Select plan. This package includes access to lower card transaction fees and capped bank transfer fees. Moreover, you can get up and running with customer onboarding services and receive help migrating from other accounting tools.

If that’s not enough, you can integrate any available add-on, line Team Members, Advanced Payments, and Gusto Payroll.

Contrasting Odoo vs FreshBooks Pricing Plans

FreshBooks vs Odoo Accounting are valuable for streamlining your business accounting without breaking the bank. Let's see which one offers better value for your small business.

Feature | Odoo Accounting | FreshBooks |

| Free Plan | One app free with unlimited users. | Lite plan at $15/month for up to 5 billable clients. |

| Standard Plan | $14.90/user/month (billed annually). | Plus plan at $30/month, suitable for more clients. |

| Custom Plan | $24.40/user/month for the 1st year. | Premium plan at $55/month with advanced features. |

| Hosting Costs | Free for self-hosting and standard cloud. | Additional fees for specific features. |

| Ideal For | Small to mid-sized businesses. | Freelancers, small businesses, various business sizes. |

Figure 1. Comparing Odoo vs FreshBooks pricing

To sum up: Odoo Accounting offers a free starting point and pricing based on the number of users. FreshBooks provides various plans with features catering to different business needs, pricing primarily based on required capabilities rather than the number of users.

Considering Pros & Cons of FreshBooks vs Odoo Accounting

Do you still need to decide which accounting software to pick, Odoo Accounting vs FreshBooks? It's time to assess the advantages and disadvantages of each platform to make a well-informed choice.

FreshBooks’ Benefits and Drawbacks

First, let’s dive into the pros and cons of using FreshBooks as your accounting software. Here's what you need to know:

Advantages

Time and mileage tracking included in all plans

Robust invoicing services, including customizable designs

Phone support from 8 a.m. to 8 p.m

Context-sensitive settings

Mobile app to respond to client queries and informs you when invoices are viewed or past due

Payroll integration with Gusto and SurePayroll

Disadvantages

The Lite plan lacks double-entry accounting basics

Limits on users and clients

Basic inventory tracking only

Strong and Weak Sides of Odoo Accounting

You might ask: “Why use Odoo Accounting?”Its customization options, scalability, and cost-effectiveness make it a prominent choice. But let’s not rush things and check the advantages and disadvantages of Odoo.

Pros

An open-source development model

Multiple apps in one solution

Excellent reconciliation features

Has an effective Amazon connector

An active community of developers, users, and enthusiasts

Cons

Its free plan only allows one app

The lack of customer support

Problems with installations

Who Uses FreshBooks vs Odoo Accounting?

FreshBooks and Odoo Accounting focus on the same market, serving companies across the United States and Canada. Let’s take a look at the details.

FreshBooks is a flexible solution suitable for small and medium-sized businesses. It works as a billing system for industries like Technology and Services, Computer Software, and Marketing. FreshBooks proudly reports over 30 million individuals have utilized their accounting software, including notable users like GitLab, Forbes, and CNN.

Similarly, Odoo Accounting also serves as the billing and invoicing software for small and middle-sized companies. What’s more is that this Odoo app is popular among such industries as Textiles, Technology and Services, and Computer Software. Also, companies like Toyota, Sodexo, WWF, and Delmonte Quality use Odoo Accounting as a part of Odoo ERP.

How to Import Data to FreshBooks or Odoo?

When setting up a new bookkeeping platform, you can start afresh or migrate over existing data from any previous software. For instance, FreshBooks lets you import via a CSV file such records as clients, expenses, items, taxes, vendors, and transactions. Other accounting data is only available for an automated migration.

As for Odoo Accounting, this billing app also has the Import feature. You can transfer via a CSV or Excel file the following records: transactions, products, and journal entries.

Yet, you can go for Accounting and Invoicing Data Migration to avoid the manual aspect. Choose the accounting data you wish to transfer and set up your Free Demo. After the migration, you can review and validate your data to ensure a seamless transition.

Your Next Accounting App: FreshBooks vs Odoo Accounting

Overall, FreshBooks is a user-friendly invoicing and billing software ideal for small businesses, freelancers, and startups. It primarily focuses on invoicing and payments. By contrast, Odoo Accounting offers a more comprehensive solution, with integration into various business processes. It's suitable for businesses seeking extensive financial management within an integrated system. But the choice is yours whether you need specialized invoicing tools or a broader suite of financial and operational features.

FreshBooks is ideal for small businesses, offering an intuitive interface and robust invoicing and accounting features that streamline financial management, allowing owners to focus on what matters.

FreshBooks is not an ERP system; it specializes in accounting and financial management and lacks the broader capabilities often found in full ERP systems, such as inventory and supply chain management.

FreshBooks doesn't charge transaction fees, making it a cost-effective option for small businesses looking to save on payment processing costs and maintain financial health.

FreshBooks goes beyond basic accounting and assists businesses in efficiently managing bookkeeping tasks, including expense tracking, income management, and more, making financial management easier.

Odoo competes with ERP and CRM software providers like Salesforce, SAP, and Zoho but stands out due to its open-source nature, affordability, and extensive suite of business applications on a single platform.

Odoo's popularity can be attributed to its flexibility, affordability, and comprehensive suite of business applications on a unified platform, appealing to businesses looking for cost-effective, customizable, and scalable solutions.

Odoo includes a robust payroll management application, offering accurate and efficient payroll handling for businesses of all sizes.

Odoo is a versatile software suite that integrates ERP and CRM functionalities, offering businesses a unified platform to manage diverse operations, including customer relations and resource planning.

Odoo is suitable for a broad range of businesses, from small startups to large enterprises, thanks to its scalability and extensive customization options, making it an adaptable and cost-effective business management solution.

Odoo Accounting is free when used as a standalone app. However, if you opt for additional Odoo apps, charges may apply.

Odoo supports bank feeds, simplifying the reconciliation of financial transactions and ensuring businesses can maintain organized and up-to-date financial records.

Have already chosen your accounting platform?

Leave the accounting records migration to us!